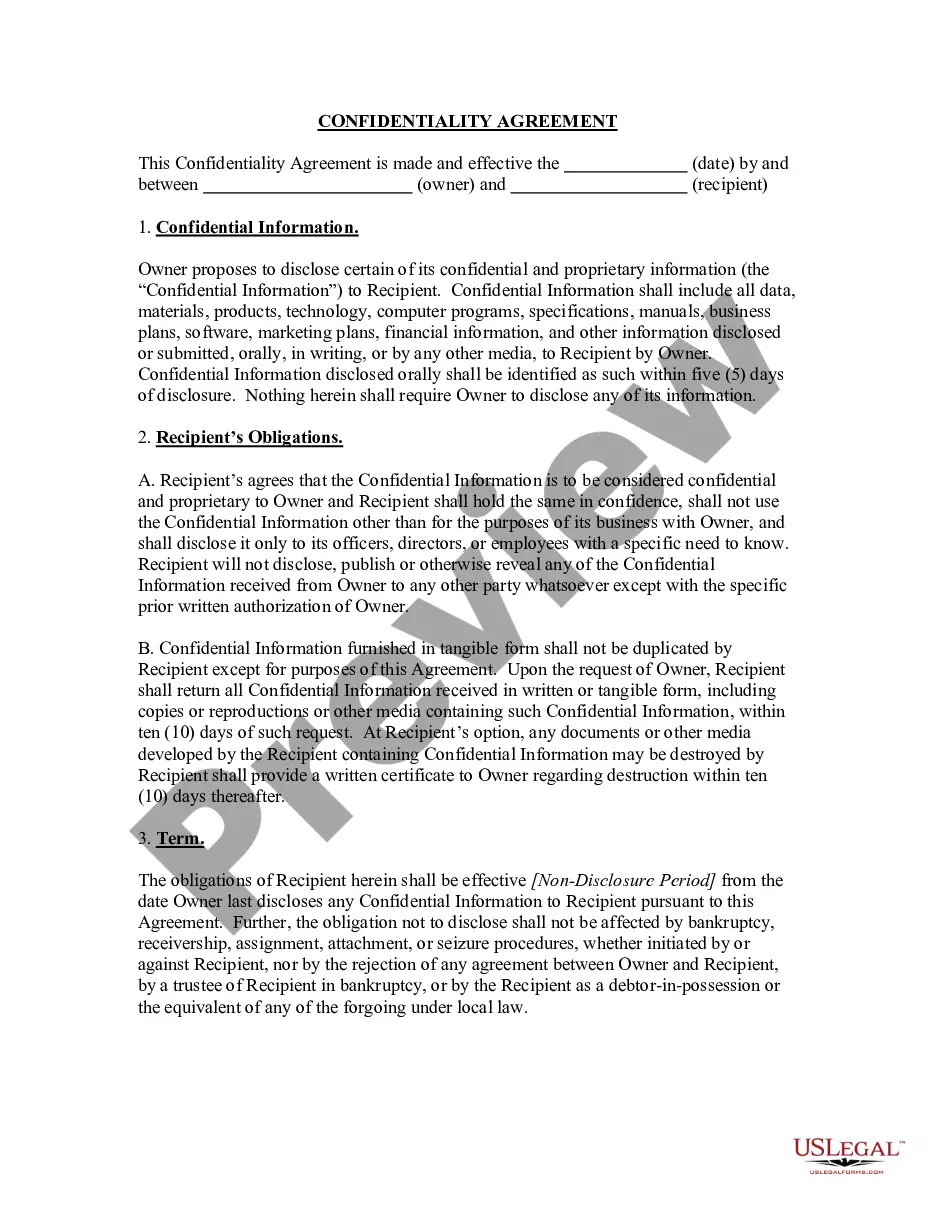

Community property with survivorship is a legal term that refers to a type of property ownership in which a married couple holds assets jointly, and upon the death of one spouse, the surviving spouse automatically inherits full ownership of the property. This type of ownership is recognized in several states in the United States, including Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. In community property with survivorship, both spouses have an equal ownership interest in all property acquired during the marriage. This includes both assets and debts. All income earned by either spouse during the marriage is considered community property as well. This means that in the event of divorce or death, all community property is typically divided equally between the spouses. When one spouse passes away in a community property with survivorship state, the surviving spouse automatically becomes the sole owner of all community property without the need for probate. This means that the property is transferred directly to the surviving spouse, bypassing the time-consuming and potentially expensive probate process. There are two common types of community property with survivorship: 1. Joint Tenancy with Right of Survivorship (TWOS): In this type of ownership, both spouses have an equal and undivided interest in the property. Upon the death of one spouse, their interest automatically transfers to the surviving spouse. This type of ownership is often used for real estate, bank accounts, and investment accounts. 2. Community Property with Right of Survivorship (PROS): This type of ownership is available in a few states, including Arizona, California, Nevada, and Wisconsin. Similar to TWOS, the PROS allows property to pass automatically to the surviving spouse, but with the added benefit of community property status. This means that the property receives a full step-up in cost basis upon the death of the first spouse, potentially reducing capital gains tax liability for the surviving spouse when the property is sold. In summary, community property with survivorship is a legal arrangement in which a married couple holds assets jointly, and upon the death of one spouse, the surviving spouse becomes the sole owner of the property. This type of ownership provides certain advantages such as bypassing probate and potentially reducing tax liabilities. The two common types of community property with survivorship are Joint Tenancy with Right of Survivorship (TWOS) and Community Property with Right of Survivorship (PROS).

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Community Property With Survivorship - Community Property Agreement

Description

How to fill out Community Property With Survivorship?

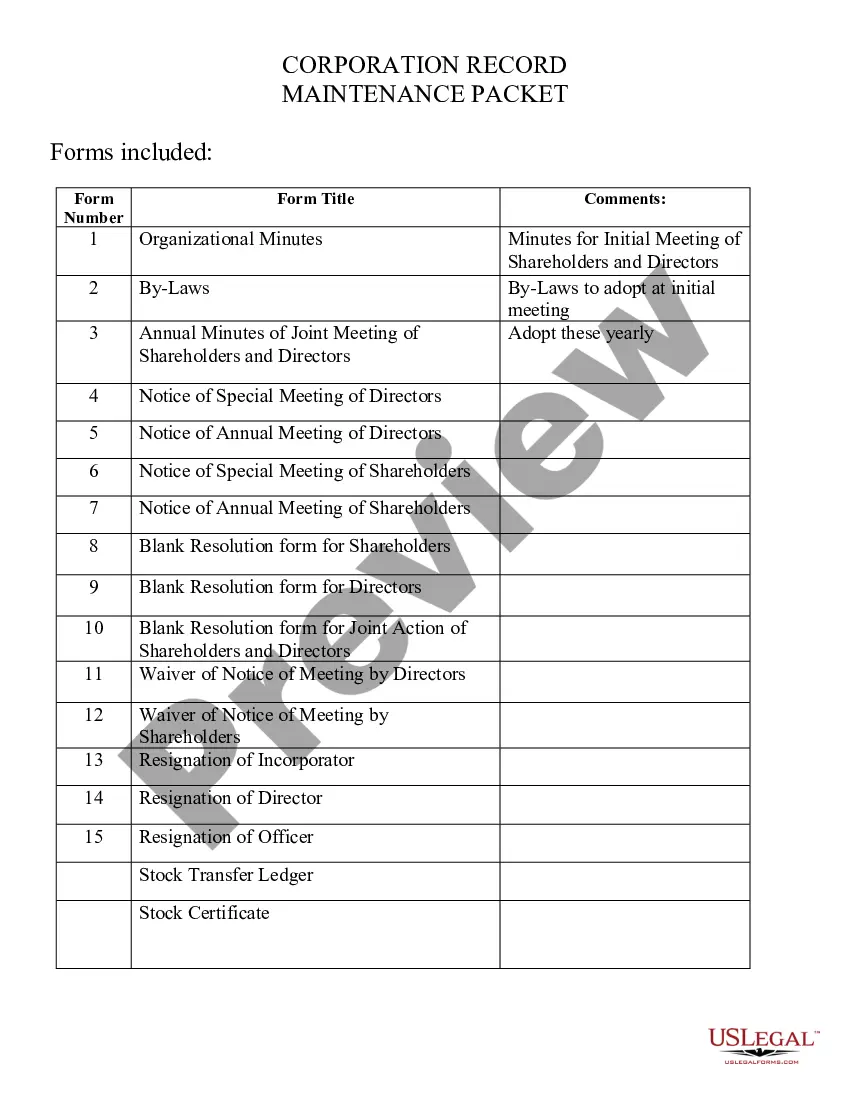

The Community Property With Survivorship you see on this page is a reusable legal template drafted by professional lawyers in line with federal and local laws. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Community Property With Survivorship will take you only a few simple steps:

- Search for the document you need and check it. Look through the sample you searched and preview it or review the form description to ensure it suits your requirements. If it does not, utilize the search option to get the appropriate one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Community Property With Survivorship (PDF, Word, RTF) and save the sample on your device.

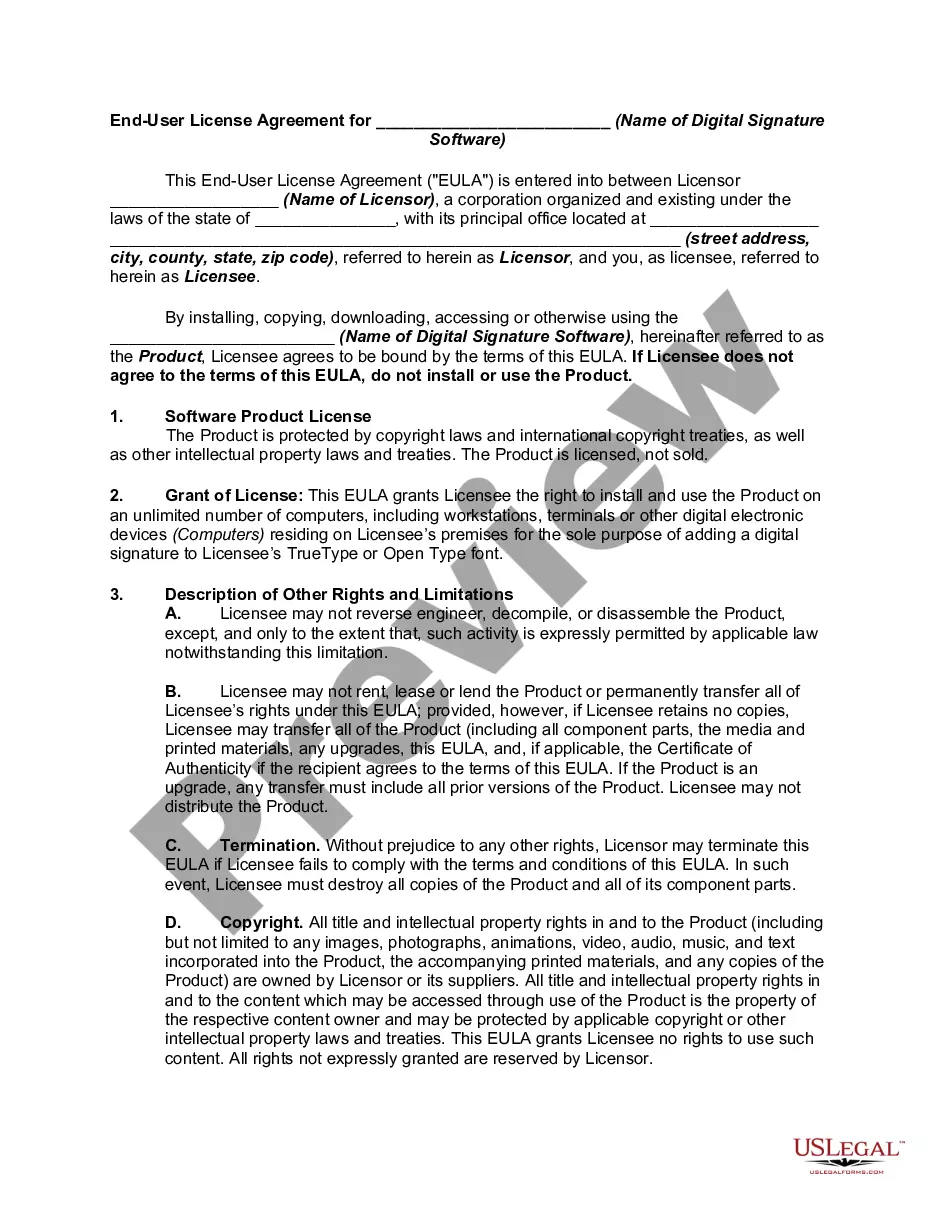

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a eSignature.

- Download your papers one more time. Use the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

Preview only performs a grammar check when you input text into the PDF. Moreover, users can only perform grammar checks on text annotations. So, it is now clear that you cannot directly check spells in Preview when you open a PDF, as it is only a PDF viewer and not an editor.

Click File > Options > Proofing, clear the Check spelling as you type box, and click OK. To turn spell check back on, repeat the process and select the Check spelling as you type box. To check spelling manually, click Review > Spelling & Grammar. But do remember to run spell check.

How to Use Spell-Check in Adobe Acrobat DC - YouTube YouTube Start of suggested clip End of suggested clip Function key to reveal the check spelling pop-up.MoreFunction key to reveal the check spelling pop-up.

For those who work frequently with PDFs, investing in Adobe Acrobat may be worthwhile. The software has a built-in spell check functionality. Navigating to the Spell Check Option: Go to 'Edit' > 'Check Spelling' > 'In Comments, Fields, & Editable Text.

Launch Adobe Acrobat on your device and open a PDF file that you wish to check. On opening the file, navigate to the ?Edit? section. Step 2. Select the option of ?Check Spelling? across the drop-down menu, followed by ?Check Spelling in Comments, Fields, & Editable Text.?

QuillBot's spell checker makes sure you spelled everything right. Our free spell checker ensures your spelling is perfect. It's everything you need to master tricky words and rules.

Grammarly's spell-checker works in your browser and across all your favorite websites and desktop apps, such as Google Docs, Microsoft Word, and Outlook. You can even use it on your Android or iPhone by downloading the Grammarly Keyboard.

Instructions and Help about PDF Spelling Check Online Open the PDF document you want to check for spelling errors in . Click on the 'Spelling' tab located at the top of the interface. Once you're in the 'Spelling' tab, click on the 'Check Spelling' button.