Are you a prospective home buyer exploring your options for financing a home purchase? If so, an FHA loan might be an attractive option for you. This detailed description will shed light on what selling purchase buyers with an FHA loan need to know, providing relevant information to help you make an informed decision. FHA loans, backed by the Federal Housing Administration, are designed to make homeownership more accessible, especially for first-time buyers or those with limited finances. These loans are issued by FHA-approved lenders and have some distinct features that set them apart from traditional loans. One of the key benefits of an FHA loan is the lower down payment requirement. With an FHA loan, buyers can put down as little as 3.5% of the purchase price, compared to the 20% typically required for conventional loans. This reduced down payment allows buyers to enter the housing market sooner, even if they have limited savings. Another advantage of an FHA loan is the flexibility when it comes to credit requirements. While traditional mortgages often demand a higher credit score, FHA loans are more lenient, making them accessible to buyers with lower credit scores. However, it's important to note that a higher credit score can still help in securing a better interest rate and loan terms. FHA loans also offer competitive interest rates, further assisting buyers in affording their dream home. These rates are usually comparable or even lower than those associated with conventional loans. The lower interest rate translates into reduced monthly mortgage payments, providing financial relief for homeowners. Additionally, FHA loans allow sellers to contribute towards the buyer's closing costs, reducing the upfront expenses associated with purchasing a home. This concession can be up to 6% of the home's purchase price, making it easier for buyers to cover fees such as appraisal, inspection, and title costs. Now, let's explore different types of selling purchase buyers with an FHA loan: 1. First-time Homebuyers: FHA loans are especially popular among first-time buyers due to the accessibility and benefits they offer. These buyers are often young individuals or couples looking to take their first step into homeownership. 2. Low-income Buyers: FHA loans are an excellent option for buyers with limited incomes who may find it challenging to save for a sizable down payment. The lower down payment requirement of 3.5% allows these buyers to overcome a significant financial barrier. 3. Buyers with Less-than-Perfect Credit: If you have a less-than-ideal credit score, an FHA loan provides an opportunity to qualify for a mortgage that may not be available through conventional loan programs. This makes homeownership achievable for buyers who are working on improving their credit history. 4. Buyers in Need of Flexible Financing: FHA loans are more flexible in terms of income and debt-to-income ratios compared to conventional loans. This makes them a great choice for buyers with variable income or high levels of debt. In conclusion, selling purchase buyers with an FHA loan experience a streamlined and accessible path towards homeownership. This loan program offers advantages such as a low down payment, competitive interest rates, flexibility in credit requirements, and seller contributions. Whether you are a first-time buyer, someone with a lower credit score, or in need of flexible financing, an FHA loan might be the ideal solution for your home buying needs.

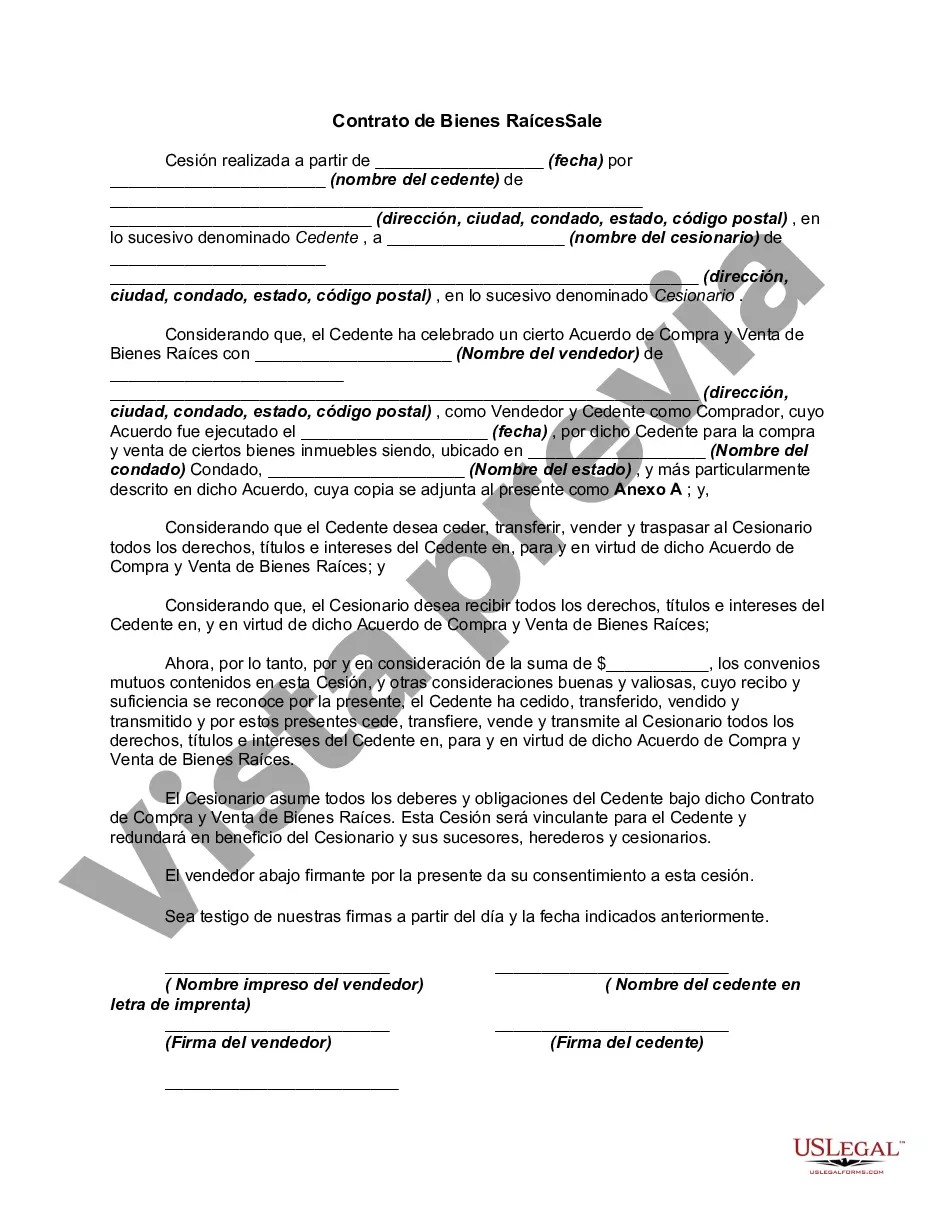

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Real Estate Sale In Spain - Assignment of Real Estate Purchase and Sale Agreement

Instant download

Description Contrato Compraventa Comprar

An assignment consists of a transfer of property or some right or interest in property from one person to another. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the interest or thing assigned. Unless there is a statute that requires that certain language be used in an assignment or that the assignment be in writing, there are really no formal requirements for an assignment. Any words which show the intent to transfer rights under a contract are sufficient to constitute an assignment.

Free preview Contrato Compraventa Acuerdo