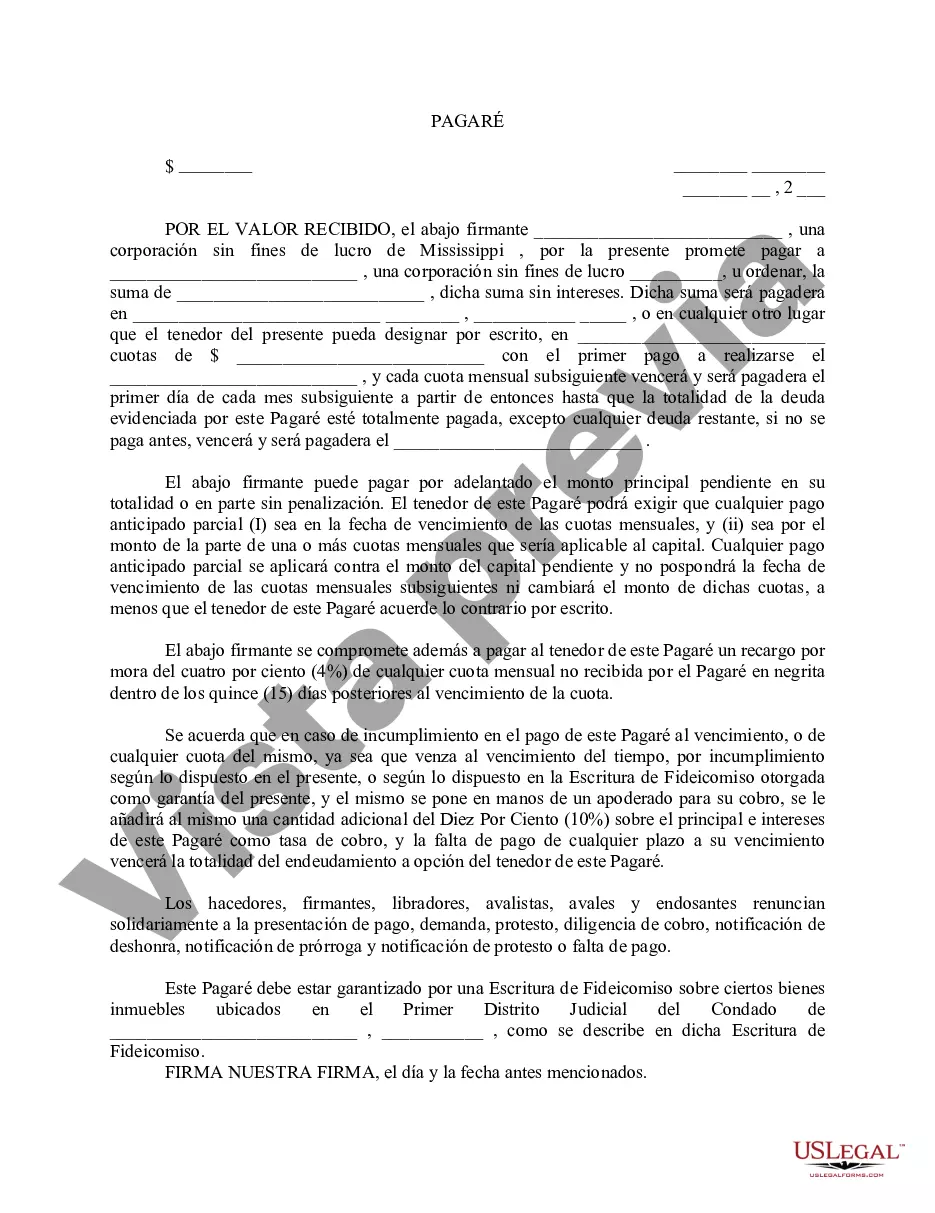

Church Promissory Note with Collateral Sample Philippines: A Comprehensive Guide In the Philippines, a Church Promissory Note with Collateral is a legally binding agreement entered into by a church or religious organization and a lending institution or individual. This document serves as a written commitment from the church to repay a loan obtained, along with specified interest and within a given period. Keywords: Church Promissory Note, Collateral, Sample, Philippines 1. Basic Components of a Church Promissory Note with Collateral: — Parties Involved: The note should clearly identify the church (borrower) and the lending institution or individual (lender). — Loan Details: The principal amount borrowed, the interest rate, and the repayment terms (frequency, duration) should be explicitly stated. — Collateral: The note should outline the assets offered as collateral to secure the loan. Common examples include land, buildings, vehicles, or other valuable properties owned by the church. — Payment Schedule: It should outline the agreed-upon repayment schedule, including due dates, amounts, and accepted payment methods. — Penalties and Default: The consequences of default, including late payment fees, penalty interest rates, or actions that the lender can take in case of non-payment, should be clearly stated. — Governing Law and Venue: The note should specify the jurisdiction whose laws will govern the agreement and the appropriate venue for any disputes. 2. Types of Church Promissory Note with Collateral in the Philippines: — Loan for Church Building or Renovation: This type of promissory note is commonly used when a church seeks financial assistance to construct or renovate its facilities. — Loan for Church Equipment: Churches may require loans to purchase essential equipment, such as sound systems, musical instruments, or multimedia devices. A promissory note that secures such loans with collateral would be appropriate. — Loan for Church Projects: When a church undertakes community projects, it may need financial aid. A promissory note can be used to document these loans, ensuring payment within a designated timeframe. In conclusion, a Church Promissory Note with Collateral in the Philippines serves as a legally binding agreement between a church and a lender. It outlines the loan details, collateral, payment schedule, penalties, and governing law. Depending on the purpose of the loan, there can be various types, such as those for building/renovation, equipment, or community projects. It is crucial for both parties to understand and agree upon the terms to ensure a transparent and successful lending agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Church Promissory Note With Collateral Sample Philippines - Promissory Note College to Church

Description

How to fill out Church Promissory Note With Collateral Sample Philippines?

It’s obvious that you can’t become a law professional overnight, nor can you grasp how to quickly draft Church Promissory Note With Collateral Sample Philippines without having a specialized set of skills. Putting together legal forms is a time-consuming process requiring a specific education and skills. So why not leave the preparation of the Church Promissory Note With Collateral Sample Philippines to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and get the document you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Church Promissory Note With Collateral Sample Philippines is what you’re looking for.

- Start your search again if you need a different form.

- Register for a free account and choose a subscription option to buy the form.

- Pick Buy now. Once the payment is through, you can get the Church Promissory Note With Collateral Sample Philippines, fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!