A business bank account for an LLC at Wells Fargo is specifically designed to meet the banking needs of a Limited Liability Company (LLC). It allows LLC owners to separate their personal and business finances, ensuring organized bookkeeping, easier tax filing, and increased professionalism. Wells Fargo offers different types of business bank accounts for LCS, each uniquely tailored to cater to specific requirements. Here are a few of the available options: 1. Wells Fargo Business Choice Checking: This account is ideal for small LCS with moderate banking needs. It offers a low monthly service fee that can be waived with qualifying transactions, access to online and mobile banking, a business debit card, and 200 free transactions per month. 2. Wells Fargo Platinum Business Checking: This account is suitable for LCS with a higher volume of transactions. It offers advanced features such as treasury management solutions, unlimited electronic transactions, no fees on cash deposits up to a specified limit, and access to additional services like Positive Pay. 3. Wells Fargo Analyzed Business Checking: This account is targeted towards large LCS with extensive banking needs. It provides customized banking solutions based on the company's transaction volume and requirements. Fees and earnings credits are calculated based on analyzed activity, so the account is tailored to the LLC's specific usage patterns. 4. Wells Fargo Business Market Rate Savings: This account is designed to help LCS grow their savings while maintaining easy access to funds. It offers competitive interest rates, online and mobile banking access, and the ability to link the account to the business checking account for overdraft protection. 5. Wells Fargo Business CDs: This account allows LCS to earn competitive fixed interest rates on their surplus funds for a specific term. It offers flexible maturity options and the security of FDIC insurance, making it a reliable investment option for LCS with long-term financial goals. Having a business bank account for your LLC at Wells Fargo not only enhances the financial management of your company but also enables you to build a strong banking relationship. Whether you're a small LLC looking for basic banking features or a large LLC in need of comprehensive banking solutions, Wells Fargo can provide the right account to meet your LLC's unique requirements.

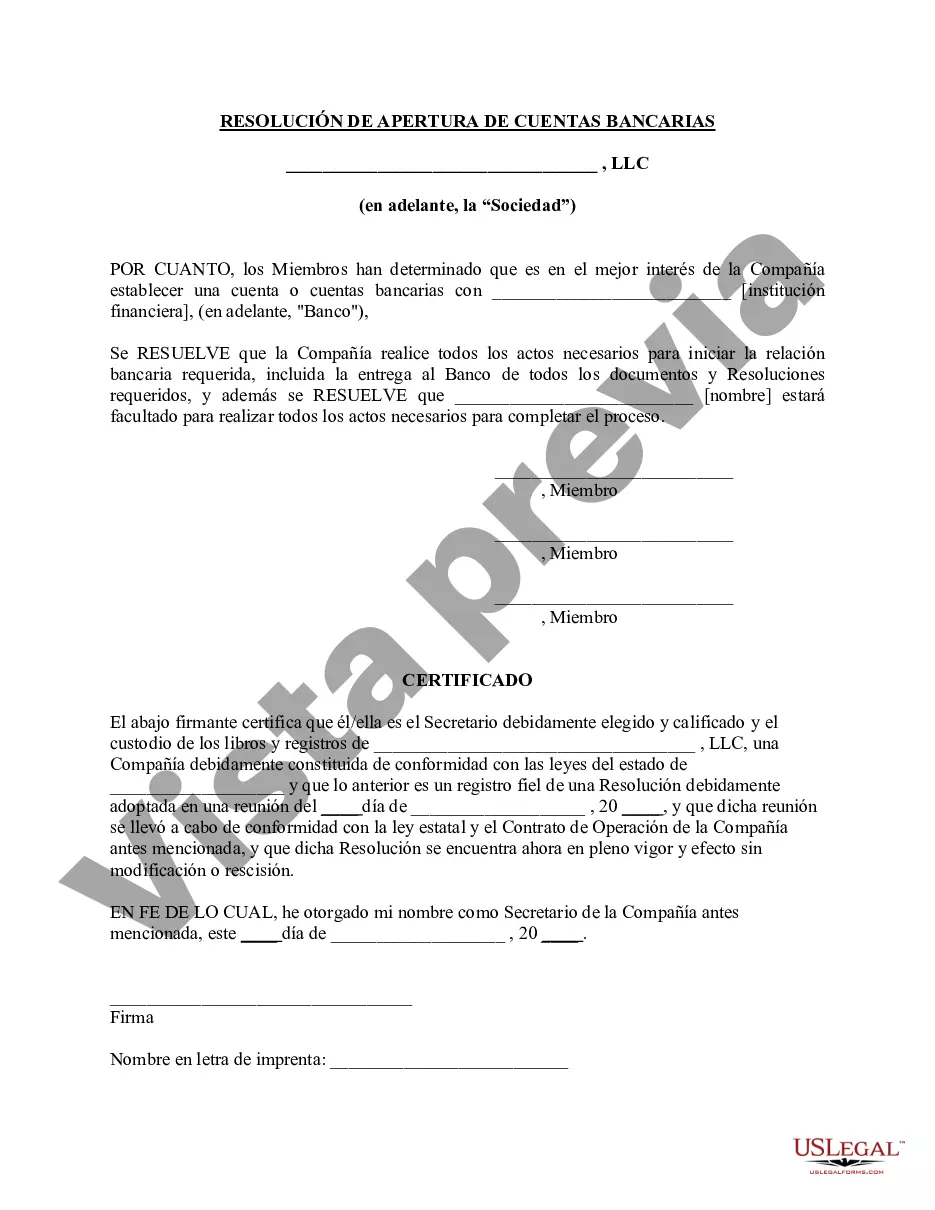

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Business Bank Account For Llc Wells Fargo - Resolution of Meeting of LLC Members to Open Bank Accounts

Description

How to fill out Business Bank Account For Llc Wells Fargo?

Creating legal documents from the ground up can frequently be intimidating.

Specific situations might entail extensive research and significant expenses.

If you’re searching for a simpler and more affordable method of generating Business Bank Account For Llc Wells Fargo or any other paperwork without unnecessary complications, US Legal Forms is always available to assist.

Our online library of over 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-compliant forms meticulously prepared by our legal professionals.

US Legal Forms enjoys a strong reputation and boasts over 25 years of expertise. Join us now and simplify the process of completing forms!

- Utilize our platform whenever you require a dependable service to quickly find and retrieve the Business Bank Account For Llc Wells Fargo.

- If you’re a returning user and have previously established an account with us, simply Log In, choose the form, and download it or access it later in the My documents section.

- Not registered yet? No problem. It requires minimal time to register and browse through the catalog.

- Before directly downloading Business Bank Account For Llc Wells Fargo, consider these suggestions.

- Examine the form preview and descriptions to confirm you’ve located the correct document.

Form popularity

FAQ

Wells Fargo is organized as a corporation. This corporate structure allows it to offer extensive financial services across the globe. Understanding the organization's nature can assist you in accessing the right resources. If you need a business bank account for your LLC, consider utilizing Wells Fargo's options.

Wells Fargo is a multinational financial services and banking company. It offers a variety of products for both individual and business clients. Knowing the company's structure can help you navigate their services more effectively, including finding a business bank account for LLCs that suits you.

To set up a business bank account for an LLC, you generally need to gather necessary documents like your EIN, operating agreement, and formation documents. Once you have these, you can visit a bank like Wells Fargo and complete the application process. They will assist you in ensuring that your account meets your business needs.

Wells Fargo is a financial services corporation. It provides a wide range of services, including banking and investment options. Understanding the type of entity Wells Fargo operates as can help you make informed decisions about your banking needs. You can find a suitable business bank account for LLCs with them.

Yes, you can open a bank account with just your EIN. However, you may also need to provide other information, such as your LLC formation documents and a valid identification. This process ensures that your account is fully compliant with regulations. Consider Wells Fargo, as they guide you through opening a business bank account for LLCs.

Wells Fargo is not an LLC; it operates as a corporate entity. This distinction is important, as different types of entities have varying structures and regulations. Knowing this can help when you consider opening a business bank account for LLC at Wells Fargo. They provide various options suitable for your business needs.

Yes, you can open a bank account in your LLC name. When you do this, it helps separate your personal and business finances. This is an essential step for maintaining liability protection and ensuring accurate accounting. You can choose Wells Fargo for a business bank account for LLCs, as they offer tailored services.

No, Wells Fargo is not an LLC. It is a publicly traded corporation that provides financial services to individuals and businesses. Although it's not an LLC, you can easily establish a business bank account for LLCs at Wells Fargo. This allows your LLC to manage its finances effectively.

To open a business bank account for LLC at Wells Fargo, start by gathering your EIN and necessary documentation like your formation papers. Next, visit a branch or apply online through the Wells Fargo website. After submitting your application, follow their instructions and provide any additional information they request to get your account set up.

When selecting the best bank account for small businesses, consider features such as low fees, easy access, and excellent customer service. Wells Fargo provides a variety of business bank account options that cater to small businesses, ensuring you find a fit for your needs. Additionally, their strong online banking features enhance managing your finances.