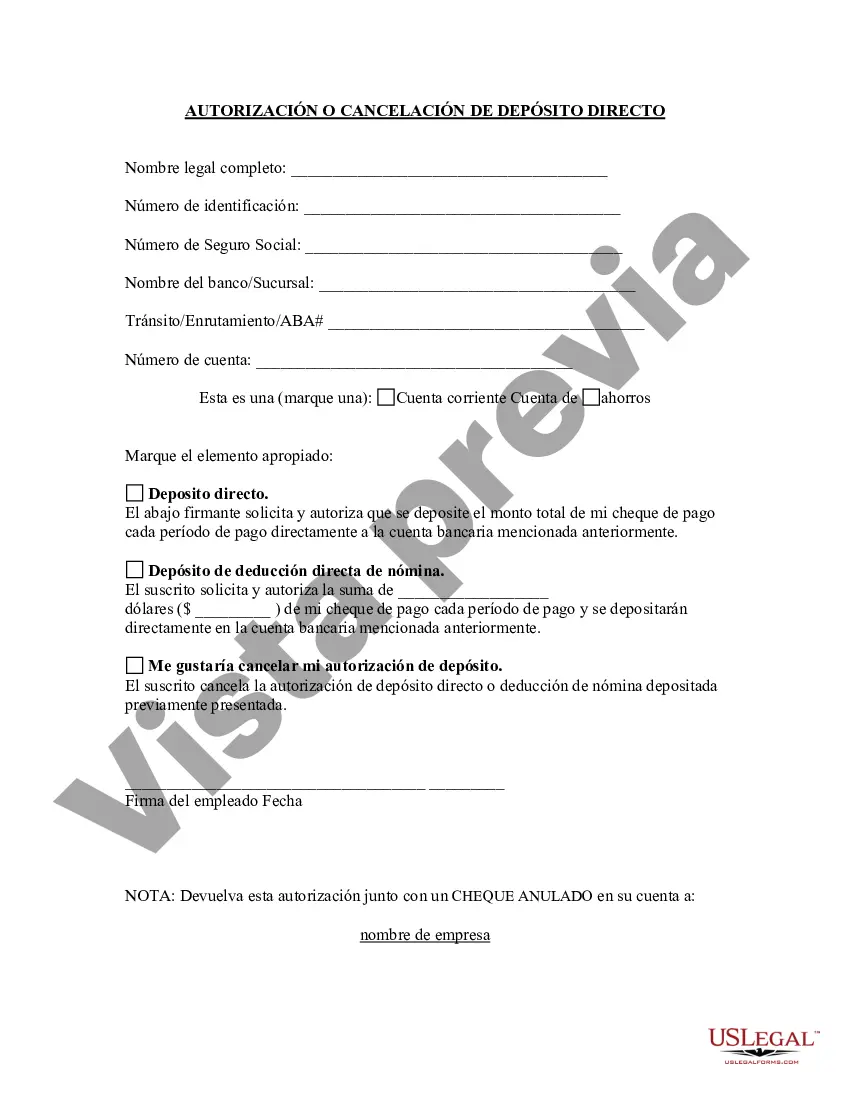

Title: Understanding the Direct Deposit Authorization Form PNC: Types and Detailed Description Introduction: Direct deposit authorization forms play a crucial role in enabling individuals to receive payments directly into their bank accounts. This article aims to provide a comprehensive understanding of the Direct Deposit Authorization Form PNC, outlining its purpose, key features, and various types available. I. What is a Direct Deposit Authorization Form PNC? The Direct Deposit Authorization Form PNC is a tool that allows PNC Bank customers to authorize the electronic transfer of funds from another entity directly into their PNC bank account. It eliminates the hassle of receiving physical checks and provides a convenient and secure method to receive payments. II. Purpose and Key Features: 1. Fast and Efficient Payment Processing: The form enables the quick and efficient processing of payments, eliminating the need for manual check deposits. 2. Reliable and Secure: Direct deposit ensures a secure means of receiving payments, reducing the risk associated with lost or stolen checks. 3. Timely Access to Funds: By opting for direct deposit, individuals gain instant access to their funds, with no delays caused by mail delivery or deposit processing. 4. Automated Allocation: The form allows individuals to allocate their funds to specific accounts, such as savings, checking, or investment accounts. III. Different Types of Direct Deposit Authorization Form PNC: 1. Payroll Direct Deposit Authorization Form: This form is commonly used by employees to authorize their employers to directly deposit their salary or wages into their PNC bank account. 2. Pension Direct Deposit Authorization Form: This form is used to authorize the direct deposit of pension or retirement benefits into a PNC bank account. 3. Government Direct Deposit Authorization Form: Government agencies often utilize this form to transfer benefits, such as social security, disability, or veteran's benefits, directly into a PNC bank account. 4. Vendor Direct Deposit Authorization Form: Vendors or contractors may be required to complete this form to establish direct deposit for their payments from PNC Bank. 5. Dividend Direct Deposit Authorization Form: Individuals who receive dividend payments from investments can utilize this form to have their dividends directly deposited into their PNC bank account. Conclusion: The Direct Deposit Authorization Form PNC is an essential tool for individuals seeking a convenient, secure, and streamlined method of receiving payments. By completing the appropriate form, individuals can ensure timely access to funds, automated allocation, and heightened security. Whether it's for payroll, government benefits, or other types of payments, PNC Bank provides a range of Direct Deposit Authorization Form options to cater to various needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Direct Deposit Authorization Form Pnc - Direct Deposit Authorization

Description

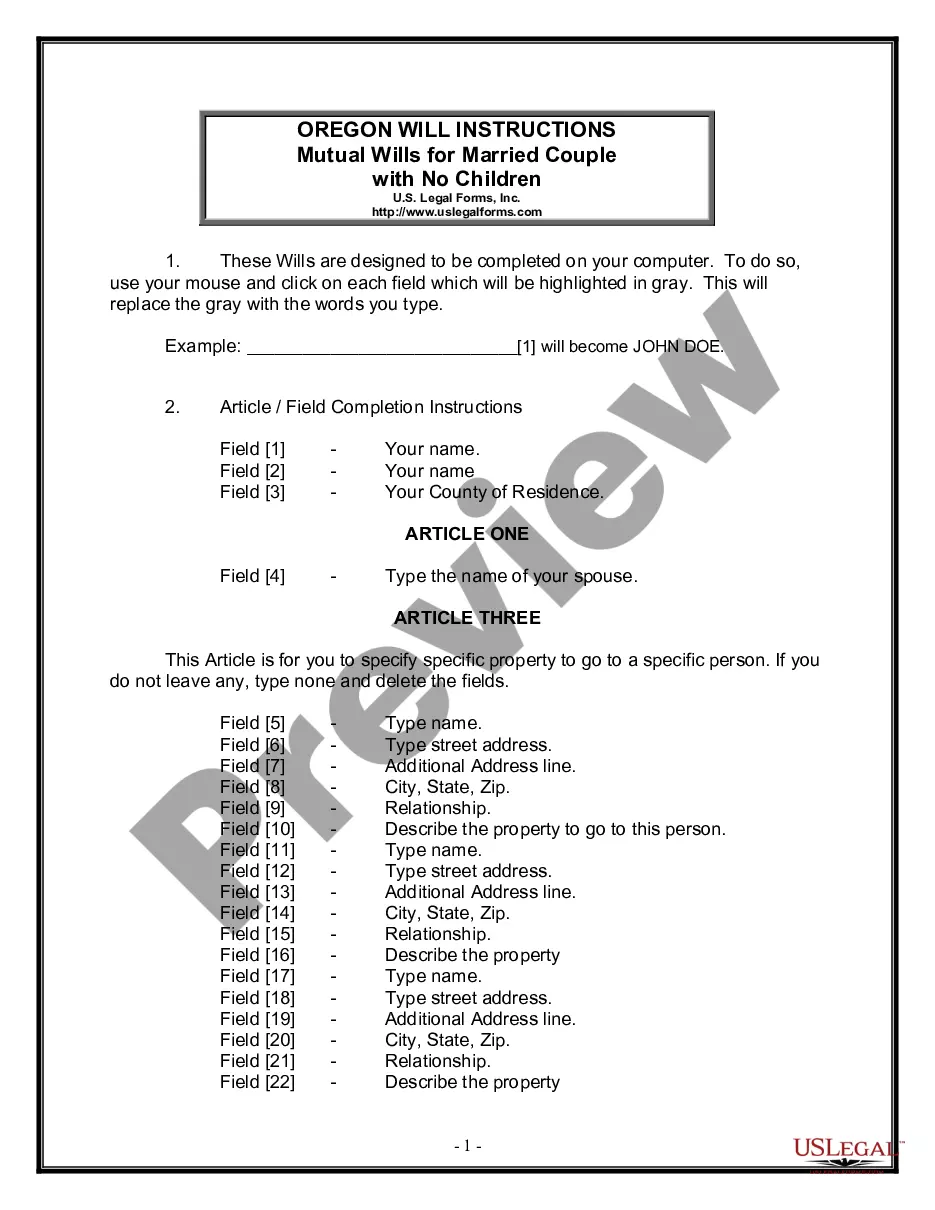

How to fill out Direct Deposit Authorization Form Pnc?

The Direct Deposit Authorization Form Pnc you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and state laws. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Direct Deposit Authorization Form Pnc will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it suits your needs. If it does not, make use of the search option to get the correct one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Direct Deposit Authorization Form Pnc (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your papers again. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

Remember: as long as an asset has a UCC lien filed against it, you're not allowed to transfer, sell, or use it as collateral for any other loan.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

A UCC financing statement ? also called a UCC-1 financing statement or a UCC-1 filing ? is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

What does it look like? A UCC-1 financing statement contains three important pieces of information: Parts 1 and 2 contain the personal and contact information of the borrower. Part 3 contains the personal and contact information of the secured party?otherwise known as the creditor.

A UCC filing is the official notice lenders use to indicate that they have a security interest in a borrower's assets or property. The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default.

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

A UCC lien filing remains on your business credit report for 5 years. This has no negative effect on your credit score, however, when someone checks your credit report it is visible and that can play a factor in your ability to be approved for things other than just business funding.