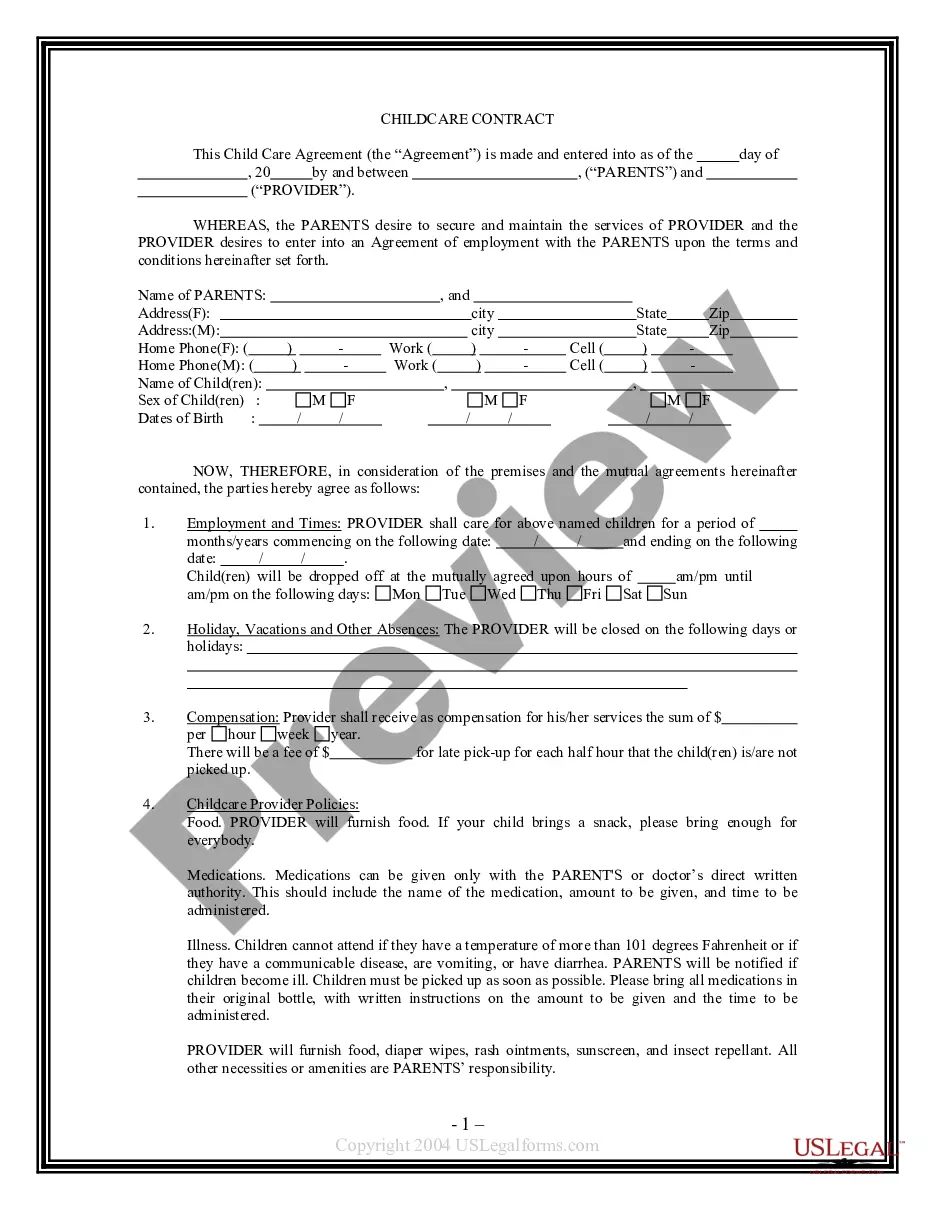

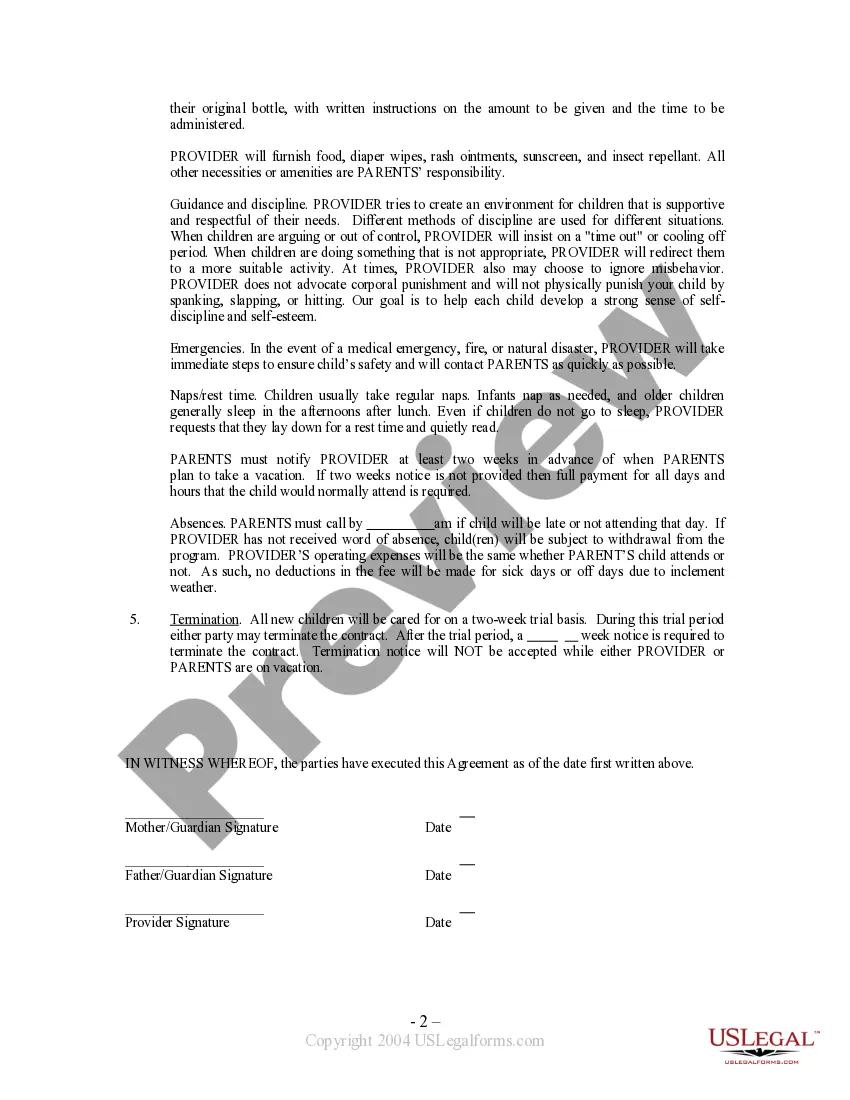

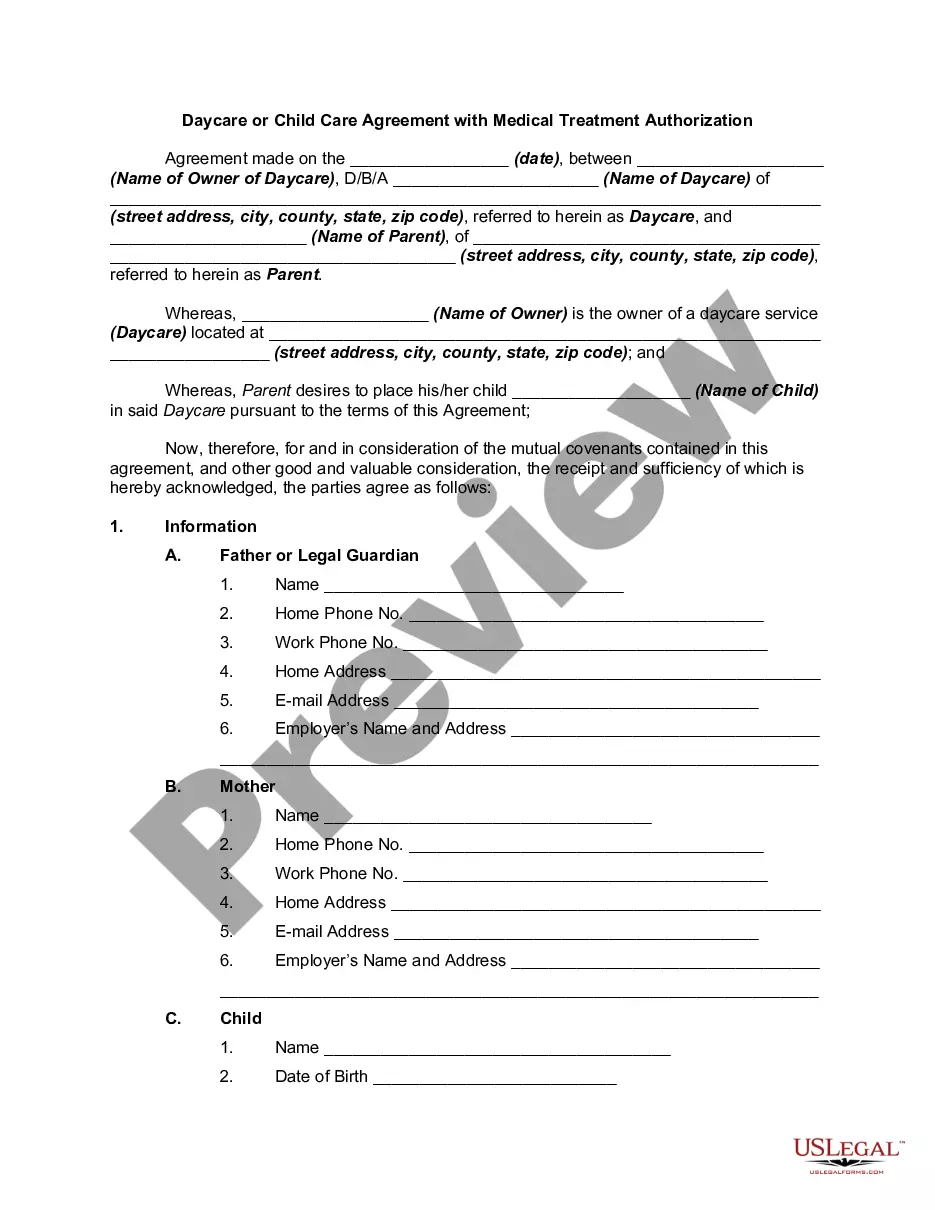

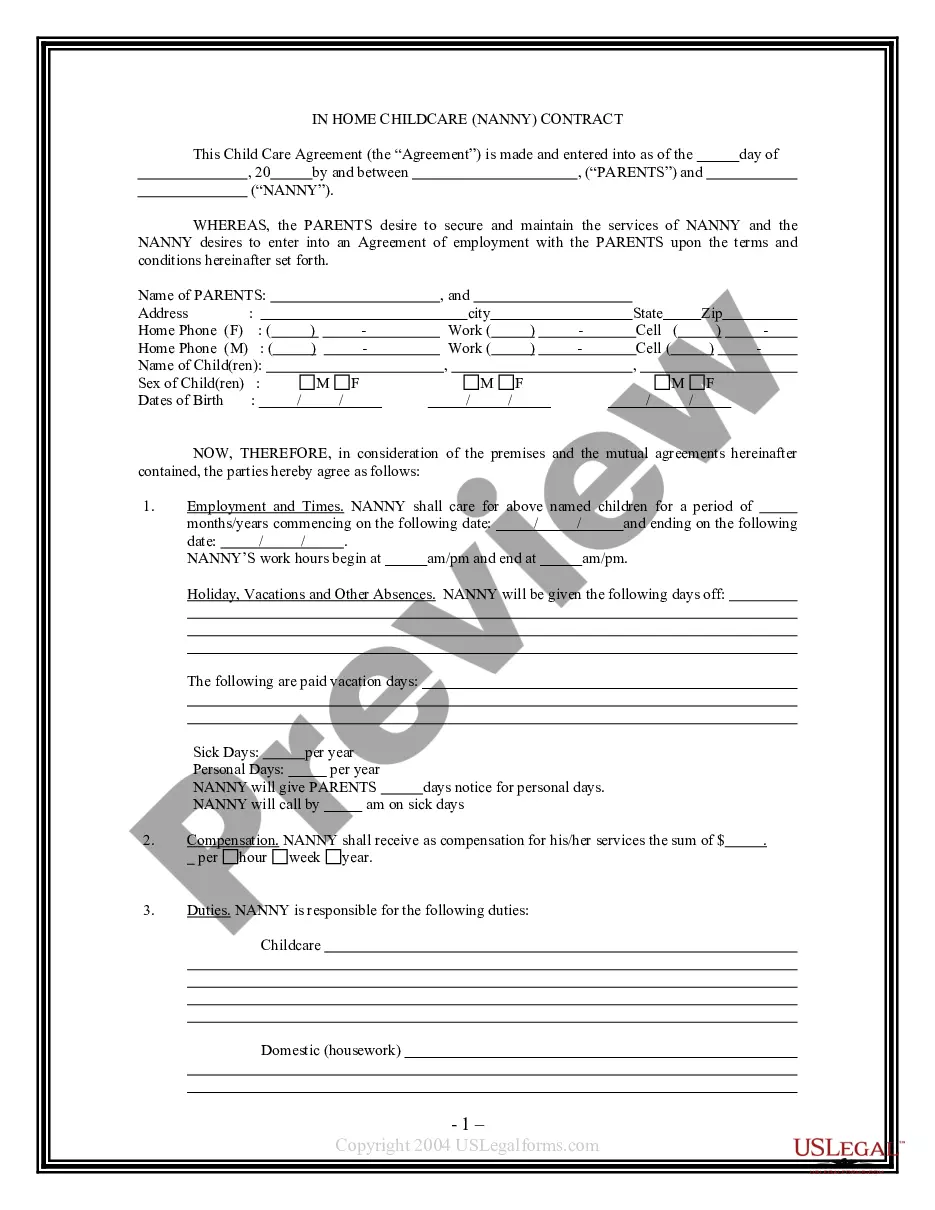

Example Of Home Daycare Contract

Description

How to fill out Childcare Or Daycare Contract?

Managing legal documents and processes can be a lengthy addition to your day.

Samples of Home Daycare Agreements and similar documents typically require you to locate them and comprehend the best methods for completing them accurately.

Thus, whether you are handling financial, legal, or personal issues, having a comprehensive and useful online collection of documents at your disposal will significantly help.

US Legal Forms is the premier online service for legal templates, providing over 85,000 state-specific documents and various resources to help you fill out your papers efficiently.

Simply Log In to your account, locate Samples of Home Daycare Agreements, and obtain it instantly in the My documents section. You can also access previously downloaded documents.

- Browse the collection of relevant documents available to you with just one click.

- US Legal Forms offers state- and county-specific documents accessible anytime for download.

- Protect your document management processes using a high-quality service that allows you to prepare any form within minutes without extra or concealed fees.

Form popularity

FAQ

Choosing an in-home daycare comes with several disadvantages that are important to consider. First, the lack of accreditation can lead to varying standards in care, which may not provide the best environment for your child. Additionally, without a formal example of home daycare contract, there can be unclear boundaries regarding policies, fees, and responsibilities. It’s essential to establish a comprehensive agreement to ensure that both you and the caregiver have a mutual understanding, thereby minimizing potential conflicts.

A simple contract is a straightforward agreement between parties outlining essential terms. For instance, an example of a home daycare contract might include details like the hours of service, fees, and policies regarding absences. This document not only protects both parties but also clarifies expectations. Utilizing platforms like uslegalforms can help you create a customized simple contract tailored to your needs.

To write a basic contract agreement, start by clearly identifying the parties involved and their roles. Next, include the key terms of the agreement, such as services provided, payment details, and any obligations. Ensure that both parties understand and agree to these terms. For a practical example, consider an example of a home daycare contract, which outlines specific responsibilities and expectations for childcare.

To report daycare income, gather all payments received from parents or guardians, ideally outlined in your example of a home daycare contract. Use Schedule C on your tax return to document your earnings and expenses. Ensure you report all income accurately to avoid issues with tax authorities. Consistent record-keeping eases this task significantly.

As a home daycare provider, you must file taxes as a self-employed individual. This process includes gathering your income details from clients and essential expenses documented through your example of a home daycare contract. Additionally, keep track of all relevant costs to maximize deductions, which can significantly affect your tax outcome. Seeking help from a tax professional can enhance accuracy.

Writing a simple contract agreement includes defining the scope of work, payment terms, and expectations from both parties. Begin with your names, followed by the service description, fees, and any policies related to cancellations. An example of a home daycare contract can serve as an excellent guide throughout this process. Using templates available from US Legal Forms can streamline your efforts.

The tax form for home daycare typically involves Schedule C, where you report your income and expenses as a business. An example of a home daycare contract can supply necessary details about your services and income, ensuring you report accurately. You may also need to file additional forms to claim deductions. Keeping thorough records simplifies this process.

The maximum tax credit for daycare expenses can vary based on income and the number of children you have in care. Generally, the Child and Dependent Care Credit might cover a percentage of your qualifying expenses. Be sure to keep your example of a home daycare contract handy, as it will provide essential details for calculating your credit. Staying informed can maximize your benefits.

Filing taxes for childcare involves reporting both your income and your expenses. Use the forms required by the IRS, and refer to your example of a home daycare contract for accurate information on the services provided. Don’t forget to claim any relevant deductions to reduce your tax liability. Consulting a tax professional can provide further guidance tailored to your situation.

To provide proof of child care expenses, keep detailed records such as receipts and invoices. An example of a home daycare contract can help clarify these expenses, as it often includes payment confirmations. You might also consider creating a monthly summary of your payments for easy reference. This documentation will support any tax claims you make.