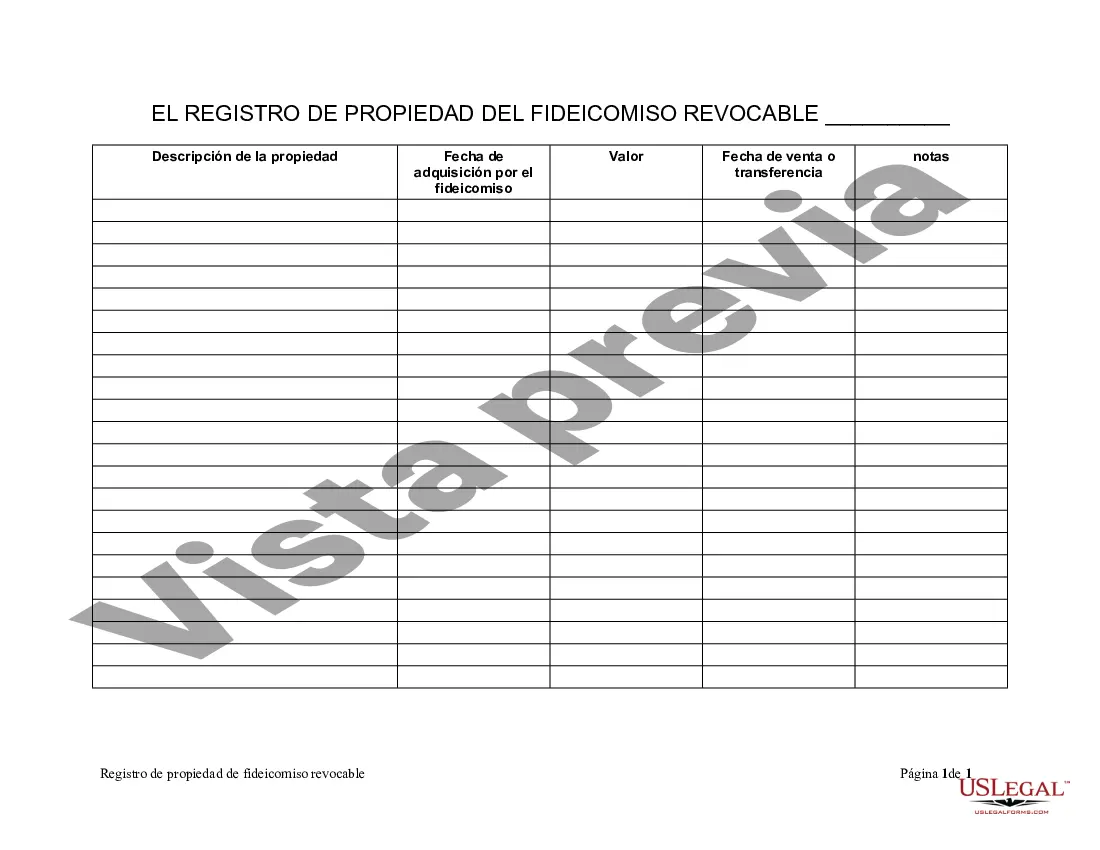

Wyoming Living Trust For Property - Wyoming Living Trust Property Record

Description

Form popularity

FAQ

The biggest mistake parents often make when establishing a trust fund is failing to clearly define their intentions and terms. Without clear guidelines, beneficiaries may not understand how the funds should be used, leading to confusion and potential disputes. Using a Wyoming living trust for property can help in providing clarity and direction. It is wise to discuss your goals with a trusted advisor.

Setting up a Wyoming living trust for property involves a few straightforward steps. First, you need to create a legal document that outlines the terms of your trust. Then, you can transfer your property into the trust by changing the title. Consulting with a professional, like uslegalforms, can simplify the process and ensure everything is done correctly.

Many individuals set up a Wyoming living trust for property due to the state's favorable laws regarding asset protection and privacy. Wyoming offers unique benefits, such as no state income tax and strong regulations that ensure your assets are secure. Trusts in Wyoming also allow for easy management of property across generations, minimizing hassle for your heirs. Overall, a Wyoming living trust for property provides peace of mind and helps you efficiently manage your assets.

You should consider excluding specific assets from your Wyoming living trust for property, particularly those that can automatically transfer upon death. Examples include retirement accounts, life insurance, and certain bank accounts. Overseeing these exclusions ensures that the trust operates effectively, optimizing your estate planning.

Setting up a living trust in Wyoming involves several crucial steps, including drafting a trust document that identifies the trust’s purpose, assets, and beneficiaries. You will also need to formally transfer ownership of assets into the trust. Legal assistance can provide clarity, and using resources like US Legal Forms can help you navigate the setup more effectively.

While a Wyoming living trust for property can hold many different assets, certain items should generally remain outside the trust. For instance, retirement accounts, life insurance policies, and certain types of payable-on-death accounts should typically not be included. Instead, these should have designated beneficiaries to ensure smooth transitions upon your passing.

Filling out a living trust requires you to provide detailed information about the assets you wish to include. This entails listing all property, accounts, and valuables, followed by naming the beneficiaries and the trustee. Additionally, using platforms like US Legal Forms can simplify drafting and filling out your Wyoming living trust for property, helping you avoid common pitfalls.

To place your assets in a Wyoming living trust for property, you need to transfer the ownership of your assets to the trust. This process typically involves executing a trust agreement and retitling assets such as real estate, bank accounts, and investments in the name of the trust. It's essential to work with a legal professional to ensure the transfer meets state laws, thus making the process efficient and seamless.

While placing your home in a Wyoming living trust for property can simplify the transfer upon death, it may introduce some complexities. For instance, transferring the title of your home into the trust may incur costs and require specific paperwork. Moreover, lenders may view the property differently, potentially complicating mortgage terms. It's vital to weigh these factors carefully, and using the US Legal Forms platform can help you navigate these concerns effectively.

When establishing a Wyoming living trust for property, certain assets may not be suitable for inclusion. For example, retirement accounts like IRAs and 401(k)s typically do not belong in a trust, as they have specific beneficiary designations. Additionally, personal property, such as automobiles, may not offer significant benefits within a trust structure. Understanding which assets to keep outside can help you maintain flexibility and efficiency in your estate plan.