- US Legal Forms

-

Michigan Declaración de Divulgación de Ventas de Bienes Raíces...

Michigan Declaración de Divulgación de Ventas de Bienes Raíces Residenciales - Michigan Residential Real Estate Sales Disclosure Statement

Description

Related Forms

Contrato de Compraventa de Bienes Inmuebles sin Corredor para Acuerdo de Venta de Casa Residencial

Lista de verificación de inspección de la vivienda del comprador

LegalLife Multistate Guide and Handbook for Selling or Buying Real Estate

Michigan Real Estate Home Sales Package with Offer to Purchase, Contract of Sale, Disclosure Statements and more for Residential House

Divulgación de pintura a base de plomo para transacciones de venta

Contrapropuesta a Contrato de Compraventa de Bienes Inmuebles

Acuerdo de Prórroga o Modificación del Contrato de Compraventa de Bienes Inmuebles

Related legal definitions

How to fill out Michigan Declaración De Divulgación De Ventas De Bienes Raíces Residenciales?

Get any template from 85,000 legal documents such as Michigan Residential Real Estate Sales Disclosure Statement on-line with US Legal Forms. Every template is prepared and updated by state-licensed legal professionals.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Michigan Residential Real Estate Sales Disclosure Statement you need to use.

- Look through description and preview the template.

- Once you are sure the template is what you need, click Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by bank card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable form is ready, print it out or save it to your gadget.

With US Legal Forms, you will always have quick access to the proper downloadable sample. The platform provides you with access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Michigan Residential Real Estate Sales Disclosure Statement easy and fast.

Form Rating

Form popularity

FAQ

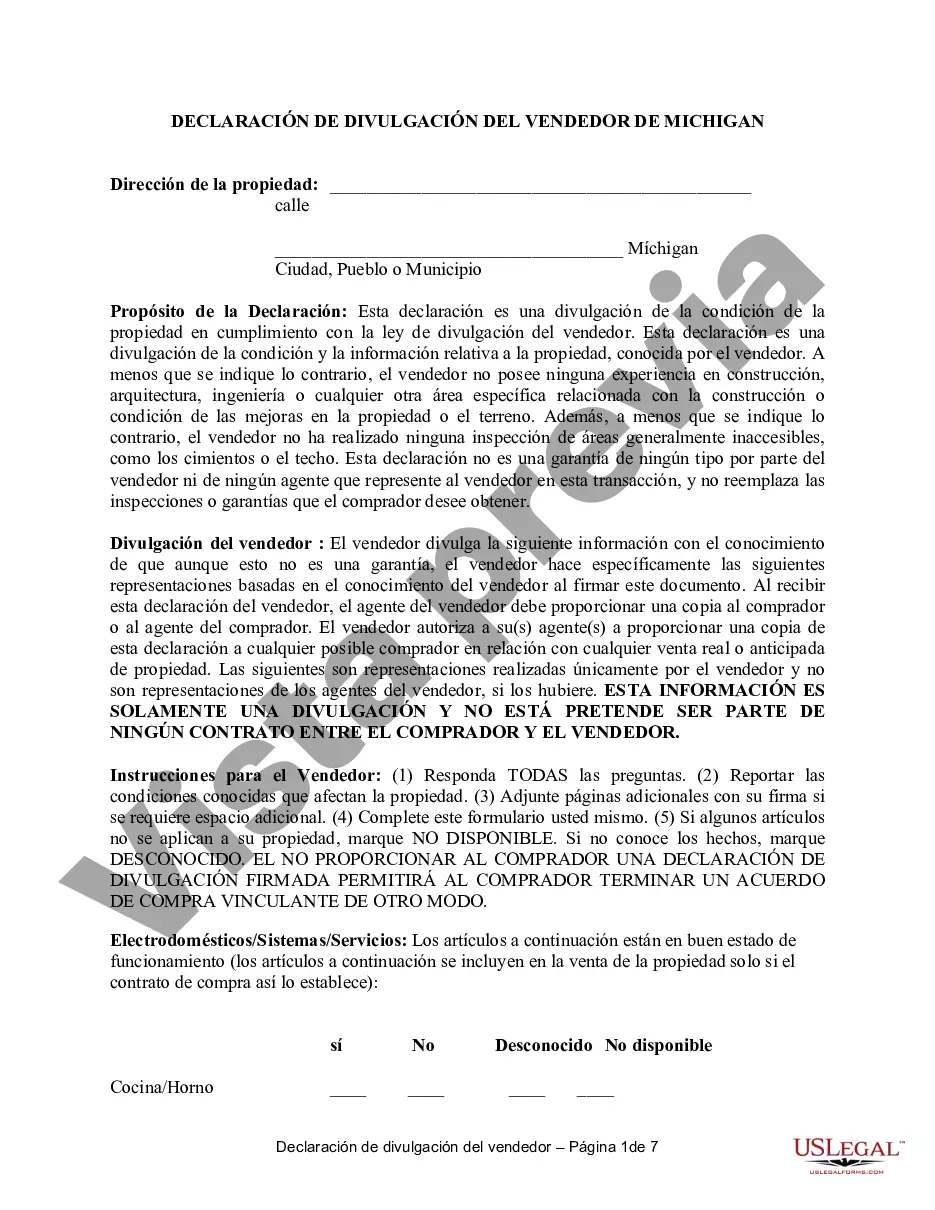

Proposito del Formulario de divulgaciA³n: Esta es una declaraciA³n de determinadas condiciones e informaciA³n en referencia a la propiedad que conoce el propietario.A menos que se informe lo contrario, el propietario no realizA³ ninguna inspecciA³n de las A¡reas generalmente inaccesibles de la propiedad.

¿CA³mo hacer un contrato de compraventa?ReAºne los datos necesarios.Acude con un notario.Revisa las condiciones del convenio.Presenta el contrato final.

Documentos necesarios para vender una casaPromesa de compraventa.Escritura vigente (copia).Certificado de Tradicion y Libertad (Vigencia no mayor a 30 dAas).Paz y salvo del impuesto predial del inmueble.Paz y salvo del IDU.Certificado de propiedad horizontal en caso de ser un apartamento o casa en conjunto.More items...a¢

El contrato de compraventa debe considerar o contener aspectos relevantes como los siguientes:Identificacion de las partes.IdentificaciA³n del inmueble objeto de compraventa.DeclaraciA³n de pertenencia del inmueble al vendedor.Precio de venta.DeclaraciA³n de la regularidad del inmueble.More items...a¢

Cuando tu y el vendedor llegan a un acuerdo, todo debe quedar escrito en un contrato....Hacer preguntas.Partes. Los nombres del comprador y el vendedor.DescripciA³n de propiedad.Oferta o monto de compra.Cantidad de dinero por adelantado.Monto del pago inicial.Contingencias.Monto y condiciones del prA©stamo.TAtulo.More items...

El contrato es vigente de manera permanente, ya que por la naturaleza del contrato de compraventa de inmueble al momento de firmar dicho contrato, se transmite la propiedad del inmueble y una vez que dicha propiedad forma parte o se integra al patrimonio del comprador ya no puede volver a formar parte del patrimonio

Una compraventa tanto en un contrato privado como en una escritura publica es plenamente vinculante para las partes.Es decir para que eso suceda y se pueda disolver un contrato no escriturado debe incluirse en el mismo una clA¡usula que advierta de tal eventualidad, un pacto expreso entre las partes.

Pese a que no es un documento valido a la hora de transmitir la propiedad a efecto registral, el contrato de compraventa privado es totalmente legal y surte efectos entre las partes, lo que darA¡ lugar a una serie de derechos y obligaciones por lo que es importante una buena redacciA³n.

¿QuA© validez tiene un contrato de compraventa sin notario?. En principio, te podemos adelantar que el contrato de compraventa se perfecciona por el consentimiento entre las partes. La ley considera el documento privado como un modo perfectamente vA¡lido de formalizar un negocio.

Los 12 documentos que el vendedor tiene que llevar para la firma ante notarioDNI o tarjeta de residencia.Recibo del ultimo pago del Impuesto sobre Bienes Inmuebles (IBI).Certificado sobre los gastos de la comunidad.Escritura de la propiedad.Documento de aceptaciA³n de la herencia, si procede.More items...a¢

Requisitos para vender una casaIdentificacion oficial o carta poder notarial.Escritura pAºblica de propiedad.Certificado de libertad de gravamen.Contrato de compraventa de un inmueble.Datos y declaraciones del vendedor.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Michigan

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

MI Seller Disclosure Act - [Loislaw 8-14-2002]

565.951 Short title.

565.952 Applicability of seller disclosure requirements.

565.953 Seller disclosure requirements; exceptions.

565.954 Written statement; delivery; time limits; compliance; terminating purchase agreement within certain time limits; expiration of right to terminate.

565.955 Liability for error, inaccuracy, or omission; delivery as compliance with requirements of act; conditions.

565.956 Disclosures; inaccuracy as result of action, occurrence, or agreement after delivery; unknown or unavailable information; basis.

565.957 Disclosure; form.

565.958 Availability of copies.

565.959 Additional disclosures.

565.960 Disclosure; good faith.

565.961 Other obligations created by law not limited.

565.962 Disclosure; amendment.

565.963 Disclosure; manner of delivery.

565.964 Transfer not invalidated by noncompliance.

565.965 Liability of agent.

565.966 Effective date.

565.951 Short title.

Sec. 1. This act shall be known and may be cited as the "seller disclosure act".

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.952 Applicability of seller disclosure requirements.

Sec. 2. The seller disclosure requirements of sections 4 to 13 apply to the transfer of any interest in real estate consisting of not less than 1 or more than 4 residential dwelling units, whether by sale, exchange, installment land contract, lease with an option to purchase, any other option to purchase, or ground lease coupled with proposed improvements by the purchaser or tenant, or a transfer of stock or an interest in a residential cooperative.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.953 Seller disclosure requirements; exceptions.

Sec. 3. The seller disclosure requirements of sections 4 to 13 do not apply to any of the following:

(a) Transfers pursuant to court order, including, but not limited to, transfers ordered by a probate court in administration of an estate, transfers pursuant to a writ of execution, transfers by any foreclosure sale, transfers by a trustee in bankruptcy, transfers by eminent domain, and transfers resulting from a decree for specific performance.

(b) Transfers to a mortgagee by a mortgagor or successor in interest who is in default, or transfers to a beneficiary of a deed of trust by a trustor or successor in interest who is in default.

(c) Transfers by a sale under a power of sale or any foreclosure sale under a decree of foreclosure after default in an obligation secured by a mortgage or deed of trust or secured by any other instrument containing a power of sale, or transfers by a mortgagee or a beneficiary under a deed of trust who has acquired the real property at a sale conducted pursuant to a power of sale under a mortgage or deed of trust or a sale pursuant to a decree of foreclosure or has acquired the real property by a deed in lieu of foreclosure.

(d) Transfers by a nonoccupant fiduciary in the course of the administration of a decedent's estate, guardianship, conservatorship, or trust.

(e) Transfers from 1 co-tenant to 1 or more other co-tenants.

(f) Transfers made to a spouse, parent, grandparent, child, or grandchild.

(g) Transfers between spouses resulting from a judgment of divorce or a judgment of separate maintenance or from a property settlement agreement incidental to such a judgment.

(h) Transfers or exchanges to or from any governmental entity.

(i) Transfers made by a person licensed under article 24 of Act No. 299 of the Public Acts of 1980, being sections 339.2401 to 339.2412 of the Michigan Compiled Laws, of newly constructed residential property that has not been inhabited.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.954 Written statement; delivery; time limits; compliance; terminating purchase agreement within certain time limits; expiration of right to terminate.

Sec. 4. (1) The transferor of any real property described in section 2 shall deliver to the transferor's agent or to the prospective transferee or the transferee's agent the written statement required by this act. If the written statement is delivered to the transferor's agent, the transferor's agent shall provide a copy to the prospective transferee or his or her agent. A written disclosure statement provided to a transferee's agent shall be considered to have been provided to the transferee. The written statement shall be delivered to the prospective transferee within the following time limits:

(a) In the case of a sale, before the transferor executes a binding purchase agreement with the prospective transferee.

(b) In the case of transfer by an installment sales contract where a binding purchase agreement has not been executed, or in the case of a lease together with an option to purchase or a ground lease coupled with improvements by the tenant, before the transferor executes the installment sales contract with the prospective transferee.

(2) With respect to any transfer subject to subsection (1), the transferor shall indicate compliance with this act either on the purchase agreement, the installment sales contract, the lease, or any addendum attached to the purchase agreement, contract, or lease, or on a separate document.

(3) Except as provided in subsection (4), if any disclosure or amendment of any disclosure required to be made by this act is delivered after the transferor executes a binding purchase agreement, the prospective transferee may terminate the purchase agreement by delivering written notice of termination to the transferor or the transferor's agent within the following time limits:

(a) Not later than 72 hours after delivery of the disclosure statement to the prospective transferee, if the disclosure statement was delivered to the prospective transferee in person.

(b) Not later than 120 hours after delivery of the disclosure statement to the prospective transferee, if the disclosure statement was delivered to the prospective transferee by registered mail.

(4) A transferee's right to terminate the purchase agreement expires upon the transfer of the subject property by deed or installment sales contract.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.955 Liability for error, inaccuracy, or omission; delivery as compliance with requirements of act; conditions.

Sec. 5. (1) The transferor or his or her agent is not liable for any error, inaccuracy, or omission in any information delivered pursuant to this act if the error, inaccuracy, or omission was not within the personal knowledge of the transferor, or was based entirely on information provided by public agencies or provided by other persons specified in subsection (3), and ordinary care was exercised in transmitting the information. It is not a violation of this act if the transferor fails to disclose information that could be obtained only through inspection or observation of inaccessible portions of real estate or could be discovered only by a person with expertise in a science or trade beyond the knowledge of the transferor.

(2) The delivery of any information required by this act to be disclosed to a prospective transferee by a public agency or other person specified in subsection (3) shall be considered to comply with the requirements of this act and relieves the transferor of any further duty under this act with respect to that item of information, unless the transferor has knowledge of a known defect or condition that contradicts the information provided by the public agency or the person specified in subsection (3).

(3) The delivery of a report or opinion prepared by a licensed professional engineer, professional surveyor, geologist, structural pest control operator, contractor, or other expert, dealing with matters within the scope of the professional's license or expertise, is sufficient compliance for application of the exemption provided by subsection (1) if the information is provided upon the request of the prospective transferee, unless the transferor has knowledge of a known defect or condition that contradicts the information contained in the report or opinion. In responding to a request by a prospective transferee, an expert may indicate, in writing, an understanding that the information provided will be used in fulfilling the requirements of section 7 and, if so, shall indicate the required disclosures, or parts of disclosures, to which the information being furnished applies. In furnishing the statement, the expert is not responsible for any items of information other than those expressly set forth in the statement.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.956 Disclosures; inaccuracy as result of action, occurrence, or agreement after delivery; unknown or unavailable information; basis.

Sec. 6. If information disclosed in accordance with this act becomes inaccurate as a result of any action, occurrence, or agreement after the delivery of the required disclosures, the resulting inaccuracy does not constitute a violation of this act. If at the time the disclosures are required to be made, an item of information required to be disclosed under this act is unknown or unavailable to the transferor, the transferor may comply with this act by advising a prospective purchaser of the fact that the information is unknown. The information provided to a prospective purchaser pursuant to this act shall be based upon the best information available and known to the transferor.

History: 1993, Act 92, Eff. Jan. 10, 1994.

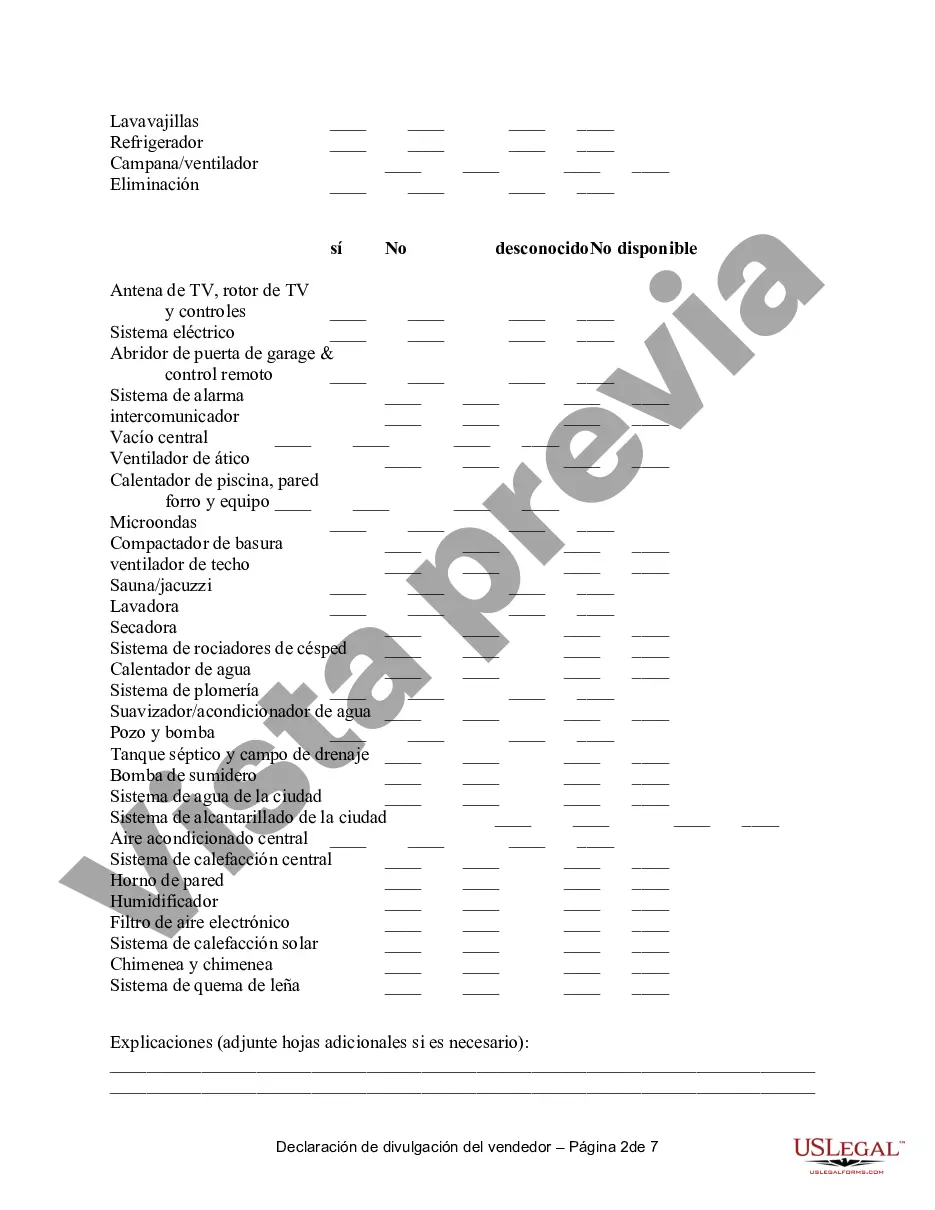

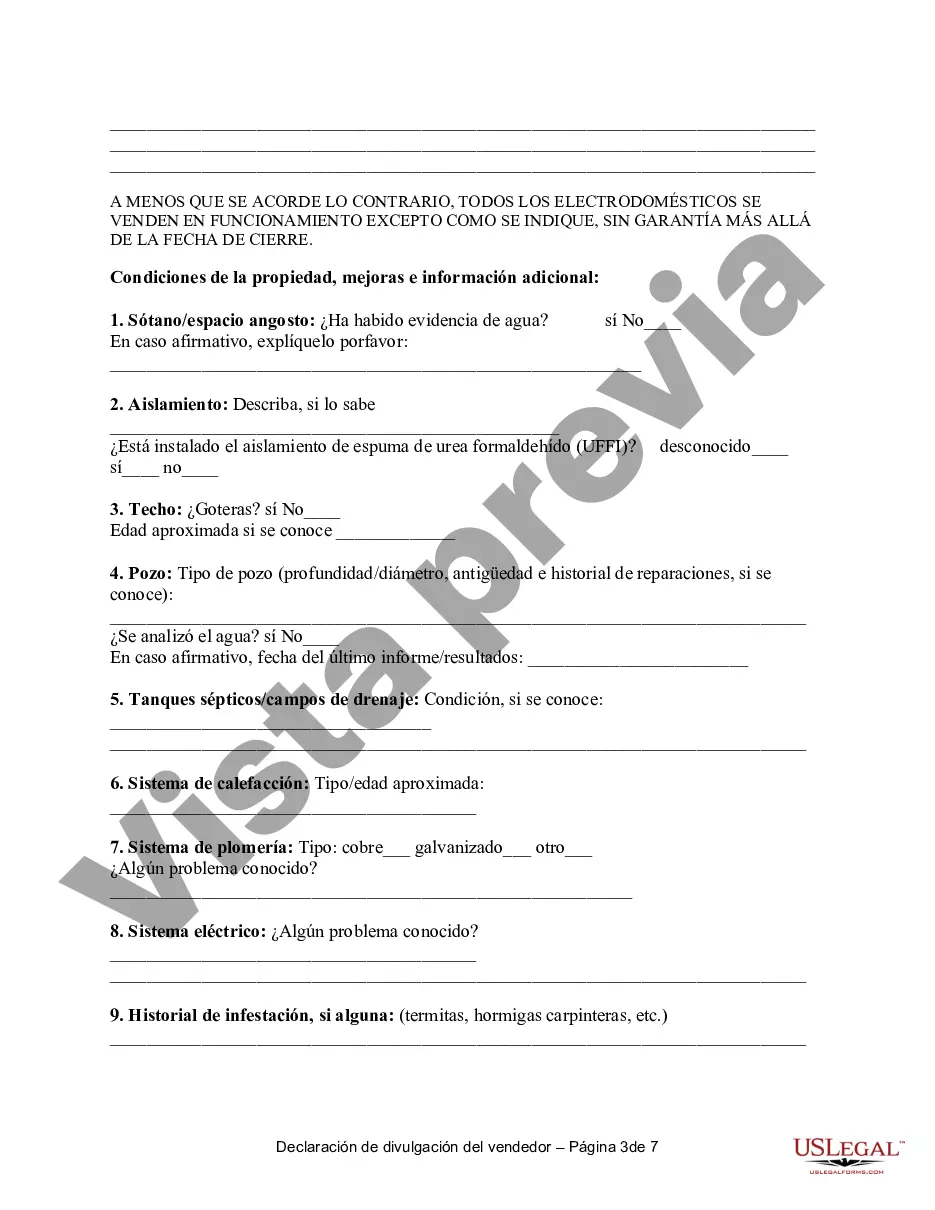

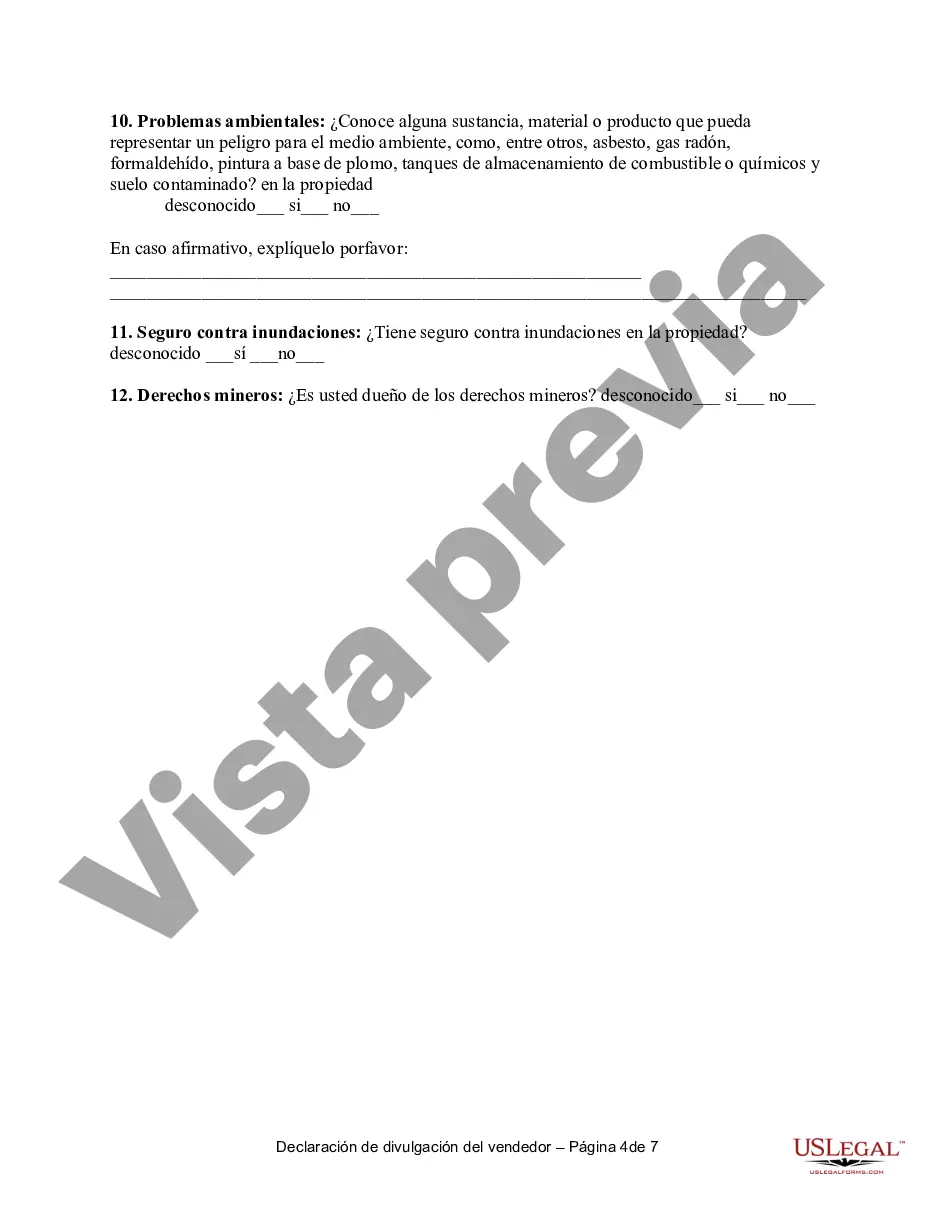

565.957 Disclosure; form.

Sec. 7. (1) The disclosures required by this act shall be made on the following form:

[See USLF form # MI-37014]

565.958 Availability of copies.

Sec. 8. Copies of the form prescribed in section 7 shall be made available to the public by all real estate brokers and real estate salespersons.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.959 Additional disclosures.

Sec. 9. A city, township, or county may require disclosures in addition to those disclosures required by section 7, and may require disclosures on a different disclosure form in connection with transactions subject to this act.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.960 Disclosure; good faith.

Sec. 10. Each disclosure required by this act shall be made in good faith. For purposes of this act, "good faith" means honesty in fact in the conduct of the transaction.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.961 Other obligations created by law not limited.

Sec. 11. The specification of items for disclosure in this act does not limit or abridge any obligation for disclosure created by any other provision of law regarding fraud, misrepresentation, or deceit in transfer transactions.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.962 Disclosure; amendment.

Sec. 12. Any disclosure made pursuant to this act may be amended in writing by the transferor, but the amendment is subject to section 4.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.963 Disclosure; manner of delivery.

Sec. 13. Delivery of a disclosure statement required by this act shall be by personal delivery, facsimile delivery, or by registered mail to the prospective purchaser. Execution of a facsimile counterpart of the disclosure statement shall be considered to be execution of the original.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.964 Transfer not invalidated by noncompliance.

Sec. 14. A transfer subject to this act shall not be invalidated solely because of the failure of any person to comply with a provision of this act.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.965 Liability of agent.

Sec. 15. An agent of a transferor shall not be liable for any violation of this act by a transferor unless any agent knowingly acts in concert with a transferor to violate this act.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.966 Effective date.

Sec. 16. This act shall take effect upon the expiration of 180 days after the date of its enactment.

History: 1993, Act 92, Eff. Jan. 10, 1994.

MI Seller Disclosure Act - [Loislaw 8-14-2002]

565.951 Short title.

565.952 Applicability of seller disclosure requirements.

565.953 Seller disclosure requirements; exceptions.

565.954 Written statement; delivery; time limits; compliance; terminating purchase agreement within certain time limits; expiration of right to terminate.

565.955 Liability for error, inaccuracy, or omission; delivery as compliance with requirements of act; conditions.

565.956 Disclosures; inaccuracy as result of action, occurrence, or agreement after delivery; unknown or unavailable information; basis.

565.957 Disclosure; form.

565.958 Availability of copies.

565.959 Additional disclosures.

565.960 Disclosure; good faith.

565.961 Other obligations created by law not limited.

565.962 Disclosure; amendment.

565.963 Disclosure; manner of delivery.

565.964 Transfer not invalidated by noncompliance.

565.965 Liability of agent.

565.966 Effective date.

565.951 Short title.

Sec. 1. This act shall be known and may be cited as the "seller disclosure act".

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.952 Applicability of seller disclosure requirements.

Sec. 2. The seller disclosure requirements of sections 4 to 13 apply to the transfer of any interest in real estate consisting of not less than 1 or more than 4 residential dwelling units, whether by sale, exchange, installment land contract, lease with an option to purchase, any other option to purchase, or ground lease coupled with proposed improvements by the purchaser or tenant, or a transfer of stock or an interest in a residential cooperative.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.953 Seller disclosure requirements; exceptions.

Sec. 3. The seller disclosure requirements of sections 4 to 13 do not apply to any of the following:

(a) Transfers pursuant to court order, including, but not limited to, transfers ordered by a probate court in administration of an estate, transfers pursuant to a writ of execution, transfers by any foreclosure sale, transfers by a trustee in bankruptcy, transfers by eminent domain, and transfers resulting from a decree for specific performance.

(b) Transfers to a mortgagee by a mortgagor or successor in interest who is in default, or transfers to a beneficiary of a deed of trust by a trustor or successor in interest who is in default.

(c) Transfers by a sale under a power of sale or any foreclosure sale under a decree of foreclosure after default in an obligation secured by a mortgage or deed of trust or secured by any other instrument containing a power of sale, or transfers by a mortgagee or a beneficiary under a deed of trust who has acquired the real property at a sale conducted pursuant to a power of sale under a mortgage or deed of trust or a sale pursuant to a decree of foreclosure or has acquired the real property by a deed in lieu of foreclosure.

(d) Transfers by a nonoccupant fiduciary in the course of the administration of a decedent's estate, guardianship, conservatorship, or trust.

(e) Transfers from 1 co-tenant to 1 or more other co-tenants.

(f) Transfers made to a spouse, parent, grandparent, child, or grandchild.

(g) Transfers between spouses resulting from a judgment of divorce or a judgment of separate maintenance or from a property settlement agreement incidental to such a judgment.

(h) Transfers or exchanges to or from any governmental entity.

(i) Transfers made by a person licensed under article 24 of Act No. 299 of the Public Acts of 1980, being sections 339.2401 to 339.2412 of the Michigan Compiled Laws, of newly constructed residential property that has not been inhabited.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.954 Written statement; delivery; time limits; compliance; terminating purchase agreement within certain time limits; expiration of right to terminate.

Sec. 4. (1) The transferor of any real property described in section 2 shall deliver to the transferor's agent or to the prospective transferee or the transferee's agent the written statement required by this act. If the written statement is delivered to the transferor's agent, the transferor's agent shall provide a copy to the prospective transferee or his or her agent. A written disclosure statement provided to a transferee's agent shall be considered to have been provided to the transferee. The written statement shall be delivered to the prospective transferee within the following time limits:

(a) In the case of a sale, before the transferor executes a binding purchase agreement with the prospective transferee.

(b) In the case of transfer by an installment sales contract where a binding purchase agreement has not been executed, or in the case of a lease together with an option to purchase or a ground lease coupled with improvements by the tenant, before the transferor executes the installment sales contract with the prospective transferee.

(2) With respect to any transfer subject to subsection (1), the transferor shall indicate compliance with this act either on the purchase agreement, the installment sales contract, the lease, or any addendum attached to the purchase agreement, contract, or lease, or on a separate document.

(3) Except as provided in subsection (4), if any disclosure or amendment of any disclosure required to be made by this act is delivered after the transferor executes a binding purchase agreement, the prospective transferee may terminate the purchase agreement by delivering written notice of termination to the transferor or the transferor's agent within the following time limits:

(a) Not later than 72 hours after delivery of the disclosure statement to the prospective transferee, if the disclosure statement was delivered to the prospective transferee in person.

(b) Not later than 120 hours after delivery of the disclosure statement to the prospective transferee, if the disclosure statement was delivered to the prospective transferee by registered mail.

(4) A transferee's right to terminate the purchase agreement expires upon the transfer of the subject property by deed or installment sales contract.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.955 Liability for error, inaccuracy, or omission; delivery as compliance with requirements of act; conditions.

Sec. 5. (1) The transferor or his or her agent is not liable for any error, inaccuracy, or omission in any information delivered pursuant to this act if the error, inaccuracy, or omission was not within the personal knowledge of the transferor, or was based entirely on information provided by public agencies or provided by other persons specified in subsection (3), and ordinary care was exercised in transmitting the information. It is not a violation of this act if the transferor fails to disclose information that could be obtained only through inspection or observation of inaccessible portions of real estate or could be discovered only by a person with expertise in a science or trade beyond the knowledge of the transferor.

(2) The delivery of any information required by this act to be disclosed to a prospective transferee by a public agency or other person specified in subsection (3) shall be considered to comply with the requirements of this act and relieves the transferor of any further duty under this act with respect to that item of information, unless the transferor has knowledge of a known defect or condition that contradicts the information provided by the public agency or the person specified in subsection (3).

(3) The delivery of a report or opinion prepared by a licensed professional engineer, professional surveyor, geologist, structural pest control operator, contractor, or other expert, dealing with matters within the scope of the professional's license or expertise, is sufficient compliance for application of the exemption provided by subsection (1) if the information is provided upon the request of the prospective transferee, unless the transferor has knowledge of a known defect or condition that contradicts the information contained in the report or opinion. In responding to a request by a prospective transferee, an expert may indicate, in writing, an understanding that the information provided will be used in fulfilling the requirements of section 7 and, if so, shall indicate the required disclosures, or parts of disclosures, to which the information being furnished applies. In furnishing the statement, the expert is not responsible for any items of information other than those expressly set forth in the statement.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.956 Disclosures; inaccuracy as result of action, occurrence, or agreement after delivery; unknown or unavailable information; basis.

Sec. 6. If information disclosed in accordance with this act becomes inaccurate as a result of any action, occurrence, or agreement after the delivery of the required disclosures, the resulting inaccuracy does not constitute a violation of this act. If at the time the disclosures are required to be made, an item of information required to be disclosed under this act is unknown or unavailable to the transferor, the transferor may comply with this act by advising a prospective purchaser of the fact that the information is unknown. The information provided to a prospective purchaser pursuant to this act shall be based upon the best information available and known to the transferor.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.957 Disclosure; form.

Sec. 7. (1) The disclosures required by this act shall be made on the following form:

[See USLF form # MI-37014]

565.958 Availability of copies.

Sec. 8. Copies of the form prescribed in section 7 shall be made available to the public by all real estate brokers and real estate salespersons.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.959 Additional disclosures.

Sec. 9. A city, township, or county may require disclosures in addition to those disclosures required by section 7, and may require disclosures on a different disclosure form in connection with transactions subject to this act.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.960 Disclosure; good faith.

Sec. 10. Each disclosure required by this act shall be made in good faith. For purposes of this act, "good faith" means honesty in fact in the conduct of the transaction.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.961 Other obligations created by law not limited.

Sec. 11. The specification of items for disclosure in this act does not limit or abridge any obligation for disclosure created by any other provision of law regarding fraud, misrepresentation, or deceit in transfer transactions.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.962 Disclosure; amendment.

Sec. 12. Any disclosure made pursuant to this act may be amended in writing by the transferor, but the amendment is subject to section 4.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.963 Disclosure; manner of delivery.

Sec. 13. Delivery of a disclosure statement required by this act shall be by personal delivery, facsimile delivery, or by registered mail to the prospective purchaser. Execution of a facsimile counterpart of the disclosure statement shall be considered to be execution of the original.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.964 Transfer not invalidated by noncompliance.

Sec. 14. A transfer subject to this act shall not be invalidated solely because of the failure of any person to comply with a provision of this act.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.965 Liability of agent.

Sec. 15. An agent of a transferor shall not be liable for any violation of this act by a transferor unless any agent knowingly acts in concert with a transferor to violate this act.

History: 1993, Act 92, Eff. Jan. 10, 1994.

565.966 Effective date.

Sec. 16. This act shall take effect upon the expiration of 180 days after the date of its enactment.

History: 1993, Act 92, Eff. Jan. 10, 1994.