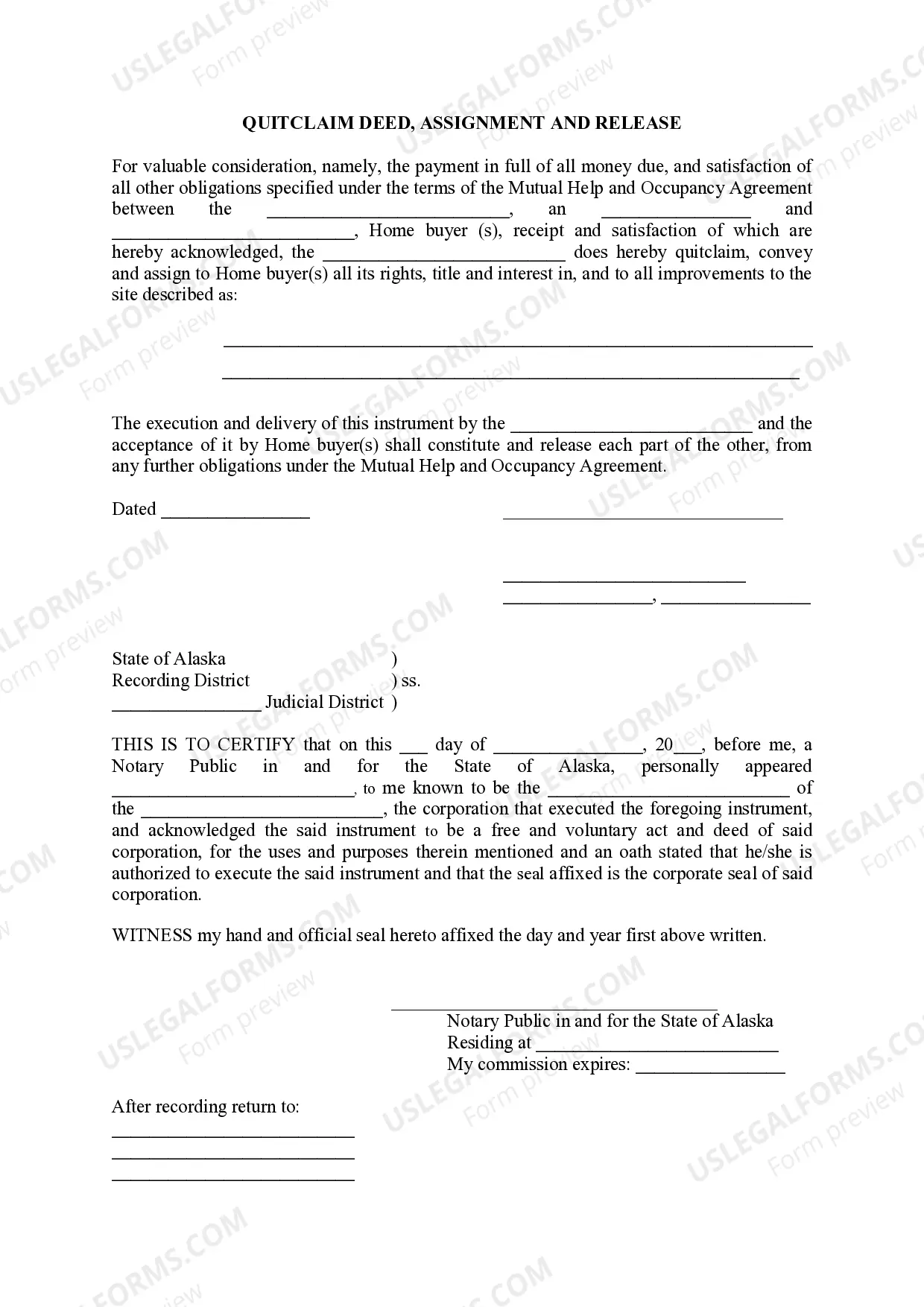

Alaska Quitclaim Deed, Assignment and Release

Description

How to fill out Alaska Quitclaim Deed, Assignment And Release?

Utilize US Legal Forms to obtain a printable Alaska Quitclaim Deed, Assignment and Release.

Our court-acceptable documents are crafted and frequently refreshed by experienced attorneys.

Ours is the most comprehensive forms library online, providing economical and precise templates for clients, legal experts, and small to medium-sized businesses.

Select Buy Now if it is the template you seek. Create your account and pay via PayPal or by credit card. Download the document to your device and feel free to reuse it multiple times. Use the Search bar if you wish to find another document template. US Legal Forms provides thousands of legal and tax samples and packages for both business and personal requirements, including the Alaska Quitclaim Deed, Assignment and Release. Over three million users have successfully benefited from our services. Choose your subscription plan and access high-quality forms in just a few clicks.

- The templates are organized into state-specific categories, and some may be pre-viewed before downloading.

- To retrieve templates, users must possess a subscription and Log In/">Log In to their account.

- Click Download next to any document you require and locate it in My documents.

- For users without a subscription, follow the suggestions below to easily locate and download the Alaska Quitclaim Deed, Assignment and Release.

- Ensure you select the correct form based on the state it is needed for.

- Examine the document by reading the description and utilizing the Preview option.

Form popularity

FAQ

Alaska quit claim deeds must be submitted to the recording district that is local to the property. They must also be accompanied by the applicable recording fee set by regulation; if the document is to be recorded for multiple purposes, it must be accompanied by the applicable fee for each of the multiple purposes.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

Once the quitclaim deed is signed and notarized, it is a valid legal document. But the grantee must also have the quitclaim deed recorded in the county recorder's office, or with the county clerk -- whoever has the authority to record deeds and property transfers.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

It will depend what state the property is in. For example, the minimum fee payable when changing the title to have someone removed from a property title in NSW is $133.48. This fee must be paid to the NSW Government Land & Property Information Department.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

Even if you sign a quitclaim deed, the mortgage balance will continue to show up on your credit report. This will hurt what is called your debt utilization ratio. This may mean you have too much debt to be qualified for your next mortgage when you want to buy a new home.