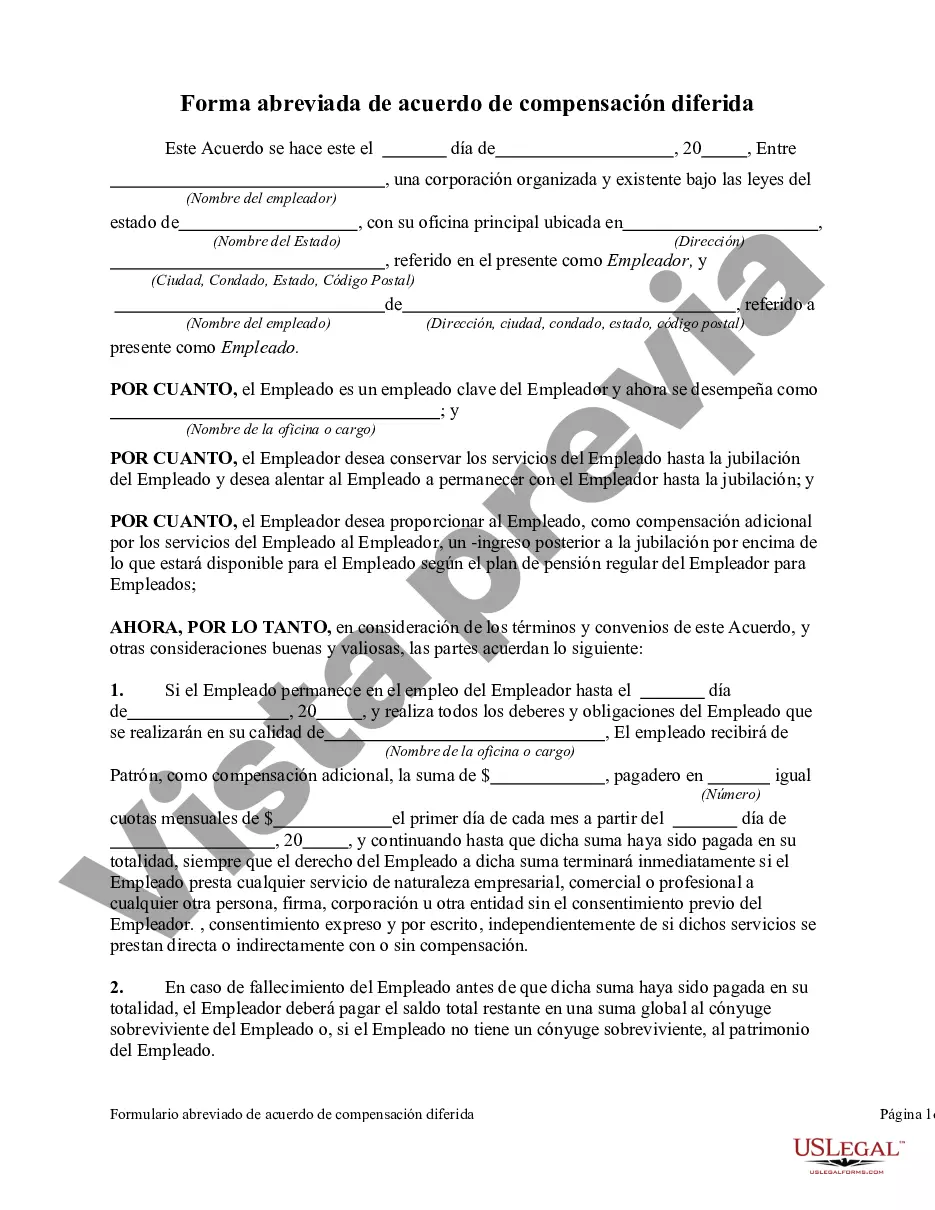

The Alaska Deferred Compensation Agreement — Short Form is a contractual arrangement allowing employees to defer a portion of their income, typically in the form of salary or bonuses, to be received at a later date. This agreement is specifically designed for individuals working in Alaska and offers various benefits to participants, including tax advantages and retirement planning options. The primary purpose of the Alaska Deferred Compensation Agreement — Short Form is to provide employees with the flexibility to defer a portion of their compensation and invest it for future use. By deferring a portion of their income, employees can potentially reduce their current taxable income, allowing them to save on taxes in the immediate term. Moreover, the agreement also allows employees to accumulate funds for retirement, as the deferred compensation can be invested in various investment options such as mutual funds, stocks, bonds, or other qualified investments. This enables employees to grow their retirement savings over time, potentially resulting in a larger nest egg for their retirement years. The Alaska Deferred Compensation Agreement — Short Form may have different variations based on the specific employer or organization offering the plan. Different plan options could include Roth deferrals, which enable employees to contribute after-tax income and potentially withdraw the funds tax-free in retirement, or traditional pre-tax deferrals where the contributions are tax-deductible in the year they are made. Participants in the agreement may also benefit from employer matching contributions, which can further boost their retirement savings. These employer matches may be subject to certain vesting requirements, meaning employees must remain with the company for a certain period to fully access the employer's contributions. Additionally, the Alaska Deferred Compensation Agreement — Short Form may offer features such as catch-up contributions for employees who are closer to retirement age, allowing them to contribute additional amounts beyond the regular annual limits. This feature enables individuals to accelerate their savings as they approach their desired retirement date. Overall, the Alaska Deferred Compensation Agreement — Short Form provides employees with a valuable tool to save for retirement while potentially reducing current tax burdens. It offers a range of investment options and features that can be tailored to individual circumstances, allowing participants to effectively plan and manage their long-term financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Acuerdo de Compensación Diferida - Forma Corta - Deferred Compensation Agreement - Short Form

Description

How to fill out Alaska Acuerdo De Compensación Diferida - Forma Corta?

If you wish to comprehensive, download, or produce authorized file themes, use US Legal Forms, the greatest selection of authorized types, that can be found on the Internet. Take advantage of the site`s easy and handy search to find the files you will need. Various themes for organization and individual reasons are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Alaska Deferred Compensation Agreement - Short Form in just a number of mouse clicks.

Should you be already a US Legal Forms customer, log in to your account and click on the Download key to get the Alaska Deferred Compensation Agreement - Short Form. Also you can access types you formerly saved inside the My Forms tab of your respective account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for that correct area/country.

- Step 2. Utilize the Preview option to examine the form`s information. Do not neglect to learn the description.

- Step 3. Should you be not happy together with the form, take advantage of the Search industry on top of the monitor to find other models of the authorized form format.

- Step 4. Once you have found the shape you will need, go through the Acquire now key. Select the pricing plan you favor and put your qualifications to register on an account.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Find the file format of the authorized form and download it in your product.

- Step 7. Complete, edit and produce or indicator the Alaska Deferred Compensation Agreement - Short Form.

Each and every authorized file format you acquire is your own forever. You may have acces to each and every form you saved with your acccount. Click on the My Forms area and pick a form to produce or download once again.

Be competitive and download, and produce the Alaska Deferred Compensation Agreement - Short Form with US Legal Forms. There are thousands of professional and condition-specific types you can use for your personal organization or individual requirements.