Alaska Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a legal contract that outlines the terms and conditions of the sale of a business in the state of Alaska. This agreement specifically focuses on the retention of employees by the buyer after the completion of the asset purchase transaction. The purpose of this agreement is to ensure a smooth transition of the business ownership while preserving the existing workforce. It provides a framework for the buyer to retain key employees from the seller's business, ensuring continuity and expertise in the operations. The agreement typically includes key provisions such as: 1. Parties: The names and details of both the buyer and the seller are stated, along with their addresses and contact information. 2. Sale of Business: A comprehensive description of the business being sold is provided, including its assets, liabilities, inventory, and any other crucial information. 3. Retained Employees: This section specifies the employees who will be retained by the buyer after the transaction. It may include criteria for selection, such as job titles, roles, and responsibilities. The agreement may also outline any special provisions for employee compensation, benefits, or incentives. 4. Employee Obligations: This clause sets forth the obligations of the retained employees. It may include provisions regarding confidentiality, non-compete agreements, non-solicitation of customers or employees, and other post-transaction obligations. 5. Purchase Price and Consideration: The agreement details the purchase price, payment terms, and any other consideration provided in exchange for the assets of the business. 6. Closing and Effective Date: This section establishes the closing date when the transaction will be completed and the effective date when the retained employees will become employees of the buyer. 7. Representations and Warranties: Both the buyer and the seller make certain representations and warranties regarding the accuracy of information provided, ownership of assets, absence of litigation, and other relevant matters. There may be different types of Alaska Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction, depending on the specific conditions and requirements of the parties involved. Some variations may include: 1. Alaskan Small Business Retained Employees Agreement: This agreement may specifically cater to small businesses in Alaska, considering their unique circumstances, industry-specific regulations, and employee retention needs. 2. Alaska Asset Purchase Agreement with Employee Retention: This agreement could focus more broadly on the asset purchase transaction, including various terms for employee retention, rather than solely on retaining employees. 3. Alaska Business Acquisition Agreement — Retained Employees: This type of agreement may cover not only the sale of business assets but also the acquisition of the entire business entity, including its liabilities, contracts, and intellectual property rights, along with the retention of employees. In conclusion, an Alaska Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a legal contract that specifies the terms and conditions of selling a business and the retention of employees by the buyer. It safeguards the continuity of the business operations by ensuring the expertise and knowledge of the retained employees. Different types of this agreement may exist, catering to unique circumstances and needs of parties involved in the sale of businesses in Alaska.

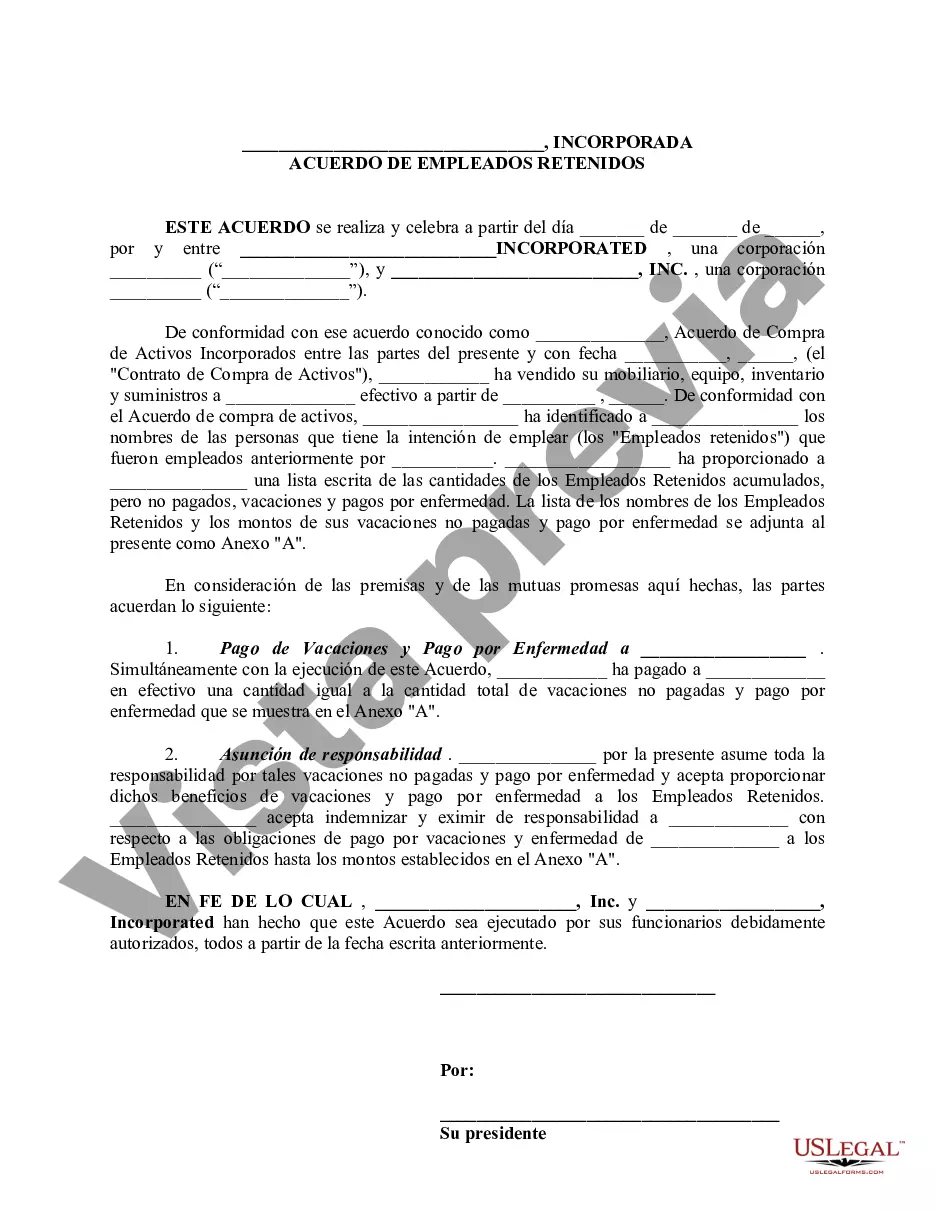

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Venta de negocio - Acuerdo de empleados retenidos - Transacción de compra de activos - Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out Alaska Venta De Negocio - Acuerdo De Empleados Retenidos - Transacción De Compra De Activos?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide range of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Alaska Sale of Business - Retained Employees Agreement - Asset Purchase Transaction in just moments.

If you currently hold a subscription, Log In to download the Alaska Sale of Business - Retained Employees Agreement - Asset Purchase Transaction from your US Legal Forms library. The Download button will be visible on every form you examine. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Alaska Sale of Business - Retained Employees Agreement - Asset Purchase Transaction. Each template you add to your account has no expiration date and is yours permanently. So, if you need to download or print another version, simply go to the My documents section and click on the form you require. Access the Alaska Sale of Business - Retained Employees Agreement - Asset Purchase Transaction with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- To use US Legal Forms for the first time, follow these simple steps.

- Ensure you have selected the appropriate form for your specific city/state.

- Click the Review button to examine the form's content.

- Read the form description to verify that you have chosen the correct form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Unlike stock purchases, employees generally do not transfer automatically in an asset purchase, meaning the buyer must expressly assume employment agreements and restric- tive covenants with the acquired personnel; any anti-assign- ment or change-in-control clauses in the acquired employees' employment contracts could

Mergers and acquisitions tend to result in job losses for employees in redundant areas in the combined company. The target company's stock price could rise in an acquisition leading to capital gains for employees who own company stock.

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

The employees who are employed by the target entity will generally come with the transaction, like a stock purchase. If certain employees at the seller/parent company provide significant services to the target entity, then the transaction will act like an asset purchase with respect to this group of employees.

At the closing of an asset purchase, employees of the seller are generally terminated as employees of the seller, and after closing, those employees are rehired by the purchaser.

If the merger or acquisition is the result of a stock purchase and employees are absorbed by the new entity, any current employment forms may remain intact unless substantive changes need to be addressed (e.g., policy changes, benefits changes, nondisclosure agreements, change in job duties or pay).

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

Interesting Questions

More info

Vault Hereinafter: Contract Form Contract Purchase Sale Business Wife Husband hereinafter Buyers agree purchase from City Laundry Services Efren Taylor hereinafter Sellers business assets including equipment fixtures goodwill inventory trademarks trade names leasehold rights known Laundromat located Kansas City purchase price Twenty Thousand Dollars shall pay follows deposit paid Block Real Estate Services date this fully executed Agreement applied purchase price closing Balance said purchase price paid Cashiers Check November Contingencies Purchase Offer Attached Total Purchase Price closing shall take place clock November office Block Real Estate Services There will close cost full purchase price shall include assets valued which itemized document attached hereto Free Purchase Business Agreement Create Download Print Depot Estate Power Attorney Last Will Testament Living Will Health Care Directive Revocable Living Trust Estate Vault More Power Attorney Last Will Testament Living