Alaska Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Triple Net Commercial Lease Agreement - Real Estate Rental?

You might spend numerous hours online searching for the legal template that meets the federal and state regulations you require.

US Legal Forms offers a wide array of legal documents that have been evaluated by experts.

You can obtain or print the Alaska Triple Net Commercial Lease Agreement - Real Estate Rental from my services.

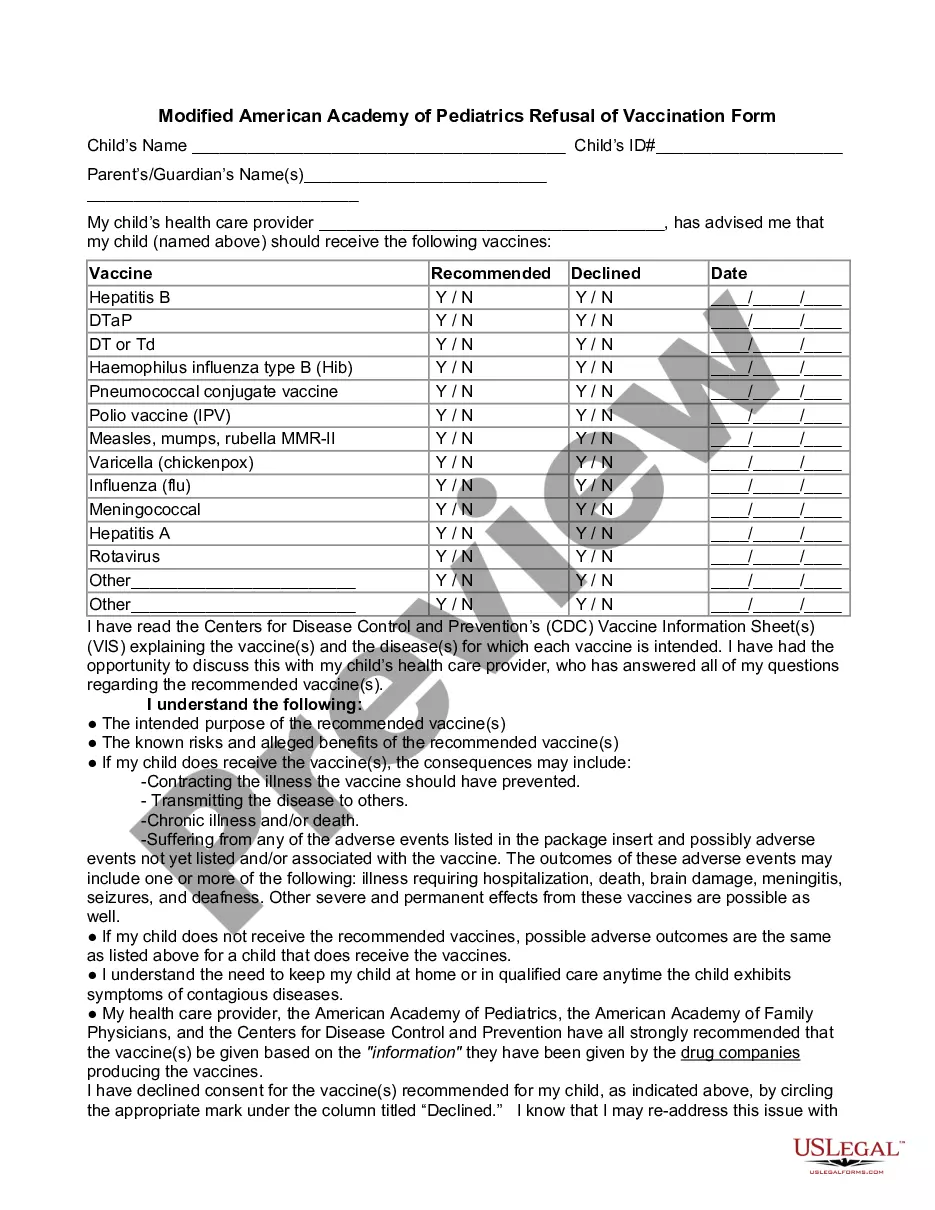

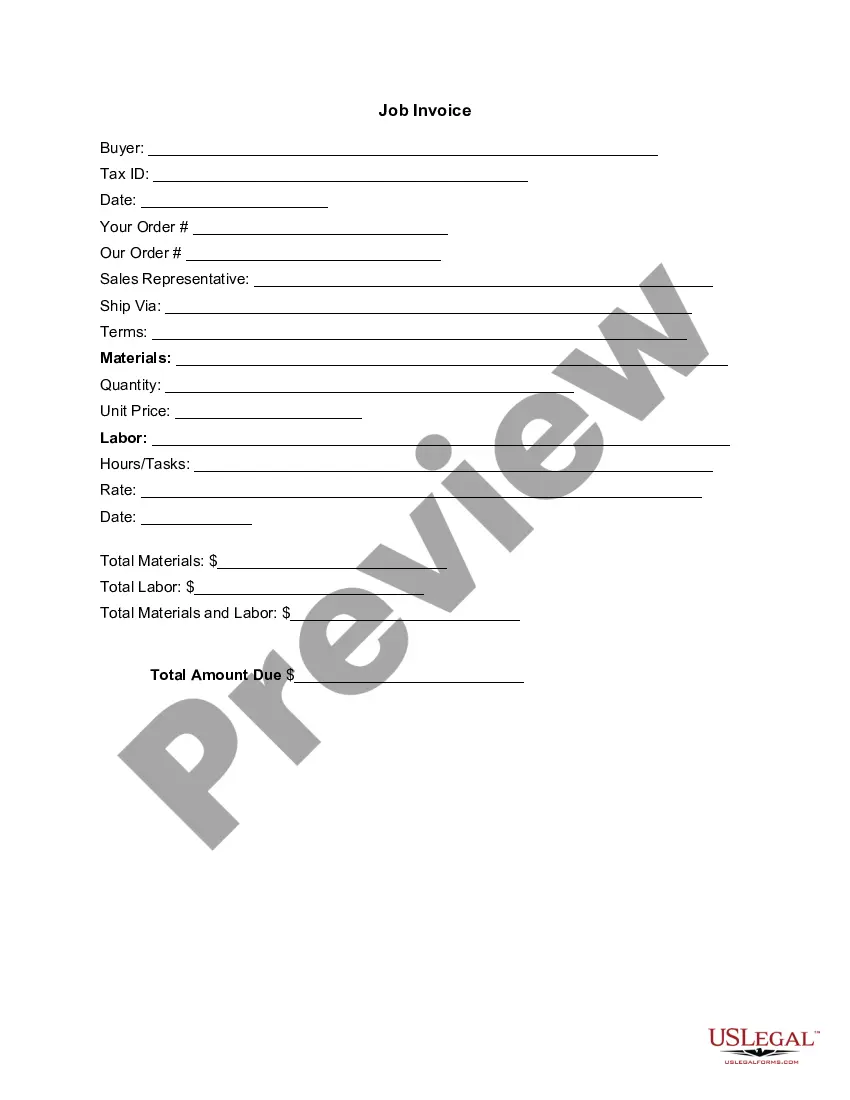

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, edit, print, or sign the Alaska Triple Net Commercial Lease Agreement - Real Estate Rental.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of the purchased form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form description to confirm you have chosen the suitable form.

Form popularity

FAQ

In an NNN lease, the landlord generally remains responsible for the structural integrity of the property and for any major repairs outside the tenant's obligations. This can include issues related to the roof and significant systems, like heating, ventilation, and air conditioning. For tenants considering an Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, it's vital to clarify these responsibilities to ensure there are no misunderstandings later.

In California, commercial landlords typically handle major repairs related to the structure and exterior of the property, such as the roof, foundations, and common areas. However, the specific responsibilities may vary based on the terms outlined in the lease agreement. For an Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, landlords often pass some of these responsibilities to tenants. It's crucial to review the lease to understand who manages which repairs.

A net lease REIT, or Real Estate Investment Trust, specializes in owning properties rented under net lease agreements. These trusts benefit from the stable and predictable income generated from long-term lease agreements, which can include Alaska Triple Net Commercial Lease Agreements - Real Estate Rentals. Investors often find net lease REITs appealing due to their potential for regular dividends and lower volatility compared to other real estate investments. You can learn more about these options and how they can fit into your financial strategy by using platforms like UsLegalForms.

The opposite of a triple net lease is a gross lease. In a gross lease agreement, the landlord covers all property expenses, including maintenance, property taxes, and insurance. This arrangement can provide more predictability for tenants, as they need only focus on their rent payments. Exploring a gross lease can be beneficial for those considering an Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, as there are many leasing options available to suit varying business needs.

The primary difference between a triple net (NNN) lease and an absolute NNN lease lies in the liability aspect. While both agreements pass most expenses related to the property to the tenant, an absolute NNN lease shifts all responsibilities, including major repairs and structural issues, to the tenant. Understanding these terms is crucial when evaluating an Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, as it impacts your long-term financial commitments. Always consider consulting with professionals or platforms like UsLegalForms for clear insights.

An absolute net lease is a leasing arrangement where the tenant agrees to cover all operational expenses tied to the property, including maintenance and major repair costs. In an Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, this often implies that the tenant takes full ownership of the financial responsibilities, allowing landlords to receive predictable rental income with less involvement in property management. This type of lease can be advantageous for investors seeking stable, low-maintenance properties.

net lease, or NN lease, is an agreement wherein the tenant pays for two additional costs beyond the base rent, typically property taxes and insurance. In the context of an Alaska Triple Net Commercial Lease Agreement Real Estate Rental, this setup can offer a balance between landlord and tenant responsibilities. This structure can benefit both parties by clarifying financial duties and ensuring better property upkeep.

Net absolute refers to a lease structure where the tenant assumes all financial obligations tied to the property, including major repairs, replacements, taxes, and insurance. In the case of an Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, this means that the tenant has significant control of the property costs without burdening the landlord. This allows landlords to focus on asset management while ensuring that tenants have a comprehensive understanding of their financial commitments.

A net net net lease, commonly referred to as NNN, is an agreement in which the tenant pays for all the property expenses in addition to the rent. In an Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, these expenses usually cover property taxes, insurance, and maintenance, providing landlords with a steady income stream. This type of lease benefits tenants by offering a clear understanding of their financial obligations associated with the property.

The best triple net leases are those that offer long-term obligations from reputable tenants and favorable terms for investors. Characteristics of high-quality leases include solid lease rates, a strong location, and tenant stability. By leveraging the Alaska Triple Net Commercial Lease Agreement - Real Estate Rental, you can identify and secure advantageous leasing opportunities.