Alaska General Form of Receipt

Description

How to fill out General Form Of Receipt?

You might invest multiple hours online attempting to discover the authentic document template that satisfies the federal and state requirements you seek.

US Legal Forms offers thousands of authentic forms that are reviewed by professionals.

It is easy to download or print the Alaska General Form of Receipt from my service.

- If you already have a US Legal Forms account, you can Log In and select the Download button.

- Then, you can complete, edit, print, or sign the Alaska General Form of Receipt.

- Every authentic document template you receive is yours indefinitely.

- To obtain another copy of any purchased template, go to the My documents section and click on the appropriate option.

- If you are utilizing the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure you have chosen the correct document template for your state/city of choice.

- Check the type outline to confirm you have selected the correct type.

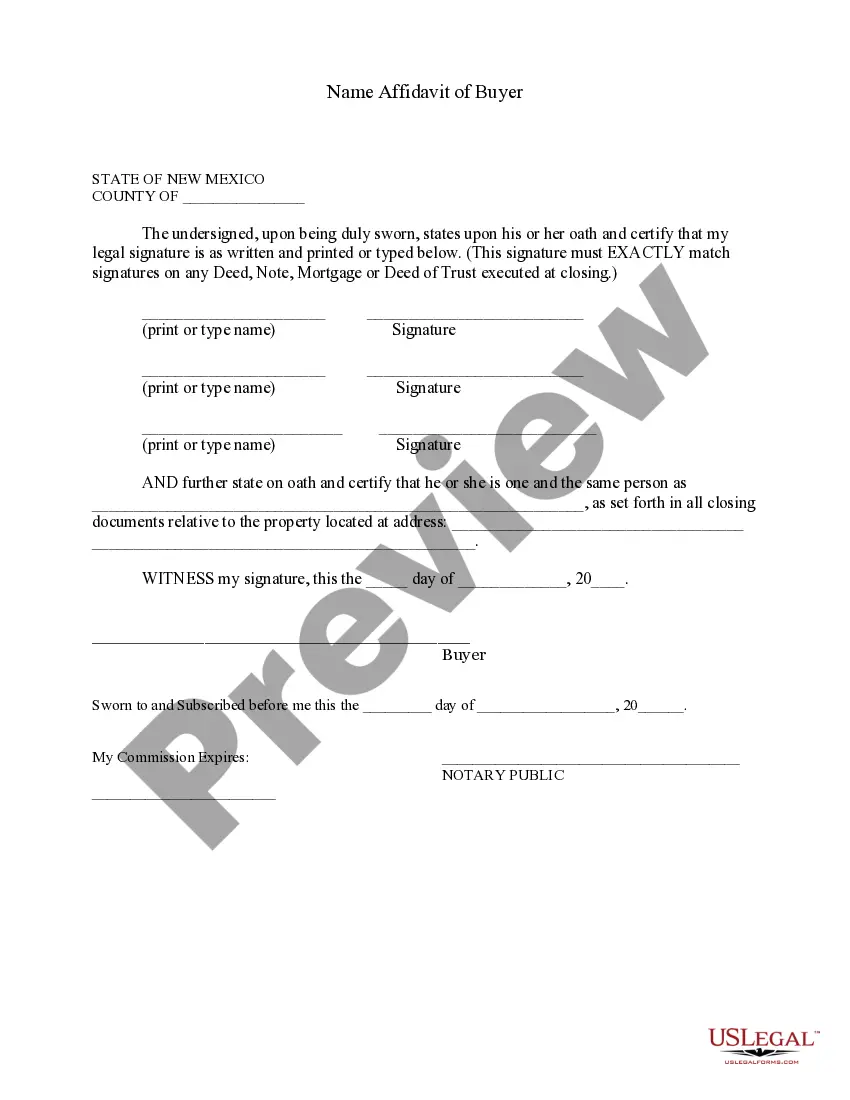

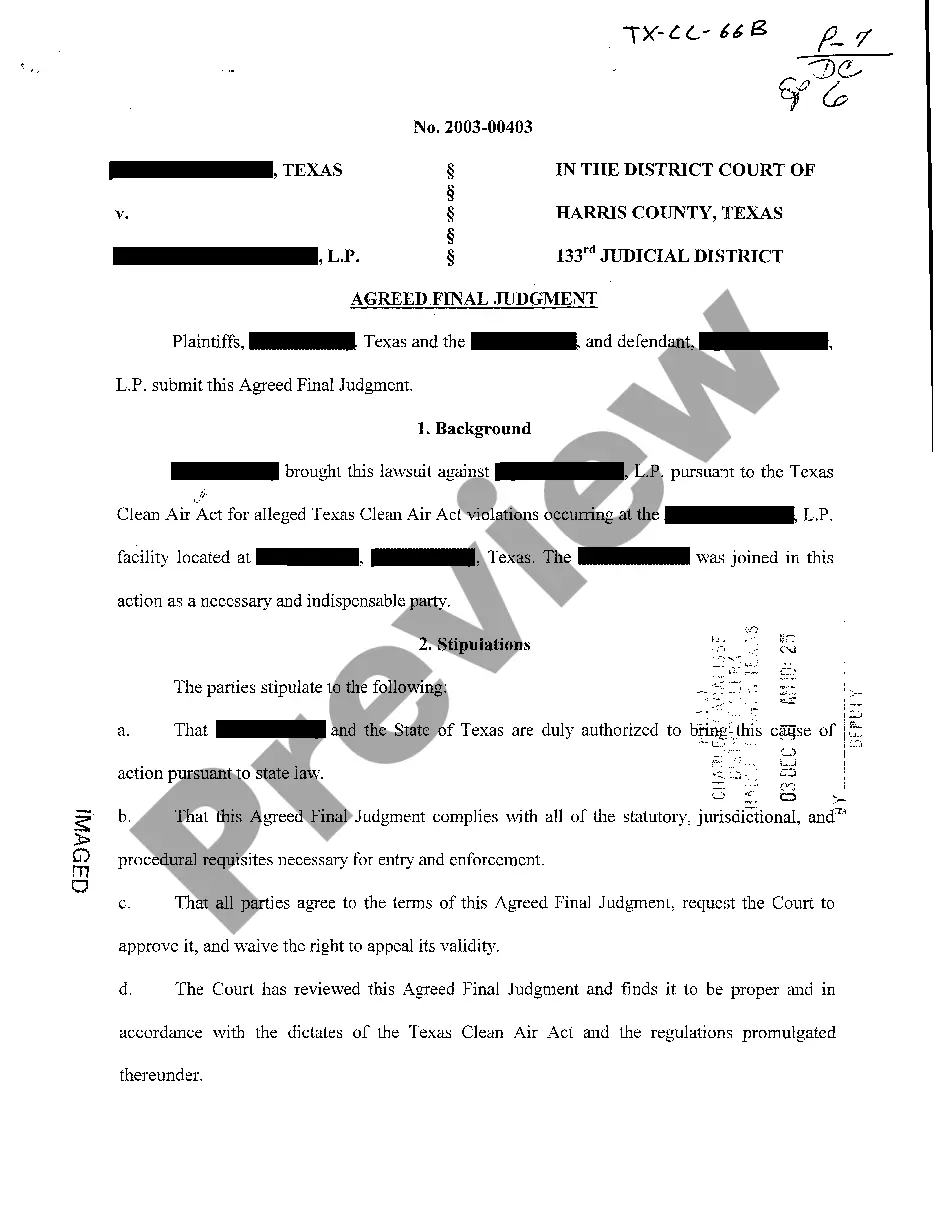

- If available, use the Preview feature to review the document template as well.

- If you need to find another version of the form, use the Search area to find the template that meets your needs and requirements.

- Once you have found the template you want, click on Acquire now to continue.

- Select the pricing plan you prefer, enter your information, and register for an account on US Legal Forms.

- Complete the transaction.

- You can use your Visa, MasterCard, or PayPal account to pay for the authentic form.

- Obtain the format of the document and download it to your device.

- Make modifications to your document if necessary.

- You can complete, edit, and sign or print the Alaska General Form of Receipt.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest variety of authentic forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

The tax form used for reporting the Alaska PFD is known as the Alaska General Form of Receipt. This form is essential when preparing your tax returns as it helps delineate the income from the PFD. Make sure to obtain and complete this form accurately to avoid any issues during the filing process.

The tax code applicable for the Alaska Permanent Fund Dividend is typically found in the Alaska General Form of Receipt. This form outlines the legal requirements for reporting the dividend on your taxes. It's essential to refer to this form to ensure you are following the correct procedures.

No, the Alaska PFD does not count as earned income. It is considered an unearned income, which you report on your tax returns using the Alaska General Form of Receipt. Understanding this helps in accurate tax planning and ensuring compliance with tax regulations.

In Alaska, obtaining a letter of testamentary involves filing a petition with the probate court. You typically need to submit relevant documents that showcase your legal standing as an executor. As you go through this process, it might help to use resources like uslegalforms to manage the paperwork effectively.

To report the Alaska PFD on your taxes, you utilize the Alaska General Form of Receipt. This form helps you declare your dividend as income for tax purposes. Make sure to keep a copy of this form for your records and provide the required information when filing your State and Federal tax returns.

The Alaska Permanent Fund Dividend (PFD) is not classified as a 1099 form. Instead, it is reported using the Alaska General Form of Receipt, which provides the necessary details for tax reporting. It is important to understand this distinction to ensure accurate tax filings.

To get an Alaska Airlines receipt, access your account on the Alaska Airlines website or app. Find your flight history, and you will be able to download or print your receipts. Make sure you have your Alaska General Form of Receipt, as it will enhance your record-keeping process.

You can easily obtain receipts for American Airlines by visiting their website and navigating to the 'Your Trips' section. Simply enter your flight details to retrieve the corresponding receipts. Using the Alaska General Form of Receipt can help compile all necessary documentation in one place.

To get receipts from Alaska Airlines, log into your Mileage Plan account on their website. Access your travel history to view past flights and request the Alaska General Form of Receipt for any specific trip. This process ensures you receive detailed documentation for your records.

Yes, you can request a receipt for checked bags. Airlines often provide this upon payment at the check-in counter or it may be found with your overall flight receipt. Having an Alaska General Form of Receipt for baggage fees can assist with budgeting or expense reports.