Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

Have you ever found yourself in a situation where you require documentation for either business or personal reasons on almost every occasion.

There is a plethora of valid document templates accessible online, but identifying reliable ones can be challenging.

US Legal Forms offers a vast collection of form templates, including the Alaska Bartering Contract or Exchange Agreement, which are designed to comply with state and federal regulations.

Once you find the right form, click Buy now.

Select the pricing plan you desire, provide the required information to create your account, and complete your purchase using PayPal or a credit/debit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Alaska Bartering Contract or Exchange Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and confirm it is for your specific city/region.

- Utilize the Preview feature to examine the form.

- Ensure the description confirms you have selected the right form.

- If the form is not what you are looking for, use the Search area to locate the form that suits your requirements.

Form popularity

FAQ

When you engage in bartering, like in an Alaska Bartering Contract or Exchange Agreement, the IRS treats the goods or services you receive as income. You must report the fair market value of these goods or services on your tax return. Additionally, if you incurred any expenses related to the barter, you can deduct those costs. It's a straightforward process, and you may find our platform at US Legal Forms helpful for creating valid contracts that align with tax regulations.

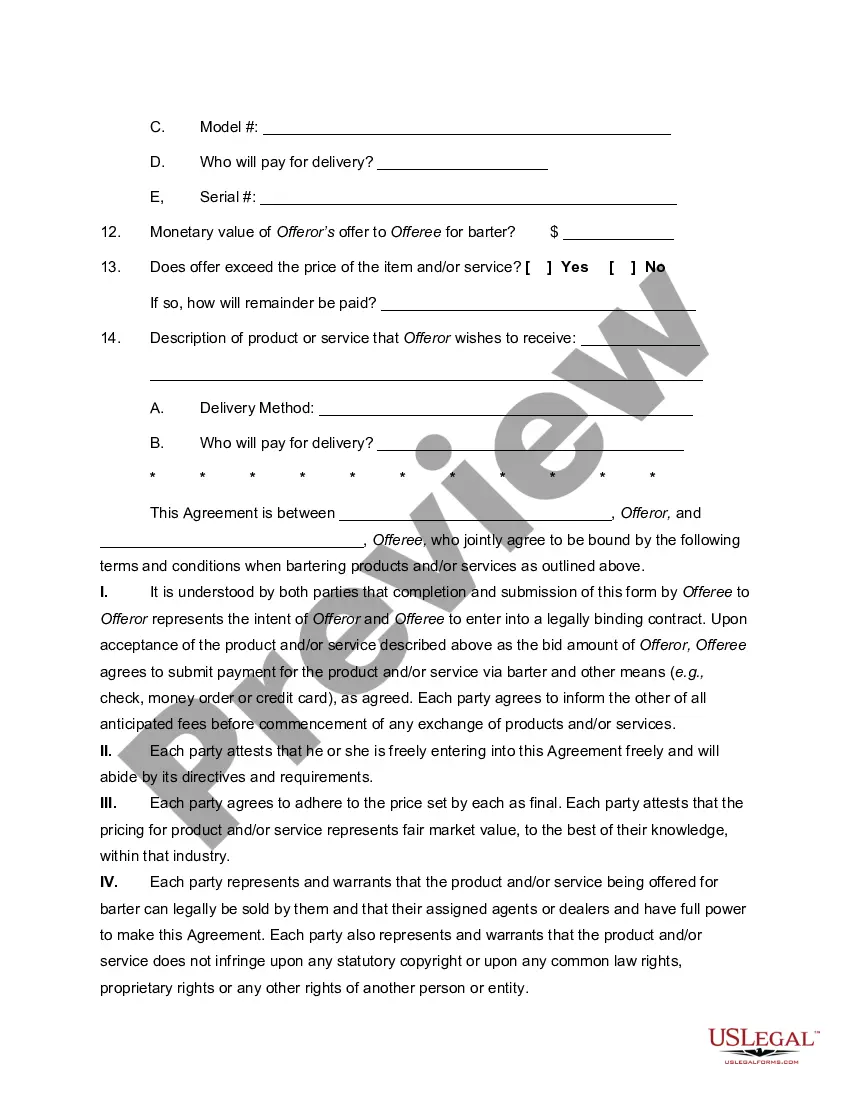

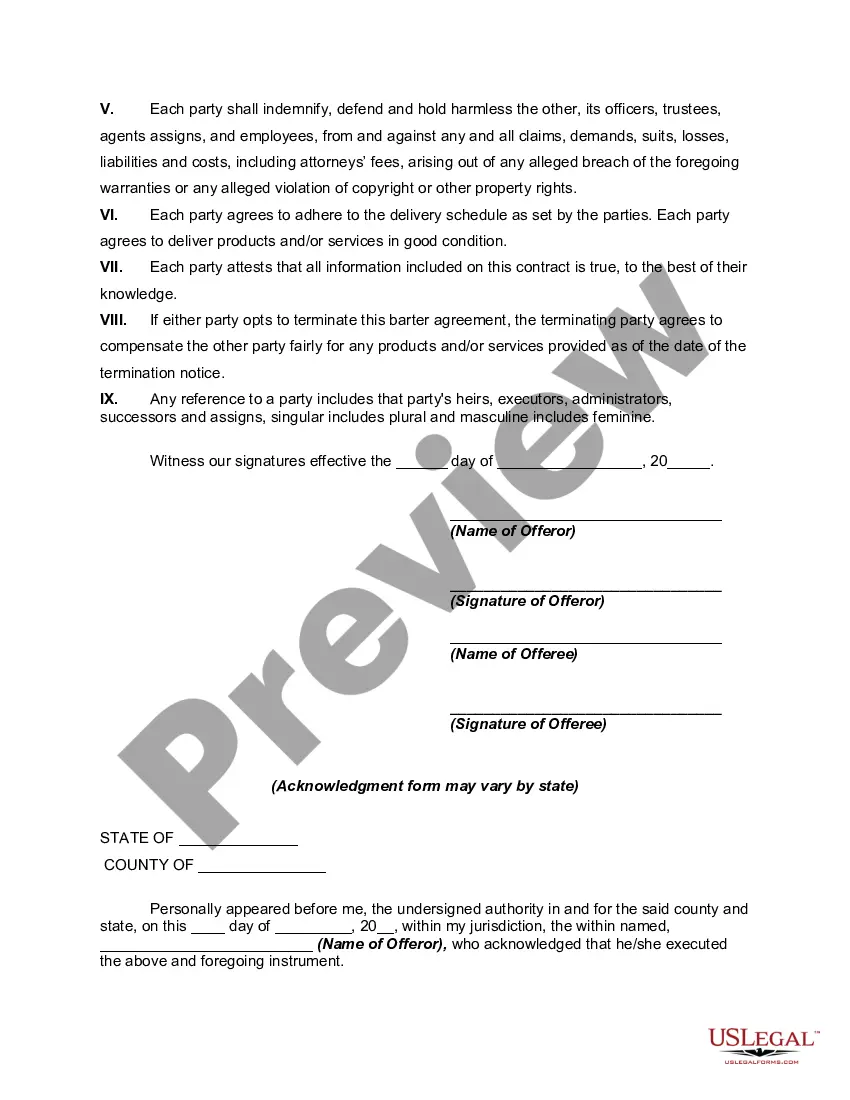

Writing a barter agreement involves outlining the terms of the exchange in a clear and concise manner. Start by detailing the parties involved, listing the items or services being exchanged, and assigning values to each. It’s advisable to include any important conditions or deadlines as well. Using a service like US Legal Forms can simplify the process, providing you with templates that ensure your Alaska Bartering Contract or Exchange Agreement is comprehensive and legally binding.

A contract of barter, commonly known as an Alaska Bartering Contract or Exchange Agreement, is a legal document that outlines the terms of a trade between two parties. This contract specifies the goods or services exchanged, the value assigned to each item, and the obligations of each party. By creating this agreement, participants can protect their interests and establish a fair understanding of the exchange. It is a vital tool for ensuring both sides are satisfied with the trade.

A contract of barter or exchange, such as an Alaska Bartering Contract or Exchange Agreement, formalizes the terms between parties engaged in bartering. This document outlines the specific goods or services being exchanged, establishes their value, and provides a framework for the transaction. Having a written agreement can protect both parties and help avoid misunderstandings.

Bartering continues to be a legal practice across the United States, including Alaska. While it faces regulations, individuals can freely barter goods and services as long as they adhere to the relevant laws. For secure transactions, consider using an Alaska Bartering Contract or Exchange Agreement to outline the terms of your exchanges clearly.

Yes, the IRS considers bartering income taxable. If you engage in an exchange that exceeds a certain value, you need to report that income on your tax return. Using an Alaska Bartering Contract or Exchange Agreement can help you keep accurate records, ensuring you meet tax obligations.

The IRS recognizes bartering as a legitimate means of trade and, therefore, allows it. However, participants must report the fair market value of goods or services exchanged as income. This makes understanding the nuances of an Alaska Bartering Contract or Exchange Agreement important for compliance with tax regulations.

Absolutely, bartering remains a viable option for trade in modern society. With the rise of online platforms and community exchanges, more people are discovering the benefits of barter. Utilizing an Alaska Bartering Contract or Exchange Agreement can help you navigate this trade and establish a fair market value for your goods and services.

A contract of barter may involve a photographer providing portraits to a local business in exchange for advertising for their photography services. This agreement should be detailed in an Alaska Bartering Contract to clarify the expectations and responsibilities of each party, creating a beneficial partnership.

An example of a barter could be a farmer trading fresh produce with a local baker in exchange for baked goods. This type of arrangement can be simplified and made official by documenting it with an Alaska Bartering Contract or Exchange Agreement, ensuring both parties are satisfied with the terms.