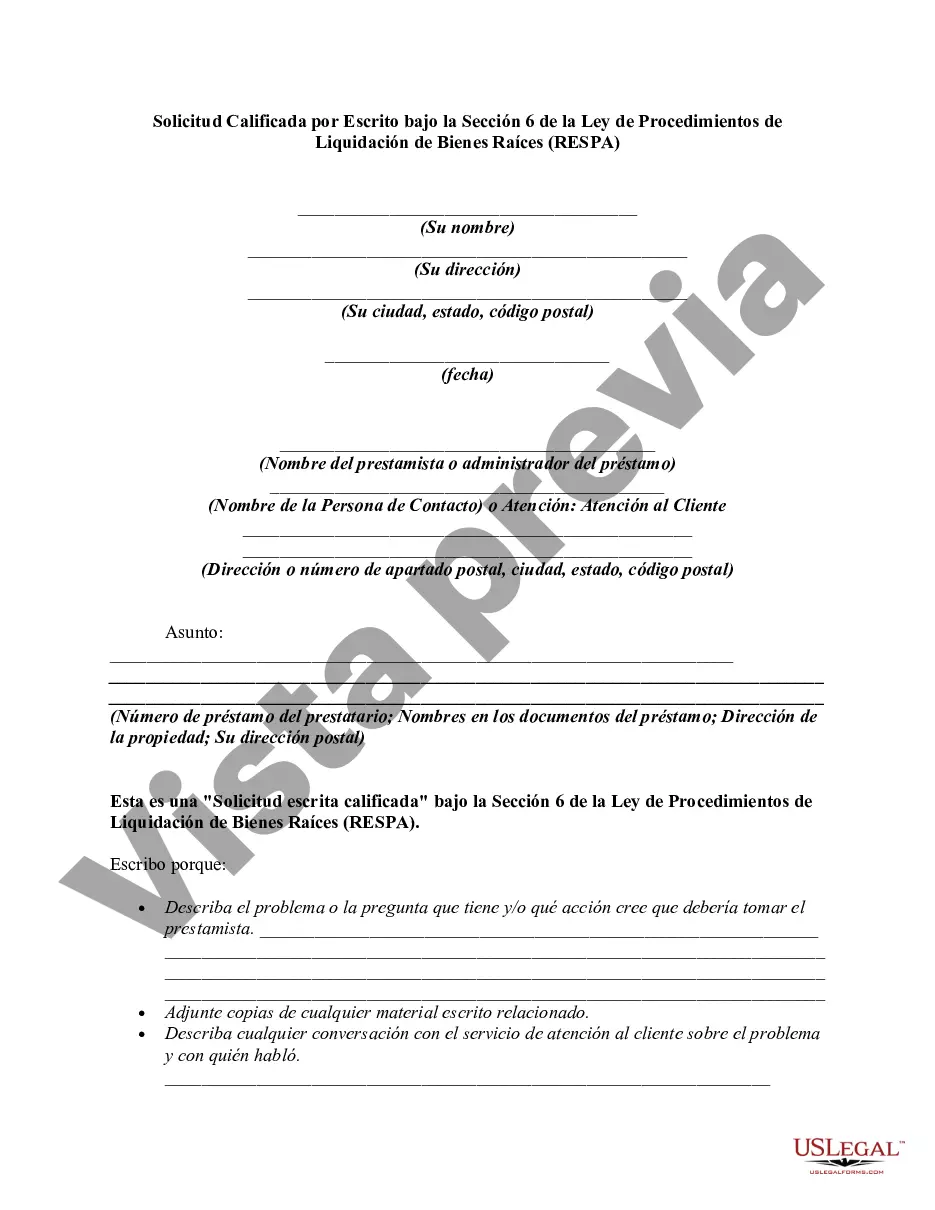

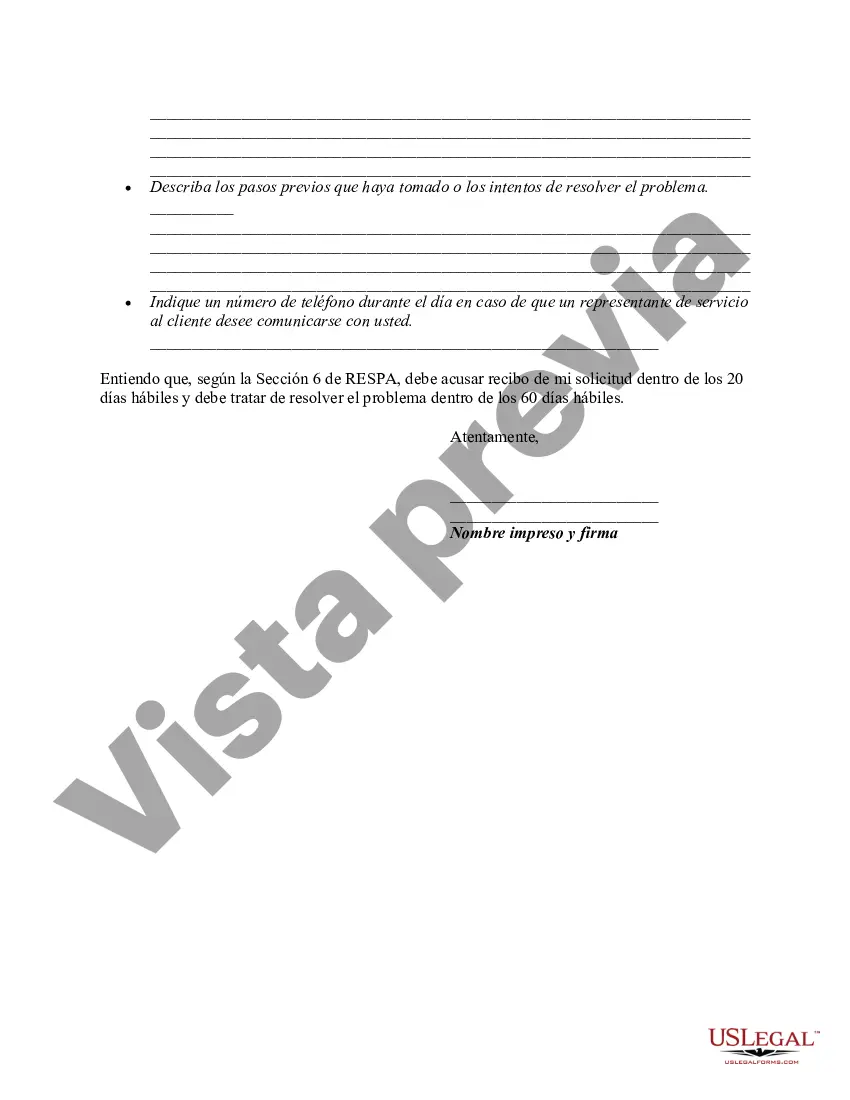

12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

An Alaska Qualified Written Request under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal document that consumers can submit to their loan services to seek information or resolve issues regarding their mortgage loans. This request is specifically related to Alaskan laws and regulations applicable to RESP. The Alaska Qualified Written Request (BWR) is a powerful tool that provides borrowers with certain rights and protections, ensuring transparency and accuracy throughout the loan servicing process. It allows customers to obtain detailed information about their loan, request a correction of any alleged errors or discrepancies, and ensure compliance with all relevant laws and regulations. Under Section 6 of the RESP, the Alaska BWR requires loan services to acknowledge receipt of the written request within a designated timeframe and conduct a thorough investigation into the matter. Here are some essential keywords and their explanations relevant to this topic: 1. Real Estate Settlement Procedures Act (RESP): RESP is a federal law that aims to protect consumers during the home buying process, prevent kickbacks and unfair practices, and ensure borrowers receive accurate and timely information about their mortgage loans. 2. Qualified Written Request (BWR): A BWR is a written correspondence sent by the borrower to the loan service, requesting information or addressing issues related to their mortgage loan. The BWR under Section 6 of RESP provides specific guidelines and rights for Alaska residents. 3. Loan Service: The loan service is the company responsible for collecting loan payments, managing escrow accounts (if applicable), and generally handling day-to-day operations of the mortgage loan on behalf of the lender. 4. Alaska Qualified Written Request: This term refers to a BWR submitted in accordance with the laws and regulations specific to Alaska, under Section 6 of RESP. The Alaska BWR enables borrowers to seek information, rectify potential errors, and resolve disputes within the Alaskan framework. It is important to note that while RESP and BWR guidelines are federally mandated, the Alaska version may have slight variations to accommodate specific state laws and regulations. However, the overall purpose and intent remain the same — to provide important consumer protections and ensure fair treatment throughout the mortgage loan process. Different types or variations of the Alaska Qualified Written Request under Section 6 of RESP may exist depending on the specific nature of the borrower's concerns or requests. However, the primary objective of any BWR is to obtain essential loan-related information, request investigations into potential errors, and facilitate prompt resolutions or corrections if necessary.An Alaska Qualified Written Request under Section 6 of the Real Estate Settlement Procedures Act (RESP) is a formal document that consumers can submit to their loan services to seek information or resolve issues regarding their mortgage loans. This request is specifically related to Alaskan laws and regulations applicable to RESP. The Alaska Qualified Written Request (BWR) is a powerful tool that provides borrowers with certain rights and protections, ensuring transparency and accuracy throughout the loan servicing process. It allows customers to obtain detailed information about their loan, request a correction of any alleged errors or discrepancies, and ensure compliance with all relevant laws and regulations. Under Section 6 of the RESP, the Alaska BWR requires loan services to acknowledge receipt of the written request within a designated timeframe and conduct a thorough investigation into the matter. Here are some essential keywords and their explanations relevant to this topic: 1. Real Estate Settlement Procedures Act (RESP): RESP is a federal law that aims to protect consumers during the home buying process, prevent kickbacks and unfair practices, and ensure borrowers receive accurate and timely information about their mortgage loans. 2. Qualified Written Request (BWR): A BWR is a written correspondence sent by the borrower to the loan service, requesting information or addressing issues related to their mortgage loan. The BWR under Section 6 of RESP provides specific guidelines and rights for Alaska residents. 3. Loan Service: The loan service is the company responsible for collecting loan payments, managing escrow accounts (if applicable), and generally handling day-to-day operations of the mortgage loan on behalf of the lender. 4. Alaska Qualified Written Request: This term refers to a BWR submitted in accordance with the laws and regulations specific to Alaska, under Section 6 of RESP. The Alaska BWR enables borrowers to seek information, rectify potential errors, and resolve disputes within the Alaskan framework. It is important to note that while RESP and BWR guidelines are federally mandated, the Alaska version may have slight variations to accommodate specific state laws and regulations. However, the overall purpose and intent remain the same — to provide important consumer protections and ensure fair treatment throughout the mortgage loan process. Different types or variations of the Alaska Qualified Written Request under Section 6 of RESP may exist depending on the specific nature of the borrower's concerns or requests. However, the primary objective of any BWR is to obtain essential loan-related information, request investigations into potential errors, and facilitate prompt resolutions or corrections if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.