Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

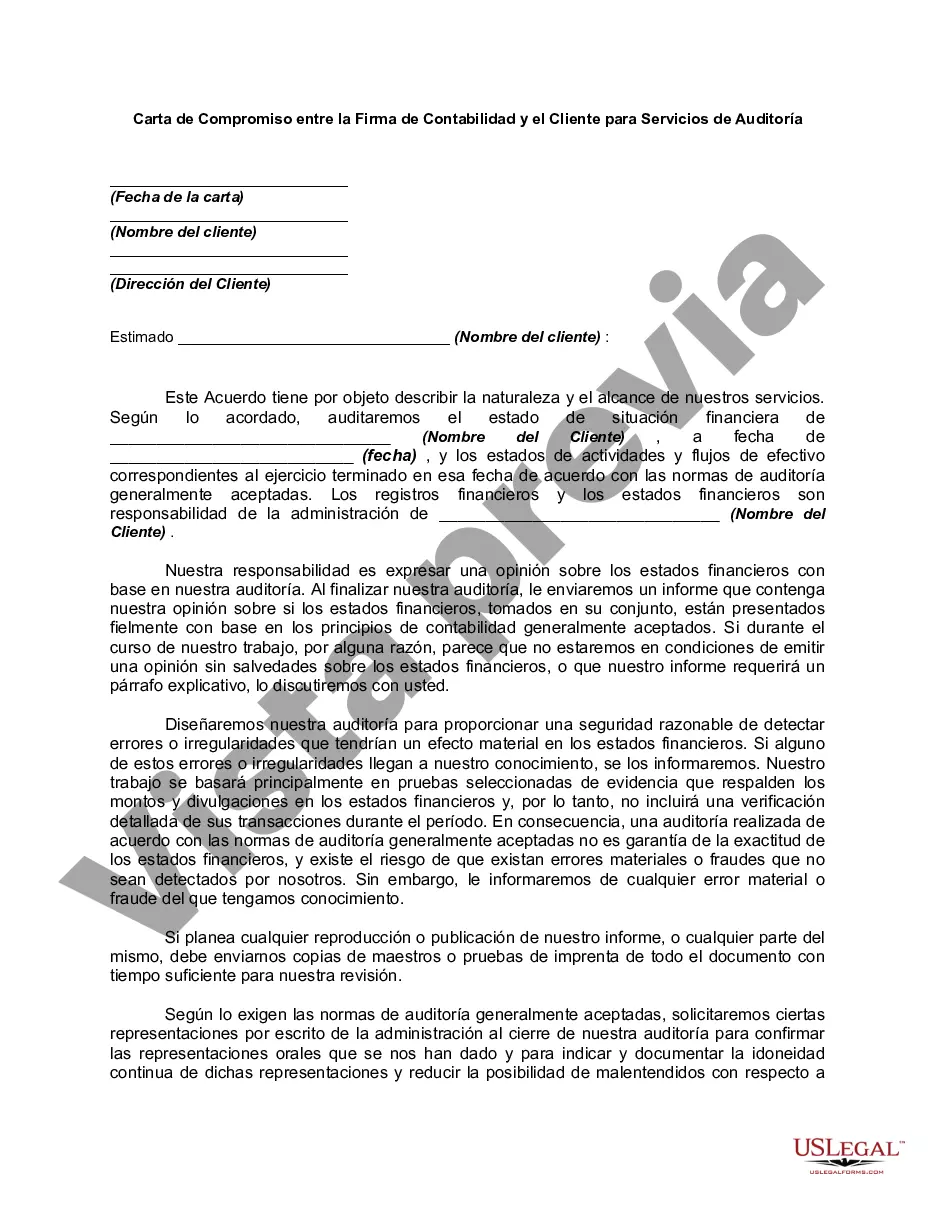

An Alaska Engagement Letter Between an Accounting Firm and Client for Audit Services is a formal agreement outlining the terms and conditions under which an accounting firm will provide audit services to a client based in Alaska. This document serves as a contract and establishes a clear understanding between both parties regarding the nature and scope of the audit engagement. The engagement letter includes various key components such as: 1. Parties involved: It identifies the accounting firm (including its name, address, and contact details) and the client company (including its legal name, address, and contact information). 2. Objectives: This section outlines the specific objectives of the audit engagement, which typically involve expressing an opinion on the financial statements' fairness and reliability. 3. Audit scope: It defines the extent of the audit procedures that will be performed. This may include reviewing financial records, conducting interviews with key personnel, and examining supporting documents. 4. Responsibilities: The letter clearly states the responsibilities of both the accounting firm and the client. The accounting firm is expected to perform the audit according to professional standards, maintain independence, and report any identified issues. The client, on the other hand, is responsible for providing accurate and complete information, facilitating access to relevant documents, and cooperating with the auditors. 5. Timeframe: The engagement letter specifies the expected start and end dates of the audit engagement, as well as any crucial deadlines related to the engagement. 6. Fee arrangement: This section outlines the fee structure for the audit services, including the basis for determining the fees (e.g., hourly rates or a fixed fee) and the payment terms. 7. Reporting and communication: The engagement letter describes how the results of the audit will be communicated, usually through the issuance of an audit report. It may also mention regular progress updates, meetings, and protocols for addressing any issues or concerns during the audit process. 8. Additional services: In some cases, the engagement letter may include provisions for additional services requested by the client not directly related to the audit engagement, such as tax planning or consulting services. These services are usually subject to separate fees and agreements. Different types of engagement letters can exist depending on the specific needs and circumstances of the client. Some variations can include: 1. Initial engagement letter: Used when the accounting firm begins a new audit engagement with a client, outlining the overall terms and conditions. 2. Annual engagement letter: Issued on a recurring basis for clients who require regular audit services. It may incorporate any changes from the previous year's engagement. 3. Engagement letter for specialized audits: For clients with unique audit requirements, such as government entities or non-profit organizations, a specialized engagement letter may be used to address specific regulatory or industry standards. By utilizing an Alaska Engagement Letter Between an Accounting Firm and Client for Audit Services, both parties can establish a clear understanding of their obligations, protect their rights, and facilitate a smooth and successful audit engagement.An Alaska Engagement Letter Between an Accounting Firm and Client for Audit Services is a formal agreement outlining the terms and conditions under which an accounting firm will provide audit services to a client based in Alaska. This document serves as a contract and establishes a clear understanding between both parties regarding the nature and scope of the audit engagement. The engagement letter includes various key components such as: 1. Parties involved: It identifies the accounting firm (including its name, address, and contact details) and the client company (including its legal name, address, and contact information). 2. Objectives: This section outlines the specific objectives of the audit engagement, which typically involve expressing an opinion on the financial statements' fairness and reliability. 3. Audit scope: It defines the extent of the audit procedures that will be performed. This may include reviewing financial records, conducting interviews with key personnel, and examining supporting documents. 4. Responsibilities: The letter clearly states the responsibilities of both the accounting firm and the client. The accounting firm is expected to perform the audit according to professional standards, maintain independence, and report any identified issues. The client, on the other hand, is responsible for providing accurate and complete information, facilitating access to relevant documents, and cooperating with the auditors. 5. Timeframe: The engagement letter specifies the expected start and end dates of the audit engagement, as well as any crucial deadlines related to the engagement. 6. Fee arrangement: This section outlines the fee structure for the audit services, including the basis for determining the fees (e.g., hourly rates or a fixed fee) and the payment terms. 7. Reporting and communication: The engagement letter describes how the results of the audit will be communicated, usually through the issuance of an audit report. It may also mention regular progress updates, meetings, and protocols for addressing any issues or concerns during the audit process. 8. Additional services: In some cases, the engagement letter may include provisions for additional services requested by the client not directly related to the audit engagement, such as tax planning or consulting services. These services are usually subject to separate fees and agreements. Different types of engagement letters can exist depending on the specific needs and circumstances of the client. Some variations can include: 1. Initial engagement letter: Used when the accounting firm begins a new audit engagement with a client, outlining the overall terms and conditions. 2. Annual engagement letter: Issued on a recurring basis for clients who require regular audit services. It may incorporate any changes from the previous year's engagement. 3. Engagement letter for specialized audits: For clients with unique audit requirements, such as government entities or non-profit organizations, a specialized engagement letter may be used to address specific regulatory or industry standards. By utilizing an Alaska Engagement Letter Between an Accounting Firm and Client for Audit Services, both parties can establish a clear understanding of their obligations, protect their rights, and facilitate a smooth and successful audit engagement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.