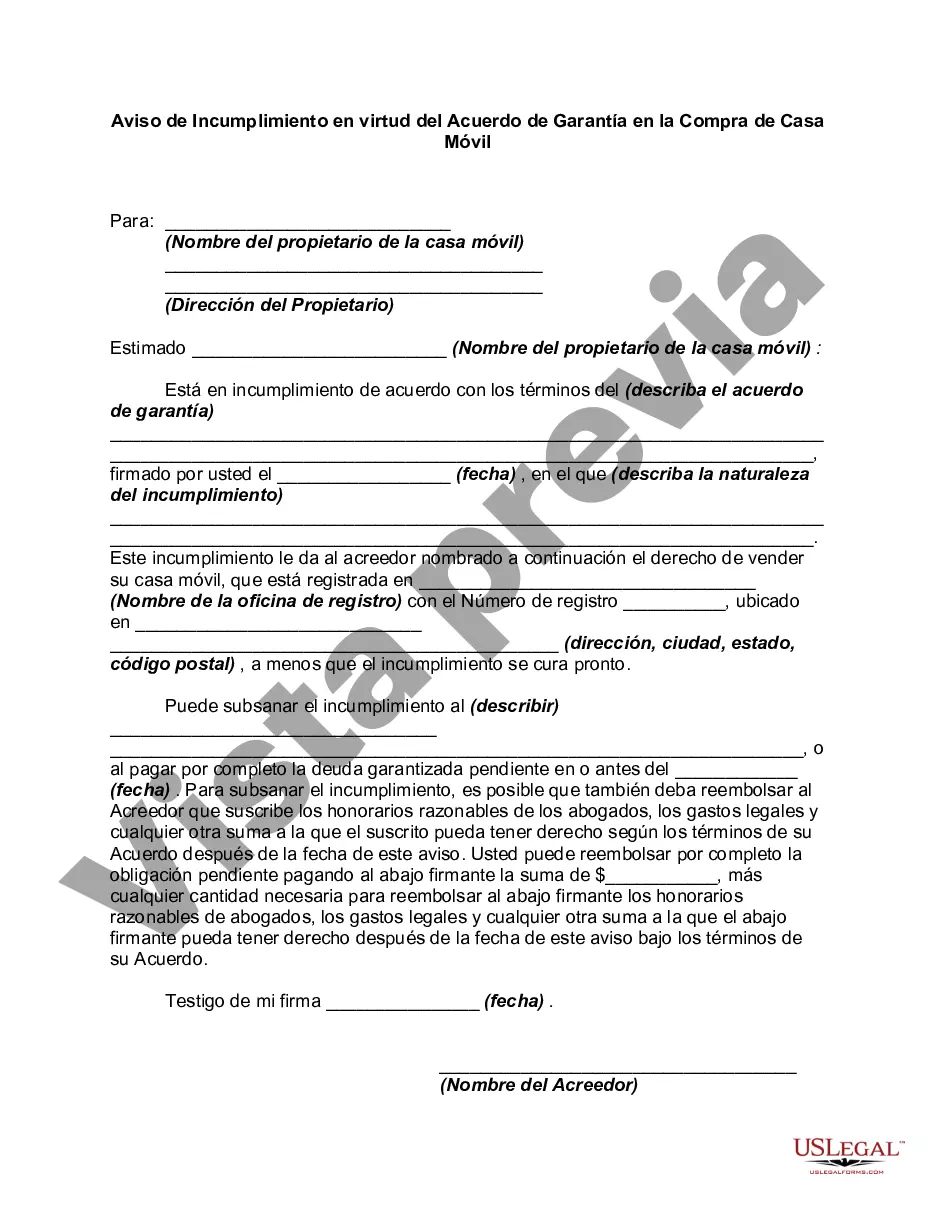

Alaska Notice of Default Under Security Agreement in Purchase of Mobile Home: A Comprehensive Guide In Alaska, a Notice of Default under a Security Agreement in the purchase of a mobile home is a legal document that outlines the homeowner's failure to meet the agreed-upon terms and conditions of their mobile home purchase agreement. The notice highlights the existence of a default in the loan or security agreement, specifically related to the mobile home. Key elements of an Alaska Notice of Default under a Security Agreement in the Purchase of a Mobile Home include: 1. Identification of Parties: The notice must accurately identify both the buyer and seller involved in the mobile home purchase agreement. This includes their legal names, addresses, and contact information. 2. Description of Mobile Home: A detailed description of the mobile home subject to the security agreement should be provided, including its make, model, year, identification number, and any distinctive characteristics or features. 3. Loan Default: The notice should clearly state the specific reasons for default regarding the loan or security agreement. This may include missed payments, late payments, or failure to maintain insurance coverage as agreed upon in the contract. 4. Cure Period: The notice should inform the buyer of a specified cure period, allowing them the opportunity to rectify the default. This period must comply with Alaska state laws and regulations, typically providing the buyer with a reasonable timeframe to bring the loan current or resolve the default issue. 5. Consequences of Non-Compliance: The notice should outline the potential consequences the buyer may face if they fail to remedy the default within the specified cure period. This may include repossession, foreclosure, or legal action pursued by the seller. Types of Alaska Notice of Default under Security Agreement in Purchase of Mobile Home: 1. Notice of Monetary Default: This notice is issued when the buyer fails to make timely payments or is in default of the agreed-upon payment plan outlined in the security agreement. 2. Notice of Insurance Default: This notice is issued when the buyer fails to maintain adequate insurance coverage on the mobile home as required by the terms of the security agreement. This type of default can put both the buyer and seller at risk in case of any damages or accidents. 3. Notice of Breach of Other Terms: This notice is issued when the buyer fails to comply with other terms of the security agreement, such as failing to pay property taxes, violating zoning restrictions, or not maintaining the mobile home as required. It is essential for buyers in Alaska to be aware of the consequences outlined in the Notice of Default under Security Agreement in the Purchase of a Mobile Home and take suitable actions to rectify the default within the provided cure period. Consulting with a legal professional knowledgeable in Alaska mobile home laws and regulations can provide essential guidance and support during this process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Alaska Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

You can spend hrs on the web looking for the legitimate file design that meets the state and federal demands you will need. US Legal Forms gives a huge number of legitimate kinds that happen to be examined by professionals. You can easily down load or printing the Alaska Notice of Default under Security Agreement in Purchase of Mobile Home from our assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and click on the Down load key. Next, it is possible to full, edit, printing, or sign the Alaska Notice of Default under Security Agreement in Purchase of Mobile Home. Every legitimate file design you buy is your own permanently. To get another duplicate of any acquired kind, check out the My Forms tab and click on the related key.

Should you use the US Legal Forms web site the first time, adhere to the basic instructions below:

- Initial, ensure that you have chosen the proper file design to the state/metropolis that you pick. Look at the kind information to make sure you have picked the appropriate kind. If accessible, make use of the Preview key to search with the file design too.

- In order to locate another edition of your kind, make use of the Search discipline to discover the design that meets your needs and demands.

- Once you have found the design you desire, just click Buy now to carry on.

- Find the costs program you desire, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can utilize your credit card or PayPal accounts to fund the legitimate kind.

- Find the formatting of your file and down load it in your device.

- Make modifications in your file if required. You can full, edit and sign and printing Alaska Notice of Default under Security Agreement in Purchase of Mobile Home.

Down load and printing a huge number of file layouts utilizing the US Legal Forms Internet site, which provides the largest assortment of legitimate kinds. Use skilled and status-particular layouts to tackle your organization or person requires.