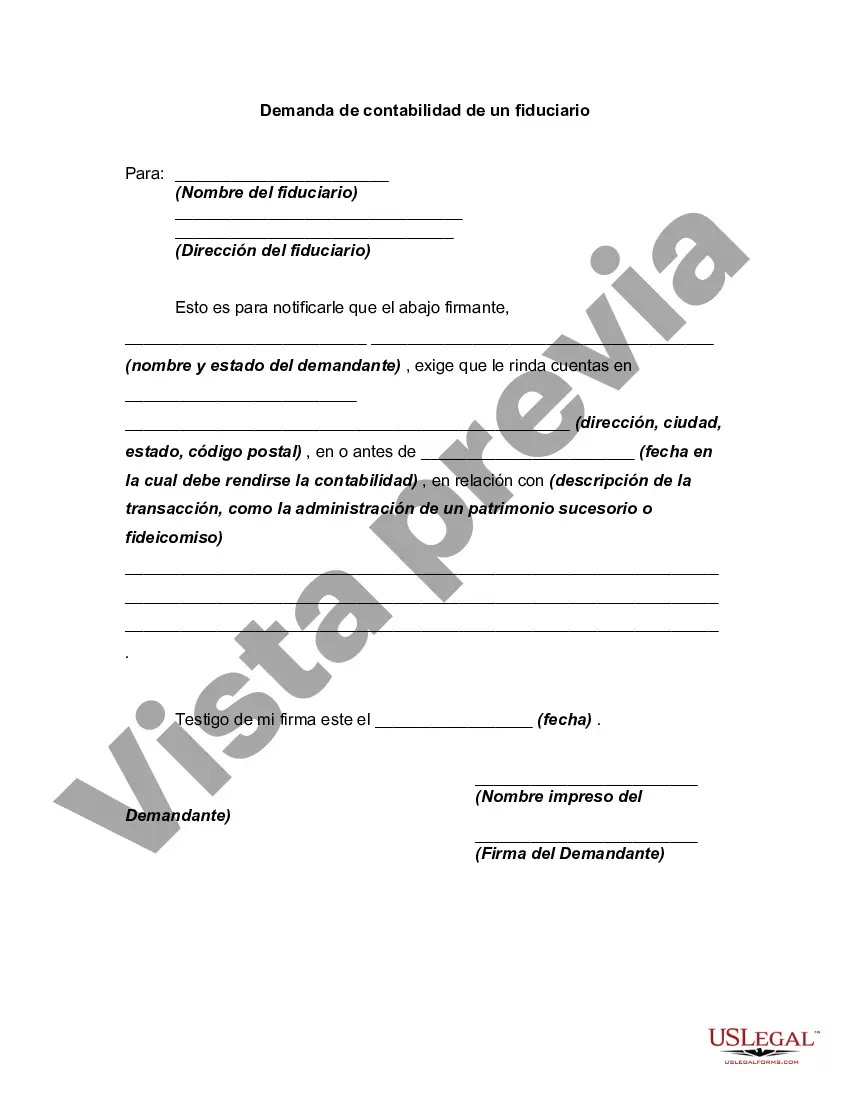

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Alaska Demand for Accounting from a Fiduciary Introduction: The state of Alaska holds strict regulations regarding fiduciary responsibilities, aiming to protect the interests and assets of beneficiaries. Part of this framework includes the provision for demand of accounting from fiduciaries, ensuring transparency and accountability. This article will provide a detailed overview of what Alaska demand for accounting from a fiduciary entails, highlighting its importance and various types. Keywords: Alaska, demand for accounting, fiduciary, regulations, beneficiaries, transparency, accountability 1. What is a Fiduciary? — Definition: A fiduciary is a person or entity entrusted to act in the best interests of another party, known as the beneficiary. This role typically involves managing assets, investments, and making financial decisions on their behalf. 2. Understanding Demand for Accounting in Alaska: — Definition: Demand for accounting refers to the legal right of beneficiaries to request a comprehensive and accurate account of the fiduciary's actions, financial transactions, and management of assets. — Importance: Alaskdemandsnd for accounting ensures transparency, prevents potential mismanagement, and protects beneficiaries' rights. 3. Types of Alaska Demand for Accounting from a Fiduciary: a) Interim Demands for Accounting: — Definition: This type of demand may be made during the fiduciary's term to assess ongoing financial activities and ensure compliance with legal obligations. — Purpose: To monitor the fiduciary's performance, identify irregularities, and address any concerns promptly. b) Final Demands for Accounting: — Definition: Final accounting demands typically occur when a fiduciary's role or relationship with the beneficiary is terminated, such as at the conclusion of a trust or estate administration. — Purpose: To provide beneficiaries with a complete record of all financial transactions, distributions, and remaining assets. 4. Steps for Initiating an Alaska Demand for Accounting: a) Reviewing the Fiduciary Agreement: — Understanding the terms and conditions outlined in the fiduciary agreement, including any provisions regarding accounting demands. b) Notifying the Fiduciary: — In accordance with Alaska law, beneficiaries must formally notify the fiduciary of their demand for accounting in writing, specifying desired account details and the period under review. c) Fiduciary's Obligations: — The fiduciary must respond promptly and provide a comprehensive account sufficiently addressing the beneficiary's concerns and queries. d) Reviewing the Accounting Provided: — The beneficiary should carefully review the accounting provided, seeking professional advice if necessary to ensure accuracy and compliance. e) Taking Legal Action if Required: — If the accounting is incomplete, inaccurate, or fails to address concerns, beneficiaries may consider seeking legal remedies, including filing a petition with the Alaska courts for an accounting order. Conclusion: Alaska demands for accounting from a fiduciary is a vital component of protecting beneficiaries' interests and ensuring accountability. Understanding the different types of demands and the steps involved promotes transparency and facilitates a healthy fiduciary-beneficiary relationship. Keywords: Alaska, demand for accounting, fiduciary, beneficiaries, transparency, accountability, interim demands, final demands, fiduciary agreement, legal action.Title: Understanding Alaska Demand for Accounting from a Fiduciary Introduction: The state of Alaska holds strict regulations regarding fiduciary responsibilities, aiming to protect the interests and assets of beneficiaries. Part of this framework includes the provision for demand of accounting from fiduciaries, ensuring transparency and accountability. This article will provide a detailed overview of what Alaska demand for accounting from a fiduciary entails, highlighting its importance and various types. Keywords: Alaska, demand for accounting, fiduciary, regulations, beneficiaries, transparency, accountability 1. What is a Fiduciary? — Definition: A fiduciary is a person or entity entrusted to act in the best interests of another party, known as the beneficiary. This role typically involves managing assets, investments, and making financial decisions on their behalf. 2. Understanding Demand for Accounting in Alaska: — Definition: Demand for accounting refers to the legal right of beneficiaries to request a comprehensive and accurate account of the fiduciary's actions, financial transactions, and management of assets. — Importance: Alaskdemandsnd for accounting ensures transparency, prevents potential mismanagement, and protects beneficiaries' rights. 3. Types of Alaska Demand for Accounting from a Fiduciary: a) Interim Demands for Accounting: — Definition: This type of demand may be made during the fiduciary's term to assess ongoing financial activities and ensure compliance with legal obligations. — Purpose: To monitor the fiduciary's performance, identify irregularities, and address any concerns promptly. b) Final Demands for Accounting: — Definition: Final accounting demands typically occur when a fiduciary's role or relationship with the beneficiary is terminated, such as at the conclusion of a trust or estate administration. — Purpose: To provide beneficiaries with a complete record of all financial transactions, distributions, and remaining assets. 4. Steps for Initiating an Alaska Demand for Accounting: a) Reviewing the Fiduciary Agreement: — Understanding the terms and conditions outlined in the fiduciary agreement, including any provisions regarding accounting demands. b) Notifying the Fiduciary: — In accordance with Alaska law, beneficiaries must formally notify the fiduciary of their demand for accounting in writing, specifying desired account details and the period under review. c) Fiduciary's Obligations: — The fiduciary must respond promptly and provide a comprehensive account sufficiently addressing the beneficiary's concerns and queries. d) Reviewing the Accounting Provided: — The beneficiary should carefully review the accounting provided, seeking professional advice if necessary to ensure accuracy and compliance. e) Taking Legal Action if Required: — If the accounting is incomplete, inaccurate, or fails to address concerns, beneficiaries may consider seeking legal remedies, including filing a petition with the Alaska courts for an accounting order. Conclusion: Alaska demands for accounting from a fiduciary is a vital component of protecting beneficiaries' interests and ensuring accountability. Understanding the different types of demands and the steps involved promotes transparency and facilitates a healthy fiduciary-beneficiary relationship. Keywords: Alaska, demand for accounting, fiduciary, beneficiaries, transparency, accountability, interim demands, final demands, fiduciary agreement, legal action.

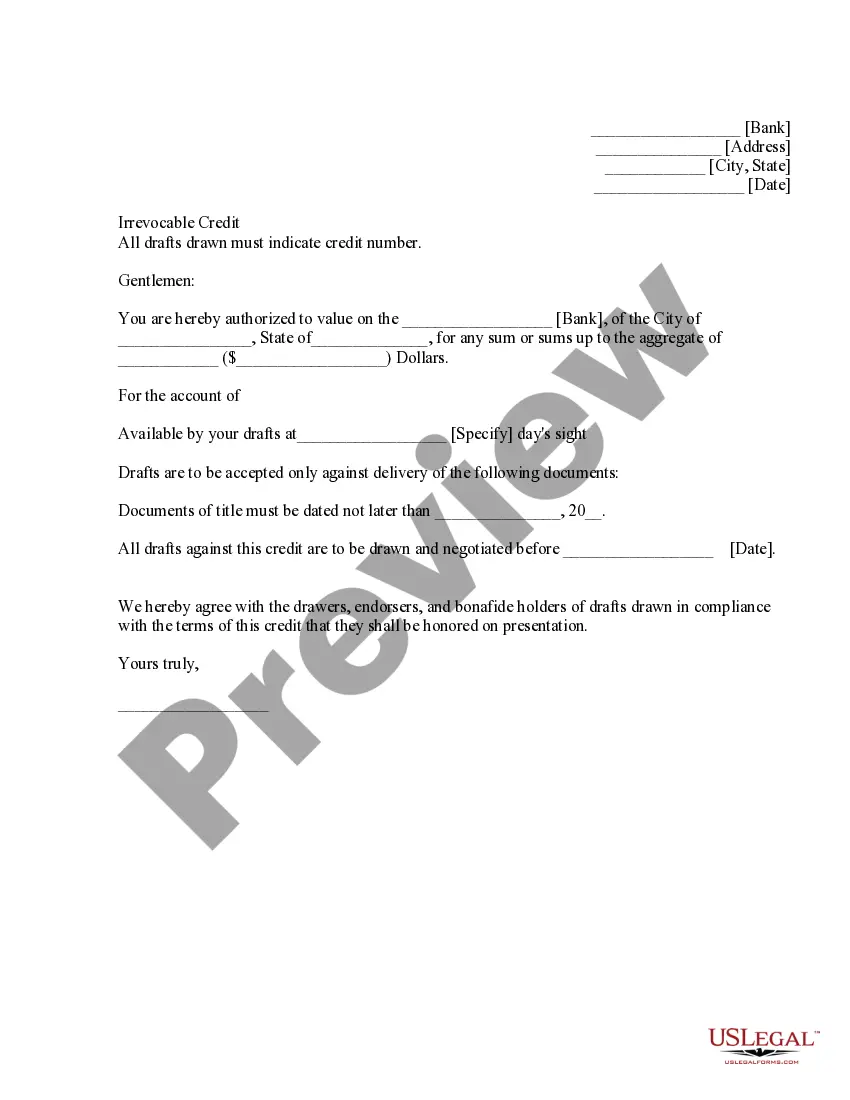

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.