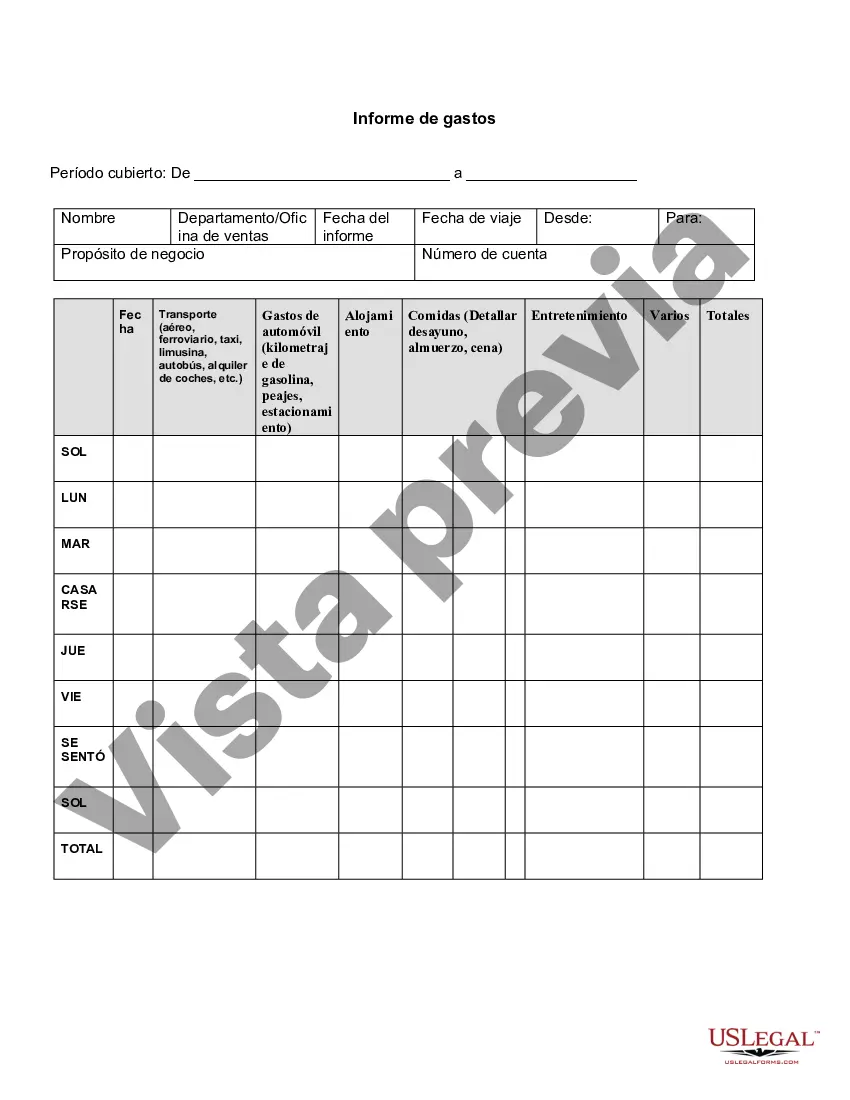

Alaska Expense Report is a comprehensive document used by individuals or organizations to record and track expenses incurred during a trip or project completed in Alaska. This report serves as a tool to monitor and evaluate expenditures accurately, ensuring transparency and adherence to budgetary constraints. Compiled with meticulousness, it assists in financial analysis and aids in making informed decisions for future spending in Alaska. The Alaska Expense Report captures various elements of expenditures, such as transportation costs, accommodation expenses, meals, and incidentals. It provides a detailed breakdown for each expense category, including date, description, amount, and purpose, allowing for easy identification and categorization of costs. This report typically highlights the monetary amounts in Alaskan currency (USD) to ensure clarity and consistency. Different types of Alaska Expense Reports may be utilized to suit specific purposes and circumstances. Some variations include: 1. Individual Expense Report: This report is completed by a single traveler or employee to document their personal expenses incurred in Alaska. It is often used for reimbursement purposes, allowing the individual to claim their eligible expenses. 2. Group Expense Report: In cases where multiple individuals travel together or work jointly on a project, a Group Expense Report is generated. This report consolidates the expenses of all participants, providing an overview of the overall costs. 3. Project Expense Report: Primarily used by organizations or businesses engaged in projects within Alaska, this report captures all expenses related to the specific project. It helps monitor the financial performance of the project, ensuring adherence to the allocated budget. 4. Department Expense Report: Large organizations with separate departments may require department-specific expense reports. These reports focus on expenses incurred by a particular department during their Alaskan operations, aiding in budget allocation and cost control. The Alaska Expense Report is crucial not only for financial tracking but also for compliance with internal policies and external regulations. It provides supporting documentation for audits, tax filings, and reimbursement claims. By using relevant keywords and accurately completing the Alaska Expense Report, individuals and organizations can maintain financial accuracy, transparency, and efficiency in their Alaskan endeavors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Informe de gastos - Expense Report

Description

How to fill out Alaska Informe De Gastos?

Discovering the right authorized papers design could be a have a problem. Of course, there are a variety of templates available on the net, but how do you obtain the authorized type you will need? Make use of the US Legal Forms website. The support provides thousands of templates, including the Alaska Expense Report, that you can use for enterprise and personal needs. All of the kinds are checked out by professionals and meet federal and state demands.

If you are previously registered, log in in your bank account and click the Download key to get the Alaska Expense Report. Make use of your bank account to check through the authorized kinds you might have bought in the past. Proceed to the My Forms tab of your own bank account and acquire an additional duplicate of the papers you will need.

If you are a fresh consumer of US Legal Forms, listed below are simple guidelines for you to comply with:

- Very first, ensure you have chosen the proper type for your metropolis/county. You may look over the shape while using Review key and browse the shape explanation to make sure it is the best for you.

- When the type fails to meet your needs, take advantage of the Seach discipline to obtain the correct type.

- When you are sure that the shape is acceptable, click the Get now key to get the type.

- Choose the rates program you would like and enter in the needed information. Make your bank account and buy the transaction using your PayPal bank account or charge card.

- Pick the submit formatting and download the authorized papers design in your product.

- Complete, modify and print and signal the acquired Alaska Expense Report.

US Legal Forms is the biggest catalogue of authorized kinds that you will find different papers templates. Make use of the company to download appropriately-created files that comply with state demands.

Form popularity

FAQ

A travel expense report is a specific type of expense report that documents expenses related to business trips. It allows employees to itemize their travel costs, ensuring they receive proper reimbursement. By utilizing an Alaska Expense Report template, you can streamline the collection of travel expenses and maintain records for accounting purposes efficiently.

To fill out an expense report, start by entering your personal details and the purpose of the expenses. Next, list each expense with the corresponding dates, amounts, and receipts. Using an Alaska Expense Report form simplifies this process, as it provides a structured way to capture all necessary details and ensures you submit complete information for reimbursement.

An expense report travel expense report specifically focuses on costs incurred during business travel. This includes fares for flights, accommodations, meals, and other travel-related expenses. Using an Alaska Expense Report for this type of documentation helps you organize travel costs and simplifies the reimbursement process for your employees.

An expense report is a document that outlines the expenses incurred by an employee while performing business-related activities. It typically includes details such as the date, amount, and purpose of each expense. Creating an Alaska Expense Report helps organizations track and manage employee spending efficiently, ensuring compliance with company policies.

To reprint a receipt, check the email confirmation you received initially as it may contain an option to reprint. If you lost the email, logging into your relevant account on the merchant's website often allows you to access and print past receipts. For comprehensive tracking of your expenses, consider using the Alaska Expense Report feature, which keeps all your documents in one place.

You can get an Alaska Airlines receipt through multiple channels. Start by logging into your Alaska Airlines account and viewing your booking history. If you have trouble accessing it online, you may also call customer service for help. Ensuring that you have your Alaska Expense Report organized makes retrieving receipts much easier and faster.

To obtain an Alaska receipt, first check your email for any confirmation messages from Alaska Airlines regarding your travel. If you can't find it, visit the Alaska Airlines website and navigate to the 'Manage Flights' section, where you can access your itineraries and request copies of receipts. Alternatively, you can contact Alaska Airlines customer service for assistance. Having a clear Alaska Expense Report helps track your travel expenditures efficiently.

An example of expense reimbursement in your Alaska Expense Report could be travel costs for a business trip. If you incurred costs for airfare, meals, and lodging while on a work trip, you would document these expenses and request reimbursement from your employer. Always keep receipts and use a reliable platform like US Legal Forms for documentation.

The IRS allows expense reimbursements as long as they are for ordinary and necessary costs incurred in the course of business. For your Alaska Expense Report, ensure that all expenses comply with these guidelines to avoid any tax implications. Additionally, keep thorough records and receipts to substantiate your claims.

Writing a reimbursement form for your Alaska Expense Report requires clear articulation of your expenses. Introduce the report with your personal information and the reporting period. List each expense in detail, and ensure you attach the appropriate receipts to substantiate your claims.

More info

In addition to providing a full accounting of all expenses for the current period, expense reports can be used to see a list of all your current and future expenses as well as a forecast of what expenses you may incur in the future.