Alaska Aging of Accounts Receivable, also known as the Alaska A/R Aging Report or simply the A/R Aging, is a financial management tool used by businesses in Alaska to track and analyze the status of their outstanding customer payments. It provides insights into how long it takes customers to pay their invoices and helps businesses identify potential cash flow issues or bottlenecks in their accounts receivable process. The Alaska Aging of Accounts Receivable categorizes outstanding customer invoices into different time periods based on their due dates. Typically, the report is divided into columns representing various time frames, such as 0-30 days, 31-60 days, 61-90 days, and 91+ days. These time frames help businesses assess the timeliness of customer payments and take appropriate actions for effective credit and collections management. With the Alaska Aging of Accounts Receivable report, businesses can identify trends and patterns in their customer payment behavior. By analyzing the report, they can pinpoint customers who consistently delay payments, determine if their credit policies are effective, and evaluate the financial health of their customer base. There are several types of Alaska Aging of Accounts Receivable reports that businesses may utilize based on their specific needs and preferences. These include: 1. Summary A/R Aging Report: Provides an overview of the total outstanding accounts receivable by age category, allowing businesses to quickly assess the overall state of their receivables. 2. Detailed A/R Aging Report: Offers a more comprehensive view of the aging of each individual invoice. It includes details such as invoice numbers, customer names, dates of invoices, and amounts outstanding. This report enables businesses to perform detailed analysis and follow-up actions on specific invoices or customers. 3. Customer A/R Aging Report: Focuses on the aging of accounts receivable by customer. It gives insights into individual customer payment patterns and helps businesses identify customers with high outstanding amounts or extended payment delays. 4. Salesperson A/R Aging Report: Divides the aging of accounts receivable based on the salesperson responsible for each customer. This report helps evaluate salesperson performance by analyzing their ability to collect payments from their customers promptly. Businesses in Alaska utilize the Alaska Aging of Accounts Receivable reports to maintain a healthy cash flow, improve collections, and manage credit risks. It serves as a valuable tool for financial planning, identifying potential issues, and optimizing the accounts receivable process to ensure efficient working capital management.

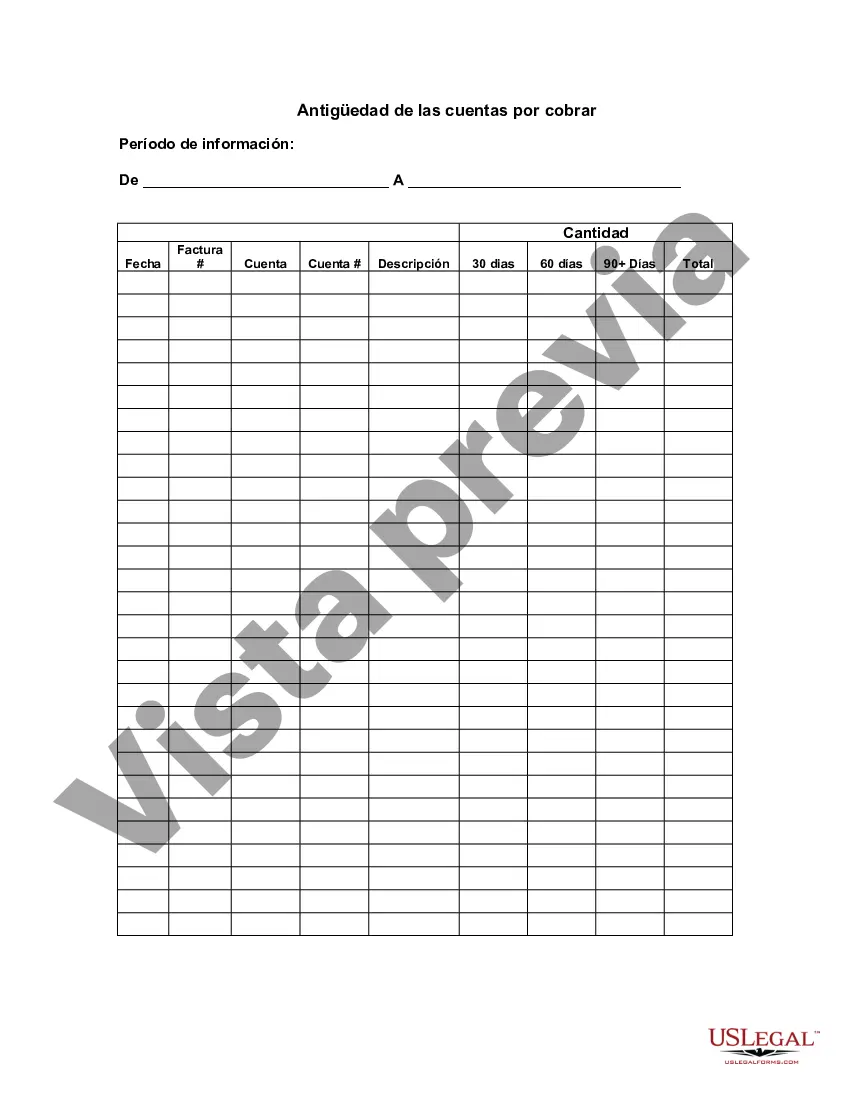

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Alaska Antigüedad De Las Cuentas Por Cobrar?

Have you been in the placement the place you will need documents for both company or personal uses almost every working day? There are a lot of authorized file themes available on the Internet, but locating kinds you can rely is not straightforward. US Legal Forms gives thousands of kind themes, much like the Alaska Aging of Accounts Receivable, which can be composed to satisfy federal and state specifications.

When you are currently knowledgeable about US Legal Forms site and possess an account, merely log in. Next, you can acquire the Alaska Aging of Accounts Receivable format.

If you do not provide an bank account and need to begin using US Legal Forms, adopt these measures:

- Get the kind you will need and ensure it is for your right city/region.

- Make use of the Review key to review the form.

- Read the description to actually have chosen the right kind.

- If the kind is not what you are seeking, use the Research discipline to find the kind that fits your needs and specifications.

- When you find the right kind, click Purchase now.

- Opt for the costs plan you would like, fill in the specified information to make your bank account, and purchase the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a handy paper structure and acquire your version.

Locate every one of the file themes you have purchased in the My Forms menu. You can get a additional version of Alaska Aging of Accounts Receivable any time, if required. Just go through the required kind to acquire or printing the file format.

Use US Legal Forms, the most comprehensive selection of authorized forms, in order to save time and stay away from faults. The assistance gives appropriately created authorized file themes that you can use for an array of uses. Generate an account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

To write an accounts receivable aging report, begin by listing all outstanding invoices along with their due dates. Next, categorize these invoices into various aging buckets, such as current, 30 days, 60 days, and 90+ days overdue. The Alaska Aging of Accounts Receivable framework helps ensure your report is structured and easy to analyze. Finally, generate this report regularly to stay on top of account management and follow through with collection efforts.

An accounts receivable aging report will provide valuable insights into overdue invoices and the overall health of your receivables. It helps you identify which customers are late in their payments and how long they have been overdue. Using the Alaska Aging of Accounts Receivable technique, businesses can improve their collection strategies and maintain better relationships with clients. Furthermore, it serves as a critical tool for financial forecasting.

To calculate the aging of accounts receivable, review your accounts and create an ageing report. You can group receivables based on their due dates into segments like current, overdue, and heavily overdue. This approach provides insight into payment trends and is crucial for effectively managing Alaska Aging of Accounts Receivable, enabling you to optimize your recovery strategies.

The aging of accounts receivable can be calculated by grouping outstanding invoices based on the time they have been unpaid. Typically, businesses categorize receivables into brackets such as current, 30 days, 60 days, and 90 days or more. This method provides a clear picture of your financial status, allowing you to focus on reducing your Alaska Aging of Accounts Receivable.

To calculate receivables ageing in Excel, you can create a table that lists all invoices alongside their due dates. Use a simple formula to subtract the invoice date from the current date, which will give you the age of each receivable. You can employ conditional formatting to highlight overdue accounts, helping you manage your Alaska Aging of Accounts Receivable effectively.

Average turnover ratios for the company's industry.An AR turnover ratio of 7.8 has more analytical value if you can compare it to the average for your industry. An industry average of 10 means Company X is lagging behind its peers, while an average ratio of 5.7 would indicate they're ahead of the pack.

Accounts receivable aging is the process of distinguishing open accounts receivables based on the length of time an invoice has been outstanding. Accounts receivable aging is useful in determining the allowance for doubtful accounts.

Credit balances in accounts receivable should be investigated and manually added back to each aging bucket to get a clear picture of accounts receivable aging. An acceptable performance indicator would be to have no more than 15 to 20 percent total accounts receivable in the greater than 90 days category.

As a general rule, the average business for multiple industries across the country is shooting for a past due receivables percentage in the neighborhood of 10-15%, but depending on your specific circumstances, your ideal number could end up being much higher or lower than that.

It is used as a gauge to determine the financial health of a company's customers. If the accounts receivable aging shows a company's receivables are being collected much slower than normal, this is a warning sign that business may be slowing down or that the company is taking greater credit risk in its sales practices.

More info

Budgeting involves looking back at your past financial plan on a regular basis and making it more effective for the future. This is the method we use with our businesses. We have already looked at some aspects of how you would go about setting up a budget. We have also talked about the process for planning your money. Today we look at the next level of budgeting. Instead of creating a set of yearly expenses that you simply live within, your focus should be to identify the amount of money you will need every month or every year to meet your needs or wants. This will help you to break this cycle of running out of money every month. You do this through this system of periodic budgets. This isn't a fancy or hard-to-follow budgeting system. It's more like a monthly planner that has the tools to automatically make sure your money is being spent correctly by the right recipients. It's like a set of checklists that help you track all of your expenses for the upcoming month or year.