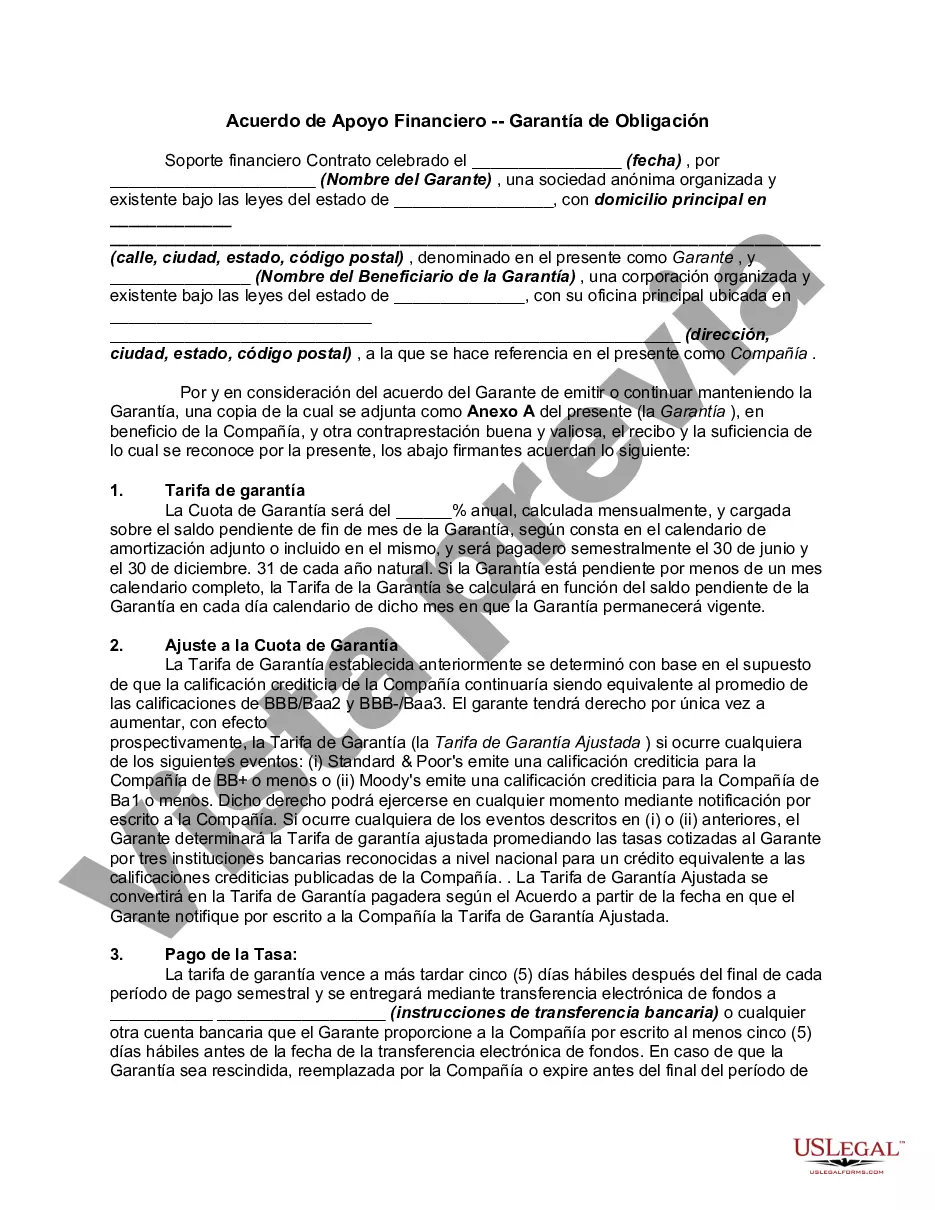

In this agreement, one corporation (the Guarantor) is providing financial assistance to another Corporation (the Corporation) by guaranteeing certain indebtedness for the Company in exchange for a guaranty fee.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alaska Financial Support Agreement — Guaranty of Obligation is a legal contract that outlines the terms and conditions of financial support provided by one party (the guarantor) to another party (the obliged). This agreement ensures that the obliged fulfills their financial obligations by having a guarantor commit to covering any potential defaults or non-payment. In Alaska, there are several types of Financial Support Agreement — Guaranty of Obligation, each serving different purposes and scenarios. Here are some notable types: 1. Commercial Lease Guaranty: This type of agreement focuses on providing financial support for commercial leases. It ensures that the business tenant can meet rent payments, obligations, and other liabilities related to the leased property. 2. Loan Guaranty Agreement: In cases where an individual or business seeks financial assistance from a lender, a loan guaranty agreement is used. The guarantor pledges to repay the loan should the borrower default or fail to meet their repayment conditions. 3. Construction Performance Guaranty: When contractors or construction companies undertake projects, this agreement offers financial support to ensure timely completion and adherence to project specifications. The guarantor guarantees fulfillment of the contractor's obligations, ensuring performance and quality standards are met. 4. Payment Guaranty: This type of guaranty agreement focuses specifically on the obliged's payment obligations towards creditors or suppliers. The guarantor ensures that payment is made in full and on time, protecting the obliged from potential legal actions due to non-payment. 5. Lease Guaranty Agreement: A lease guaranty agreement comes into play when a tenant requires financial support to secure a lease. Here, the guarantor commits to meeting lease payments if the primary tenant fails to fulfill their rental obligations. In all these different types of Alaska Financial Support Agreement — Guaranty of Obligation, the document includes essential details such as the identities of the guarantor and obliged, a clear description of the obligation being guaranteed, the terms and conditions of the agreement, and the rights and responsibilities of both parties. It is essential that all parties involved carefully review and understand the agreement before signing to ensure clarity and a mutual understanding of their commitments.Alaska Financial Support Agreement — Guaranty of Obligation is a legal contract that outlines the terms and conditions of financial support provided by one party (the guarantor) to another party (the obliged). This agreement ensures that the obliged fulfills their financial obligations by having a guarantor commit to covering any potential defaults or non-payment. In Alaska, there are several types of Financial Support Agreement — Guaranty of Obligation, each serving different purposes and scenarios. Here are some notable types: 1. Commercial Lease Guaranty: This type of agreement focuses on providing financial support for commercial leases. It ensures that the business tenant can meet rent payments, obligations, and other liabilities related to the leased property. 2. Loan Guaranty Agreement: In cases where an individual or business seeks financial assistance from a lender, a loan guaranty agreement is used. The guarantor pledges to repay the loan should the borrower default or fail to meet their repayment conditions. 3. Construction Performance Guaranty: When contractors or construction companies undertake projects, this agreement offers financial support to ensure timely completion and adherence to project specifications. The guarantor guarantees fulfillment of the contractor's obligations, ensuring performance and quality standards are met. 4. Payment Guaranty: This type of guaranty agreement focuses specifically on the obliged's payment obligations towards creditors or suppliers. The guarantor ensures that payment is made in full and on time, protecting the obliged from potential legal actions due to non-payment. 5. Lease Guaranty Agreement: A lease guaranty agreement comes into play when a tenant requires financial support to secure a lease. Here, the guarantor commits to meeting lease payments if the primary tenant fails to fulfill their rental obligations. In all these different types of Alaska Financial Support Agreement — Guaranty of Obligation, the document includes essential details such as the identities of the guarantor and obliged, a clear description of the obligation being guaranteed, the terms and conditions of the agreement, and the rights and responsibilities of both parties. It is essential that all parties involved carefully review and understand the agreement before signing to ensure clarity and a mutual understanding of their commitments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.