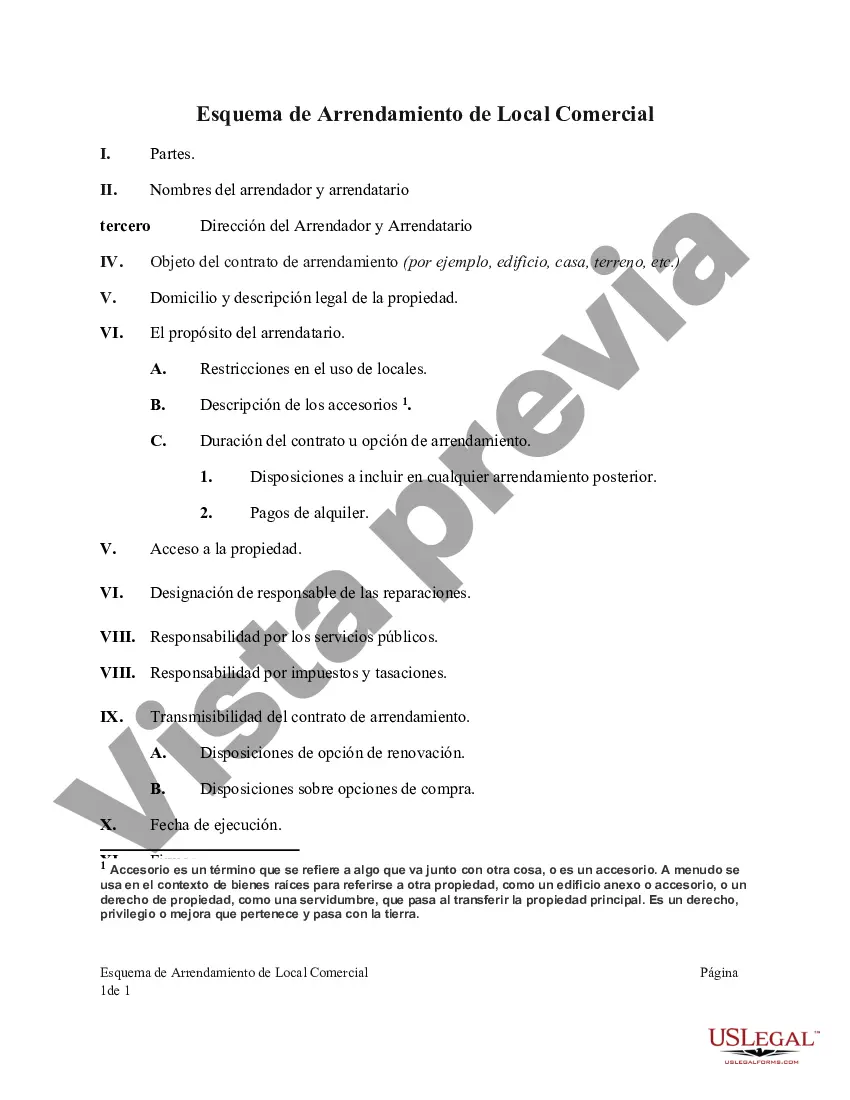

Title: Alaska Outline of Lease of Business Premises: A Comprehensive Guide for Business Owners Introduction: Leasing business premises in Alaska requires careful consideration and a proper understanding of the legal aspects involved. This guide provides a detailed overview of the Alaska Outline of Lease of Business Premises, explaining its purpose, clauses, and terms commonly included. It also highlights different types of lease agreements applicable in Alaska. Whether you are a small business owner looking for a commercial space or a landlord seeking to lease your property, this guide offers valuable insights for a successful lease arrangement. 1. Understanding the Alaska Outline of Lease of Business Premises: The Alaska Outline of Lease of Business Premises is a standardized legal document used as a framework for commercial lease agreements within the state. It serves to establish the rights and responsibilities of both landlords and tenants, ensuring the protection of their respective interests. The outline typically covers critical lease components such as rent, term, maintenance, insurance, utilities, and dispute resolution. 2. Key Clauses and Terms Found in the Alaska Outline of Lease of Business Premises: — Rent and Payment Terms: Clearly outlines the rent amount, frequency, method of payment, and any potential penalties for late payments. — Premises Description: Accurately defines the physical location and boundaries of the commercial space being leased. — Lease Term: Specifies the duration of the lease agreement, including start and end dates, renewal options, and termination clauses. — Maintenance and Repairs: States the responsibilities of the landlord and tenant regarding property maintenance and repairs, including the allocation of costs. — Alterations and Improvements: Outlines the conditions under which tenants can make alterations or improvements to the premises with landlord's consent and the potential restoration obligations. — Use Restrictions: Details the permissible business activities within the leased premises and any limitations or restrictions imposed by the landlord or local authorities. — Insurance and Liability: Specifies the insurance coverage required, such as liability insurance, and outlines the parties' liabilities in case of damage or accidents. — Utilities: Addresses the responsibility for utility payments, including water, electricity, heating, and waste management. — Security Deposit: Outlines the amount of the security deposit, procedures for its return or deductions, and any interest accrual. — Default and Termination: Defines the circumstances under which either party can terminate the lease agreement and outlines the consequences of default. 3. Types of Alaska Outline of Lease of Business Premises: — Gross Lease: Also known as a full-service lease, where the tenant pays a fixed rent, and the landlord covers all operating expenses. — Net Lease: Requires the tenant to pay a fixed rent along with specific additional expenses such as property taxes, insurance, and utilities. — Triple Net Lease: Similar to a net lease, but with the tenant responsible for property taxes, insurance, utilities, maintenance, and repairs, in addition to rent. — Percentage Lease: Typically used in retail establishments, where the tenant pays a base rent along with a percentage of the sales revenue. Conclusion: Understanding the Alaska Outline of Lease of Business Premises is vital for both landlords and tenants entering into commercial lease agreements in Alaska. By familiarizing yourself with the key clauses and terms discussed above, you can negotiate the terms effectively, protect your interests, and ensure a successful leasing experience. It is advisable to consult a legal professional for specific guidance and customization of the lease agreement to meet your unique business requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Esquema de Arrendamiento de Local Comercial - Outline of Lease of Business Premises

Description

How to fill out Alaska Esquema De Arrendamiento De Local Comercial?

Discovering the right authorized document template can be quite a have difficulties. Of course, there are a lot of layouts available on the net, but how can you get the authorized develop you will need? Use the US Legal Forms web site. The support gives a large number of layouts, including the Alaska Outline of Lease of Business Premises, which you can use for enterprise and private needs. All of the forms are examined by professionals and meet up with federal and state specifications.

When you are currently signed up, log in to your accounts and then click the Acquire key to get the Alaska Outline of Lease of Business Premises. Make use of accounts to check with the authorized forms you might have ordered earlier. Proceed to the My Forms tab of the accounts and acquire an additional version from the document you will need.

When you are a brand new customer of US Legal Forms, allow me to share easy guidelines that you can comply with:

- Very first, make sure you have selected the appropriate develop to your area/state. You are able to examine the form making use of the Preview key and study the form outline to guarantee this is basically the right one for you.

- In case the develop does not meet up with your preferences, make use of the Seach industry to obtain the correct develop.

- Once you are certain that the form is acceptable, click the Purchase now key to get the develop.

- Choose the pricing plan you would like and enter in the necessary information. Build your accounts and pay for the transaction making use of your PayPal accounts or Visa or Mastercard.

- Select the file structure and obtain the authorized document template to your system.

- Full, modify and print and sign the received Alaska Outline of Lease of Business Premises.

US Legal Forms may be the largest collection of authorized forms for which you can find various document layouts. Use the service to obtain expertly-manufactured documents that comply with express specifications.