Alaska Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is an estate planning tool designed to protect and manage assets for the benefit of the trust or (also known as the granter or settler). This type of trust is governed by Alaska Statutes, which provide favorable provisions for the creation, administration, and taxation of trusts. The primary purpose of an Alaska Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is to ensure the long-term asset protection and financial security of the trust or. By establishing this type of trust, the trust or transfers ownership of assets into the trust, thus removing them from their personal estate. One specific type of Alaska Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is known as the "Alaska Domestic Asset Protection Trust" (ADAPT). The Alaska ADAPT offers unique advantages, as it allows the trust or to be a discretionary beneficiary of the trust, meaning they may receive income payments from the trust after a specified waiting period. Another variant of this trust is the "Alaska Qualified Personnel Residence Trust" (PRT). This trust is commonly used to transfer a primary residence or vacation home into an irrevocable trust while allowing the trust or to continue residing in the property for a specified term. At the end of the term, the property passes to the trust beneficiaries, reducing potential estate taxes. Under the Alaska Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, the trust or typically names a trustee to manage the trust assets. The trustee has a fiduciary duty to act in the best interest of the trust or and beneficiaries, ensuring the assets are protected and distributed according to the trust terms. The income payable to the trust or after a specified time can vary depending on the trust's provisions. In some cases, the trust or may receive a fixed amount of income annually, while in others, the income may be discretionary. This income can prove particularly beneficial, providing the trust or with financial support during their lifetime while preserving assets for future generations. Alaska's favorable trust laws make the state a popular choice for individuals seeking asset protection and long-term financial planning. By establishing an Alaska Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, individuals can safeguard their wealth, ensure a steady income stream, and provide for their loved ones' financial well-being. It is essential to work with knowledgeable estate planning professionals and attorneys familiar with Alaska trust laws to ensure compliance and fully capitalize on the benefits offered by the various types of Alaska Irrevocable Trusts for Future Benefit of Trust or with Income Payable to Trust or after Specified Time.

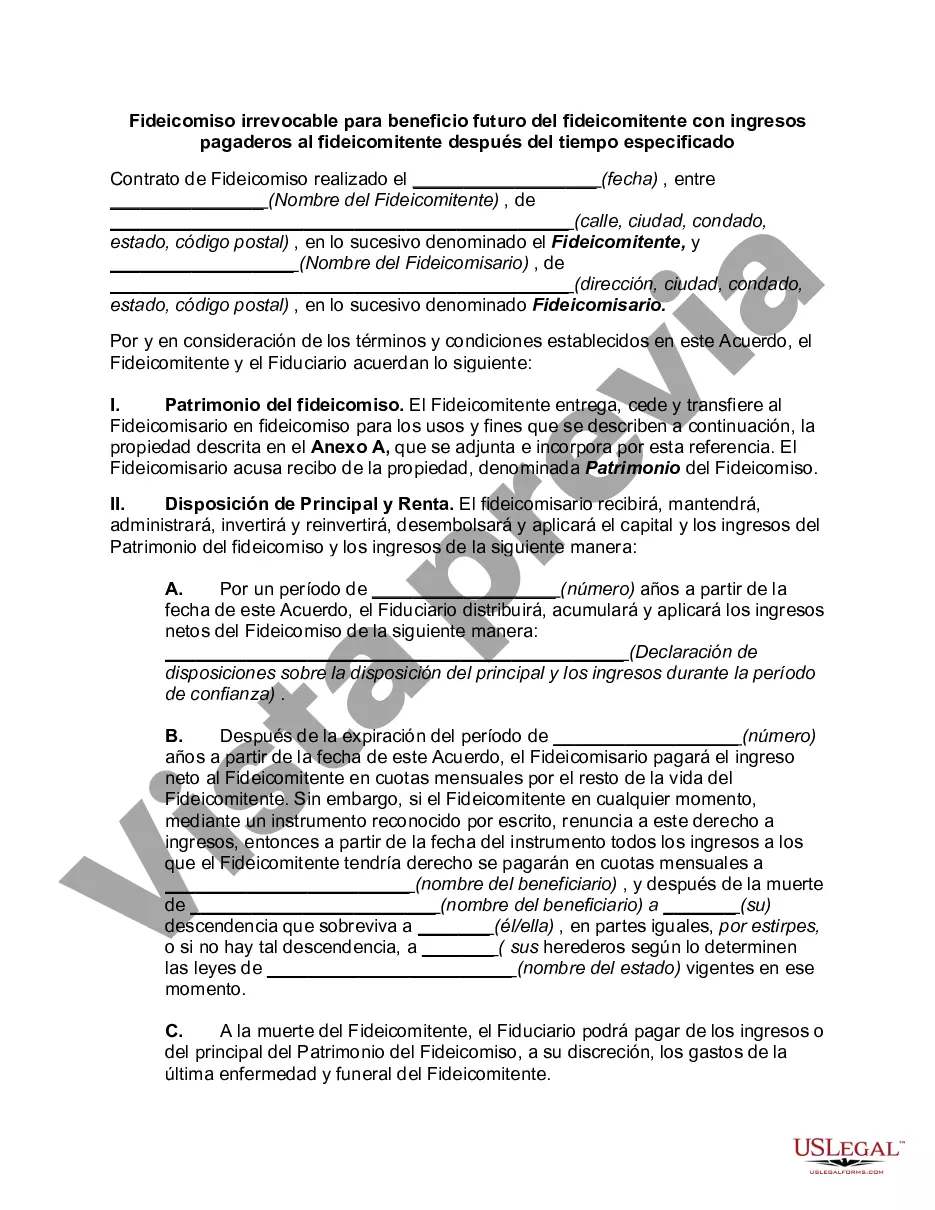

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Alaska Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

US Legal Forms - among the biggest libraries of legal varieties in America - provides a wide range of legal file layouts it is possible to download or print. Using the web site, you may get a huge number of varieties for company and personal reasons, categorized by types, says, or keywords and phrases.You will find the newest versions of varieties just like the Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in seconds.

If you already have a subscription, log in and download Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in the US Legal Forms library. The Download button can look on each form you view. You have access to all earlier saved varieties from the My Forms tab of your own bank account.

If you would like use US Legal Forms for the first time, here are easy guidelines to obtain started off:

- Make sure you have selected the right form for the area/state. Click on the Preview button to analyze the form`s information. Look at the form information to actually have chosen the proper form.

- When the form does not satisfy your requirements, take advantage of the Research discipline at the top of the monitor to find the one which does.

- In case you are satisfied with the form, validate your selection by simply clicking the Purchase now button. Then, pick the pricing program you prefer and provide your credentials to register to have an bank account.

- Method the financial transaction. Utilize your charge card or PayPal bank account to perform the financial transaction.

- Choose the format and download the form on the gadget.

- Make adjustments. Load, change and print and signal the saved Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Every single web template you included with your bank account does not have an expiration time and is also your own property forever. So, if you would like download or print one more copy, just go to the My Forms segment and click on in the form you require.

Gain access to the Alaska Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms, probably the most substantial library of legal file layouts. Use a huge number of specialist and condition-specific layouts that fulfill your organization or personal demands and requirements.