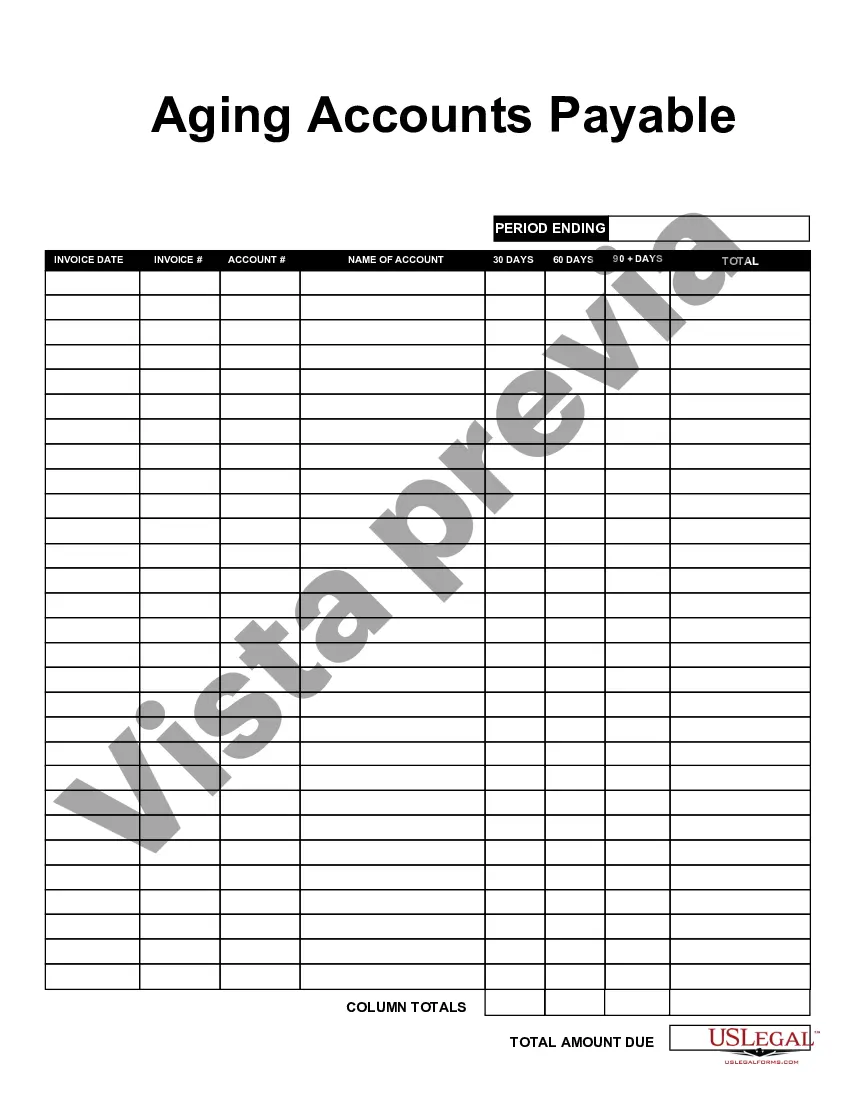

Alaska Aging Accounts Payable refers to a financial management process used by businesses and organizations in Alaska to track and manage outstanding payments owed to vendors or suppliers. It involves monitoring and categorizing unpaid invoices based on the length of time they have been outstanding. This allows businesses to gain insights into their cash flow situation, identify potential liquidity issues, and prioritize payment activities. Keywords: Alaska, Aging Accounts Payable, financial management process, outstanding payments, vendors, suppliers, unpaid invoices, cash flow, liquidity issues, prioritize payment activities. There are two types of Alaska Aging Accounts Payable: 1. Current Payables: This category comprises invoices that are still within their agreed-upon payment terms. These are typically invoices that have been recently issued by vendors or suppliers and are awaiting payment within a specified timeframe, usually within 30 days. 2. Past Due Payables: This category includes invoices that have exceeded their agreed-upon payment terms, usually beyond the 30-day mark. These unpaid invoices represent a financial liability for businesses, as they are considered overdue and require immediate attention to avoid potential penalties, such as late fees or strained vendor relationships. Overall, Alaska Aging Accounts Payable plays a crucial role in maintaining healthy financial operations for businesses in Alaska. By effectively managing and organizing outstanding payments, businesses can ensure timely payments, maintain strong relationships with vendors, and improve their overall financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Alaska Antigüedad De Cuentas Por Pagar?

Are you currently within a place that you require paperwork for sometimes business or specific functions virtually every day? There are tons of legitimate document themes available on the Internet, but locating versions you can rely on is not simple. US Legal Forms provides a large number of develop themes, such as the Alaska Aging Accounts Payable, which are written in order to meet federal and state requirements.

In case you are currently informed about US Legal Forms website and get your account, simply log in. Next, you can download the Alaska Aging Accounts Payable design.

If you do not provide an profile and would like to begin to use US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is to the correct city/region.

- Make use of the Review switch to check the form.

- See the information to actually have selected the correct develop.

- In case the develop is not what you`re searching for, utilize the Lookup industry to discover the develop that meets your requirements and requirements.

- When you obtain the correct develop, just click Purchase now.

- Select the pricing prepare you want, complete the desired information and facts to generate your bank account, and buy your order making use of your PayPal or bank card.

- Choose a hassle-free paper file format and download your version.

Find all of the document themes you possess bought in the My Forms food list. You can get a further version of Alaska Aging Accounts Payable anytime, if possible. Just click on the required develop to download or produce the document design.

Use US Legal Forms, probably the most considerable collection of legitimate varieties, in order to save time as well as steer clear of errors. The support provides appropriately produced legitimate document themes which you can use for a variety of functions. Create your account on US Legal Forms and start producing your daily life easier.