Title: Alaska Demand for a Shareholders Meeting: A Comprehensive Overview Introduction: This detailed description provides an in-depth exploration of Alaska Demand for a Shareholders Meeting, addressing its definition, importance, and highlighting different types of demands. We will explore how shareholders exercise their rights, the legal framework governing these demands, and the key factors driving such meetings in Alaska. 1. Understanding Alaska Demand for a Shareholders Meeting: — Definition: An Alaska Demand for a Shareholders Meeting refers to a formal request made by shareholders of a company incorporated in Alaska to convene a meeting to discuss specific matters. — Purpose: It allows shareholders to voice their concerns, seek information, debate critical decisions, elect or remove directors, approve corporate actions, and ensure accountability and transparency within the company. — Legal Rights: Shareholders are entitled to make demands as mandated by the Alaska Business Corporation Act and the company's bylaws. 2. Key Factors that Trigger Alaska Demand for a Shareholders Meeting: — Financial Performance: A significant decline in company profits, consistently poor performance, or the occurrence of sudden losses can drive shareholders to demand a meeting to address underlying issues. — Corporate Governance: Shareholders may request a meeting when they suspect misconduct, unethical practices, lack of transparency, or when they want to propose changes to the existing board or management structure. — Strategic Decisions: Relating to mergers, acquisitions, divestment, restructuring, or entering into significant partnerships, shareholders may demand a meeting to evaluate and discuss potential ramifications. 3. Types of Alaska Demand for a Shareholders Meeting: — General Demand: Shareholders have the right to demand a general meeting to discuss broad concerns and key agendas affecting the company's interests. — Special Demand: Shareholders can also make a special demand for a meeting to address specific topics that require immediate attention or important decisions, such as a proposed acquisition or divestment. 4. Process and Legal Framework: — Procedural Requirements: Shareholders need to follow specific procedures outlined in the company's bylaws or Articles of Incorporation for making a demand. This typically includes the number of shares required, the timeframe, and the format of the demand. — Minimum Shareholding: Generally, shareholders must hold a minimum number of shares or a specific percentage to exercise their right to demand a meeting. — Notice Requirements: Once a demand is properly made, companies have a legal obligation to notify shareholders about the meeting and provide sufficient notice period before the scheduled date. Conclusion: Alaska Demand for a Shareholders Meeting provides a crucial mechanism for shareholders to actively participate in corporate decision-making, ensuring corporate transparency, and protecting their investment interests. Understanding the various types of demands and the legal framework empowers shareholders to actively engage in shaping their company's future in Alaska.

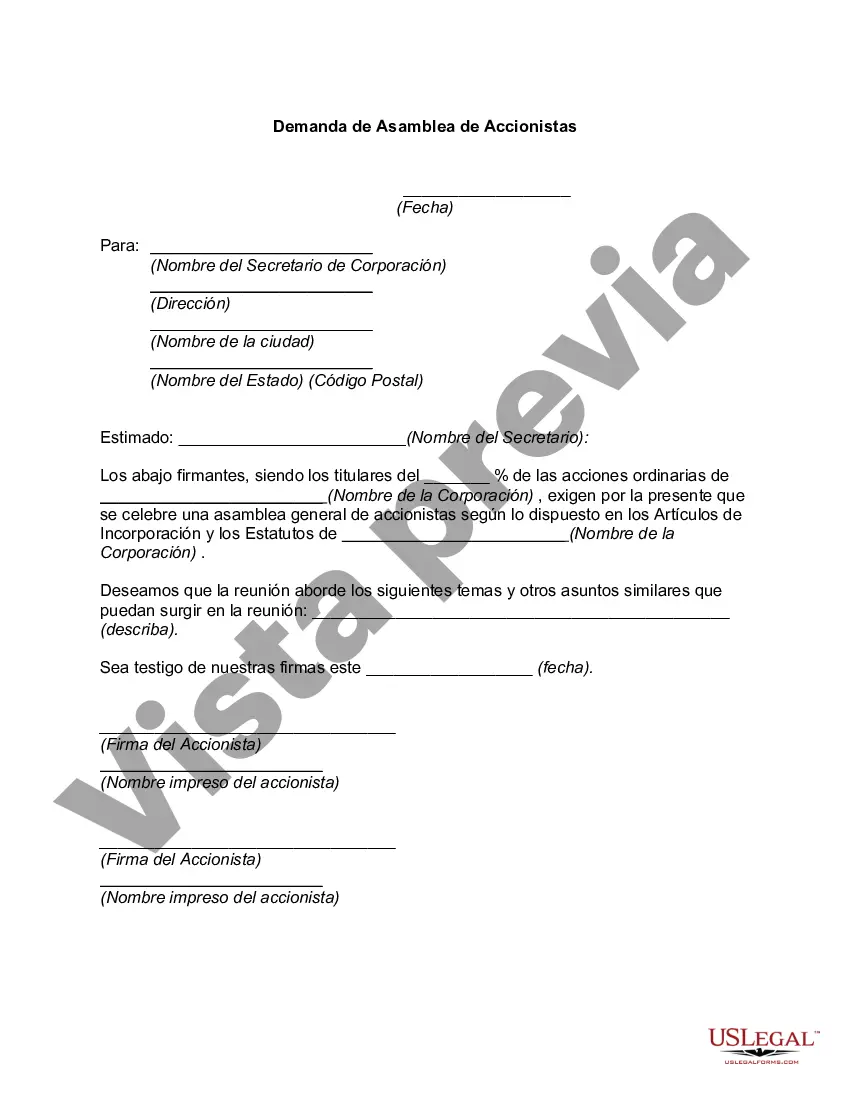

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alaska Demanda de Asamblea de Accionistas - Demand for a Shareholders Meeting

Description

How to fill out Alaska Demanda De Asamblea De Accionistas?

Discovering the right legitimate document web template might be a have a problem. Naturally, there are a variety of web templates available on the Internet, but how do you find the legitimate type you need? Utilize the US Legal Forms web site. The support gives thousands of web templates, including the Alaska Demand for a Shareholders Meeting, that can be used for organization and private requirements. Each of the types are examined by professionals and satisfy state and federal demands.

In case you are currently registered, log in to the bank account and click the Obtain button to find the Alaska Demand for a Shareholders Meeting. Use your bank account to appear with the legitimate types you have acquired earlier. Proceed to the My Forms tab of your own bank account and have an additional version of the document you need.

In case you are a fresh user of US Legal Forms, here are straightforward instructions for you to adhere to:

- Initial, make sure you have selected the proper type for the city/region. You are able to check out the shape using the Preview button and read the shape explanation to guarantee it is the right one for you.

- When the type fails to satisfy your requirements, take advantage of the Seach industry to get the appropriate type.

- When you are positive that the shape is proper, go through the Acquire now button to find the type.

- Opt for the costs plan you need and enter the required info. Make your bank account and purchase an order with your PayPal bank account or Visa or Mastercard.

- Opt for the submit formatting and obtain the legitimate document web template to the device.

- Total, modify and print out and sign the received Alaska Demand for a Shareholders Meeting.

US Legal Forms will be the most significant library of legitimate types that you can find numerous document web templates. Utilize the company to obtain professionally-produced documents that adhere to state demands.