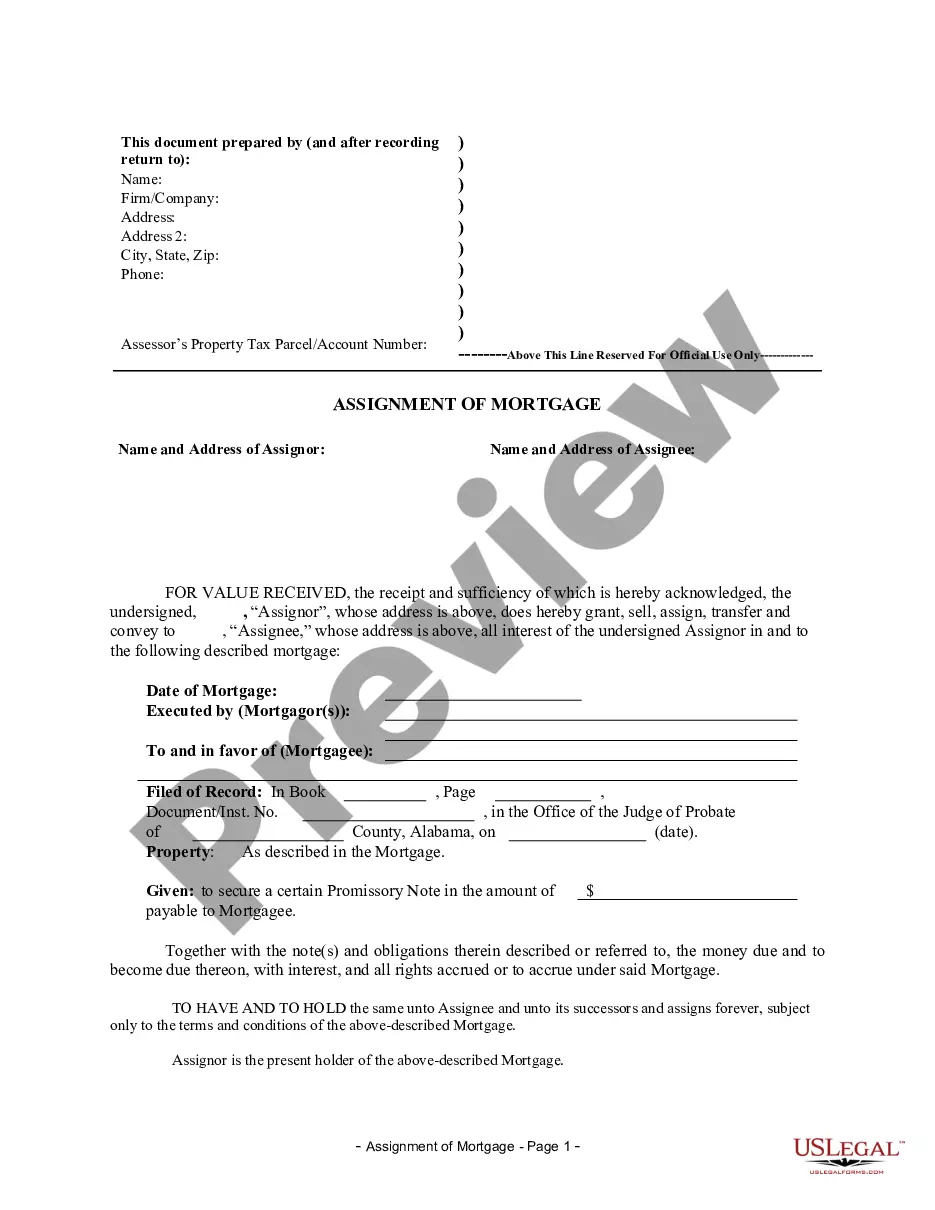

Assignment of Mortgage by Corporate Mortgage Holder

Assignments Generally: Lenders,

or holders of mortgages or deeds of trust, often assign mortgages or deeds

of trust to other lenders, or third parties. When this is done the

assignee (person who received the assignment) steps into the place of the

original lender or assignor. To effectuate an assignment, the general

rules is that the assignment must be in proper written format and recorded

to provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Alabama Law

Alabama Recognizes: Mortgages and Deeds

of Trust.

Assignment: An assignment of mortgage must

be in writing and recorded. 35-4-51.

Demand to Satisfy: The Mortgagee (holder

of the mortgage) must satisfy the mortgage upon payment and demand from

the mortgagors (borrowers) to satisfy the mortgage. 35-10-26.

Recording Satisfaction: Upon demand, the

Mortgagee "shall file a properly executed and notarized satisfaction of

the mortgage or otherwise cause the mortgage to be satisfied". 35-10-26

Marginal Satisfaction: Marginal satisfaction

is still recognized. 35-10-27.

Penalty: If the mortgagee fails to satisfy

the mortgage within 30 days of demand, the Mortgagee may be liable for

statutory damages of $200.00. 35-10-30.

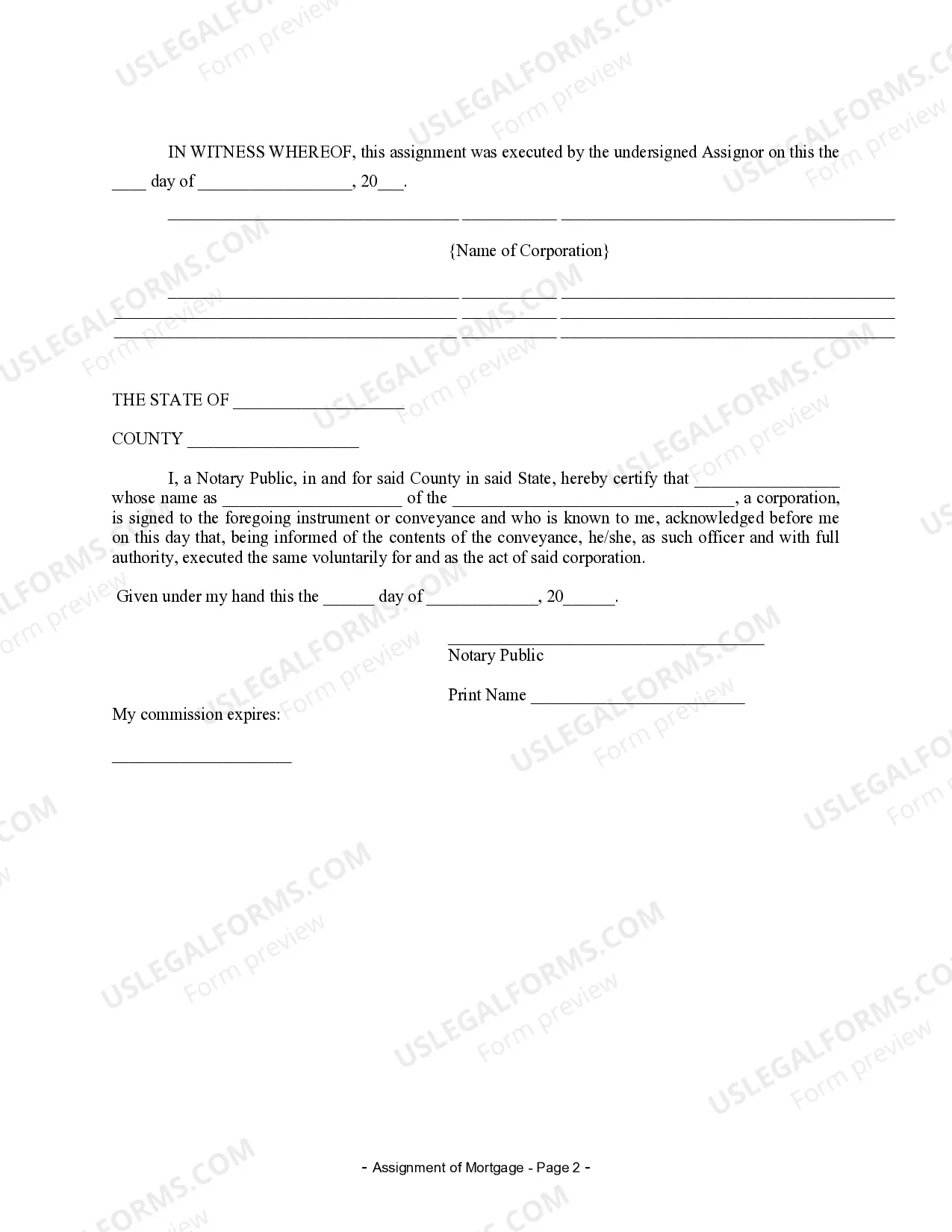

Acknowledgment: An assignment or satisfaction

must contain a proper Alabama acknowledgment, or other acknowledgment approved

by Statute. 34-4-29.

Alabama Statutes

Section 35-4-51

What instruments admitted to record; filing as notice of contents;

section cumulative.

Except as may be otherwise provided by the Uniform Commercial Code,

all deeds, mortgages, deeds of trust, bills of sale, contracts or

other documents purporting to convey any right, title, easement, or interest

in any real estate or personal property and all assignments of mortgages,

deeds of trust or other securities for debt or extension agreements

with respect thereto, when executed in accordance with law, shall be admitted

to record in the office of the probate judge of any county. Their filing

for registration shall constitute notice of their contents.

This section shall not be construed as superseding or repealing

any other laws effective in Alabama relative to the subject matter in this

article, but shall be held and construed to be cumulative.

Section 35-10-26

Title revested upon payment of debt.

The payment or satisfaction of the real property mortgage debt divests

the title passing by the mortgage. "Payment or satisfaction of the real

property mortgage debt" shall not occur until there is no outstanding indebtedness

or other obligation secured by the mortgage, and no commitment or agreement

by the mortgagee to make advances, incur obligations or otherwise give

value (collectively referred to as "extend value"), under any agreement,

including, without limitation, agreements providing for future advances,

open end, revolving or other lines of credit, or letters of credit. Upon

the written request to satisfy a mortgage signed by the mortgagors

and by all other persons who have a right to require the mortgagee to extend

value or signed by other authorized representatives on behalf of the mortgagors

and such other persons, which notice shall actually be served upon the

mortgagee, and provided there is no outstanding obligation secured by the

mortgage at that time, the mortgagee shall file a properly executed

and notarized satisfaction of the mortgage or otherwise cause the mortgage

to be satisfied in accordance with other applicable provisions of law.

From and after such written request for mortgage satisfaction, neither

the mortgagors nor any other person who signed such request, or on whose

behalf such request was signed, shall have the right to request or demand

that the mortgagee extend value under the mortgage or other agreements

and the mortgagee shall be released from all obligations and commitments

to extend value thereunder.

Section 35-10-27

Entry of full payment or satisfaction in record; Generally.

If a mortgage or deed of trust which is of record has been fully

paid or satisfied, the mortgagee or transferee or assignee of the mortgage,

or trustee or cestui que trust of the deed of trust, who has received payment

or satisfaction, must on request in writing of the mortgagor, or of a creditor

of the mortgagor having a lien or claim on the property mortgaged, or of

a purchaser from the mortgagor, or owner of the lands mortgaged, or a junior

mortgagee, or of the debtor in a deed of trust, enter the fact of payment

or satisfaction on the margin of the record of the mortgage or deed

of trust. Such entry must be witnessed by the judge of probate, or his

clerk, who, in his official capacity, must attest said satisfaction, and

for making such attestation the judge of probate is entitled to a fee of

$25. Or satisfaction may be made by an attorney-in-fact authorized by an

instrument executed and acknowledged as is required of conveyances and

filed for record, which entry need not be attested. Such entry operates

as a release of the mortgage or deed of trust, and is a bar to all actions

thereon.

Section 35-10-30

Penalty.

(a) If, for 30 days after such request, the mortgagee or

assignee or transferee, trustee or cestuique trust, fails to make any entry

required by this article he forfeits to the party making the request

$200.00 unless there is pending, or there is instituted, an action

within that time, in which the fact of partial payment or satisfaction

is or may be contested. In construing this article, the right of action

given herein shall be considered as a personal right, and shall not be

lost or waived by a sale of the property covered by the mortgage or deed

of trust before a demand was made for the satisfaction to be entered upon

the record.

(b) All actions for the recovery of the penalties mentioned in this

article shall be brought in the county where such mortgage or other instrument

is recorded.