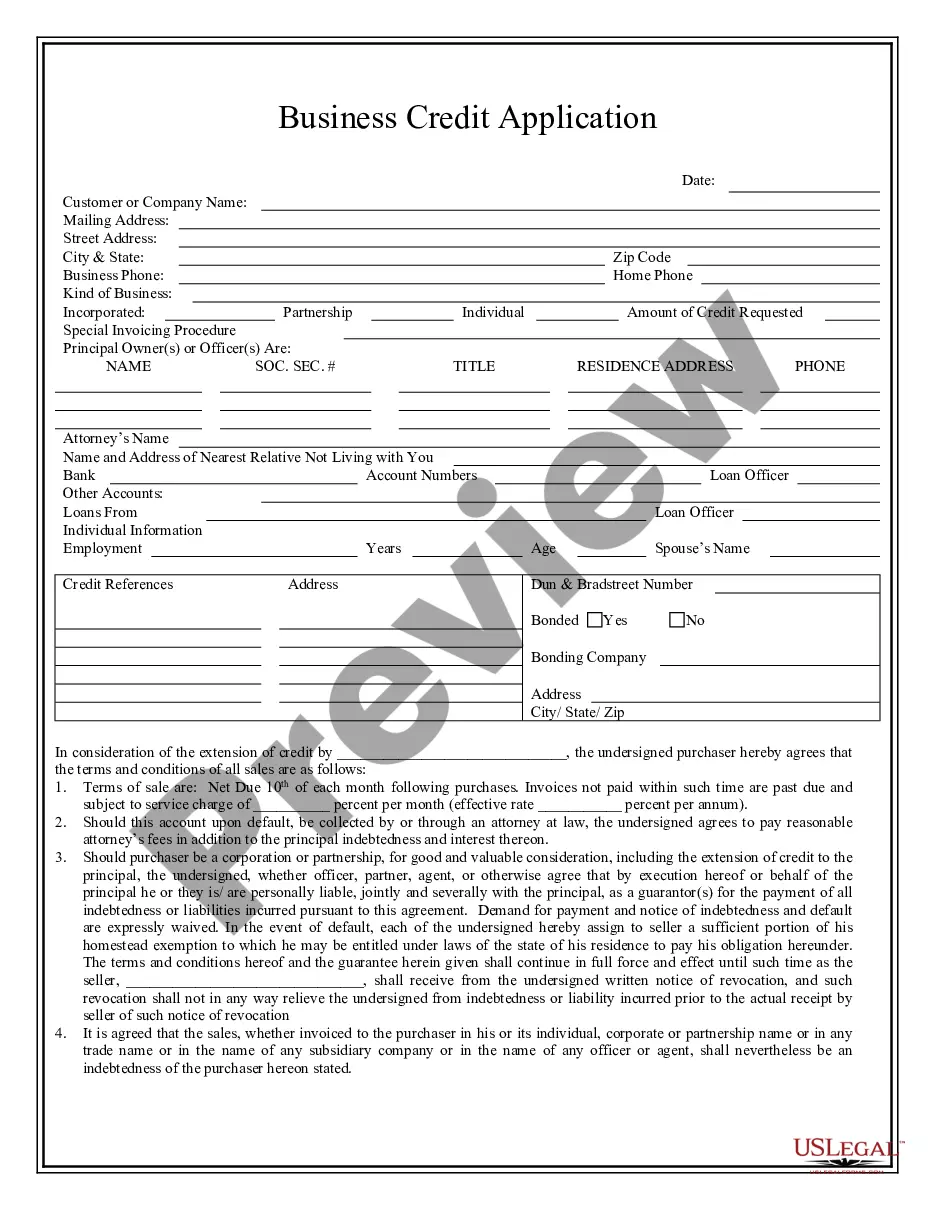

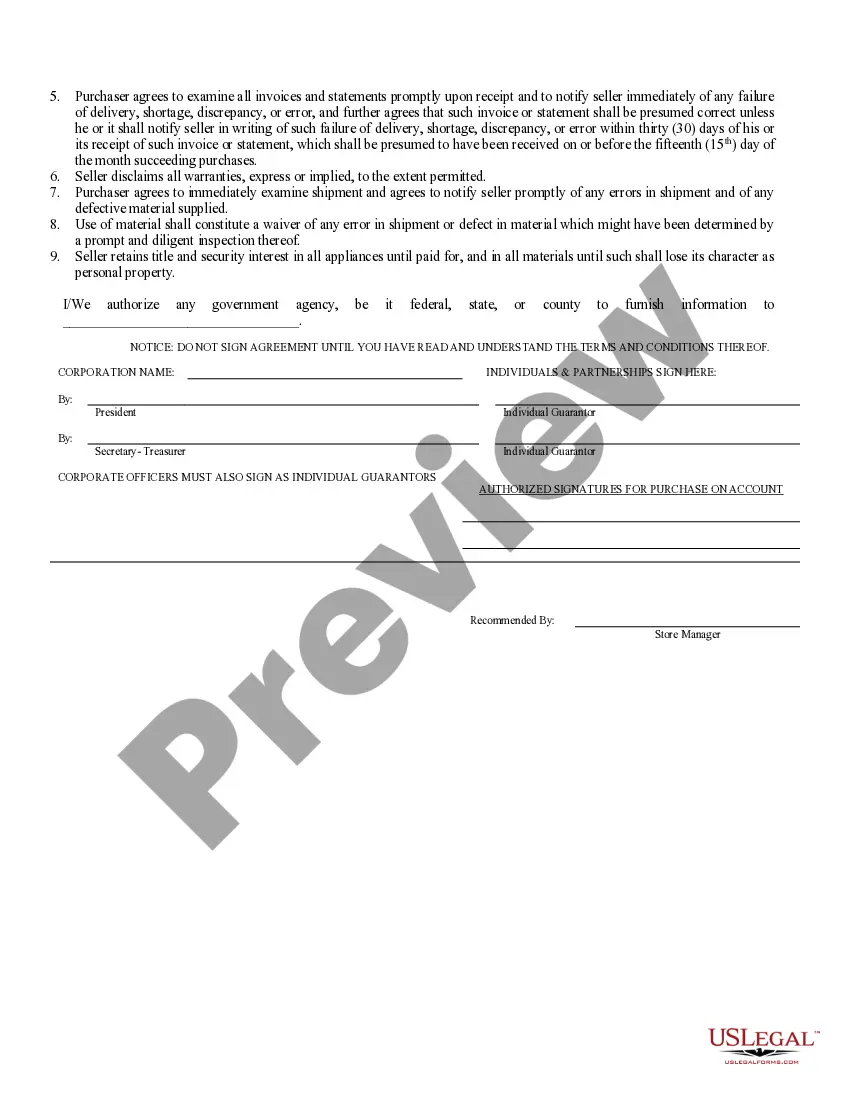

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Alabama Business Credit Application

Description

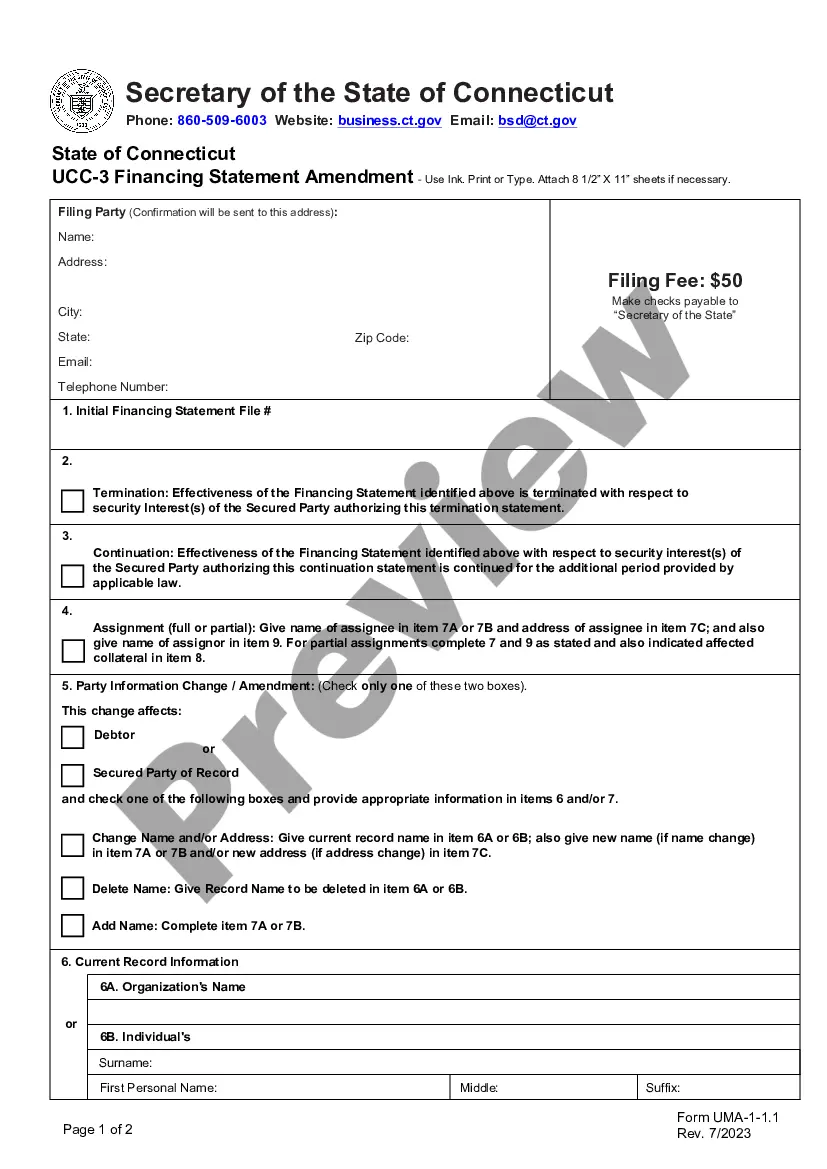

How to fill out Alabama Business Credit Application?

Employing Alabama Business Credit Application samples created by experienced attorneys provides you the chance to steer clear of complications while completing forms.

Simply download the template from our site, fill it out, and request a legal expert to validate it.

This can conserve you significantly more time and energy than searching for a lawyer to draft a document from the beginning to cater to your needs.

Remember to verify all provided information for accuracy before submitting it or dispatching it. Minimize the time spent on completing forms with US Legal Forms!

- If you hold a US Legal Forms subscription, just Log In to your account and navigate back to the form page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a document, your saved samples will be available in the My documents tab.

- If you lack a subscription, it's not a major issue.

- Just follow the instructions below to register for an account online, obtain, and finish your Alabama Business Credit Application template.

- Ensure you are downloading the correct state-specific form.

Form popularity

FAQ

Establishing credit for your LLC involves a few key steps. Start by registering your business and obtaining an EIN. Next, open a business bank account and apply for a business credit card to begin building a credit history. When you fill out an Alabama Business Credit Application, be sure to showcase your business’s financial responsibility and timely payments. Using platforms like US Legal Forms can guide you through each step, making the process smoother.

To quickly obtain business credit for your LLC, start by ensuring your business is registered with the state and has all necessary licenses. Next, open a business bank account and establish a solid financial history. When you complete an Alabama Business Credit Application, consider seeking accounts with vendors that report to credit bureaus, as this can rapidly build your credit profile. US Legal Forms can help streamline this process with their resources and templates.

Yes, you can use your Employer Identification Number (EIN) to build business credit. The EIN acts as a unique identifier for your business, much like a Social Security number does for individuals. When you apply for an Alabama Business Credit Application, lenders will often use your EIN to review your business credit profile. It is essential to ensure your business is registered and that you use the EIN consistently for all credit-related transactions.

A business credit application form is a document that businesses complete to apply for credit lines or loans from lenders. This form typically requires details about your business, including its structure, financial history, and credit needs. Submitting an Alabama Business Credit Application can give lenders a clearer picture of your financial health and increase your chances of securing funding.

No, you do not need an LLC to start a small business in Alabama; however, forming one can offer liability protection and potential tax benefits. You can choose other business structures like sole proprietorship or partnership. Regardless of your choice, an Alabama Business Credit Application remains a key step in establishing your business credit, which is essential for growth.

Yes, having an LLC does not automatically exclude you from obtaining a business license in Alabama. Local governments often require businesses to apply for licenses depending on the services or products offered. Applying for an Alabama Business Credit Application is beneficial as it helps formalize your business activities and demonstrate compliance with state regulations.

Registering as a small business in Alabama involves choosing a business structure, such as an LLC or corporation. You will need to file the necessary forms with the Alabama Secretary of State. Once registered, applying for an Alabama Business Credit Application can assist you in building your business credit reputation, which is vital for securing loans and credit in the future.

To establish a business credit file, start by registering your business with the appropriate state authorities and obtaining a federal Employer Identification Number (EIN). Next, open a business bank account and ensure that your business is listed with major credit bureaus. An Alabama Business Credit Application will help you formally create and report your credit activity, paving the way for future financial benefits.

The credit application form for business is a specific request document that businesses must complete to apply for credit or loans. This form gathers vital information about your company, such as its revenue, credit history, and financial statements. Submitting a well-prepared Alabama Business Credit Application can improve your chances of securing the financial resources you need. Proper completion and submission of this form are crucial steps toward accessing credit for your business.

The Alabama employer tax credit is a financial incentive offered by the state to encourage businesses to hire and retain employees. This credit can significantly reduce your tax burden and enhance your overall financial strategy. Understanding these credits can be advantageous for your business growth. For those exploring financing options, the Alabama Business Credit Application can streamline the process of obtaining the necessary funds to capitalize on such opportunities.