Alabama Deferred Compensation Agreement - Long Form

Description

How to fill out Deferred Compensation Agreement - Long Form?

Selecting the appropriate legal document format can be a challenge.

Clearly, there is an assortment of templates available online, but how do you locate the legal form you require? Utilize the US Legal Forms website.

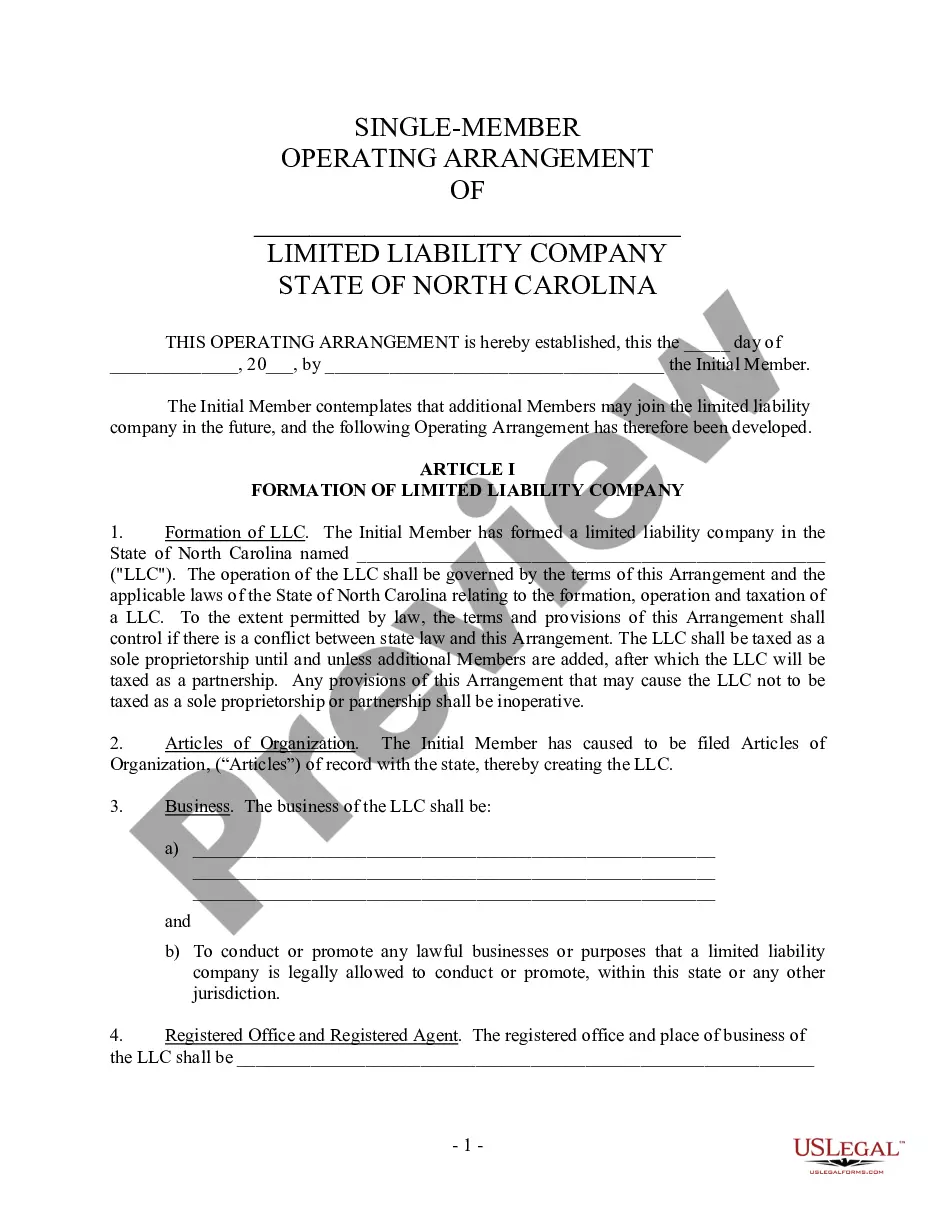

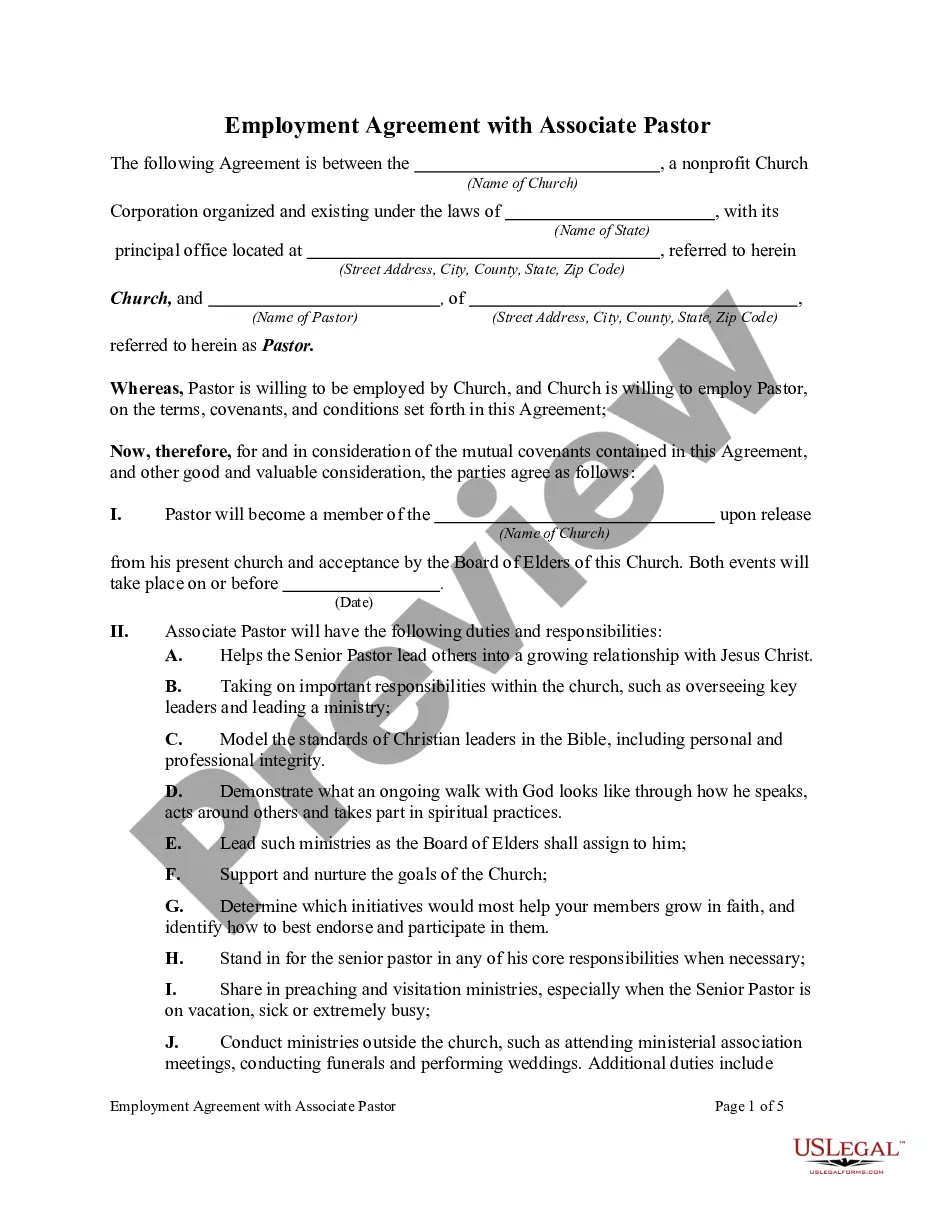

The platform provides a multitude of templates, such as the Alabama Deferred Compensation Agreement - Long Form, applicable for both business and personal purposes.

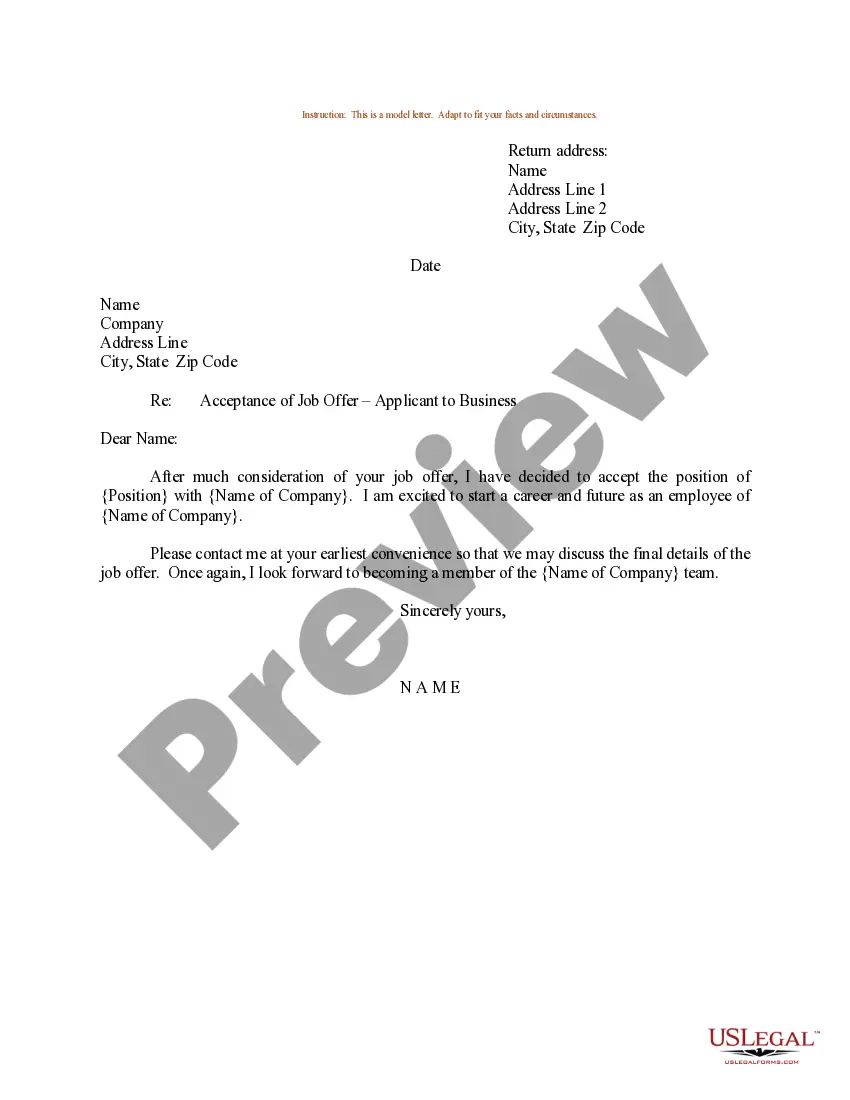

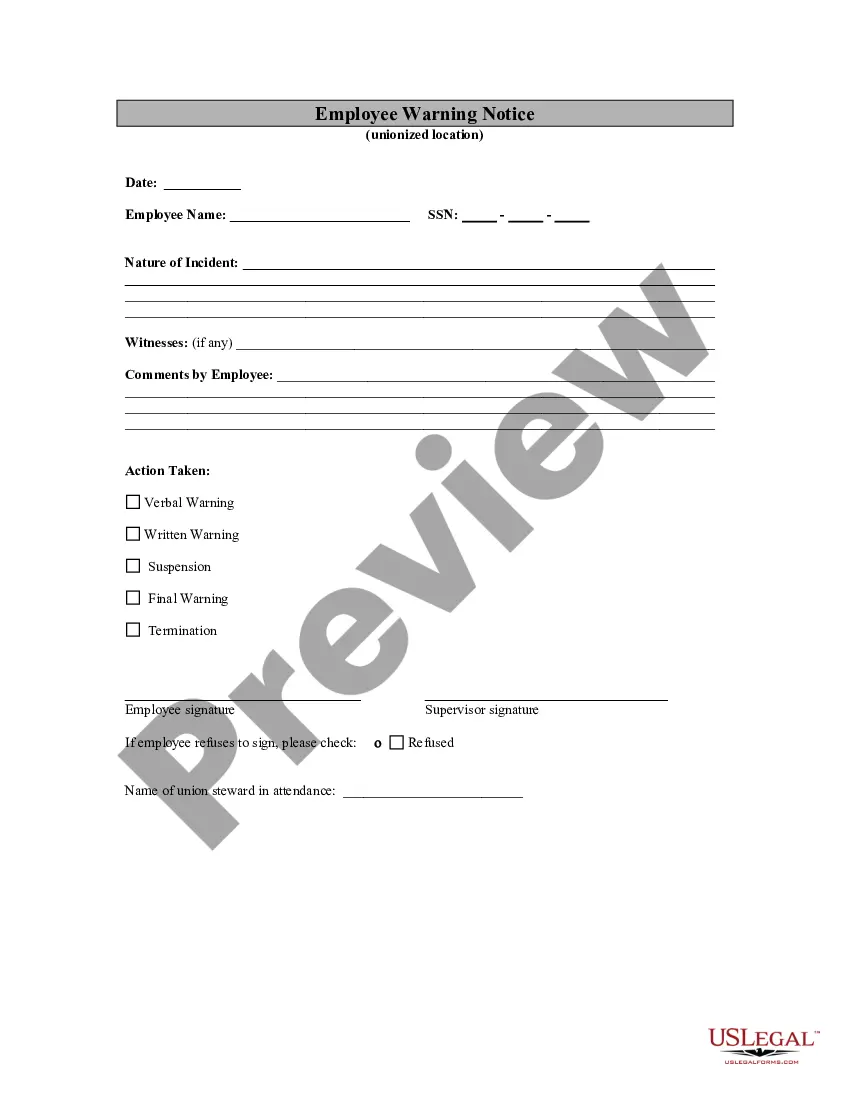

First, ensure that you have selected the correct form for your locality. You can review the form using the Review button and examine the form description to confirm that it is suitable for your needs.

- All the forms are vetted by professionals and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Alabama Deferred Compensation Agreement - Long Form.

- Use your account to browse the legal forms you have purchased previously.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you're a new user of US Legal Forms, here are straightforward instructions for you to follow.

Form popularity

FAQ

You may make withdrawals from your RSA. The minimum withdrawal is $500 or, if your balance is less than $500, the total balance of your account. Withdrawals are subject to a 20% Federal income tax withholding. You may also annuitize this account and receive additional monthly annuity payments.

When I withdraw my funds, how are they taxed? Distributions of amounts previously deferred as well as interest earned are subject to federal income tax withholding. Amounts deferred after January 1, 1997, as well as any interest earned, will be subject to state of Alabama income tax upon distribution.

Secure a Better Tomorrow with RSA-1RSA-1 is a tremendous benefit offered to you by the Retirement Systems of Alabama. By contribut- ing pre-tax dollars, a member lowers his/her taxable income and reduces the amount of taxes he/she pays. Each and every member of TRS and ERS should take advantage of this plan.

457 plans are IRS-sanctioned, tax-advantaged employee retirement plans. They are offered by state, local government, and some nonprofit employers. Participants are allowed to contribute up to 100% of their salary, provided it does not exceed the applicable dollar limit for the year.

RSA Plan means The Kroger Co. 401(k) Retirement Savings Account Plan, as it may be amended from time to time.

No. The only way to get money out of an ERS account is to terminate employment and withdraw the entire account.

Former employees of RSA, Sun Alliance or Royal Insurance may have pension entitlement in one or more occupational pension scheme.

RSA-1 is an Internal Revenue Code Section 457 deferred compensation plan for public employees. This voluntary plan allows you to save and invest extra money for retirement, tax deferred. Not only will you defer taxes immediately, your contributions and any earnings will grow on a tax-deferred basis as well.