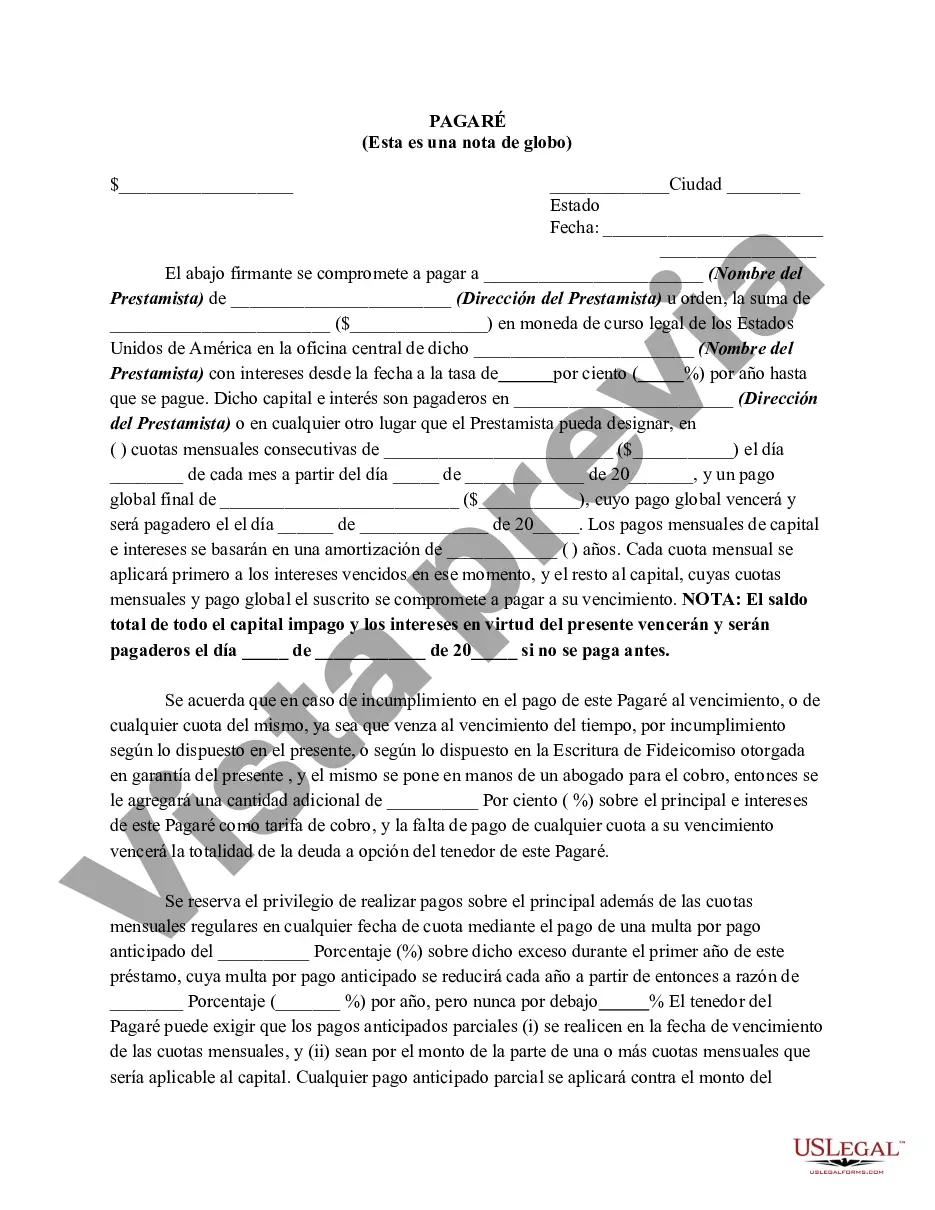

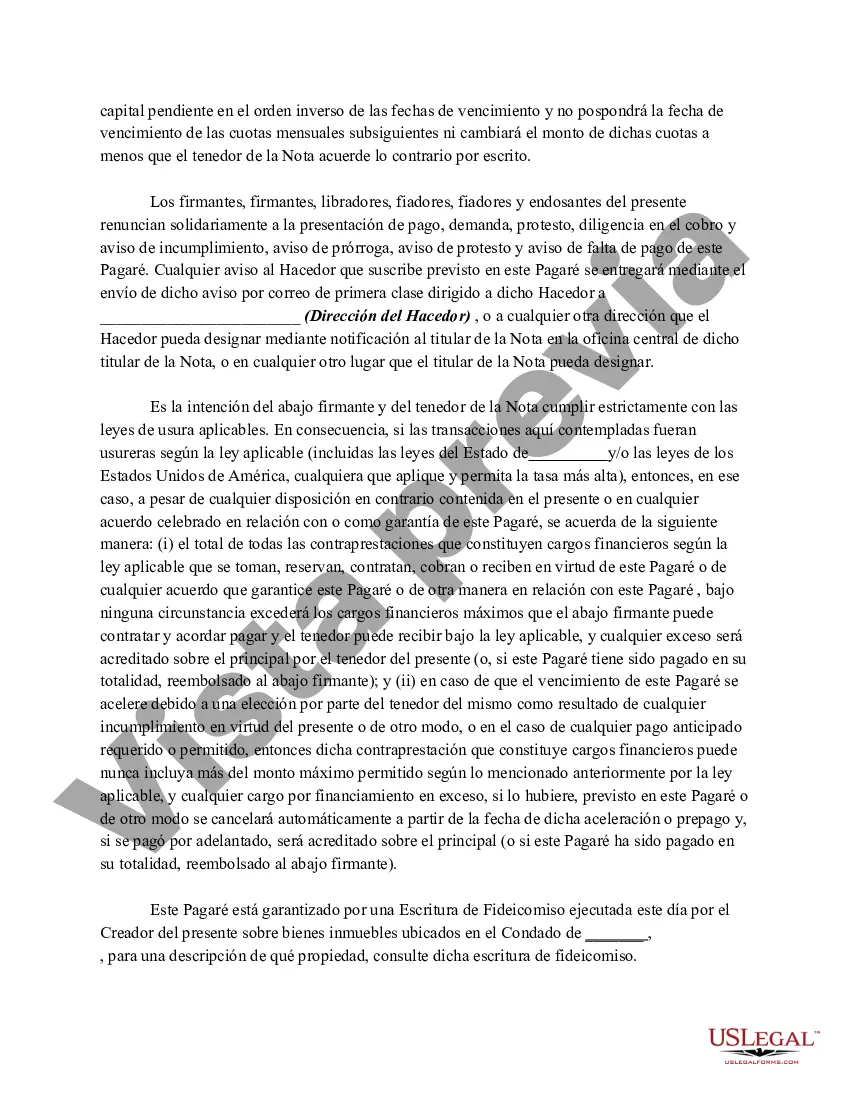

An Alabama Promissory Note — Balloon Note is a legal document frequently used in loan transactions in the state of Alabama. It outlines the terms and conditions of a loan agreement between a lender and a borrower. The key characteristic of a balloon note is that it requires the borrower to make regular small payments (usually monthly or quarterly) for a fixed period of time, followed by a large, lump-sum payment at the end, known as the "balloon payment." The Alabama Promissory Note — Balloon Note contains essential information such as the names and addresses of both the lender and the borrower, the principal loan amount, the interest rate, and the scheduled payment dates. It also includes provisions related to prepayment penalties, late fees, and default consequences. The purpose of a balloon note is to provide borrowers with more flexibility in repayment by allowing them to make lower monthly payments during the loan term. However, the large balloon payment at the end serves as a risk for the borrower, as they must find a way to pay off the remaining principal balance. There are different types of Alabama Promissory Note — Balloon Note based on the loan specifics and parties involved. For instance, if the loan is secured by collateral (such as a property or vehicle), it would be referred to as a secured balloon note. In contrast, an unsecured balloon note does not involve any collateral. It is crucial for both the lender and the borrower to carefully review and understand the terms and conditions of the Alabama Promissory Note — Balloon Note before signing. Legal advice is often recommended ensuring compliance with Alabama state laws and to safeguard the rights and responsibilities of both parties.

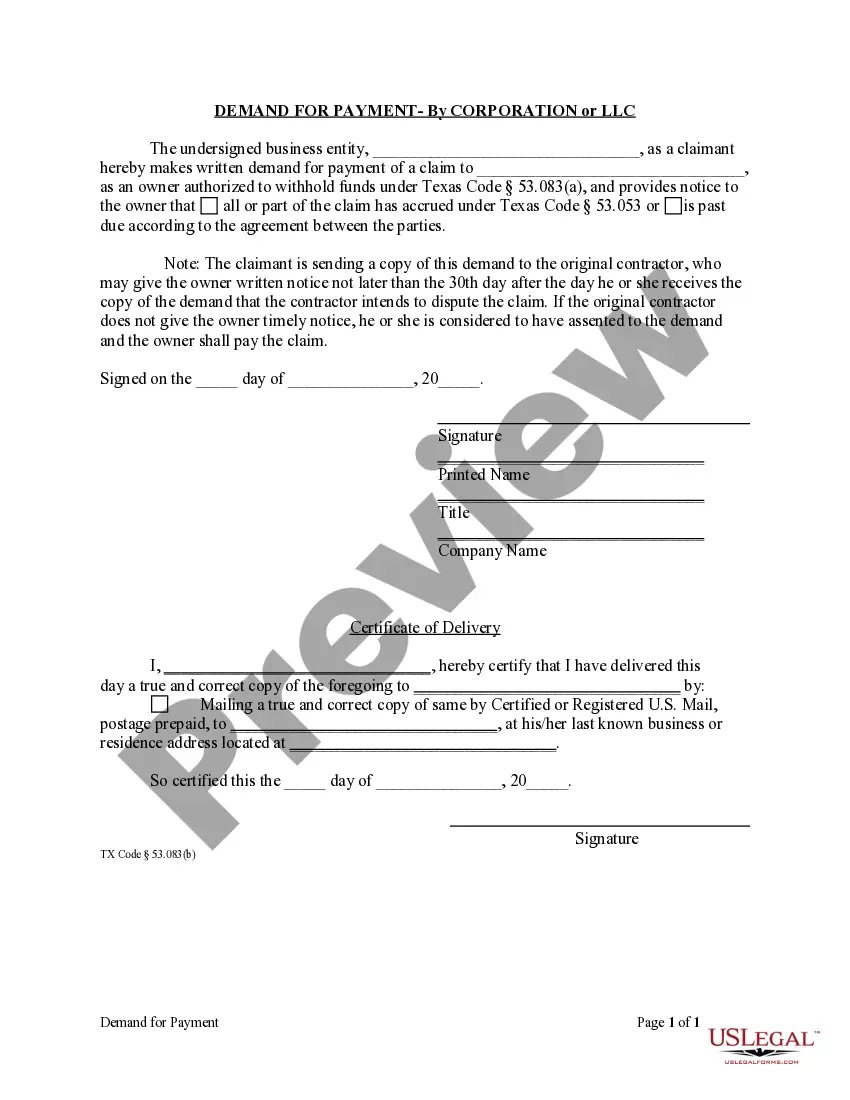

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Pagaré - Pagaré Globo - Promissory Note - Balloon Note

Description

How to fill out Alabama Pagaré - Pagaré Globo?

If you wish to acquire, obtain, or print legal document templates, utilize US Legal Forms, the most extensive assortment of legal templates available online.

Take advantage of the site`s user-friendly search to find the documents you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

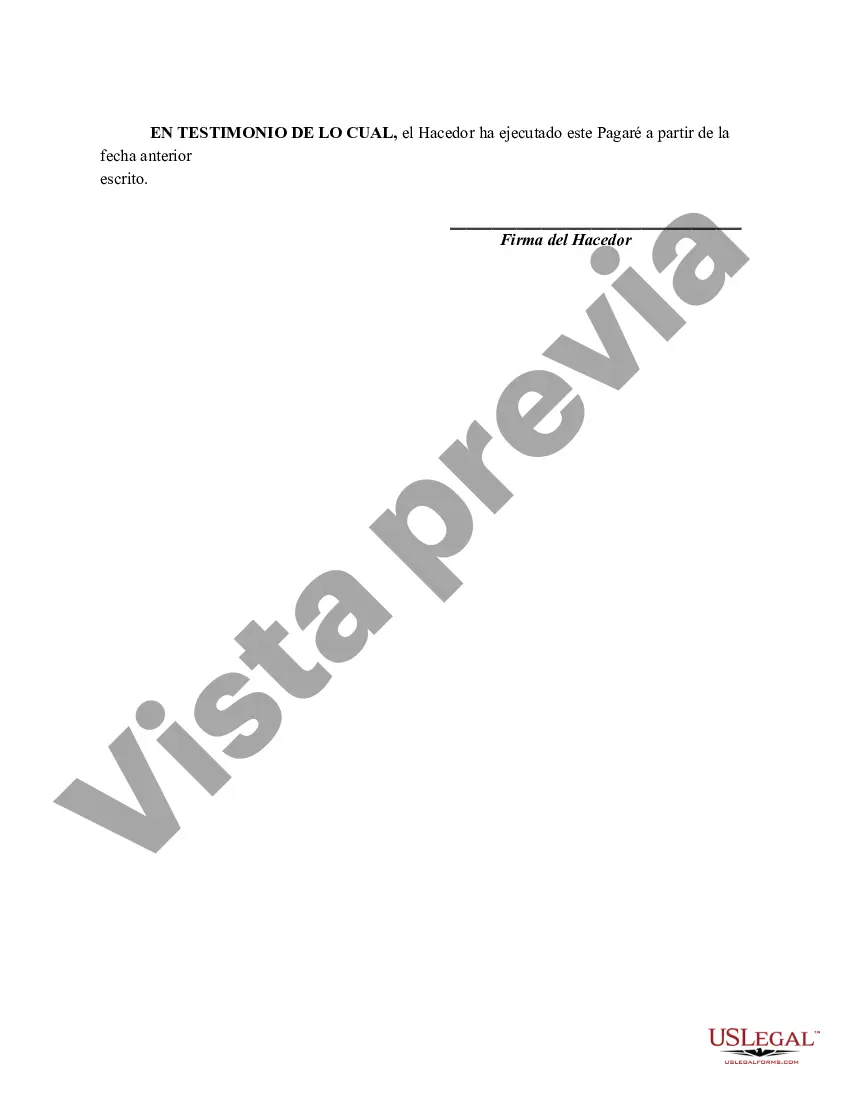

Step 6. Choose the format of the legal form and save it to your device.Step 7. Fill out, edit, and print or sign the Alabama Promissory Note - Balloon Note.Every legal document template you purchase is your property indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.Stay competitive and obtain, and print the Alabama Promissory Note - Balloon Note with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- Utilize US Legal Forms to find the Alabama Promissory Note - Balloon Note with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to retrieve the Alabama Promissory Note - Balloon Note.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s details. Ensure you read the summary.

- Step 3. If you are not content with the form, use the Search feature at the top of the page to find other versions of the legal form template.

- Step 4. Once you have found the form you require, click on the Purchase now button. Select the payment plan you prefer and provide your information to register for the account.

Form popularity

FAQ

The major problem with balloon payments is unpredictability. Borrowers may find it challenging to plan for a large payment, leading to potential financial hardship. If the borrower cannot refinance or gather enough funds, they may face serious consequences. Understanding the terms of an Alabama Promissory Note - Balloon Note is essential to avoid pitfalls, and legal advice can help clarify any uncertainties.

A major disadvantage of a balloon payment is the risk of not being able to make that final large payment when it is due. This can lead to financial strain or even foreclosure if you cannot secure refinancing or sources of income. It’s vital for borrowers to consider their financial stability before choosing an Alabama Promissory Note - Balloon Note. Always plan for that final amount to avoid surprises.

To fill out a promissory note, start by entering the names of both the borrower and lender, along with their pertinent addresses. Next, indicate the principal amount being borrowed, the interest rate, and the repayment schedule. It’s vital to include any late fees or penalties for missed payments. You can utilize the uslegalforms platform to find a customizable Alabama Promissory Note - Balloon Note template to simplify this process.

In Alabama, notarization is not strictly necessary for a promissory note, including the Alabama Promissory Note - Balloon Note, to be considered valid. However, notarization can provide added protection and serve as evidence of the parties' intentions. It may also simplify the process in case of disputes. Ultimately, while notarization isn't required, it can be beneficial.

For an Alabama Promissory Note - Balloon Note to be valid, it must include essential elements such as the amount owed, the interest rate, and the repayment terms. Both parties should clearly state their names and signatures, ensuring mutual consent to the agreement. Without these components, the note may lack enforceability. It's crucial to follow these guidelines to secure your interests.

In Alabama, a promissory note can still be valid even if it is not notarized. However, having the note notarized adds a layer of legal protection and helps establish authenticity. If you plan to enforce the Alabama Promissory Note - Balloon Note in court, a notarized version may strengthen your position. Therefore, while notarization is not a strict requirement, it is often a wise choice.

A balloon payment is a larger-than-usual one-time payment at the end of the loan term. If you have a mortgage with a balloon payment, your payments may be lower in the years before the balloon payment comes due, but you could owe a big amount at the end of the loan.

A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.