Alabama Financial Statement Form - Individual

Description

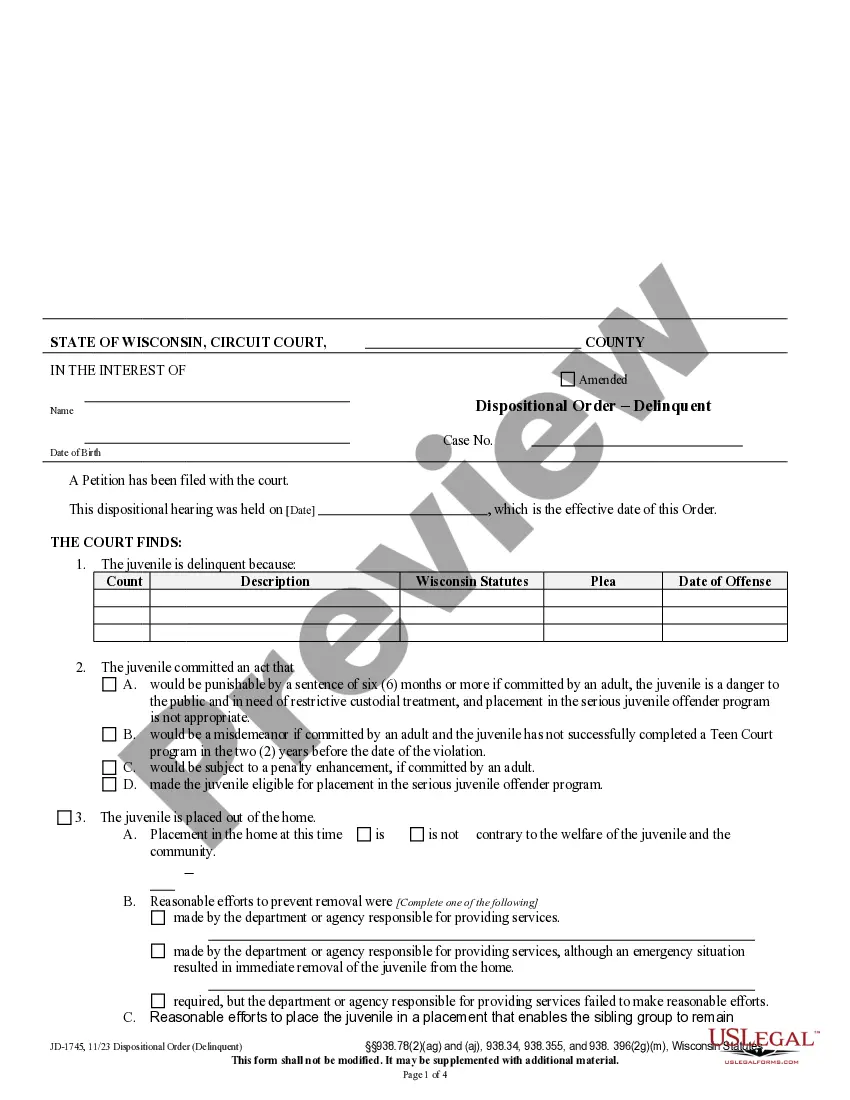

How to fill out Financial Statement Form - Individual?

Are you in a circumstance where you frequently require documents for both commercial or particular purposes? There is a multitude of legal document templates accessible online, but locating reliable options can be challenging.

US Legal Forms offers thousands of template options, including the Alabama Financial Statement Form - Individual, designed to fulfill both state and federal requirements.

If you are acquainted with the US Legal Forms website and have created an account, simply Log In. After logging in, you can download the Alabama Financial Statement Form - Individual template.

You can view all the document templates you have purchased in the My documents section. You can obtain another copy of the Alabama Financial Statement Form - Individual at any time if needed. Simply click on the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save you time and avoid mistakes. The service offers properly crafted legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- Obtain the form you need and make sure it is intended for the correct city/state.

- Click the Review button to evaluate the form.

- Read the description to confirm you have selected the appropriate form.

- If the form isn't what you're looking for, utilize the Search feature to find the form that meets your needs and specifications.

- Once you find the right form, click Acquire now.

- Choose your desired pricing plan, fill out the necessary information to create your account, and process the payment using your PayPal or credit card.

- Select a convenient file format and download your version.

Form popularity

FAQ

The individual filing threshold in Alabama depends on your filing status and age. Generally, if your income meets or exceeds certain levels, you will need to submit the Alabama Financial Statement Form - Individual. It’s wise to check the latest guidelines on Alabama's Department of Revenue website for the specific complete details. Platforms like uslegalforms can help clarify your filing requirements based on your situation.

To file Form 40 in Alabama, you must send it to the Alabama Department of Revenue. You can mail your completed Alabama Financial Statement Form - Individual to their address provided on the form. Alternatively, e-filing options are also available. Using uslegalforms can help generate the form correctly and provide the necessary filing instructions.

You can file your Alabama state taxes online, which is a convenient option for many taxpayers. Using e-filing options, including the Alabama Financial Statement Form - Individual, speeds up the processing time for your refund. Platforms like uslegalforms offer secure and efficient online submission capabilities. This way, you can feel confident that your taxes are filed correctly and promptly.

Yes, Alabama is currently accepting state returns, including the Alabama Financial Statement Form - Individual. You can submit your return electronically or by mail. Be sure to check deadlines for submitting your forms to avoid penalties. Preparing your return with uslegalforms can streamline this process.

Yes, you can file your Alabama state taxes using TurboTax. Simply select the Alabama Financial Statement Form - Individual when you're ready to complete your state return. TurboTax guides you through the process, making it easier to file accurately. With its user-friendly interface, you can ensure that you meet all Alabama tax requirements.

Creating a financial statement for an individual starts with compiling financial records like bank statements, tax returns, and property documents. Use the Alabama Financial Statement Form - Individual to organize your information in a clear format. This structured approach helps present your financial picture accurately and can assist in any future financial discussions.

To fill out a UCC 1 form correctly, provide accurate details about the debtor and the secured party. Ensure you include all relevant collateral information and consult the Alabama Financial Statement Form - Individual for guidance on financial data that may be required. Always verify each section to prevent any mistakes that could delay processing.

Filling out a personal financial statement requires you to clearly document your financial situation. On the Alabama Financial Statement Form - Individual, input your income sources, such as salaries and investments, followed by your liabilities, including debts. Always double-check the information for accuracy and completeness before submission.

To fill in a financial statement, begin by gathering all your financial documents, including income statements, asset lists, and liabilities. Then, start the Alabama Financial Statement Form - Individual by entering your personal information accurately. Follow the form, entering amounts for income, expenses, and assets, ensuring you check each section for completeness.

To fill out the A4 form, start by entering your personal information accurately in the designated fields. Next, calculate your withholding allowances based on your tax situation, and be sure to reference your financial situation on the Alabama Financial Statement Form - Individual for clarity. Once complete, submit it to your employer to ensure proper withholding.