The Alabama Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legal document that outlines the terms and conditions regarding the sale of a business in Alabama. This agreement specifically caters to sole proprietorship where the purchase price is contingent upon completing an audit of the business's financial records. It ensures that both the buyer and seller are protected and have a clear understanding of the transaction. The Alabama Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit includes several key clauses and provisions that are crucial for a successful business sale. These elements may vary depending on the specific circumstances and requirements of the parties involved. Different types or variations of this agreement may include: 1. Confidentiality Clause: This clause ensures that both parties agree to maintain the confidentiality of any non-public information disclosed during the process of the sale. 2. Purchase Price Contingency: This clause outlines the condition that the final purchase price of the business will be determined after the completion of a thorough audit of the business's financial records. It specifies the timeframe, responsibilities, and procedures of the audit. 3. Seller's Representations and Warranties: This section details the warranties and statements made by the seller regarding the business, financial information, assets, liabilities, and legal compliance. It aims to provide assurances to the buyer regarding the accuracy of the information presented by the seller. 4. Assets Included in the Sale: This clause enumerates the specific assets included in the sale, such as inventory, equipment, intellectual property rights, contracts, and permits. It ensures that both parties have a clear understanding of what is being transferred. 5. Allocation of Purchase Price: This provision determines how the purchase price will be allocated among the various assets being sold. It may have significant tax implications, as certain assets may qualify for different depreciation or capital gains treatment. 6. Transition and Training: This section covers any agreed-upon transitional arrangements, where the seller may be obligated to assist the buyer in the transfer of ownership by offering training, introductions to clients, or sharing business contacts. 7. Indemnification: This clause establishes the obligations of each party to indemnify and hold the other harmless for any losses, damages, liabilities, or claims arising from the sale of the business, except those resulting from intentional misconduct or a breach of the agreement. 8. Governing Law and Jurisdiction: This provision specifies that the agreement will be interpreted and governed by the laws of the state of Alabama. It also designates a specific jurisdiction for the resolution of any disputes that may arise. It is important to consult with a legal professional to ensure that the Alabama Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit accurately reflects the intentions and desired outcomes of the parties involved, and to tailor the agreement to their unique circumstances.

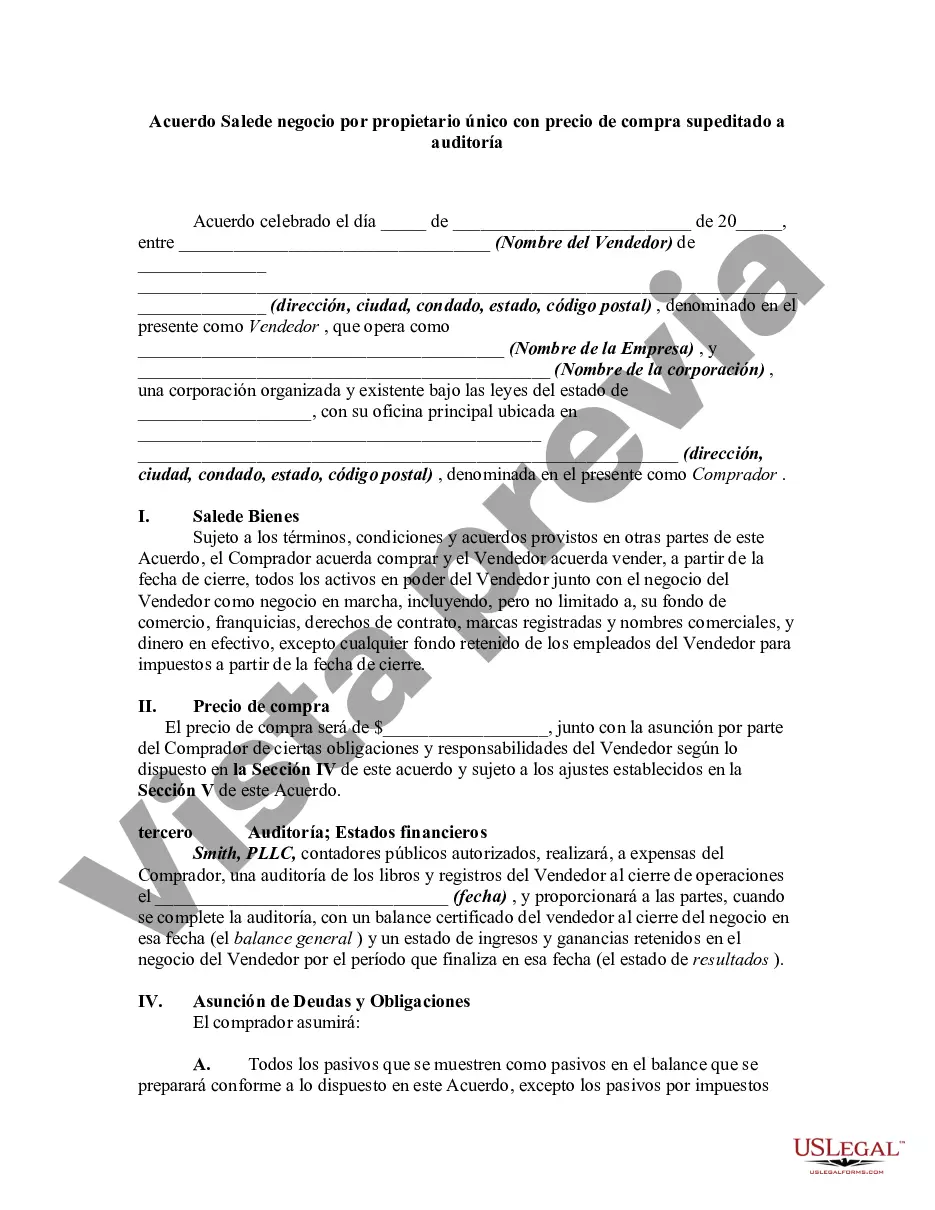

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Acuerdo de venta de negocio por propietario único con precio de compra sujeto a auditoría - Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Alabama Acuerdo De Venta De Negocio Por Propietario único Con Precio De Compra Sujeto A Auditoría?

Choosing the best lawful papers format can be a struggle. Of course, there are a variety of themes available on the Internet, but how do you discover the lawful kind you want? Take advantage of the US Legal Forms internet site. The services offers thousands of themes, such as the Alabama Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, which you can use for enterprise and personal demands. Each of the forms are checked by pros and meet state and federal needs.

When you are presently listed, log in for your bank account and click on the Down load option to get the Alabama Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit. Make use of bank account to check with the lawful forms you may have bought in the past. Proceed to the My Forms tab of your own bank account and have yet another duplicate of the papers you want.

When you are a new customer of US Legal Forms, listed below are easy recommendations that you should stick to:

- Very first, be sure you have selected the right kind for your city/county. It is possible to examine the form utilizing the Review option and browse the form description to ensure this is the right one for you.

- If the kind fails to meet your needs, use the Seach area to get the right kind.

- When you are certain that the form is acceptable, select the Acquire now option to get the kind.

- Opt for the pricing program you desire and enter the essential information and facts. Build your bank account and buy your order using your PayPal bank account or credit card.

- Pick the data file formatting and download the lawful papers format for your system.

- Complete, change and print and indicator the acquired Alabama Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

US Legal Forms is the largest catalogue of lawful forms in which you can find numerous papers themes. Take advantage of the company to download professionally-made documents that stick to state needs.