Some state real estate commissions require the use of a buyout addendum when a real estate broker enters into a contract to purchase a property: i) concurrent with the listing of such property; ii) as an inducement or to facilitate the property owner's purchase of another property; or iii) continues to market that property on behalf of the owner under an existing listing contract.

It is generally recommended that a real estate broker use such an addendum when he/she continues to market the property and is only agreeing to buy it to make the deal. If a licensee actually wants to own the property, using the addendum does not solve the conflict of interest.

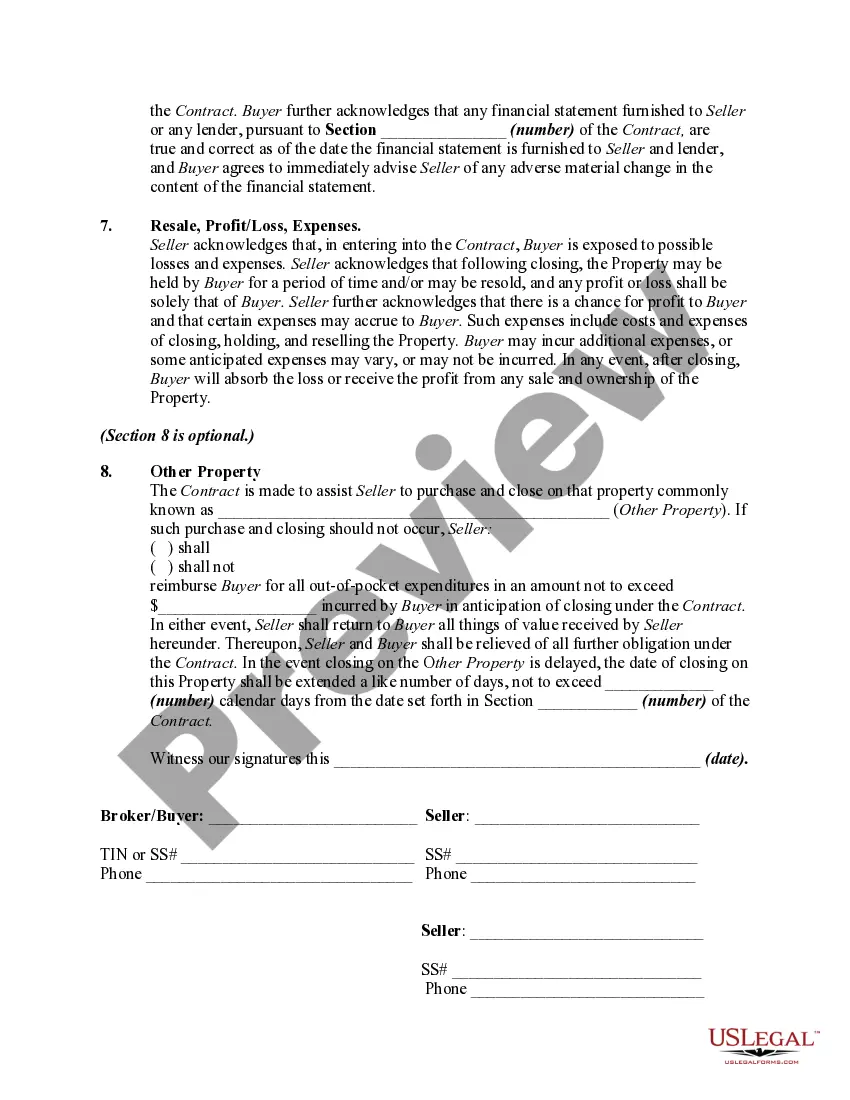

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.