Alabama Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Are you currently in the situation where you require documents for either organizational or personal objectives nearly every day.

There are numerous legal document templates accessible online, but locating trustworthy ones is challenging.

US Legal Forms provides thousands of form templates, such as the Alabama Bill of Transfer to a Trust, which are designed to fulfill state and federal regulations.

When you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can download another copy of the Alabama Bill of Transfer to a Trust anytime, if required. Just select the form you need to download or print the template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service offers well-crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Subsequently, you can download the Alabama Bill of Transfer to a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/state.

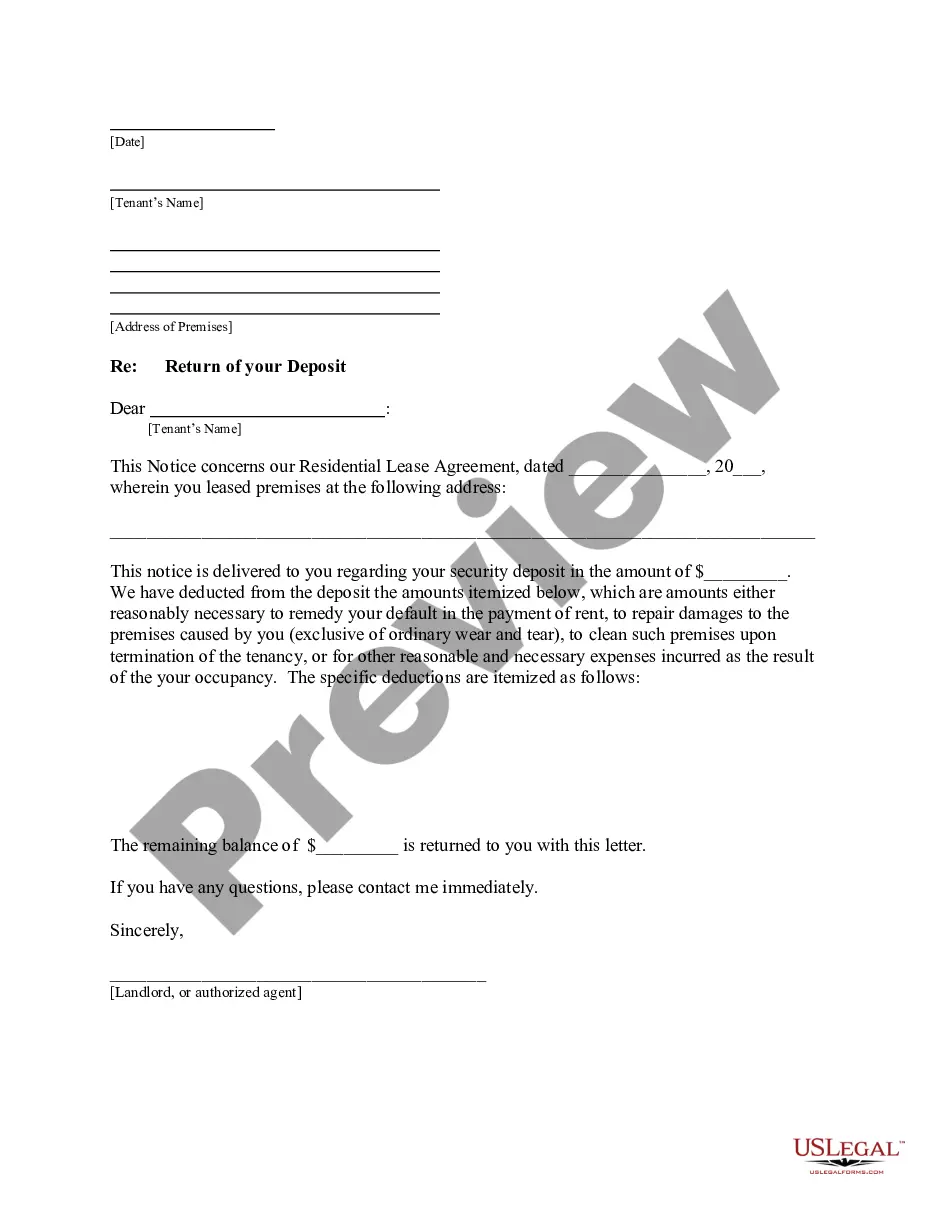

- Use the Review option to verify the form.

- Examine the outline to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Yes, a home with a mortgage can be transferred to a trust using the Alabama Bill of Transfer to a Trust. It is important to inform your lender about the transfer, as they may require you to get their approval. By placing your home in a trust, you can ensure that your property is managed according to your wishes, even after your passing. Using US Legal Forms can help simplify this process and provide the necessary documents for a smooth transfer.

Assets are added to a trust through a process called funding. This involves changing the title of the assets so they are owned by the trust. Familiarizing yourself with the Alabama Bill of Transfer to a Trust can greatly assist in ensuring that all assets are properly included in your estate plan.

To place your house in a trust in Alabama, you will need to work with an attorney to draft the trust document and prepare a new deed. This deed must then be filed with the local probate court to make the trust the official owner of the property. The Alabama Bill of Transfer to a Trust is a helpful resource in facilitating this process.

Putting your house into a trust may have a few disadvantages. You may encounter transfer taxes, or your home could become more challenging to refinance or sell. Knowing the details behind the Alabama Bill of Transfer to a Trust can help you navigate these potential downsides more smoothly.

The bill of transfer for a trust is a legal document that officially moves assets from an individual to the trust. This document outlines the assets being transferred and affirms that ownership is now held by the trust. Utilizing the Alabama Bill of Transfer to a Trust can simplify this process significantly.

While there are many benefits to putting assets in a trust, there are downsides to consider. One downside is potential costs associated with creating and managing the trust. Additionally, some may face challenges understanding the Alabama Bill of Transfer to a Trust, which could complicate the transfer process.

Transferring items to a trust often requires that you list the items in the trust document. You may also need to fill out specific forms depending on the item type, such as a Bill of Transfer for tangible personal property. This ensures that every item you wish to transfer is legally included in the trust.

To transfer accounts to a trust, contact your financial institution to initiate the process. Typically, you will complete a beneficiary designation form and provide a copy of the trust document. This ensures that your accounts are managed under the Alabama Bill of Transfer to a Trust.

In Alabama, placing a house in a trust involves executing a new deed that transfers ownership from you to the trust. You will need to file this deed with the county probate court. One common tool for this is the Alabama Bill of Transfer to a Trust, which facilitates a smooth transition of property ownership.

To transfer assets into a trust, you need to re-title those assets in the name of the trust. This process often involves completing a Bill of Transfer to a Trust. Ensure that all documents are properly executed to avoid any legal issues in the future.