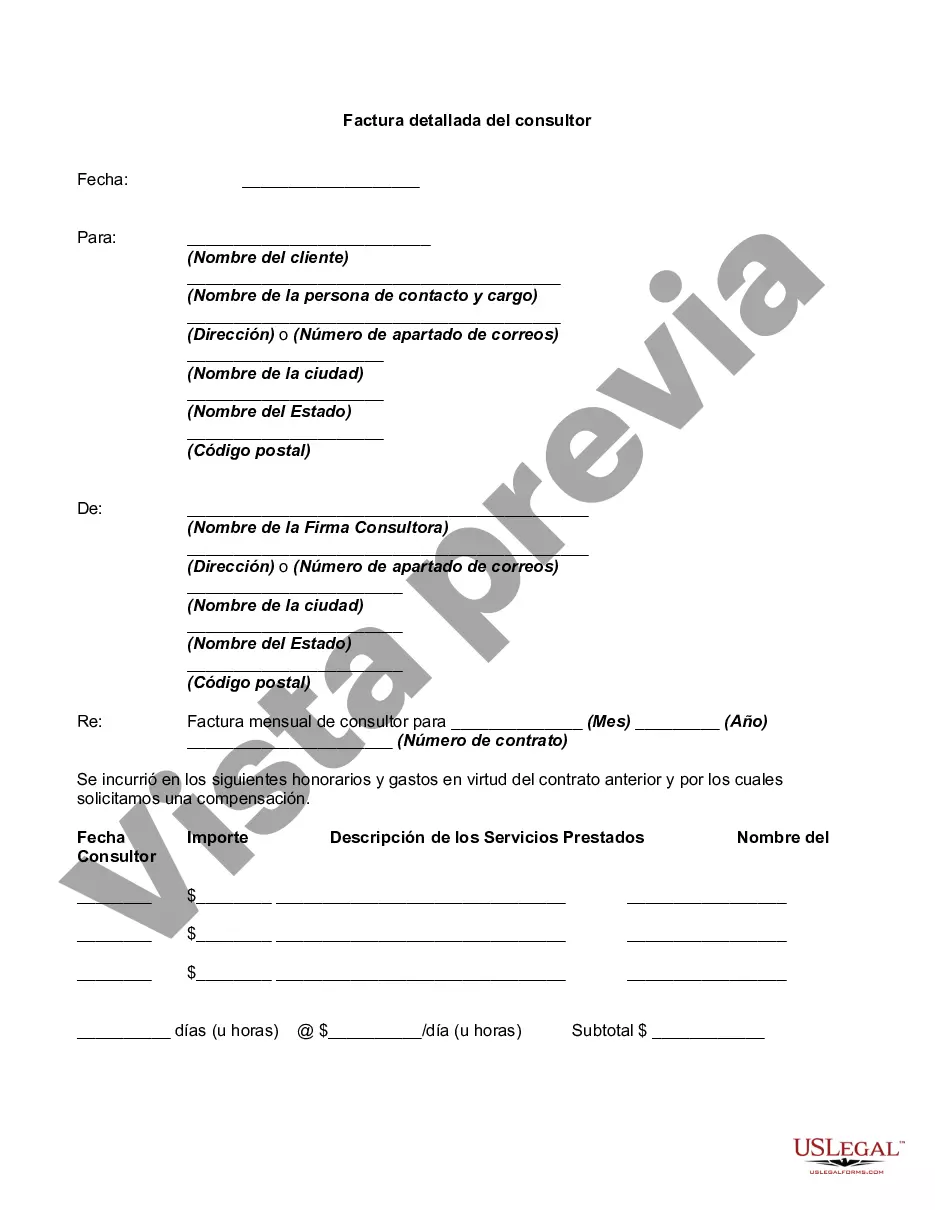

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Detailed Consultant Invoice is a comprehensive document that provides a detailed breakdown of services or consulting work performed in the state of Alabama. It serves as a professional invoice that outlines the scope of services, rates, and any additional expenses incurred during the consulting engagement. This invoice is commonly used by consultants, freelancers, or consulting firms operating in Alabama. The Alabama Detailed Consultant Invoice includes several key elements to ensure clarity and accuracy in billing and payment: 1. Contact Information: The invoice begins with the consultant's name, address, phone number, and email address. It also includes the client's contact details, ensuring easy communication and identification. 2. Invoice Date and Number: This section mentions the date the invoice is generated, along with a unique invoice number for reference and organization. 3. Client Information: The invoice includes the client's name, address, and any specific project or engagement details to identify the recipient clearly. 4. Description of Services: This is a crucial part of the invoice where the consultant outlines the services provided during the consulting engagement. It includes a detailed description of the tasks, deliverables, and milestones achieved. Each service is separately listed along with the corresponding date and duration. 5. Hourly Rate/Consulting Fee: The detailed consultant invoice includes the rate charged per hour or flat consulting fee for the services rendered. This ensures transparency and clarity in billing. 6. Total Hours Worked: The invoice specifies the number of hours worked on each service or task, along with the total sum of hours to provide a transparent breakdown of the billed amount. 7. Additional Expenses: If there are any additional expenses incurred during the consulting engagement, such as travel expenses, accommodation costs, or materials used, they are mentioned separately with their corresponding costs. 8. Subtotal and Taxes: The subtotal section calculates the total fees for services provided, including any additional expenses. Any applicable taxes, such as sales tax or value-added tax, are added to the subtotal to calculate the final amount. 9. Payment Terms: The Alabama Detailed Consultant Invoice specifies the payment terms, such as payment due date and accepted payment methods. It also includes any late payment penalties or discounts for early payment if applicable. Types of Alabama Detailed Consultant Invoices: 1. Hourly Rate Invoice: This type of invoice is used when a consultant charges an hourly rate for their services. It includes a breakdown of hours worked on each task or service. 2. Flat Fee Invoice: A flat fee invoice is utilized when a consultant charges a fixed amount for the entire consulting engagement. It includes a breakdown of services or tasks performed along with the total flat fee. 3. Retainer Invoice: If a consultant works on a retainer basis, where they provide ongoing services for a fixed period, a retainer invoice is used. It outlines the agreed-upon retainer fee, hours worked, and any additional expenses. 4. Expense Invoice: In cases where a consultant incurs significant expenses during the project, an expense invoice is generated to detail those costs separately from the consulting fee. In conclusion, the Alabama Detailed Consultant Invoice is a comprehensive document that outlines the services provided, fees charged, and any additional expenses incurred during a consulting engagement in Alabama. It ensures transparency, accuracy, and professionalism in the billing process for consultants and clients alike.Alabama Detailed Consultant Invoice is a comprehensive document that provides a detailed breakdown of services or consulting work performed in the state of Alabama. It serves as a professional invoice that outlines the scope of services, rates, and any additional expenses incurred during the consulting engagement. This invoice is commonly used by consultants, freelancers, or consulting firms operating in Alabama. The Alabama Detailed Consultant Invoice includes several key elements to ensure clarity and accuracy in billing and payment: 1. Contact Information: The invoice begins with the consultant's name, address, phone number, and email address. It also includes the client's contact details, ensuring easy communication and identification. 2. Invoice Date and Number: This section mentions the date the invoice is generated, along with a unique invoice number for reference and organization. 3. Client Information: The invoice includes the client's name, address, and any specific project or engagement details to identify the recipient clearly. 4. Description of Services: This is a crucial part of the invoice where the consultant outlines the services provided during the consulting engagement. It includes a detailed description of the tasks, deliverables, and milestones achieved. Each service is separately listed along with the corresponding date and duration. 5. Hourly Rate/Consulting Fee: The detailed consultant invoice includes the rate charged per hour or flat consulting fee for the services rendered. This ensures transparency and clarity in billing. 6. Total Hours Worked: The invoice specifies the number of hours worked on each service or task, along with the total sum of hours to provide a transparent breakdown of the billed amount. 7. Additional Expenses: If there are any additional expenses incurred during the consulting engagement, such as travel expenses, accommodation costs, or materials used, they are mentioned separately with their corresponding costs. 8. Subtotal and Taxes: The subtotal section calculates the total fees for services provided, including any additional expenses. Any applicable taxes, such as sales tax or value-added tax, are added to the subtotal to calculate the final amount. 9. Payment Terms: The Alabama Detailed Consultant Invoice specifies the payment terms, such as payment due date and accepted payment methods. It also includes any late payment penalties or discounts for early payment if applicable. Types of Alabama Detailed Consultant Invoices: 1. Hourly Rate Invoice: This type of invoice is used when a consultant charges an hourly rate for their services. It includes a breakdown of hours worked on each task or service. 2. Flat Fee Invoice: A flat fee invoice is utilized when a consultant charges a fixed amount for the entire consulting engagement. It includes a breakdown of services or tasks performed along with the total flat fee. 3. Retainer Invoice: If a consultant works on a retainer basis, where they provide ongoing services for a fixed period, a retainer invoice is used. It outlines the agreed-upon retainer fee, hours worked, and any additional expenses. 4. Expense Invoice: In cases where a consultant incurs significant expenses during the project, an expense invoice is generated to detail those costs separately from the consulting fee. In conclusion, the Alabama Detailed Consultant Invoice is a comprehensive document that outlines the services provided, fees charged, and any additional expenses incurred during a consulting engagement in Alabama. It ensures transparency, accuracy, and professionalism in the billing process for consultants and clients alike.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.