Alabama Owner Financing Contracts for Land are legally binding agreements between a seller and a buyer of land, where the buyer finances the purchase directly with the seller, instead of going through a traditional lender. This type of contract is beneficial for buyers who may not be able to secure financing through a bank or prefer a more flexible payment arrangement. The Alabama Owner Financing Contract for Land typically includes crucial information such as the names and addresses of both the seller and buyer, a detailed description of the land being sold, the purchase price, and the terms of the financing arrangement. These contracts often specify the down payment amount, the interest rate, the length of the repayment period, and any penalties or additional fees for late payments. Different types of Alabama Owner Financing Contracts for Land may include adjustable-rate mortgages, where the interest rate fluctuates over time based on market conditions. There are also fixed-rate contracts, which offer a stable interest rate throughout the entire repayment period. Additionally, some contracts may have a balloon payment provision, requiring the buyer to make a substantial payment at the end of a specified term. The advantage of an Alabama Owner Financing Contract for Land lies in its flexibility. Buyers can negotiate the terms directly with the seller, potentially obtaining more favorable conditions compared to traditional financing methods. It also eliminates extensive paperwork, making the buying process faster and more efficient. However, as with any contract, it is essential for both parties to thoroughly understand the terms and seek legal advice if needed. For sellers, it is crucial to conduct due diligence to ensure the buyer's ability to repay the loan, as the land being sold generally serves as collateral until the full payment is made. In summary, Alabama Owner Financing Contracts for Land provide an alternative financing option for buyers who are unable to secure traditional bank loans or prefer more flexible payment terms. By allowing direct negotiations between buyer and seller, these contracts offer greater customization options. However, both parties should exercise caution and seek professional advice to ensure a clear understanding of the contract terms and protect their interests.

Alabama Owner Financing Contract for Land

Description

How to fill out Owner Financing Contract For Land?

US Legal Forms - one of the most extensive collections of legal templates in the United States - offers a range of legal document formats that you can download or print.

By utilizing the website, you can find numerous templates for business and personal needs, organized by categories, states, or keywords. You can quickly locate the latest versions of documents such as the Alabama Owner Financing Contract for Land.

If you already possess a subscription, Log In to download the Alabama Owner Financing Contract for Land from the US Legal Forms library. The Download button will be visible on each document you view.

Complete the payment. Use your credit card or PayPal account to finalize the payment.

Select the format and download the document to your device. Make edits. Complete, modify, print, and sign the downloaded Alabama Owner Financing Contract for Land. Each document added to your account has no expiration and is yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the document you need. Access the Alabama Owner Financing Contract for Land through US Legal Forms, which is one of the largest collections of legal document formats. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you are new to US Legal Forms, here are some simple steps to help you start.

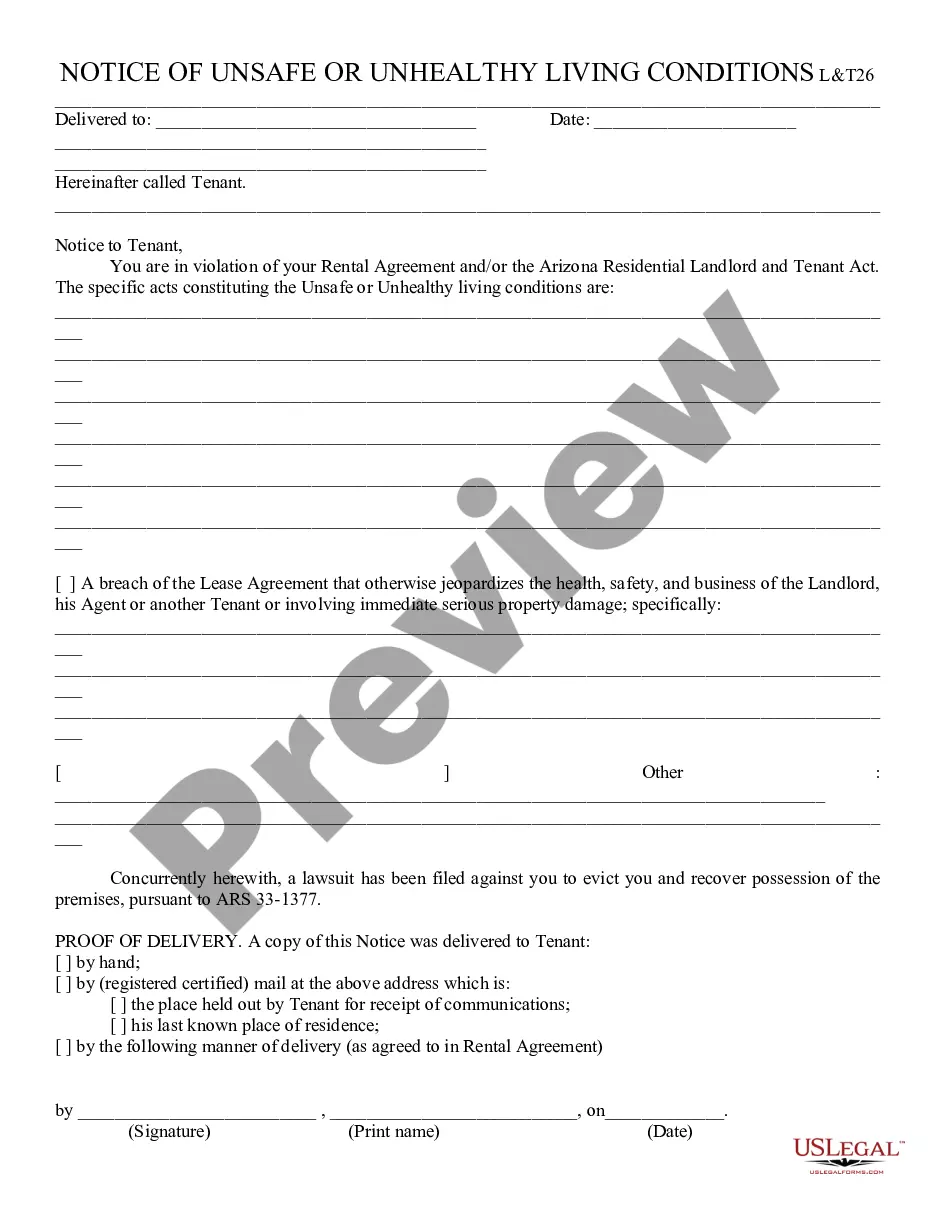

- Ensure you have selected the correct document for your city/state.

- Click the Preview button to review the content of the document.

- Read the document details to confirm that you have picked the appropriate form.

- If the document does not suit your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Purchase now button.

- Next, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Owner financing can be a smart choice for many buyers, especially if they seek more flexible terms compared to traditional loans. It opens opportunities for those with limited financial options while allowing sellers to earn interest over time. Ultimately, reviewing the benefits and risks in an Alabama Owner Financing Contract for Land empowers you to make an informed decision.

To write an owner finance contract, first outline the terms of the agreement, including down payment, interest rate, payment schedule, and any contingencies. It's wise to include provisions for default and maintenance responsibilities. Utilizing templates or services like US Legal Forms can simplify the process of crafting an Alabama Owner Financing Contract for Land.

Owner financing can be a favorable option for land transactions, especially for those who face challenges securing bank loans. It offers flexibility in payment structures and terms, making it appealing for both buyers and sellers. If you're considering this route, reviewing the Alabama Owner Financing Contract for Land ensures that it aligns with your financial goals.

Owner financing benefits both buyers and sellers, providing a streamlined purchasing process. Buyers may gain access to land they might not qualify for under traditional financing, while sellers can attract more potential buyers and earn interest. Thus, an Alabama Owner Financing Contract for Land serves as a powerful tool for both parties to achieve their goals.

The owner finance contract for land sale is an agreement where the seller provides financing to the buyer instead of utilizing a bank or financial institution. This contract outlines the terms, including payment schedules, interest rates, and any contingencies. Having a well-structured Alabama Owner Financing Contract for Land can ensure clear communication between both parties.

The downside of owner financing often includes the potential for higher interest rates compared to traditional loans. Moreover, sellers may face risks if buyers default on payments. It's crucial to thoroughly evaluate the Alabama Owner Financing Contract for Land for both parties' protection and to mitigate risks.

To make a land contract agreement, gather essential information including the buyer’s and seller’s names, property details, and financial terms. It is crucial to include provisions for payments, default clauses, and legal signatures. An Alabama Owner Financing Contract for Land can simplify this process by ensuring all legalities are understood and followed. Utilizing resources from USLegalForms can help you draft a comprehensive, legally binding contract with ease.

Typically, the buyer and seller cooperate to set up owner financing. The seller may have specific preferences for the terms, while the buyer should clearly communicate their financial capabilities. Using a platform like USLegalForms can help both parties craft a solid Alabama Owner Financing Contract for Land that is fair and legally sound.

To secure owner financing on land, identify sellers who are open to offering this option. An Alabama Owner Financing Contract for Land can simplify the process, allowing you to negotiate terms directly with the seller. Conduct due diligence on the property and make a compelling offer to enhance your chances of approval.

To set up an owner financing contract, begin by discussing terms with the seller, including payment amounts and schedules. Next, draft a comprehensive Alabama Owner Financing Contract for Land that outlines all terms, including interest rates and default conditions. Consider using platforms like USLegalForms for templates and legal guidance to ensure your contract meets local requirements.

More info

You can create a contract to either extend payment monthly, weekly, bimonthly, yearly, and the contract can be for an owner equity as well. The contract can extend lines of credit for loans, to lease property, and to buy homes. Create an ownership contract for the owner of home, investment property, co-op, or company. The Owner Financing Contract is a unique template that allows property owners to have a consistent, written agreement between the two parties. The ownership agreement can be used to help secure a mortgage, as the owner of a property can pay the agreed to amount monthly, weekly, bi-weekly, or by the end of each billing period. In addition, it can help simplify the overall property financing process by simplifying the terms. There is no need for monthly check-ups, and the property owner will never have to worry about the terms of the loan. The signature generator works with almost any device and is free.