Alabama Owner Financing Contract for Home

Description

How to fill out Owner Financing Contract For Home?

Have you found yourself in a situation where you require documents for possibly business or personal purposes almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust isn't simple.

US Legal Forms offers thousands of form templates, such as the Alabama Owner Financing Contract for Home, that are designed to meet federal and state requirements.

Choose the pricing plan you want, provide the required information to create your account, and finalize your purchase using your PayPal or Visa or Mastercard.

Select a convenient file format and download your version. Access all the document templates you have purchased in the My documents menu. You can retrieve another version of the Alabama Owner Financing Contract for Home anytime, if necessary. Just go through the needed form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service offers expertly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Alabama Owner Financing Contract for Home template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific area/state.

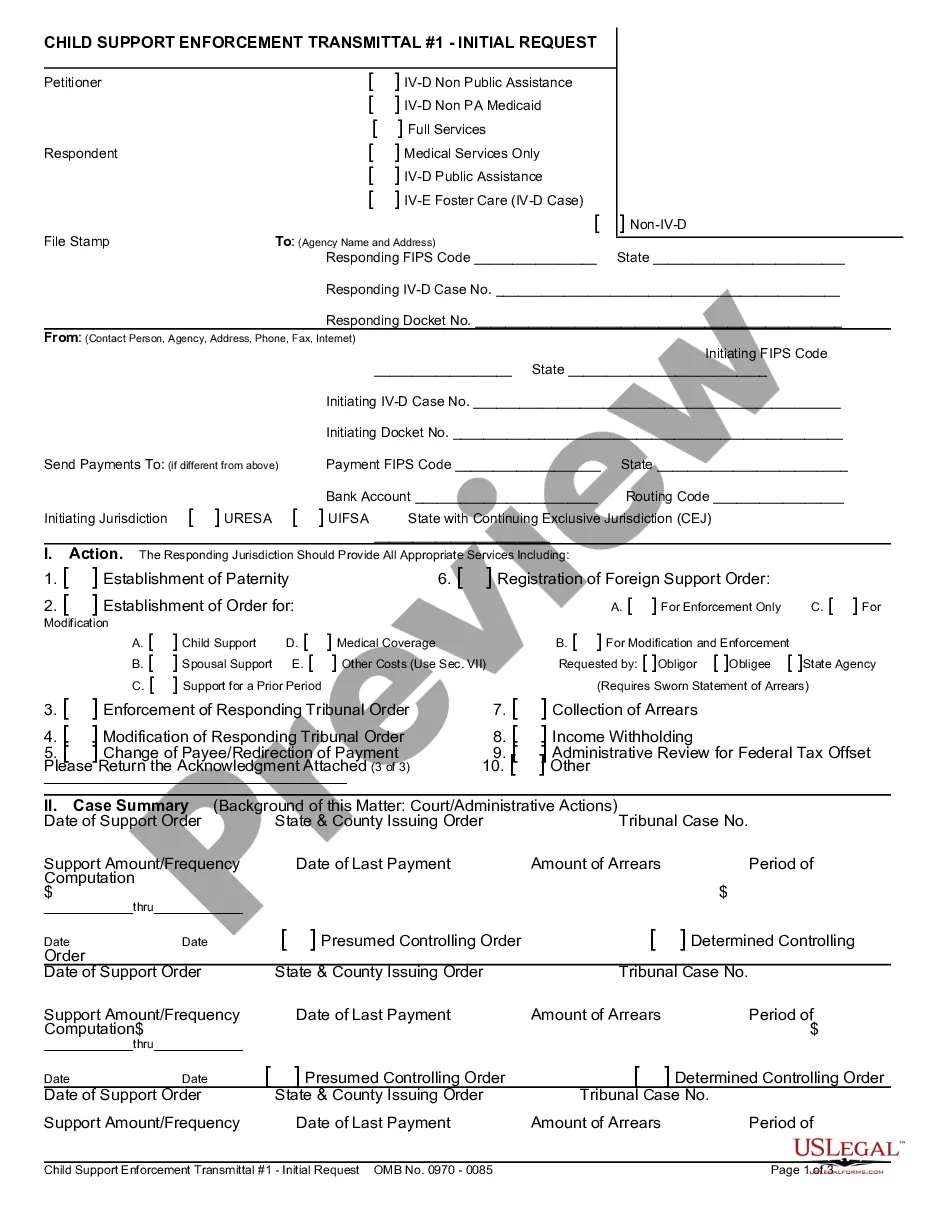

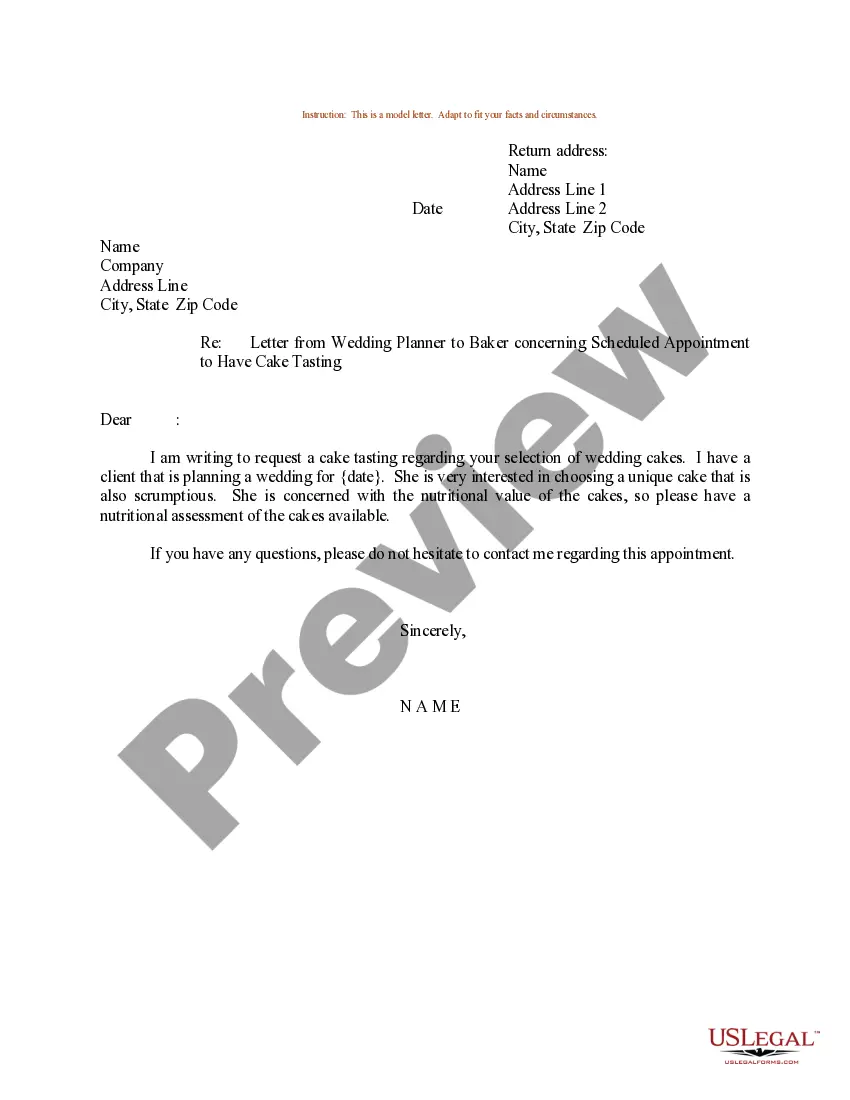

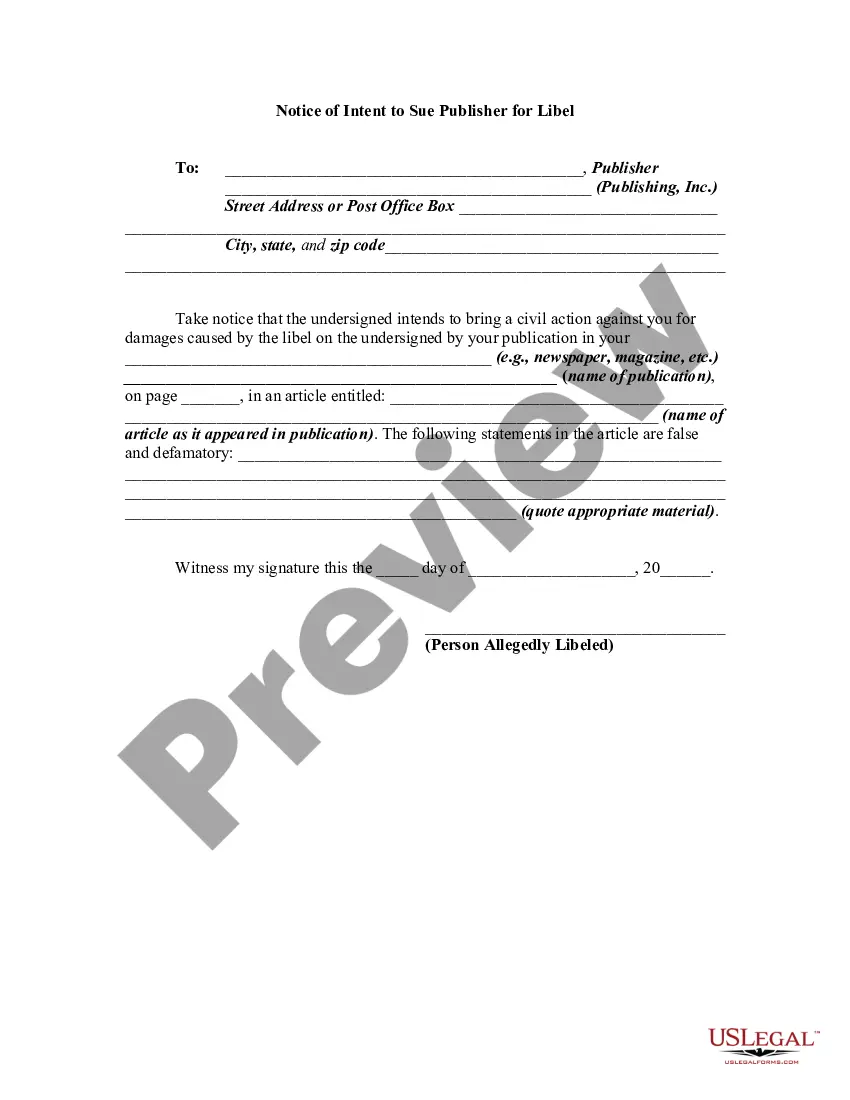

- Utilize the Preview option to view the form.

- Review the description to confirm that you have selected the correct form.

- If the form isn’t what you’re searching for, use the Search box to find the form that meets your needs and requirements.

- Once you find the right form, click Buy now.

Form popularity

FAQ

The owner financed home contract outlines the terms of the transaction between the buyer and the seller, specifying payment details and conditions. This contract protects both parties, ensuring clarity on financing terms, property condition, and payment schedules. Particularly in Alabama, using an Alabama Owner Financing Contract for Home can streamline the process and ensure compliance with local laws. These contracts help simplify the owner financing method for both buyers and sellers.

In owner financing arrangements, the seller essentially holds the deed until the buyer fulfills the terms of the contract. This setup allows the buyer to occupy the property while making payments. It's crucial to specify this in the Alabama Owner Financing Contract for Home, so all parties are aware of the arrangement.

To set up an owner financing contract, start by drafting the agreement with clear terms for payment amounts and schedules. It is wise to include provisions for property maintenance and default consequences. Using a professional platform like Uslegalforms ensures your Alabama Owner Financing Contract for Home is comprehensive and legally sound.

Typical terms for owner financing in Alabama often include a 10% to 20% down payment and an interest rate that may be higher than conventional loans. The contracts frequently feature a repayment period of 5 to 30 years. Clearly outlining these terms in the Alabama Owner Financing Contract for Home will benefit both the buyer and the seller.

For reporting owner financing on your taxes, you must report any interest income received from the buyer. It's also important to document the initial sale and the terms outlined in the Alabama Owner Financing Contract for Home. Consulting with a tax professional can help ensure compliance and maximize your tax benefits.

In Alabama, the seller typically sets up owner financing for a home sale. This process involves negotiation between the seller and buyer on the financing terms. Both parties should clearly understand their responsibilities and the agreement structure. A well-crafted Alabama Owner Financing Contract for Home can streamline this process significantly.

Filling out a house contract requires you to provide accurate details about the property, seller, and buyer. It is important to clearly state the sale conditions, payment terms, and any applicable buyer rights. If you are unsure how to proceed, consider using USLegalForms to guide you in completing an Alabama Owner Financing Contract for Home correctly and thoroughly.

Writing an owner finance contract involves detailing essential information such as the property address, buyer and seller details, and the financing terms. Make sure to include any specific obligations or rights that each party has. With resources from USLegalForms, you can create a well-structured Alabama Owner Financing Contract for Home that meets your needs.