This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally-binding document that outlines the terms of a loan agreement in the state of Alabama. This type of promissory note is commonly used when the borrower needs a longer period to repay the loan and the lender prefers to receive accrued interest at the end of the loan term. In this particular type of promissory note, the borrower does not have any payment obligations until the maturity date specified in the agreement. The borrower is expected to pay the loan amount in full on the maturity date, along with the accumulated interest that has been compounded annually. Key features of an Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually: 1. Principal Amount: The promissory note will clearly state the initial loan amount provided by the lender. 2. Maturity Date: The specific date on which the borrower is required to repay the loan in full is mentioned in the note. 3. No Payment Due Until Maturity: Unlike traditional promissory notes, this type ensures that the borrower does not need to make any periodic payments or pay interest until the maturity date. 4. Interest Rate: The promissory note will mention the annual interest rate charged on the loan. In this case, interest is compounded annually, meaning it increases the principal balance each year. 5. Calculation of Interest: The note will detail the method used to calculate interest, typically mentioning the compound interest formula applied annually. 6. Default and Remedies: The consequences of defaulting on the loan, such as late payment fees or legal actions, may be specified in the agreement. 7. Signatures: The document should include the signatures of both the borrower and lender to ensure its legal validity. While the general concept of an Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually remains the same, there may be variations based on specific requirements or circumstances. Examples of such variations may include: 1. Secured Promissory Note: When the borrower pledges collateral (e.g., property, vehicle) as security for the loan, it becomes a secured promissory note. 2. Unsecured Promissory Note: If no collateral is provided, the promissory note remains unsecured, which means it relies solely on the borrower's promise to repay. 3. Simple Interest Promissory Note: Instead of compounding annually, the interest may be calculated and charged periodically using the simple interest method. 4. Balloon Payment Promissory Note: This type of promissory note allows the borrower to make smaller periodic payments over the loan term, with a larger "balloon" payment due on the maturity date. When creating an Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it is strongly recommended consulting legal professionals or use reliable online templates to ensure compliance with state laws and specific financial requirements.Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally-binding document that outlines the terms of a loan agreement in the state of Alabama. This type of promissory note is commonly used when the borrower needs a longer period to repay the loan and the lender prefers to receive accrued interest at the end of the loan term. In this particular type of promissory note, the borrower does not have any payment obligations until the maturity date specified in the agreement. The borrower is expected to pay the loan amount in full on the maturity date, along with the accumulated interest that has been compounded annually. Key features of an Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually: 1. Principal Amount: The promissory note will clearly state the initial loan amount provided by the lender. 2. Maturity Date: The specific date on which the borrower is required to repay the loan in full is mentioned in the note. 3. No Payment Due Until Maturity: Unlike traditional promissory notes, this type ensures that the borrower does not need to make any periodic payments or pay interest until the maturity date. 4. Interest Rate: The promissory note will mention the annual interest rate charged on the loan. In this case, interest is compounded annually, meaning it increases the principal balance each year. 5. Calculation of Interest: The note will detail the method used to calculate interest, typically mentioning the compound interest formula applied annually. 6. Default and Remedies: The consequences of defaulting on the loan, such as late payment fees or legal actions, may be specified in the agreement. 7. Signatures: The document should include the signatures of both the borrower and lender to ensure its legal validity. While the general concept of an Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually remains the same, there may be variations based on specific requirements or circumstances. Examples of such variations may include: 1. Secured Promissory Note: When the borrower pledges collateral (e.g., property, vehicle) as security for the loan, it becomes a secured promissory note. 2. Unsecured Promissory Note: If no collateral is provided, the promissory note remains unsecured, which means it relies solely on the borrower's promise to repay. 3. Simple Interest Promissory Note: Instead of compounding annually, the interest may be calculated and charged periodically using the simple interest method. 4. Balloon Payment Promissory Note: This type of promissory note allows the borrower to make smaller periodic payments over the loan term, with a larger "balloon" payment due on the maturity date. When creating an Alabama Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it is strongly recommended consulting legal professionals or use reliable online templates to ensure compliance with state laws and specific financial requirements.

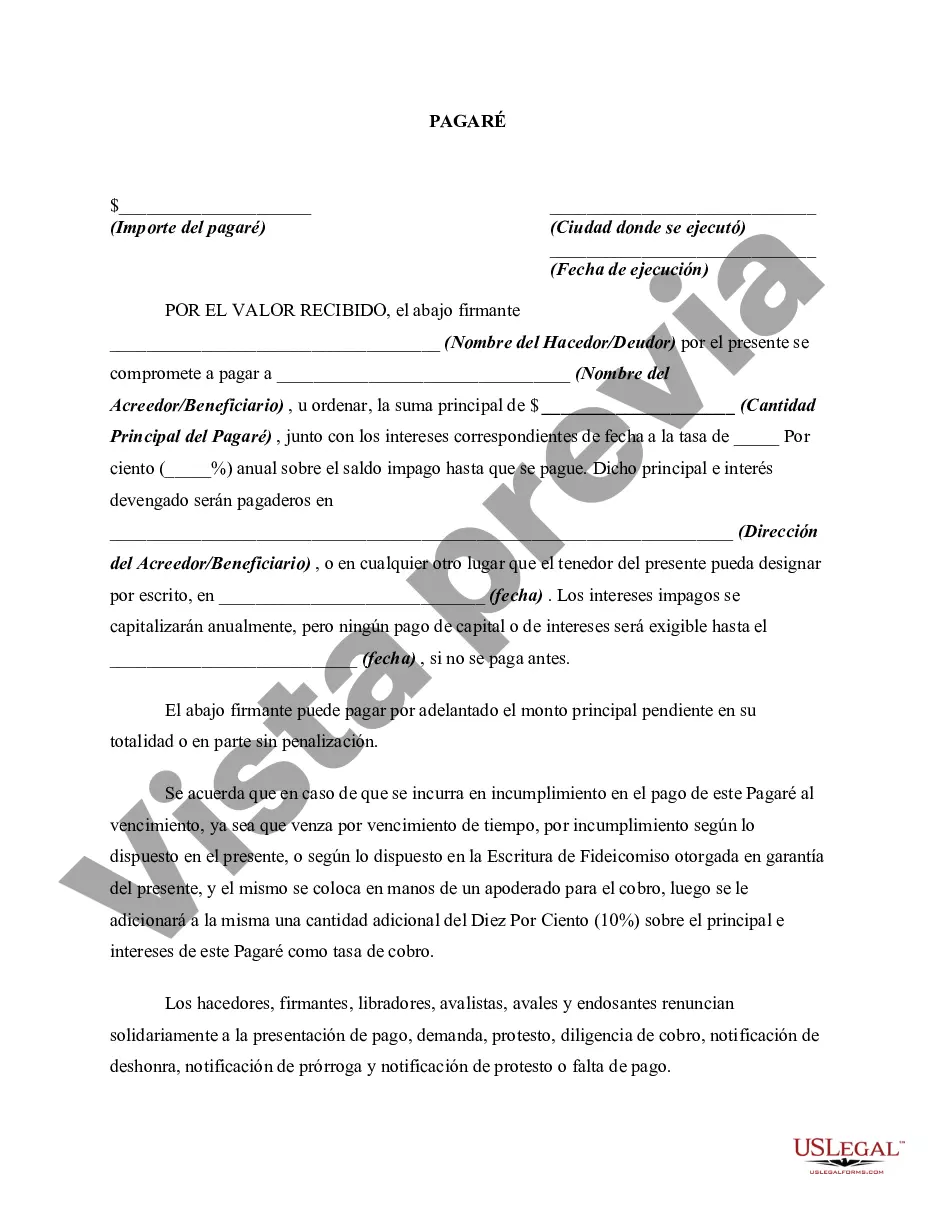

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.