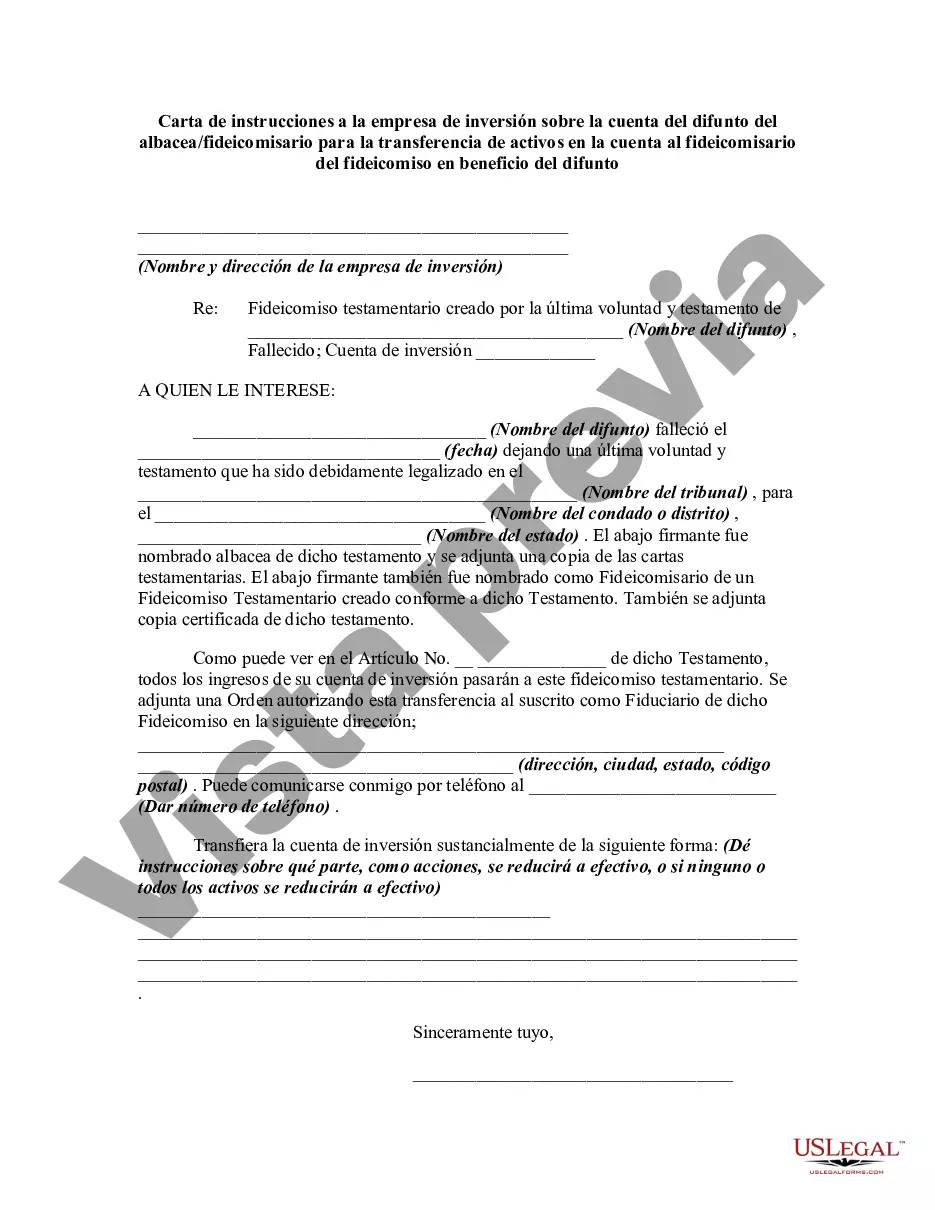

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Alabama Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent is a legal document that outlines the specific instructions for transferring the assets in a deceased individual's investment account to a trustee of a trust established for the benefit of the decedent. This letter serves as a directive from the executor or trustee to the investment firm, ensuring a smooth transfer of assets and proper management of the trust. Keywords: Alabama, Letter of Instruction, Investment Firm, Account of Decedent, Executor, Trustee, Transfer of Assets, Trustee of Trust, Benefit of Decedent. Different Types of Alabama Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: 1. Simple Alabama Letter of Instruction: This type of letter of instruction is used when the transfer of assets from the investment account to the trust is straightforward and uncomplicated. It often includes basic details about the account, trustee information, and beneficiary information. 2. Complex Alabama Letter of Instruction: In certain cases, the transfer of assets may involve complex arrangements such as multiple investment accounts, various types of assets, or unique instructions for managing the trust. A complex letter of instruction provides meticulous directions to ensure proper asset transfer and management. 3. Alabama Letter of Instruction with Specific Asset Allocation: If the decedent had specific preferences or requirements regarding the allocation of assets in their investment account to different beneficiaries or charitable organizations, this type of letter of instruction is used. It outlines the desired asset distribution and provides guidance to the investment firm and trustee. 4. Alabama Letter of Instruction with Investment Strategy: In situations where the decedent had specific investment strategies or preferences, this type of letter of instruction is included. It advises the investment firm and trustee on how to manage and invest the assets within the trust, considering the decedent's wishes and long-term goals. 5. Alabama Letter of Instruction for Highly Regulated Assets: In cases where the decedent's investment account includes highly regulated assets such as stocks, bonds, or real estate, a specific letter of instruction is necessary. It ensures compliance with state and federal regulations and guides the investment firm and trustee in properly transferring and managing these assets within the trust. Remember, it is essential to consult with a legal professional to draft and customize the Alabama Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent according to specific circumstances and legal requirements.Alabama Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent is a legal document that outlines the specific instructions for transferring the assets in a deceased individual's investment account to a trustee of a trust established for the benefit of the decedent. This letter serves as a directive from the executor or trustee to the investment firm, ensuring a smooth transfer of assets and proper management of the trust. Keywords: Alabama, Letter of Instruction, Investment Firm, Account of Decedent, Executor, Trustee, Transfer of Assets, Trustee of Trust, Benefit of Decedent. Different Types of Alabama Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: 1. Simple Alabama Letter of Instruction: This type of letter of instruction is used when the transfer of assets from the investment account to the trust is straightforward and uncomplicated. It often includes basic details about the account, trustee information, and beneficiary information. 2. Complex Alabama Letter of Instruction: In certain cases, the transfer of assets may involve complex arrangements such as multiple investment accounts, various types of assets, or unique instructions for managing the trust. A complex letter of instruction provides meticulous directions to ensure proper asset transfer and management. 3. Alabama Letter of Instruction with Specific Asset Allocation: If the decedent had specific preferences or requirements regarding the allocation of assets in their investment account to different beneficiaries or charitable organizations, this type of letter of instruction is used. It outlines the desired asset distribution and provides guidance to the investment firm and trustee. 4. Alabama Letter of Instruction with Investment Strategy: In situations where the decedent had specific investment strategies or preferences, this type of letter of instruction is included. It advises the investment firm and trustee on how to manage and invest the assets within the trust, considering the decedent's wishes and long-term goals. 5. Alabama Letter of Instruction for Highly Regulated Assets: In cases where the decedent's investment account includes highly regulated assets such as stocks, bonds, or real estate, a specific letter of instruction is necessary. It ensures compliance with state and federal regulations and guides the investment firm and trustee in properly transferring and managing these assets within the trust. Remember, it is essential to consult with a legal professional to draft and customize the Alabama Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent according to specific circumstances and legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.