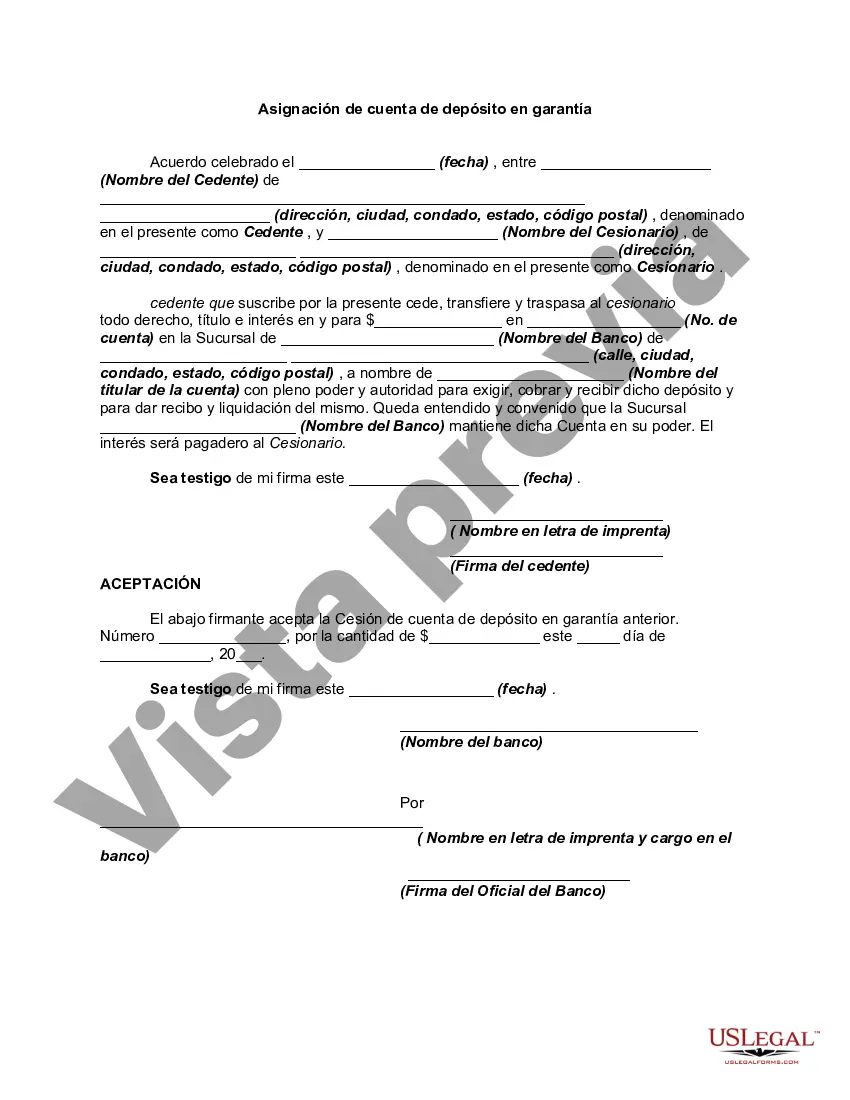

An Assignment is a transfer of a property right or title to some particular person under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, personal property, or other thing assigned. An escrow account is held in the borrower's name to pay obligations such as property taxes, insurance premiums, lease payments, hazard insurance, and other associated property payments and expenses when they are due in connection with a mortgage loan.

form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Keywords: Alabama, Assignment of Escrow Account, types Alabama Assignment of Escrow Account: A Detailed Description In Alabama, the Assignment of Escrow Account refers to a legal process wherein a party transfers the rights and obligations associated with an escrow account to another party. An escrow account is typically established in real estate transactions to ensure smooth and secure handling of funds until all the necessary conditions are met. An Alabama Assignment of Escrow Account can occur in different situations, and understanding the various types is crucial for those involved in real estate transactions. Below are the different types of Alabama Assignment of Escrow Account: 1. Real Estate Purchase and Sale: One common type is when a buyer and seller enter into a purchase and sale agreement. The buyer typically deposits the earnest money into an escrow account, which is held by a neutral third party. If both parties agree to assign the rights and obligations associated with the escrow account, they can execute an Assignment of Escrow Account. This assignment might occur when there is a change in the buyer or seller, or when one party transfers their interest to another. 2. Mortgage and Loan Transactions: Another type of Alabama Assignment of Escrow Account can be found in mortgage and loan transactions. When a borrower secures financing, the lender may require the establishment of an escrow account to ensure the payment of property taxes, insurance premiums, and other related expenses. Under certain circumstances, the lender may allow the borrower to assign this escrow account to another party, such as a new lender or a loan service. 3. Business and Commercial Transactions: Escrow accounts are also commonly used in business and commercial transactions. For instance, when a business entity is sold or merged, funds may be held in escrow to cover potential liabilities or post-closing adjustments. The parties involved may decide to assign the rights and obligations of the escrow account, providing flexibility and facilitating the successful completion of the transaction. Regardless of the type of Alabama Assignment of Escrow Account, it is crucial to ensure compliance with the applicable laws and regulations. Any assignment should be executed in writing and typically requires the consent of all parties involved, including the escrow agent or company. Consulting with a knowledgeable attorney or a trusted escrow professional is recommended to navigate the complexities and protect the interests of all parties involved. In summary, an Alabama Assignment of Escrow Account involves the transfer of rights and obligations associated with an escrow account to another party. This process can occur in various situations, including real estate purchase and sale, mortgage and loan transactions, as well as business and commercial transactions. Understanding the different types of assignments is vital for anyone involved in such transactions to ensure compliance and effectively fulfill their contractual obligations.Keywords: Alabama, Assignment of Escrow Account, types Alabama Assignment of Escrow Account: A Detailed Description In Alabama, the Assignment of Escrow Account refers to a legal process wherein a party transfers the rights and obligations associated with an escrow account to another party. An escrow account is typically established in real estate transactions to ensure smooth and secure handling of funds until all the necessary conditions are met. An Alabama Assignment of Escrow Account can occur in different situations, and understanding the various types is crucial for those involved in real estate transactions. Below are the different types of Alabama Assignment of Escrow Account: 1. Real Estate Purchase and Sale: One common type is when a buyer and seller enter into a purchase and sale agreement. The buyer typically deposits the earnest money into an escrow account, which is held by a neutral third party. If both parties agree to assign the rights and obligations associated with the escrow account, they can execute an Assignment of Escrow Account. This assignment might occur when there is a change in the buyer or seller, or when one party transfers their interest to another. 2. Mortgage and Loan Transactions: Another type of Alabama Assignment of Escrow Account can be found in mortgage and loan transactions. When a borrower secures financing, the lender may require the establishment of an escrow account to ensure the payment of property taxes, insurance premiums, and other related expenses. Under certain circumstances, the lender may allow the borrower to assign this escrow account to another party, such as a new lender or a loan service. 3. Business and Commercial Transactions: Escrow accounts are also commonly used in business and commercial transactions. For instance, when a business entity is sold or merged, funds may be held in escrow to cover potential liabilities or post-closing adjustments. The parties involved may decide to assign the rights and obligations of the escrow account, providing flexibility and facilitating the successful completion of the transaction. Regardless of the type of Alabama Assignment of Escrow Account, it is crucial to ensure compliance with the applicable laws and regulations. Any assignment should be executed in writing and typically requires the consent of all parties involved, including the escrow agent or company. Consulting with a knowledgeable attorney or a trusted escrow professional is recommended to navigate the complexities and protect the interests of all parties involved. In summary, an Alabama Assignment of Escrow Account involves the transfer of rights and obligations associated with an escrow account to another party. This process can occur in various situations, including real estate purchase and sale, mortgage and loan transactions, as well as business and commercial transactions. Understanding the different types of assignments is vital for anyone involved in such transactions to ensure compliance and effectively fulfill their contractual obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.