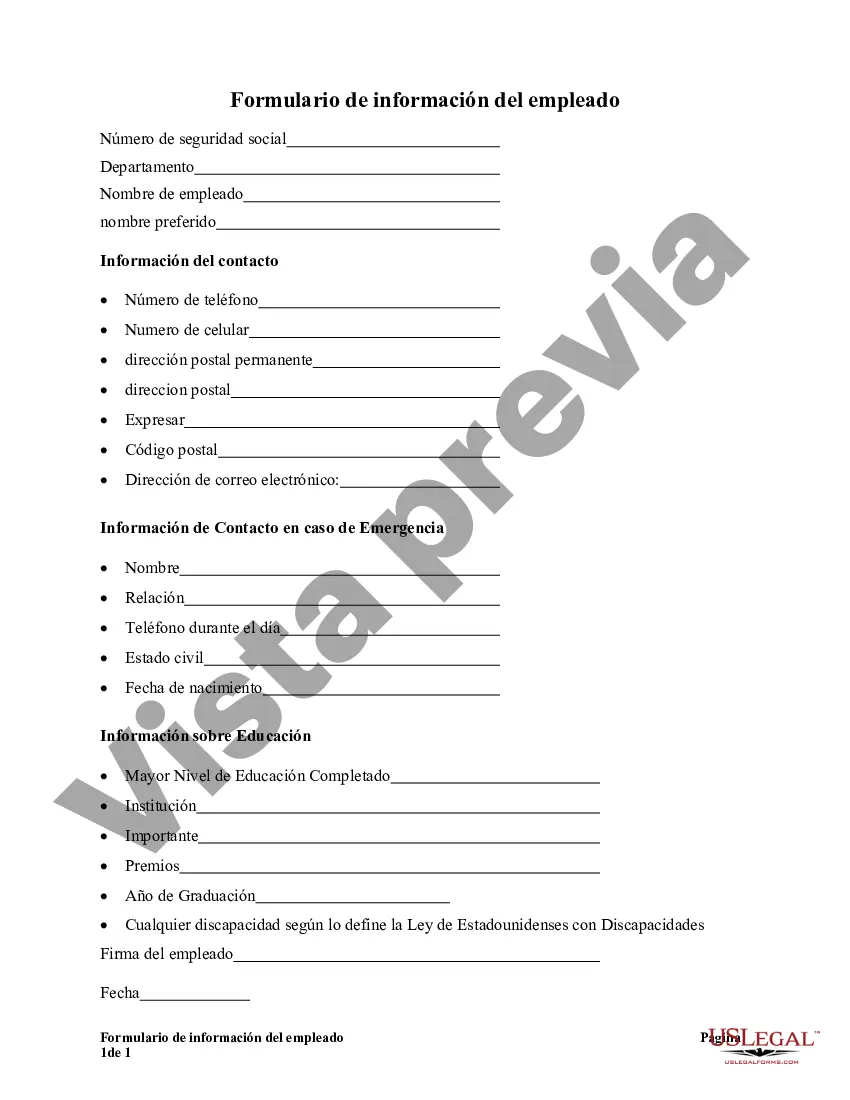

Alabama Employee Information Form is a crucial document designed to gather necessary details from employees working in the state of Alabama. This form serves multiple purposes and plays a vital role in complying with state laws and regulations. By utilizing relevant keywords and providing a detailed description, here is an overview of what the Alabama Employee Information Form entails. The Alabama Employee Information Form is a standardized document companies in Alabama used to collect essential data about their employees. This form aids in establishing accurate employment records and ensures compliance with various legal obligations. It is typically completed by newly hired employees, providing the employer with vital information to initiate the onboarding process effectively. The Alabama Employee Information Form covers a wide range of details that include personal information, contact information, emergency contacts, and employment-related specifics. It also collects information related to tax implications and insurance coverage, allowing the employer to fulfill their obligations under relevant state and federal laws. Some specific sections included in the Alabama Employee Information Form are as follows: 1. Personal Information: This section requires employee input regarding their full name, address, date of birth, social security number, and other identifying information required for employment purposes. 2. Contact Information: Here, the employee is asked to provide their phone number, email address, and any alternate contact information to ensure effective communication between the employer and the employee. 3. Emergency Contacts: In case of any unforeseen circumstances, employees are asked to provide details of one or more emergency contacts who can be reached in case of an emergency. 4. Employment Details: This section captures essential employment-related information, such as the employee's job title, department, supervisor's name, start date, and regular work hours. 5. Tax Information: To comply with tax laws, the Alabama Employee Information Form collects the employee's federal tax withholding information, including their filing status, number of allowances, and additional withholding amounts, if any. 6. Insurance Coverage: Some companies provide different types of insurance coverage, such as health insurance, life insurance, or retirement plans. This section gathers the necessary data to determine eligibility and manage relevant employee benefits. Different types of Alabama Employee Information Forms may exist based on the specific requirements of the employer or industry. For example, there might be separate forms for full-time employees, part-time employees, temporary employees, or independent contractors. Additionally, certain industries that require additional information, such as healthcare or government sectors, may have industry-specific forms tailored to their needs. In conclusion, the Alabama Employee Information Form is a comprehensive document that gathers critical employee details necessary for proper record-keeping and compliance with legal obligations. It ensures accurate tax withholding, effective communication, and appropriate administration of employee benefits. Different variations of the form may exist based on the employer's requirements and industry-specific considerations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Formulario de información del empleado - Employee Information Form

Description

How to fill out Alabama Formulario De Información Del Empleado?

Discovering the right legal papers format could be a struggle. Naturally, there are tons of layouts available online, but how will you get the legal type you require? Make use of the US Legal Forms web site. The assistance provides 1000s of layouts, including the Alabama Employee Information Form, which you can use for company and private needs. All of the varieties are checked out by pros and satisfy state and federal specifications.

Should you be previously signed up, log in to your profile and click the Acquire switch to get the Alabama Employee Information Form. Utilize your profile to check from the legal varieties you might have acquired earlier. Visit the My Forms tab of your profile and get one more backup of your papers you require.

Should you be a new customer of US Legal Forms, listed here are straightforward directions so that you can follow:

- First, ensure you have selected the proper type to your town/area. You may look through the form using the Preview switch and read the form description to ensure this is the right one for you.

- If the type is not going to satisfy your requirements, use the Seach discipline to find the appropriate type.

- Once you are positive that the form is proper, go through the Buy now switch to get the type.

- Choose the costs prepare you want and type in the necessary info. Make your profile and pay for an order making use of your PayPal profile or bank card.

- Opt for the submit formatting and down load the legal papers format to your gadget.

- Complete, edit and printing and signal the received Alabama Employee Information Form.

US Legal Forms is definitely the most significant local library of legal varieties that you can see a variety of papers layouts. Make use of the service to down load appropriately-created files that follow condition specifications.