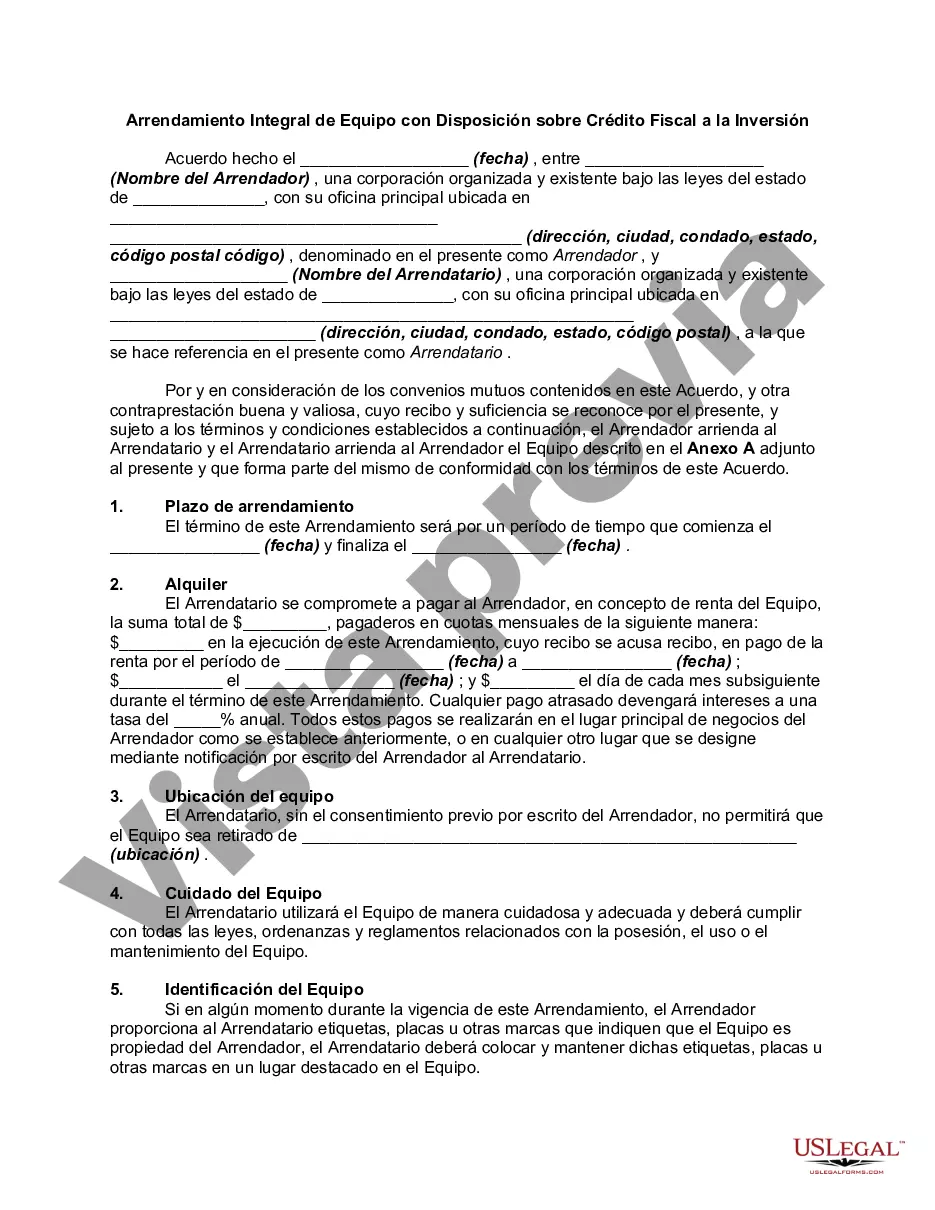

Alabama Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal agreement that outlines the terms and conditions for leasing equipment in the state of Alabama. This type of lease specifically contains a provision regarding investment tax, which is a tax incentive offered by the state government to encourage businesses to invest in new equipment. The Alabama Comprehensive Equipment Lease with Provision Regarding Investment Tax enables businesses to lease a wide range of equipment, including but not limited to industrial machinery, vehicles, computer systems, office equipment, and construction tools. This lease agreement is designed to provide flexibility to businesses by offering options such as short-term or long-term leases, lease-to-own arrangements, and lease extensions. The provision regarding investment tax in this lease allows businesses to avail tax benefits for leasing equipment and making investments in Alabama. Under this provision, lessees may be eligible for tax credits, deductions, or accelerated depreciation on their leased equipment, providing a significant financial advantage for businesses operating in the state. It is important to note that there might be variations or specific types of Alabama Comprehensive Equipment Leases with Provision Regarding Investment Tax, tailored to different industries or specific equipment categories. For example, there could be specialized leases for construction equipment, medical equipment, or technology-related equipment. These specializations cater to the unique needs and requirements of particular industries, ensuring that businesses have access to the specific equipment they require. In conclusion, the Alabama Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal agreement that enables businesses in Alabama to lease equipment while availing tax benefits for their investments in the state. With various options and potential industry-specific leases available, this agreement provides businesses with the flexibility and financial advantages necessary to thrive in their respective fields.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Alabama Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Have you been inside a place in which you require documents for possibly business or person reasons virtually every day time? There are a variety of lawful document themes available on the net, but getting kinds you can rely on is not simple. US Legal Forms gives a large number of kind themes, just like the Alabama Comprehensive Equipment Lease with Provision Regarding Investment Tax, which can be published to satisfy state and federal requirements.

When you are currently knowledgeable about US Legal Forms internet site and possess your account, simply log in. Afterward, you are able to obtain the Alabama Comprehensive Equipment Lease with Provision Regarding Investment Tax design.

Should you not offer an account and would like to start using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is to the right town/area.

- Take advantage of the Preview button to review the shape.

- See the information to ensure that you have selected the right kind.

- If the kind is not what you are seeking, use the Research field to obtain the kind that suits you and requirements.

- If you get the right kind, just click Get now.

- Pick the costs program you need, submit the desired information and facts to make your bank account, and buy the order with your PayPal or charge card.

- Decide on a practical paper structure and obtain your version.

Get every one of the document themes you might have bought in the My Forms menu. You can aquire a extra version of Alabama Comprehensive Equipment Lease with Provision Regarding Investment Tax anytime, if required. Just click the necessary kind to obtain or printing the document design.

Use US Legal Forms, one of the most substantial collection of lawful varieties, to save lots of some time and steer clear of blunders. The assistance gives skillfully made lawful document themes that you can use for a variety of reasons. Create your account on US Legal Forms and initiate making your lifestyle easier.