A financial hardship resulting in a need for such an affidavit such as this form can be defined as a material change in the financial situation of a person that is or will affect their ability to pay their debts. Many things can cause a hardship such as a payment Increase on your mortgage note, loss of your job, business failure, damage to property, death of a spouse or other family member, severe illness, divorce, medical bills, or just accruing too much debt.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

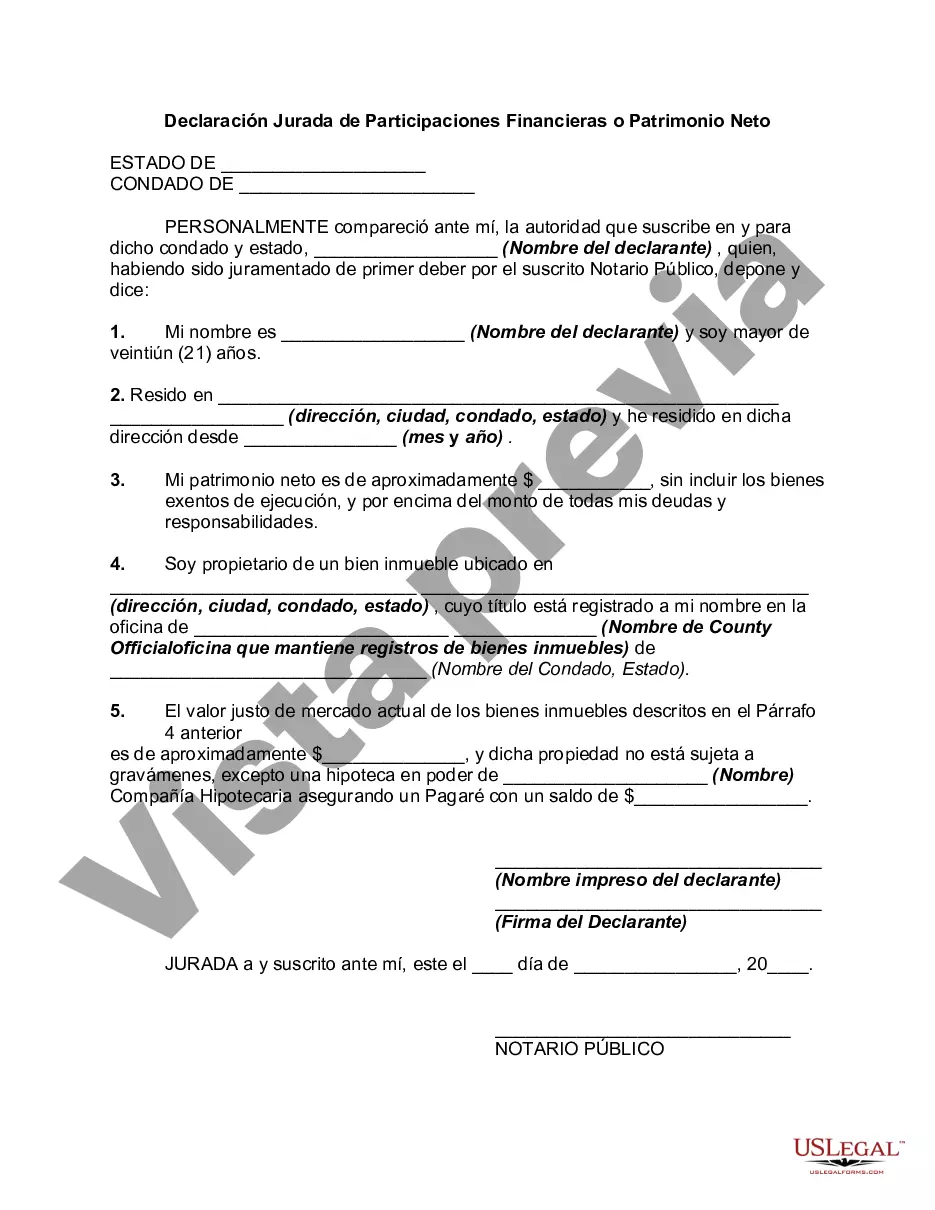

The Alabama Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document that provides a detailed overview of an individual's or entity's financial situation. It is commonly used in various legal proceedings such as divorce cases, child support hearings, and probate matters to assess the financial standing of the involved parties. This affidavit aims to present a comprehensive snapshot of an individual's net worth by listing their assets and liabilities. Key components of the Alabama Affidavit of Financial Holdings or Net Worth — Assets and Liabilities typically include: 1. Personal Information: This section collects vital personal details, including the full name, address, contact information, and social security number of the individual or entity submitting the affidavit. 2. Asset Disclosure: Here, the affidavit outlines all assets held by the individual or entity. This can include real estate properties, vehicles, bank accounts, investment portfolios, retirement accounts, valuable belongings, and any other valuable assets. 3. Liability Disclosure: This section requires the disclosure of all existing debts, loans, mortgages, credit card balances, and other financial obligations. 4. Income Disclosure: The Affidavit may also require the individual or entity to disclose their income sources, such as employment wages, business profits, rental income, royalties, and any other sources of revenue. 5. Monthly Expenses: This part allows for the declaration of regular monthly expenses, including mortgage or rent payments, utility bills, insurance premiums, childcare costs, education expenses, and any other significant regular expenditures. 6. Supporting Documentation: The individual or entity may be required to attach supporting documents, such as bank statements, tax returns, property deeds, loan agreements, or any other relevant financial records to substantiate the information provided in the affidavit. Different types of Alabama Affidavit of Financial Holdings or Net Worth — Assets and Liabilities may vary based on the specific legal purpose or intended use. For instance, there may be separate affidavits required for divorce cases, child support determinations, probate proceedings, or even business transactions. However, the fundamental purpose remains consistent across these variations: to provide an accurate and comprehensive representation of an individual's or entity's financial situation.The Alabama Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document that provides a detailed overview of an individual's or entity's financial situation. It is commonly used in various legal proceedings such as divorce cases, child support hearings, and probate matters to assess the financial standing of the involved parties. This affidavit aims to present a comprehensive snapshot of an individual's net worth by listing their assets and liabilities. Key components of the Alabama Affidavit of Financial Holdings or Net Worth — Assets and Liabilities typically include: 1. Personal Information: This section collects vital personal details, including the full name, address, contact information, and social security number of the individual or entity submitting the affidavit. 2. Asset Disclosure: Here, the affidavit outlines all assets held by the individual or entity. This can include real estate properties, vehicles, bank accounts, investment portfolios, retirement accounts, valuable belongings, and any other valuable assets. 3. Liability Disclosure: This section requires the disclosure of all existing debts, loans, mortgages, credit card balances, and other financial obligations. 4. Income Disclosure: The Affidavit may also require the individual or entity to disclose their income sources, such as employment wages, business profits, rental income, royalties, and any other sources of revenue. 5. Monthly Expenses: This part allows for the declaration of regular monthly expenses, including mortgage or rent payments, utility bills, insurance premiums, childcare costs, education expenses, and any other significant regular expenditures. 6. Supporting Documentation: The individual or entity may be required to attach supporting documents, such as bank statements, tax returns, property deeds, loan agreements, or any other relevant financial records to substantiate the information provided in the affidavit. Different types of Alabama Affidavit of Financial Holdings or Net Worth — Assets and Liabilities may vary based on the specific legal purpose or intended use. For instance, there may be separate affidavits required for divorce cases, child support determinations, probate proceedings, or even business transactions. However, the fundamental purpose remains consistent across these variations: to provide an accurate and comprehensive representation of an individual's or entity's financial situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.