The Alabama General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion is an important legal document designed to facilitate the transfer of wealth to minors while providing tax benefits to the donor. This trust agreement allows for annual gifts to minors that can qualify for the gift tax exclusion, which helps optimize financial planning strategies. Keywords: Alabama, General Form, Trust Agreement, Minor, Qualifying, Annual Gift Tax Exclusion Different types of Alabama General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion can include: 1. Revocable General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion: This type of trust agreement allows the donor to revoke or amend the trust at any time, maintaining control over the gifted assets until the minor reaches a specified age or another triggering event occurs. 2. Irrevocable General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion: In contrast to the revocable trust, this type of trust agreement cannot be altered or revoked once it is established. The assets transferred to the trust become the property of the trust and are managed by the trustee for the benefit of the minor. 3. Testamentary General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion: This trust agreement is created through a will and only becomes effective upon the death of the donor. It allows for the transfer of assets to the trust for the benefit of the minor, qualifying for the annual gift tax exclusion. 4. Special Needs General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion: This type of trust agreement is specifically designed to protect and provide for minors with special needs. It ensures that the gifted assets do not jeopardize their eligibility for government benefits while still allowing them to benefit from the annual gift tax exclusion. Overall, the Alabama General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion provides a flexible and effective means for donors to transfer wealth to minors while minimizing tax implications. It is important to consult with a legal professional to determine the most suitable type of trust agreement based on individual circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Formulario general de acuerdo de fideicomiso para menores que califican para la exclusión anual del impuesto sobre donaciones - General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out Alabama Formulario General De Acuerdo De Fideicomiso Para Menores Que Califican Para La Exclusión Anual Del Impuesto Sobre Donaciones?

If you wish to total, acquire, or printing legal papers themes, use US Legal Forms, the greatest collection of legal varieties, that can be found on the Internet. Use the site`s easy and hassle-free look for to discover the documents you need. A variety of themes for organization and individual uses are sorted by types and suggests, or key phrases. Use US Legal Forms to discover the Alabama General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion in just a number of mouse clicks.

If you are currently a US Legal Forms buyer, log in to your account and click on the Down load switch to get the Alabama General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion. You can even gain access to varieties you previously saved inside the My Forms tab of your account.

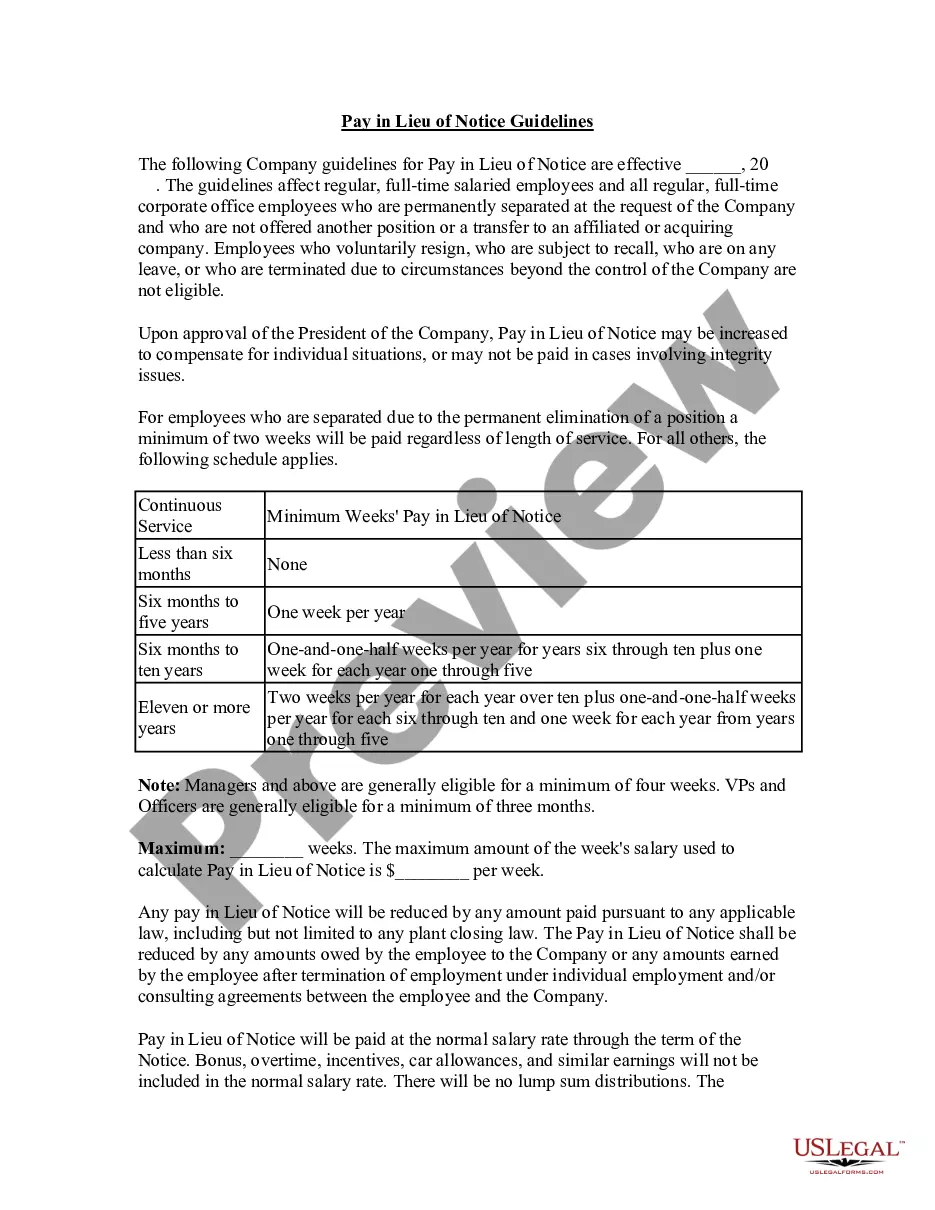

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for that correct town/nation.

- Step 2. Make use of the Review choice to look over the form`s articles. Do not forget to read the explanation.

- Step 3. If you are unsatisfied together with the kind, utilize the Look for discipline on top of the monitor to locate other models in the legal kind format.

- Step 4. When you have discovered the form you need, click the Purchase now switch. Select the pricing plan you prefer and add your accreditations to register for an account.

- Step 5. Process the purchase. You may use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the structure in the legal kind and acquire it on your own system.

- Step 7. Complete, revise and printing or indicator the Alabama General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion.

Every single legal papers format you get is the one you have forever. You have acces to each and every kind you saved inside your acccount. Click the My Forms portion and pick a kind to printing or acquire once more.

Compete and acquire, and printing the Alabama General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion with US Legal Forms. There are thousands of expert and express-distinct varieties you can use to your organization or individual demands.