Title: Alabama Sample Letter for Employee Automobile Expense Allowance: A Comprehensive Guide Introduction: In this article, we will provide a detailed description of Alabama Sample Letters for Employee Automobile Expense Allowance. We understand the importance of employer reimbursement for employees' business-related automobile expenses in Alabama and aim to offer insights into the various types of expense allowances letters that can be used in this context. Keywords: Alabama, Sample Letter, Employee Automobile Expense Allowance, business-related expenses, reimbursement, employer, reimbursement letters 1. Definition and Purpose of an Employee Automobile Expense Allowance: Employee Automobile Expense Allowance refers to a policy where an employer supports their employees by reimbursing expenses incurred while using their personal vehicles for business purposes. This encourages productivity while ensuring employees are appropriately compensated for their expenditures. Keywords: Definition, Purpose, Employee Automobile Expense Allowance, reimbursement, personal vehicles, business purposes 2. Basic Components of an Alabama Sample Letter for Employee Automobile Expense Allowance: A well-structured letter often consists of several key sections, including: a. Objective Statement: Clearly state the purpose of the letter—establishing an allowance for employee automobile expenses in Alabama. b. Employee Details: Provide the employee's name, designation, and other relevant information to personalize the letter. c. Mileage Reimbursement Rate: Specify the reimbursement rate per mile driven for business-related purposes in Alabama. d. Expense Allowance Guidelines: Outline the specific expenses covered under the allowance, such as fuel, tolls, parking fees, and maintenance costs. Keywords: Components, Alabama Sample Letter, Employee Automobile Expense Allowance, objective statement, employee details, mileage reimbursement rate, expense allowance guidelines 3. Types of Alabama Sample Letters for Employee Automobile Expense Allowance: a. Initial Allowance Letter: This letter is used to inform employees about the new expense allowance policy and its implementation details. It typically includes guidelines for claiming reimbursements and any necessary forms. b. Annual Allowance Update Letter: When reviewing the allowance policy annually, employers may send a letter to employees updating the reimbursement rates or modifying the terms of the allowance program. c. Milestone Achievement Bonus Letter: This letter recognizes exceptional performance and grants an additional expense allowance to deserving employees as a reward for their accomplishments. Keywords: Alabama Sample Letter, Employee Automobile Expense Allowance, Initial Allowance Letter, Annual Allowance Update Letter, Milestone Achievement Bonus Letter, reimbursement rates, terms, performance, reward Conclusion: In conclusion, Alabama Sample Letters for Employee Automobile Expense Allowance play a crucial role in facilitating business-related expense reimbursements. By providing comprehensive guidelines and using appropriate keywords, employers can effectively communicate the policy details to their employees. Remember, transparency and adherence to Alabama regulations are essential when drafting these letters.

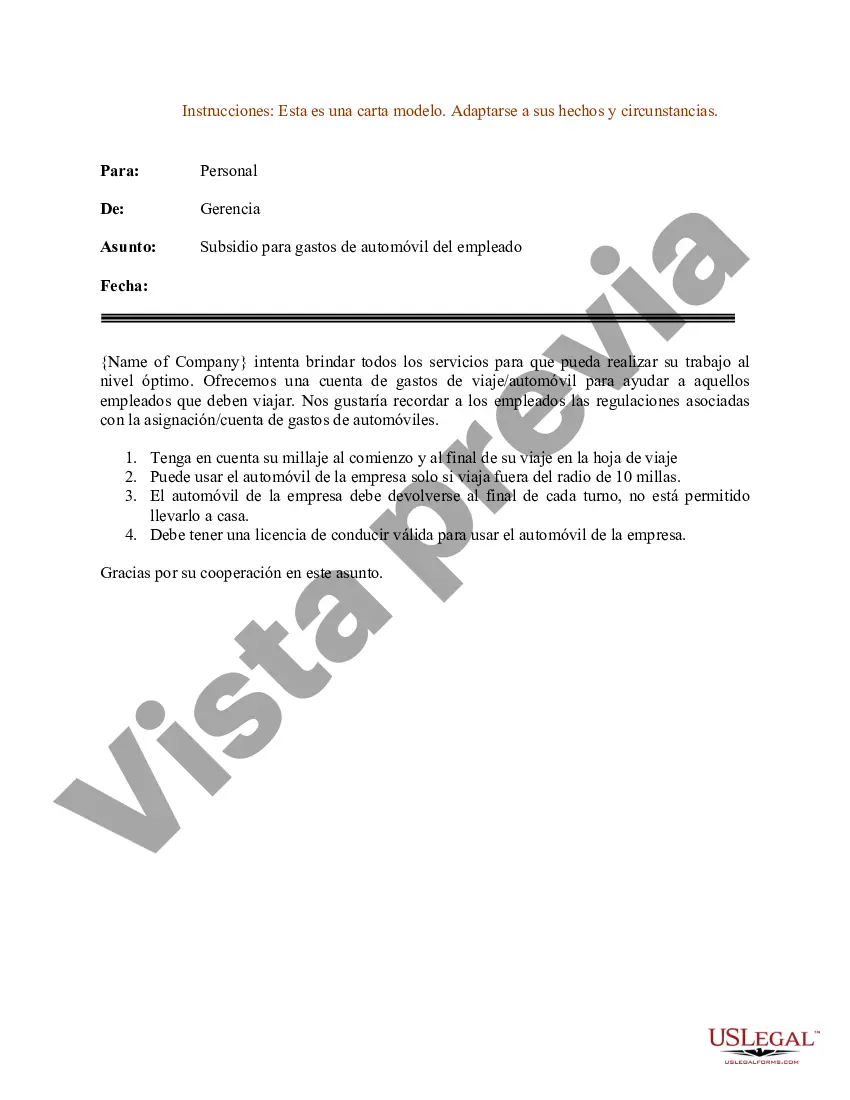

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Modelo de carta para asignación de gastos de automóvil para empleados - Sample Letter for Employee Automobile Expense Allowance

Description

How to fill out Alabama Modelo De Carta Para Asignación De Gastos De Automóvil Para Empleados?

US Legal Forms - one of the most significant libraries of authorized forms in the States - delivers a variety of authorized file themes you can download or printing. Utilizing the internet site, you may get 1000s of forms for company and individual reasons, sorted by categories, claims, or keywords and phrases.You will find the most up-to-date versions of forms just like the Alabama Sample Letter for Employee Automobile Expense Allowance in seconds.

If you have a membership, log in and download Alabama Sample Letter for Employee Automobile Expense Allowance in the US Legal Forms library. The Down load switch can look on every develop you perspective. You have access to all earlier delivered electronically forms in the My Forms tab of your respective accounts.

If you wish to use US Legal Forms initially, listed below are simple instructions to help you get started:

- Make sure you have selected the proper develop for your area/county. Click the Review switch to review the form`s articles. See the develop outline to ensure that you have selected the appropriate develop.

- In the event the develop does not satisfy your specifications, use the Search industry towards the top of the screen to find the one who does.

- If you are pleased with the shape, verify your selection by simply clicking the Buy now switch. Then, choose the rates prepare you favor and supply your qualifications to register on an accounts.

- Process the financial transaction. Use your credit card or PayPal accounts to finish the financial transaction.

- Choose the file format and download the shape on the system.

- Make adjustments. Complete, edit and printing and sign the delivered electronically Alabama Sample Letter for Employee Automobile Expense Allowance.

Every single template you put into your bank account lacks an expiry time and is also yours permanently. So, if you would like download or printing an additional version, just proceed to the My Forms area and click about the develop you want.

Get access to the Alabama Sample Letter for Employee Automobile Expense Allowance with US Legal Forms, by far the most extensive library of authorized file themes. Use 1000s of skilled and express-distinct themes that fulfill your business or individual needs and specifications.