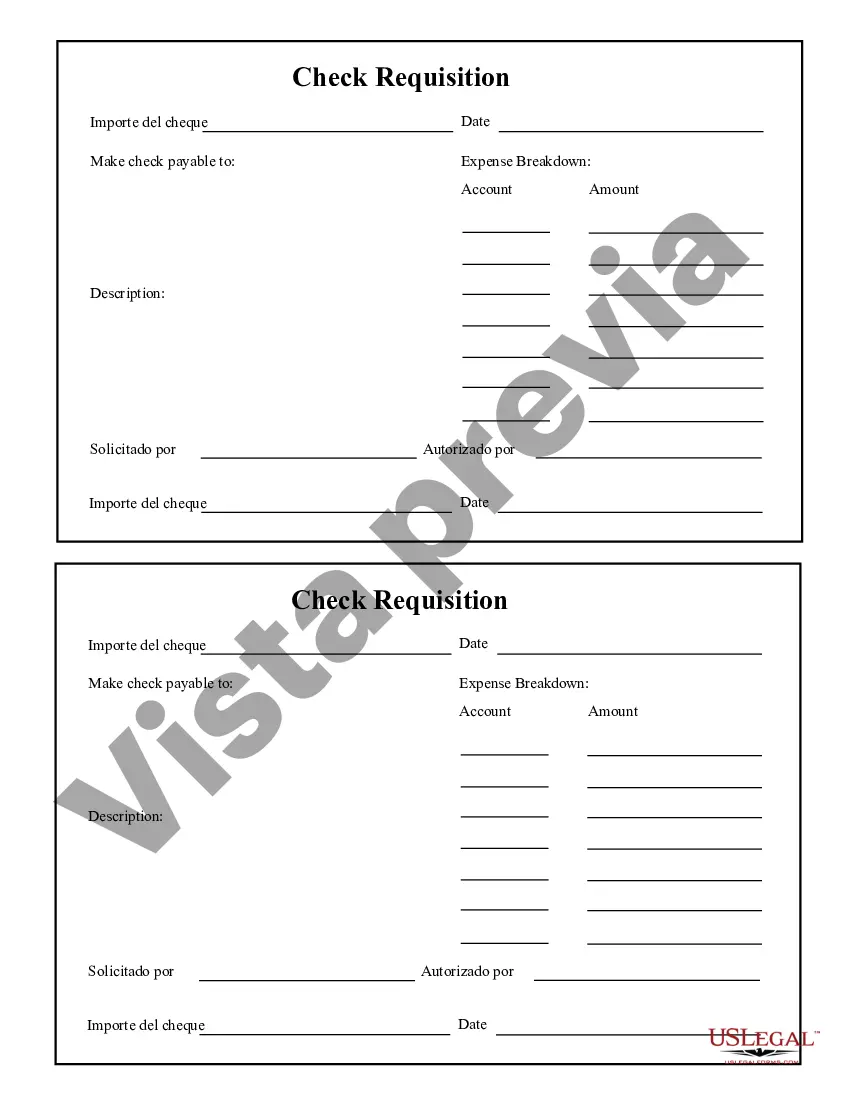

The Alabama Check Requisition Report is a vital document used to track and manage the process of check requisitions within the state of Alabama. It provides a detailed overview of all check requests made by different entities, such as government agencies, organizations, or individuals, highlighting important information and ensuring accurate financial management. This report plays a crucial role in monitoring and controlling financial transactions, ensuring transparency and accountability, and adhering to established policies and procedures. It serves as a comprehensive record of all check requisitions, offering detailed insights into the expenditure patterns and financial activities of an entity. The Alabama Check Requisition Report typically includes the following information: 1. Requisition Number: A unique identifier for each check requisition made within the state. 2. Requisition Date: The date on which the check requisition was initiated or approved. 3. Requisitioning Entity: The government agency, organization, or individual requesting the check. 4. Payee Information: The name and contact details of the recipient or payee of the check. 5. Check Amount: The specified amount to be paid. 6. Purpose of Payment: A detailed description or explanation of why the check is being issued. 7. Account Coding: The specific account to which the payment will be charged or allocated. 8. Approval Details: The name and signature of the authorized personnel who approved the requisition. 9. Disbursement Status: The current status of the check, such as pending, issued, or canceled. 10. Receiving Entity: If applicable, the government agency or department responsible for receiving the check. 11. Receiving Date: The date on which the check was received and processed. Different types of Alabama Check Requisition Reports include those utilized within various governmental departments, educational institutions, nonprofit organizations, and other entities that require a systematic approach to managing financial transactions. While the overall structure and content of the report remain consistent, slight variations may occur depending on the specific requirements and regulations governing each organization or department. To optimize the efficiency and accuracy of financial operations, utilizing standardized templates and incorporating electronic check requisition systems can provide additional benefits. These systems enable streamlined workflows, easier data entry and retrieval, as well as improved security and record-keeping. Additionally, integrating customizable fields and automated approval processes can further enhance the effectiveness of the Alabama Check Requisition Report. In conclusion, the Alabama Check Requisition Report is a crucial tool for efficient financial management, providing detailed insights into the check requisition process. By maintaining accurate records and following standardized procedures, organizations and government agencies can ensure transparency, accountability, and effective utilization of funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Informe de solicitud de cheques - Check Requisition Report

Description

How to fill out Alabama Informe De Solicitud De Cheques?

It is possible to spend time on the web attempting to find the legitimate record web template that meets the federal and state demands you need. US Legal Forms offers thousands of legitimate kinds that are examined by specialists. You can easily acquire or produce the Alabama Check Requisition Report from our support.

If you have a US Legal Forms bank account, you are able to log in and then click the Download option. Following that, you are able to total, modify, produce, or indication the Alabama Check Requisition Report. Each and every legitimate record web template you buy is your own eternally. To obtain one more version for any acquired develop, visit the My Forms tab and then click the related option.

If you are using the US Legal Forms site the first time, adhere to the basic recommendations listed below:

- Very first, be sure that you have chosen the best record web template for that region/area of your liking. See the develop description to make sure you have selected the right develop. If readily available, make use of the Preview option to appear with the record web template at the same time.

- If you wish to locate one more variation of your develop, make use of the Research area to obtain the web template that suits you and demands.

- When you have found the web template you need, click Acquire now to continue.

- Choose the rates strategy you need, type in your accreditations, and sign up for your account on US Legal Forms.

- Total the deal. You can utilize your credit card or PayPal bank account to cover the legitimate develop.

- Choose the formatting of your record and acquire it to the gadget.

- Make changes to the record if needed. It is possible to total, modify and indication and produce Alabama Check Requisition Report.

Download and produce thousands of record web templates using the US Legal Forms web site, which offers the most important collection of legitimate kinds. Use professional and express-particular web templates to take on your small business or specific demands.