Alabama Credit Information Request is a formal process through which individuals can obtain their credit information within the state of Alabama. It allows individuals to access important credit data such as their credit score, credit history, and other financial information that is used by various lenders and organizations to evaluate their creditworthiness. Various types of Alabama Credit Information Request include: 1. Alabama Credit Report Request: This type of request enables individuals to obtain a comprehensive credit report from credit reporting agencies such as Equifax, Experian, or TransUnion. The credit report incorporates detailed information about an individual's credit accounts, payment history, outstanding balances, and any public records such as bankruptcies or liens. 2. Alabama Credit Score Request: Alabama residents can also request their credit score, which is a numerical representation of their creditworthiness. A credit score is typically used by lenders to assess the risk associated with extending credit to an individual. The most common credit scoring model used is the FICO score, which ranges from 300 to 850. Higher scores indicate better creditworthiness. 3. Alabama Credit Freeze Request: This type of request allows individuals to freeze their credit, which restricts access to their credit report. By placing a credit freeze, individuals can prevent unauthorized individuals from opening new credit accounts or obtaining loans using their personal information. This is an effective measure to protect against identity theft and fraud. 4. Alabama Credit Dispute Request: In case individuals spot inaccuracies or discrepancies in their credit report, they can file a credit dispute request. This request allows individuals to challenge questionable information and request the credit reporting agencies to investigate and correct any errors. Disputed information can include incorrect account balances, payment histories, or identity-related discrepancies. 5. Alabama Credit Monitoring Request: Alabama residents can also request credit monitoring services to proactively monitor any changes or potential threats to their credit history. Credit monitoring services provide regular credit report updates, alerts for suspicious activities, and identity theft protection features to help individuals stay aware and vigilant about their credit status. In summary, Alabama Credit Information Request encompasses various types of requests such as credit report requests, credit score requests, credit freeze requests, credit dispute requests, and credit monitoring requests. These processes enable individuals to access and manage their credit information effectively, ensuring accuracy and protection against fraud in the state of Alabama.

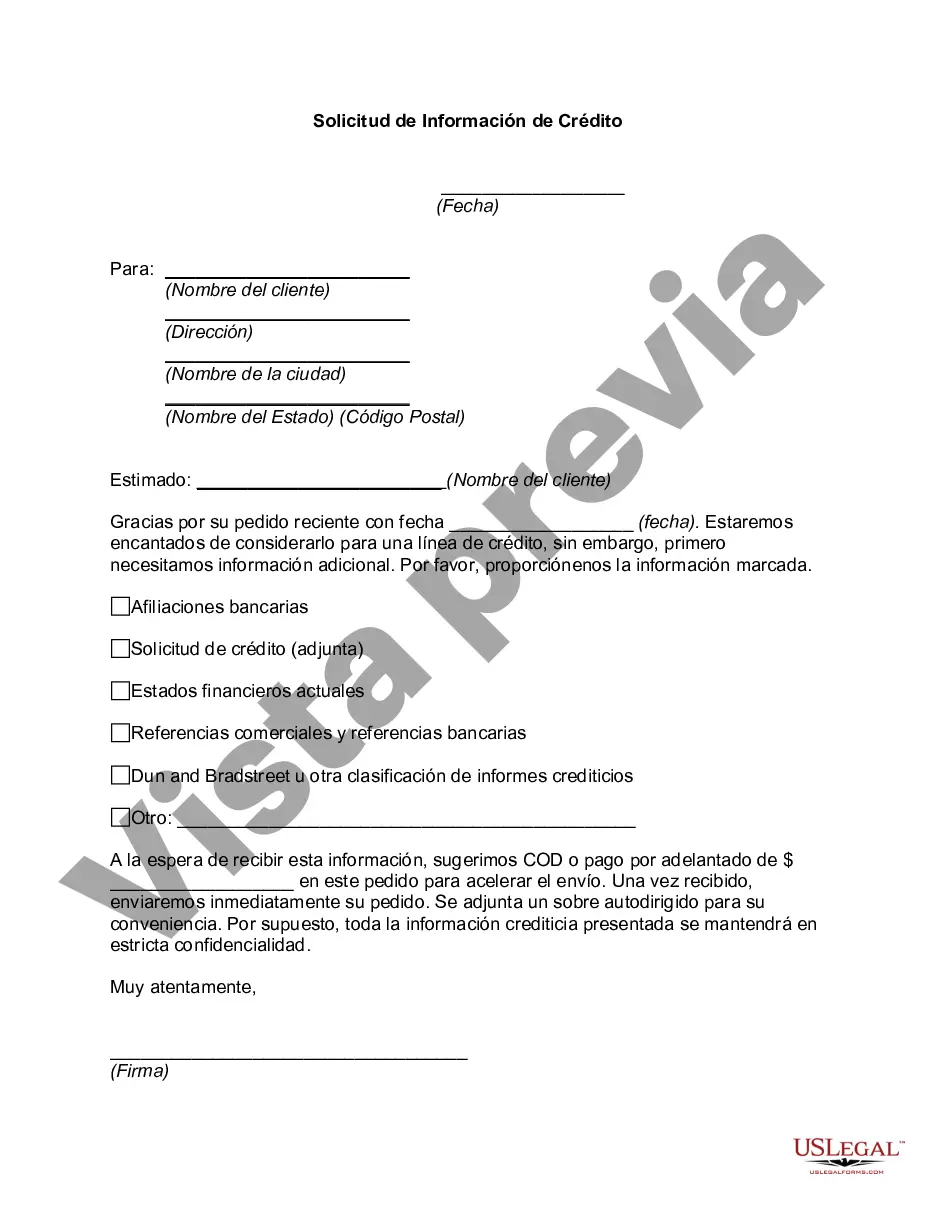

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Alabama Solicitud De Información De Crédito?

Discovering the right authorized papers design could be a have difficulties. Of course, there are a variety of themes available online, but how would you find the authorized type you need? Make use of the US Legal Forms website. The assistance provides 1000s of themes, including the Alabama Credit Information Request, that you can use for organization and private requirements. Each of the types are examined by specialists and fulfill federal and state needs.

In case you are presently authorized, log in to your accounts and then click the Download button to obtain the Alabama Credit Information Request. Use your accounts to appear from the authorized types you might have ordered previously. Go to the My Forms tab of your own accounts and acquire yet another version in the papers you need.

In case you are a new user of US Legal Forms, here are simple guidelines so that you can follow:

- First, ensure you have chosen the correct type for your personal area/state. You can look through the shape using the Preview button and study the shape explanation to make sure this is the right one for you.

- In case the type does not fulfill your expectations, use the Seach field to discover the appropriate type.

- Once you are certain that the shape is suitable, go through the Get now button to obtain the type.

- Pick the costs plan you would like and enter in the essential information and facts. Create your accounts and pay money for the order with your PayPal accounts or charge card.

- Pick the file file format and acquire the authorized papers design to your device.

- Total, edit and print out and signal the acquired Alabama Credit Information Request.

US Legal Forms will be the largest catalogue of authorized types where you will find numerous papers themes. Make use of the service to acquire professionally-manufactured documents that follow condition needs.