Alabama Charitable Gift Annuity is a type of planned giving option wherein a donor transfers assets to a charitable organization in exchange for a fixed income stream for life, while also providing support to the preferred charitable cause. This philanthropic tool provides individuals with the opportunity to make a lasting impact and receive financial benefits in return. In Alabama, there are primarily two types of Charitable Gift Annuities available: 1. Immediate Gift Annuity: An immediate Alabama Charitable Gift Annuity allows donors to make a charitable contribution and receive immediate income payments. The annuity rate is determined based on the donor's age at the time of the gift, with the payments typically starting soon after the donation is made. The donor benefits from a charitable income tax deduction and the security of a fixed income stream. 2. Deferred Gift Annuity: A deferred Alabama Charitable Gift Annuity enables donors to make a gift and defer the income payments until a later date, usually chosen by the donor. This option allows for potential growth of the annuity during the deferral period, resulting in higher income payments when they commence. Similar to the immediate gift annuity, donors receive a charitable income tax deduction in the year they make the gift. In both types of Charitable Gift Annuities, the size of the charitable deduction granted and the fixed annuity income are determined by various factors including the age of the donor, payout rate chosen, and the current annuity rates as published by the American Council on Gift Annuities (CGA) at the time of the gift. Alabama Charitable Gift Annuities provide several advantages, including potential tax benefits, a secure income source, favorable fixed annuity rates, and the ability to support charitable organizations important to the donor. Before entering into any planned giving arrangement, it is always recommended consulting with a qualified financial advisor or attorney to ensure the chosen option aligns with the donor's financial goals and philanthropic aspirations.

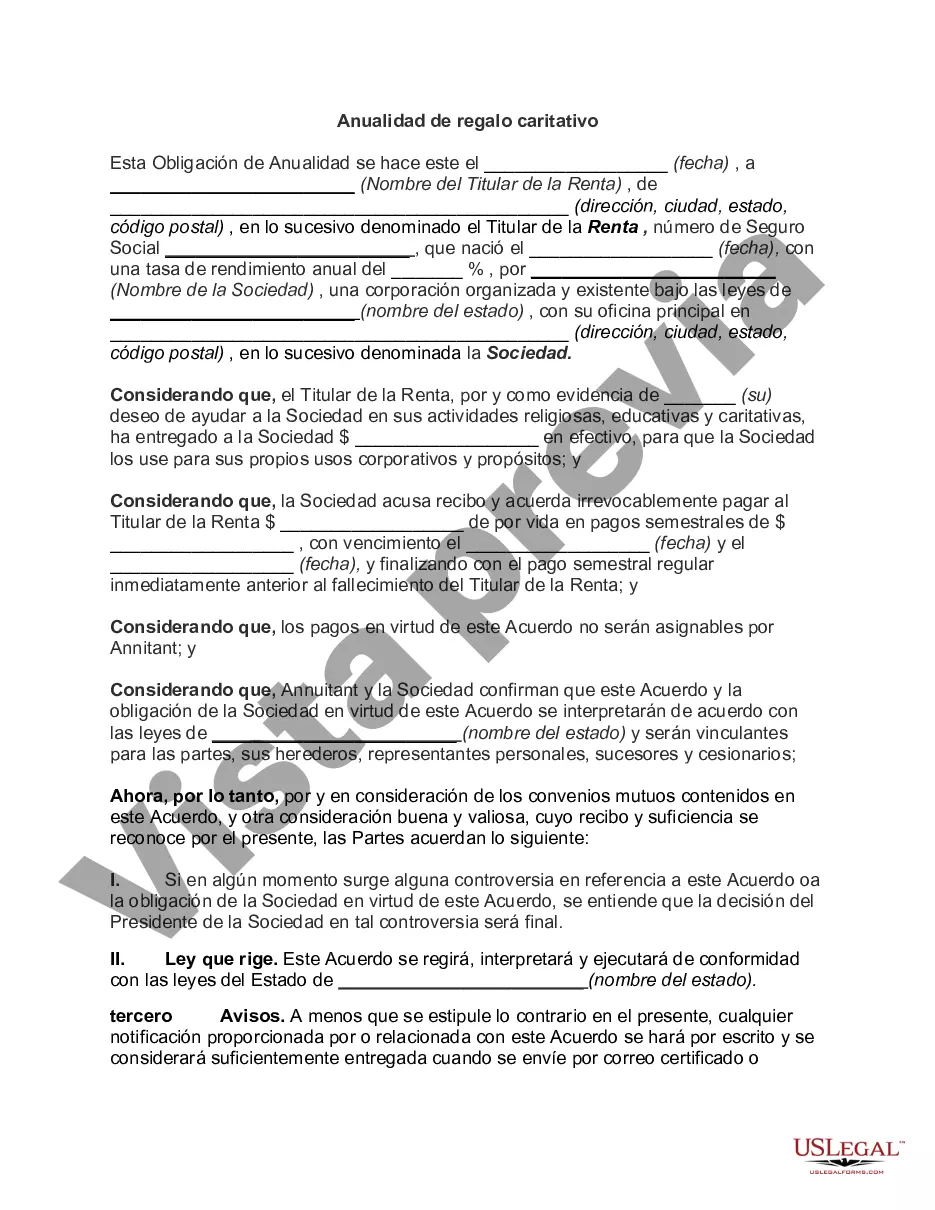

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Alabama Anualidad De Regalo Caritativo?

Choosing the right legal papers design can be a struggle. Naturally, there are tons of templates accessible on the Internet, but how do you obtain the legal form you require? Make use of the US Legal Forms website. The service gives a large number of templates, such as the Alabama Charitable Gift Annuity, that can be used for business and personal requirements. All of the forms are checked out by experts and meet federal and state requirements.

In case you are previously signed up, log in in your accounts and click the Download button to obtain the Alabama Charitable Gift Annuity. Make use of your accounts to look through the legal forms you possess ordered earlier. Go to the My Forms tab of your accounts and have another duplicate of your papers you require.

In case you are a whole new end user of US Legal Forms, allow me to share basic directions for you to follow:

- Initial, ensure you have chosen the right form for your metropolis/area. You are able to look over the shape using the Preview button and browse the shape outline to make sure this is the right one for you.

- When the form fails to meet your preferences, utilize the Seach field to find the proper form.

- Once you are positive that the shape is suitable, select the Get now button to obtain the form.

- Opt for the prices program you would like and enter in the necessary information. Design your accounts and buy the transaction using your PayPal accounts or bank card.

- Select the data file formatting and obtain the legal papers design in your gadget.

- Comprehensive, revise and print and indicator the acquired Alabama Charitable Gift Annuity.

US Legal Forms may be the most significant library of legal forms in which you can find a variety of papers templates. Make use of the company to obtain appropriately-manufactured papers that follow status requirements.