Alabama Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is a legal entity that operates in the state of Alabama with the purpose of providing charitable aid and benefiting the community. These trusts are established with the intention of achieving tax-exempt status from the Internal Revenue Service (IRS). The Alabama Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status is governed by specific guidelines and regulations outlined by both state and federal laws. These trusts are often created by individuals, families, or organizations with a philanthropic motive, seeking to support various charitable causes while enjoying the potential tax benefits associated with charitable giving. To qualify for tax-exempt status, these trusts must undergo a thorough application and approval process with the IRS. This process involves fulfilling specific criteria, such as having a clearly stated charitable purpose, ensuring that the assets and income generated are used exclusively for charitable activities, and maintaining transparency in financial reporting. There are several types of Alabama Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status, including: 1. Charitable Remainder Trusts (CRTs): A CRT allows individuals to donate assets to the trust, receive income during their lifetime or a predetermined period, and have the remaining assets go to the designated charitable organizations upon termination. 2. Charitable Lead Trusts (Cuts): Through a CLT, individuals can provide income to charitable organizations for a specific period while retaining the remainder for themselves or their heirs. Cuts are often used for wealth transfer and estate planning purposes. 3. Private Foundations: Private foundations are a form of charitable trust established by individuals, families, or corporations. These foundations serve as a dedicated entity that manages and distributes charitable funds to various nonprofits and organizations to achieve their philanthropic objectives. 4. Donor-Advised Funds (Days): Days are charitable trust accounts managed by sponsoring organizations. Donors can contribute to these funds and recommend distributions to specific charities over time, providing flexibility and involvement in the charitable giving process. In conclusion, Alabama Charitable Trusts with Creation Contingent upon Qualification for Tax Exempt Status play a significant role in promoting philanthropy and community development within the state. By adhering to the requirements set forth by state and federal regulations, these trusts enable individuals, families, and organizations to make a lasting charitable impact while potentially enjoying tax benefits tied to their contributions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Fideicomiso benéfico con creación supeditada a la calificación para el estado de exención de impuestos - Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

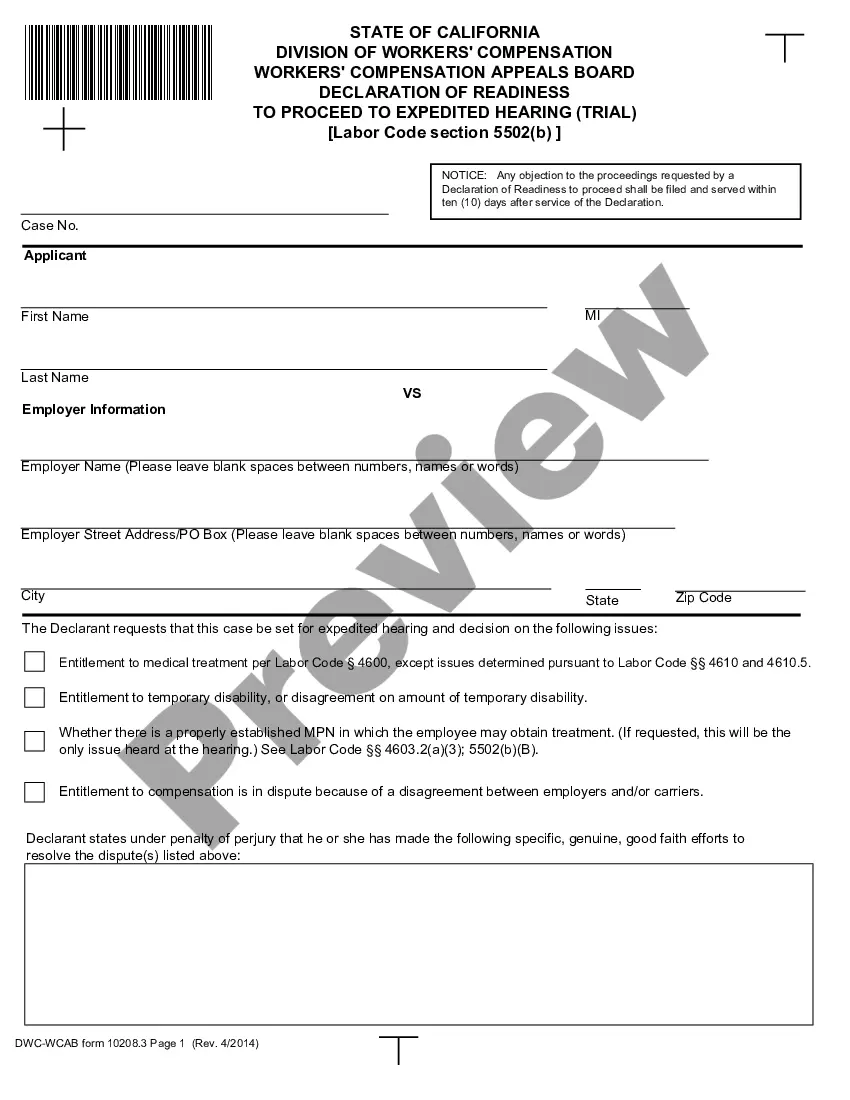

How to fill out Alabama Fideicomiso Benéfico Con Creación Supeditada A La Calificación Para El Estado De Exención De Impuestos?

Choosing the right lawful record design might be a have a problem. Of course, there are plenty of web templates available online, but how can you get the lawful form you require? Utilize the US Legal Forms internet site. The assistance gives 1000s of web templates, including the Alabama Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, that you can use for company and private demands. All the types are inspected by specialists and meet up with federal and state needs.

If you are presently listed, log in to the bank account and click the Download button to find the Alabama Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status. Utilize your bank account to appear with the lawful types you possess bought formerly. Proceed to the My Forms tab of the bank account and acquire one more duplicate in the record you require.

If you are a whole new customer of US Legal Forms, allow me to share easy directions for you to adhere to:

- First, ensure you have chosen the correct form to your city/region. You may examine the form using the Review button and look at the form outline to guarantee it is the right one for you.

- In case the form is not going to meet up with your preferences, take advantage of the Seach area to discover the proper form.

- When you are positive that the form would work, go through the Buy now button to find the form.

- Select the rates prepare you would like and enter the required information. Design your bank account and pay money for an order utilizing your PayPal bank account or charge card.

- Select the data file formatting and obtain the lawful record design to the product.

- Comprehensive, revise and print out and sign the attained Alabama Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

US Legal Forms may be the greatest collection of lawful types that you can discover a variety of record web templates. Utilize the service to obtain professionally-produced files that adhere to express needs.