Alabama Yearly Expenses refer to the various financial obligations and costs that individuals, businesses, and government entities in Alabama incur on an annual basis. These expenses are vital for the functioning and development of the state and can be classified into different categories such as personal expenses, business expenses, and government expenses. 1. Personal Expenses in Alabama: — Housing Costs: This includes rent or mortgage payments, property taxes, homeowner's insurance, and maintenance fees. — Utilities: Monthly bills for electricity, water, gas, and sewage services. — Transportation: Vehicle costs, including fuel, insurance, registration fees, and maintenance. — Healthcare: Medical insurance premiums, out-of-pocket expenses, and prescription medications. — Education: Tuition fees, textbooks, school supplies, and other educational expenses. — Groceries and Food: Regular expenses for groceries, dining out, and food items. — Entertainment: Expenses related to leisure activities, hobbies, events, and vacations. — Taxes: Alabama state income taxes, property taxes, sales taxes, and other applicable taxes. 2. Business Expenses in Alabama: — Employee Salaries and Benefits: Wages, healthcare coverage, retirement plans, and other employee-related expenses. — Rent and Utilities: Leasing or owning business property, utilities like electricity, water, and internet services. — Equipment and Supplies: Purchasing or leasing machinery, office supplies, and other necessary equipment. — Marketing and Advertising: Expenses for promoting products/services, advertising campaigns, and digital marketing. — Insurance: Business liability insurance, property insurance, and workers' compensation coverage. — Taxes and Licensing: Business-related taxes such as sales tax, business licenses, and permits. — Technology and Software: Expenses for computer systems, software licenses, and IT support. — Research and Development: Investment in innovation, product development, and market research. 3. Government Expenses in Alabama: — Education and Infrastructure: Funding for public schools, colleges/universities, and transportation systems. — Health and Social Services: Financial support for hospitals, Medicaid, welfare programs, and public assistance. — Law Enforcement and Judiciary: Salaries for police officers, court fees, and legal services. — Public Administration: Salaries for government officials, administrative expenses, and office operations. — Public Utilities: Maintaining and improving public utilities such as water supply, wastewater treatment, and electricity distribution. — Economic Development: Initiatives and incentives to attract businesses, promote entrepreneurship, and stimulate economic growth. — Environmental Protection: Conservation efforts, regulation enforcement, and pollution control measures. — Emergency Services: Fire departments, emergency medical services, disaster response, and prevention measures. In conclusion, Alabama Yearly Expenses cover a wide range of personal, business, and government-related costs necessary for the smooth functioning and development of the state. Understanding and managing these expenses are crucial for individuals, businesses, and government agencies in Alabama to ensure financial stability and growth.

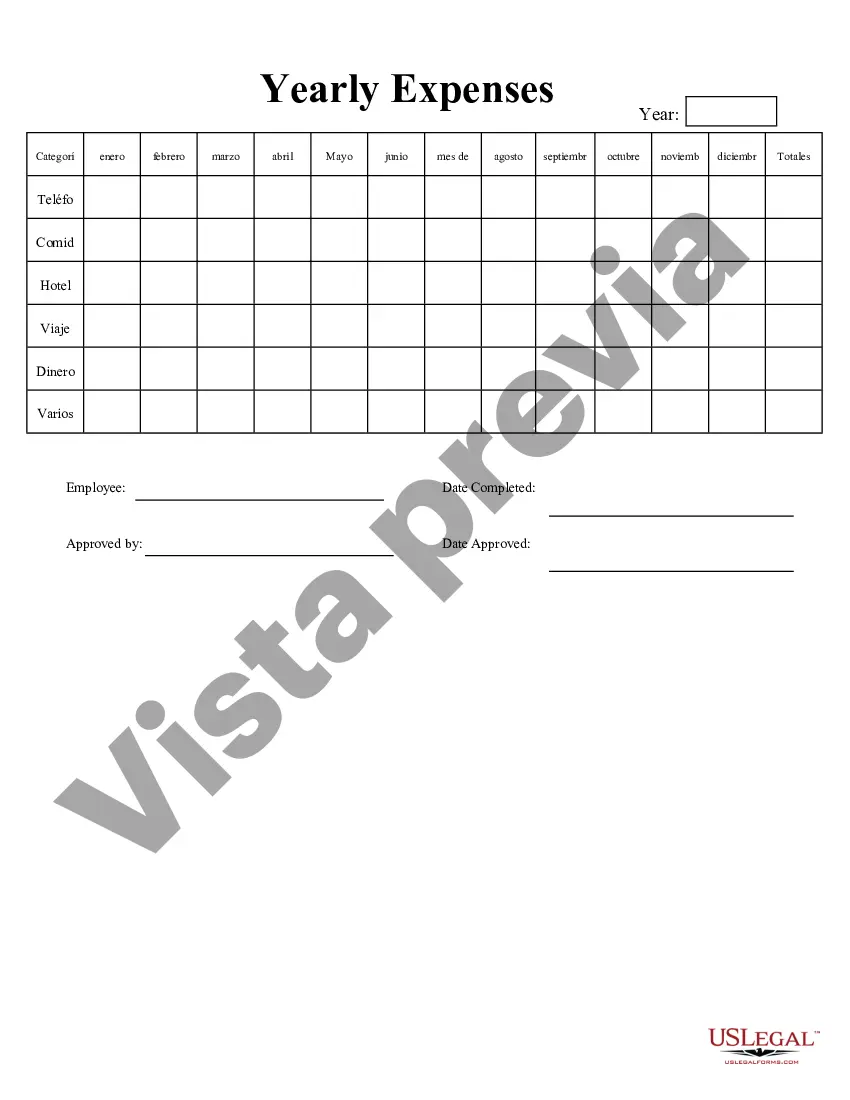

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alabama Gastos Anuales - Yearly Expenses

Description

How to fill out Alabama Gastos Anuales?

Are you presently within a situation the place you will need paperwork for possibly company or specific functions virtually every working day? There are a variety of legal file layouts available on the Internet, but discovering kinds you can trust is not easy. US Legal Forms gives 1000s of develop layouts, much like the Alabama Yearly Expenses, that happen to be created to fulfill federal and state needs.

When you are already knowledgeable about US Legal Forms site and possess a merchant account, basically log in. Next, it is possible to obtain the Alabama Yearly Expenses web template.

If you do not provide an account and would like to begin to use US Legal Forms, adopt these measures:

- Get the develop you require and ensure it is for that appropriate metropolis/area.

- Make use of the Preview option to review the form.

- Browse the description to ensure that you have chosen the correct develop.

- In the event the develop is not what you are looking for, make use of the Look for industry to get the develop that fits your needs and needs.

- When you find the appropriate develop, simply click Get now.

- Choose the rates prepare you need, fill out the necessary details to create your account, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Decide on a handy data file formatting and obtain your duplicate.

Get each of the file layouts you possess purchased in the My Forms food list. You can obtain a additional duplicate of Alabama Yearly Expenses anytime, if necessary. Just click on the necessary develop to obtain or produce the file web template.

Use US Legal Forms, one of the most comprehensive variety of legal varieties, in order to save some time and prevent mistakes. The support gives skillfully produced legal file layouts which can be used for an array of functions. Generate a merchant account on US Legal Forms and initiate making your daily life a little easier.