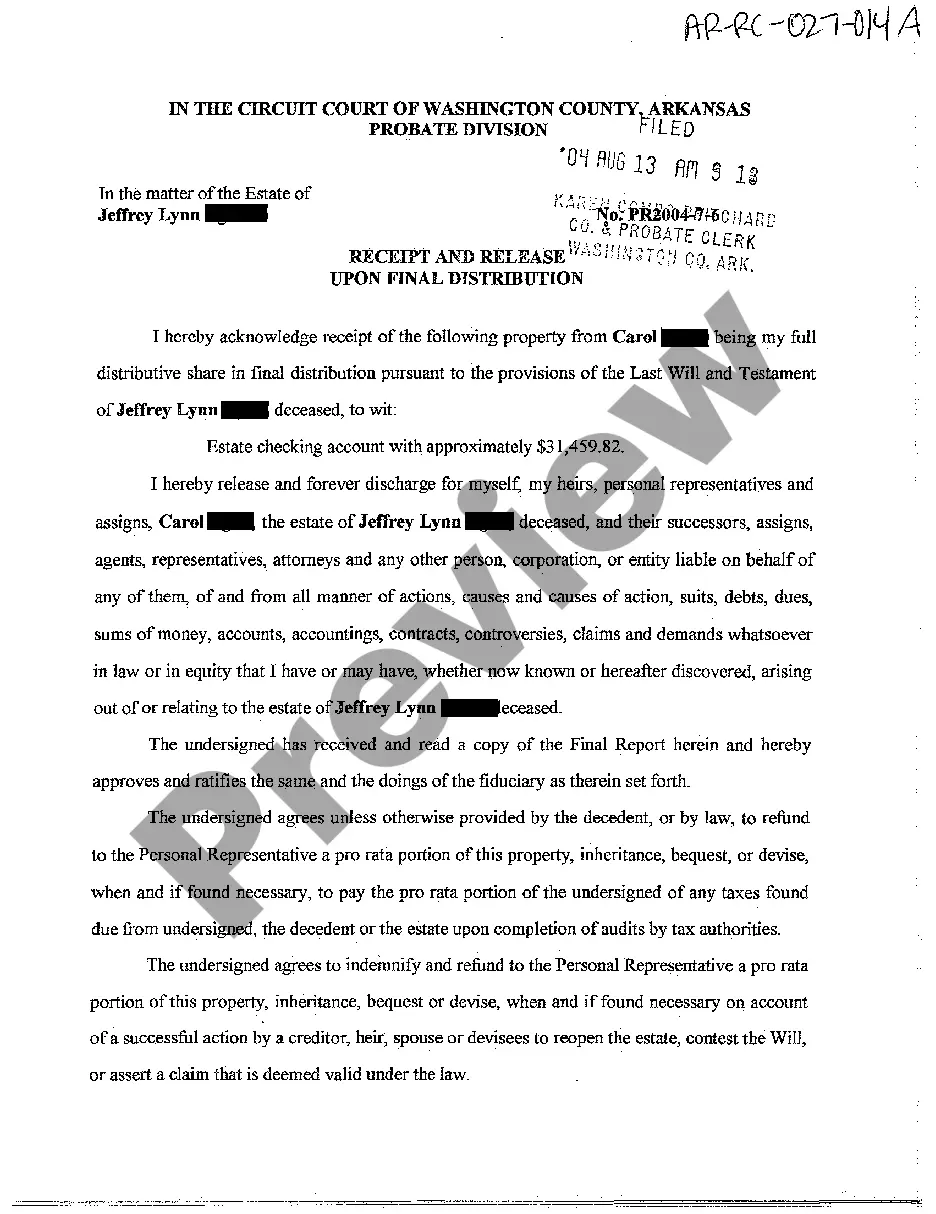

Arkansas Payment and Release Upon Final Distribution

Description

How to fill out Arkansas Payment And Release Upon Final Distribution?

Among numerous complimentary and paid templates available online, you cannot guarantee their authenticity.

For instance, consider who produced them or whether they possess sufficient expertise to meet your requirements.

Always remain composed and make use of US Legal Forms!

Utilize US Legal Forms to accomplish more for less!

- Discover Arkansas Payment and Release Upon Final Distribution templates crafted by proficient legal professionals.

- Avoid the costly and lengthy process of seeking an attorney and then paying them to draft a document that you can acquire independently.

- If you already possess a subscription, Log In to your account and locate the Download button adjacent to the file you require.

- You will also be able to access all of your previously saved documents in the My documents section.

- If this is your first time using our service, follow the instructions below to effortlessly obtain your Arkansas Payment and Release Upon Final Distribution.

- Ensure that the document you find is legitimate in your residing state.

Form popularity

FAQ

To inquire about your Arkansas state tax refund, you should contact the Arkansas Department of Finance and Administration. You can reach them by phone or through their official website where you can track your refund status. For questions regarding the process of Arkansas Payment and Release Upon Final Distribution, they provide detailed information that can guide you. Keeping easy access to these resources will help ease any concerns.

In Arkansas, employees must receive a unpaid break of at least 30 minutes for shifts longer than six hours. Employers are not legally required to offer additional breaks, but most do for convenience. Understanding your rights regarding breaks can enhance your overall work experience and relate closely to the Arkansas Payment and Release Upon Final Distribution. If you have concerns about your break time, consider discussing it with your employer or HR.

You can generally expect your Arkansas state tax refund approximately 30 to 60 days after processing. Electronic submissions often lead to quicker refunds compared to paper filings. Monitoring your refund status online can give you updates about the Arkansas Payment and Release Upon Final Distribution. If the wait feels too long, don't hesitate to contact the state revenue office for further assistance.

Generally, after your tax return is processed in Arkansas, you can expect your refund in about 3 to 6 weeks. This can vary based on several factors, including how you filed your return. If you filed electronically, you might receive your Arkansas Payment and Release Upon Final Distribution faster. Always keep an eye on your refund status through the Arkansas Department of Finance and Administration website.

Yes, IRA distributions are subject to Arkansas state income tax. The amount taxed depends on your total income and tax bracket. Being aware of your tax responsibilities helps in planning your finances better, especially when considering Arkansas Payment and Release Upon Final Distribution. It is wise to consult a tax professional for personalized advice.

Arkansas employs a graduated income tax structure, with rates ranging from 0.9% to 6.9%. The rate applied depends on your income level and filing status. Understanding your state tax obligations is essential, especially while handling Arkansas Payment and Release Upon Final Distribution. Accurate tax filing will ensure that you receive any potential refunds promptly.

Yes, Arkansas offers a state withholding form that you must use when withholding taxes from employee wages. You can find this form on the Arkansas Department of Finance and Administration website. Utilizing these forms properly is significant for smooth Arkansas Payment and Release Upon Final Distribution.

You should include your 1099 in your tax return when filing your Arkansas state taxes. Make sure to retain a copy for your records as well. This step is essential for maintaining compliance and achieving a successful Arkansas Payment and Release Upon Final Distribution.

To send your 1099 in Arkansas, mail it to the designated address of the Department of Finance and Administration. Double-check for any updates on the submission details to prevent any issues. Addressing this correctly can assist in smooth Arkansas Payment and Release Upon Final Distribution.

You should send Arkansas tax forms to the Arkansas Department of Finance and Administration. It’s vital to confirm the correct mailing address on their website, as this can change. Properly navigating this ensures a seamless Arkansas Payment and Release Upon Final Distribution process.